BTC is like a black hole in the blockchain universe, possessing a powerful gravitational pull on the liquidity of the US dollar, drawing value inescapably.

Written by: Liu Jiao Lian

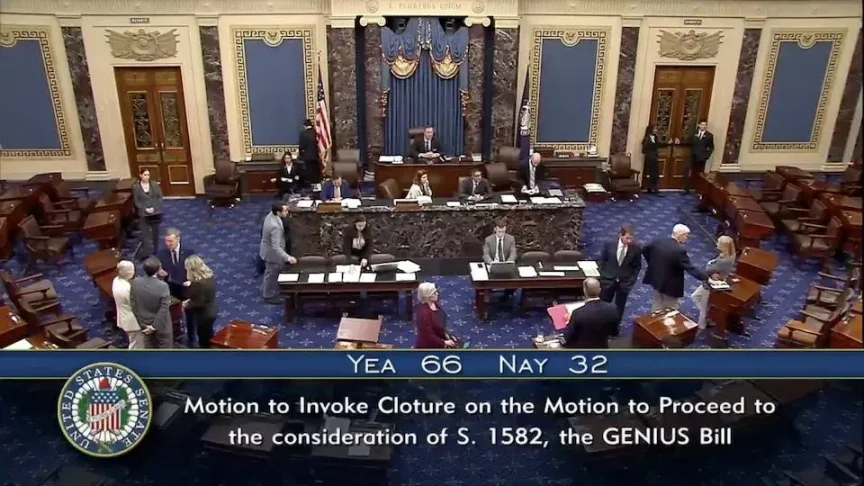

Recently, a significant event occurred in the crypto space: the U.S. Senate passed the so-called stablecoin bill procedural motion with a vote of 66 to 32, moving into the federal legislative stage.

The full name of this bill is the "National Innovation Act to Guide and Establish U.S. Dollar Stablecoins," and its English acronym happens to be GENIUS, hence the nickname "Genius Bill."

In no time, the global financial and economic circles have been buzzing about whether this so-called Genius Bill is the last struggle before the total collapse of the U.S. dollar and treasury system, or if it is indeed a genius solution to the U.S. debt crisis, helping to upgrade the dollar hegemony to version 3.0.

As is well known, the original U.S. dollar was merely a voucher for gold. The U.S. established its dollar hegemony 1.0 status through World War II. The gold dollar, as part of the post-war world order, was solidified by systems and institutions such as the Bretton Woods system, the World Bank, and the International Monetary Fund. The Bretton Woods system stipulated that the dollar was pegged to gold at a fixed exchange rate, and the legal currencies of other countries were pegged to the dollar. (Refer to Liu Jiao Lian's "History of Bitcoin," Chapter 10, Section 42)

However, just 25 years after the war, the U.S. was unable to maintain the dollar's peg to gold. U.S. economist Robert Triffin discovered that for the dollar to become an international currency, the U.S. needed to continuously export dollars, and since the dollar was pegged to gold, exporting dollars meant exporting gold, which would inevitably lead to a decrease in U.S. gold reserves, unable to support the ever-increasing amount of dollars, thus necessitating a decoupling.

Specifically, the following three goals cannot be achieved simultaneously, known as the "impossible trinity": First, the U.S. maintains a surplus in its international balance of payments, and the external value of the dollar remains stable; second, the U.S. maintains sufficient gold reserves; third, the value of the dollar can be maintained at a stable level of $35 per ounce of gold. These three goals cannot be achieved simultaneously, hence the "impossible trinity."

This inherent bug is also known as the "Triffin Dilemma."

When President Nixon suddenly unilaterally tore up the agreement in a televised speech in 1971, announcing that the dollar would no longer be pegged to gold, it signaled that dollar hegemony 1.0 was in a crisis of collapse. Without the support of gold, the value of the dollar was on shaky ground.

Great responsibilities are bestowed upon those capable. In 1973, Kissinger became Secretary of State under President Nixon. He proposed the "petrodollar" strategy. He persuaded President Nixon to fully support Israel during the Yom Kippur War (the fourth Arab-Israeli war). Under the immense military pressure from the U.S., Saudi Arabia secretly reached a key agreement with the U.S. to bundle "oil - dollar - U.S. debt":

- Saudi oil is priced and settled only in dollars; other countries must hold dollars to purchase oil.

- Saudi Arabia invests its oil revenue surplus in U.S. treasury bonds, forming a dollar repatriation mechanism.

Many people have been misled by the superficial meaning of the term "petrodollar," claiming that dollar 2.0 has shifted its anchor from gold to oil. What currency can buy is never the anchor of the currency. The anchor of a currency is what constrains and supports its issuance.

From the perspective of commodity production, the capital process of the petrodollar is: oil -> dollar -> U.S. debt.

From the perspective of capital movement, this process becomes a purely capital proliferation process: dollar -> U.S. debt -> dollar. Oil production is merely a byproduct of the capital movement process.

After China began its reform and opening up in the late 1980s, the capital movement of the dollar and U.S. debt was similarly applied to drive the production of a large number of industrial goods in China, achieving astonishing results. For this capital cycle, it does not matter whether the byproduct is oil or industrial goods. Financial capital only seeks the profits continuously extracted in high-speed circulation.

Now the U.S. no longer fears exporting dollars. Previously, exporting dollars meant exporting gold, and since the U.S. did not possess alchemy, it could not conjure gold out of thin air, leading to a rapid depletion of gold reserves. Now, it is fine; exporting dollars merely means exporting U.S. debt, which is essentially an IOU from the U.S. Treasury, allowing the U.S. to print as much as it wants.

This is the era of dollar hegemony 2.0. From the 1970s to the 2020s, approximately 45 years. The dollar in this phase, rather than being called petrodollars or any other type of dollar, is essentially debt dollars, or IOU dollars.

The crux of debt dollars lies in firmly anchoring the dollar to U.S. debt. To achieve this, two prerequisites must be met:

- The issuance, interest payment, trading, and other aspects of U.S. debt must be the best in the world, with the strongest discipline, the most reliable mechanisms, the most credible repayment, and the strongest liquidity, etc.

- The U.S. must possess the world's strongest military deterrent, compelling countries that earn large amounts of dollars to actively purchase U.S. debt.

To this end, the dollar 2.0 system is designed as a decentralized dual-spiral structure: the Treasury issues debt "disciplined" according to the debt ceiling approved by Congress but cannot directly issue dollars; the Federal Reserve is responsible for monetary policy, issuing dollars, and achieving interest rate control through open market transactions of U.S. debt.

However, while dollar 2.0 solved the problem of gold scarcity, it introduced a larger bug: any artificial constraint ultimately cannot truly restrain the desire to print money. Congressional approval is not an insurmountable barrier. Since then, the dollar embarked on an uncontrollable path of infinite debt expansion, swelling to a staggering $36 trillion in just a few decades.

After the split in Alaska in 2020, the entire dollar 2.0 system was on the verge of collapse. The reason? Because China slammed the table.

The massive U.S. debt is like a towering domino structure, with a few small dominoes at the bottom supporting the entire precarious giant. Any sufficiently impactful action could trigger a collapse of the upper layers.

Even without external shocks, such a massive scale of U.S. debt is slowly becoming unsustainable, falling into the expectation of eventual collapse.

Thus, a genius solution emerged. This is the emerging dollar hegemony 3.0 — U.S. dollar stablecoins. We might as well call it blockchain dollars or crypto dollars.

It must be said that the U.S. is still far ahead in financial innovation. It is evident that if the on-chain dollar, i.e., the stablecoin strategy, is highly successful, we may soon witness the following five monumental changes:

- The Federal Reserve's monopoly on the dollar issuance power is deconstructed. Dollar stablecoins become the "new dollars," and the issuance power of these "new dollars" is decentralized among numerous stablecoin issuers.

- The U.S. debt assets on the Federal Reserve's balance sheet are digested. Stablecoin issuers will compete fiercely for U.S. debt as the legal reserves supporting the issuance of dollar stablecoins.

- As more and more traditional dollar assets are mapped onto the blockchain as tokens (RWA - Real World Assets) or other nominal forms, the massive trading of RWA assets combined with crypto-native assets (like BTC) will create enormous demand for dollar stablecoins, leading to explosive growth in the scale of dollar stablecoins.

- As the trading scale of "RWA assets - dollar stablecoins" experiences explosive growth, the trading scale of "traditional assets - dollars" will gradually be surpassed, becoming a thing of the past.

- As the dollar's role as a medium in asset trading diminishes, it will become a subsidiary in the closed loop of "U.S. debt - dollar - dollar stablecoin."

The traditional mechanism for issuing U.S. debt dollars is: the Treasury issues U.S. debt to the market, absorbing dollars. The Federal Reserve issues dollars and purchases U.S. debt from the market. This achieves a remote linkage, using U.S. debt to support the issuance of dollars.

In contrast, the issuance mechanism for dollar stablecoins is: stablecoin issuers receive customers' dollars and issue dollar stablecoins on the blockchain. Then, stablecoin issuers use the received dollars to purchase U.S. debt from the market.

Let’s derive this using semi-quantitative numerical assumptions.

Traditional method: The Federal Reserve issues an additional $100 million, purchases $100 million worth of U.S. debt from the market, injecting $100 million of liquidity into the market. The Treasury issues $100 million worth of U.S. debt to the market, absorbing $100 million of liquidity.

The problem is: if the Federal Reserve insists on its so-called policy independence and refuses to undertake the task of purchasing U.S. debt to inject liquidity, it will put significant pressure on the Treasury's debt issuance, forcing U.S. debt auctions to yield relatively high interest rates, which would be very unfavorable for the U.S. government's future debt repayment.

Assuming there is a sufficiently large amount of dollar stablecoins: stablecoin issuers absorb $100 million, issuing $100 million of stablecoins. The stablecoin issuers then use $100 million to purchase U.S. debt, injecting $100 million of liquidity into the market. The Treasury issues $100 million worth of U.S. debt, absorbing $100 million of liquidity.

Note that there can be a cyclical leverage effect here. If in the future, the vast majority of tradable assets are tokenized as RWA assets on-chain, then the $100 million absorbed by the Treasury will ultimately flow into various RWA assets. Specifically, the Treasury spends $100 million, and the institutions receiving the dollars will exchange all of that $100 million for dollar stablecoins from the stablecoin issuers (note that this is the issuance of $100 million worth of stablecoins), to purchase various RWA assets or simply hoard BTC, thus achieving a $100 million return flow to the stablecoin issuers.

The stablecoin issuers, having received this $100 million, can continue to purchase $100 million of U.S. debt, injecting liquidity into the market. The Treasury can then issue another $100 million of U.S. debt, absorbing this $100 million. This process continues in a cycle.

From this point, we can see that the entire cycle only uses $100 million as a tool, allowing for nearly infinite issuance of U.S. debt and dollar stablecoins. After one cycle, U.S. debt increases by $100 million, and correspondingly, dollar stablecoins also increase by $100 million. After N cycles, both U.S. debt and dollar stablecoins have increased by N hundred million dollars.

Of course, in reality, the cycle cannot be 100% without loss. Some dollars will inevitably not flow back to the stablecoin. Assuming this loss ratio is 20%, it can be easily calculated that the total leverage ratio is 5 times. This is similar to the money multiplier in a fractional reserve banking system.

Currently, with U.S. debt at $36 trillion, under the condition that the Federal Reserve cannot continue printing money, that is, with the stock of dollars unchanged, through the cyclical issuance of dollar stablecoins, assuming a leverage of 5 times, the expansion space for U.S. debt can suddenly open up to $36 trillion multiplied by 5, equaling $180 trillion.

The U.S. Treasury, that is, the U.S. government, can happily continue to issue U.S. debt without looking at the Federal Reserve's face!

The additional $180 - 36 = $144 trillion of U.S. debt is supported not by dollars printed by the Federal Reserve, but by the dollar stablecoins printed by stablecoin issuers on various chains.

The Federal Reserve's dollar minting power has been deconstructed and replaced by the minting power of stablecoin issuers' dollar stablecoins.

When dollar stablecoins are widely used for various cross-border payments or daily transactions, the dollar can truly relax, becoming a mere auxiliary role in the "U.S. debt - dollar stablecoin" cycle.

What role does BTC play in this entire process?

Jiao Lian made an analogy: a black hole.

A black hole in the universe has a strong gravitational pull, drawing in light that cannot escape.

BTC is like a black hole in the blockchain universe, possessing a powerful gravitational pull on the liquidity of the US dollar, drawing value inescapably. In this way, dollar liquidity is continuously absorbed into the blockchain universe, converted into dollar stablecoins. Then, the dollars are re-released as liquidity through the exchange of U.S. debt, creating a continuous cycle.

However, if the massive issuance of dollar stablecoins cannot be sold to the world, at least reaching a corresponding multiple of economic scale, it is easy to imagine that the actual purchasing power of the dollar or dollar stablecoins will depreciate.

Today, the total amount of dollar stablecoins is still far from matching U.S. debt, estimated to be less than $200 billion in total. To reach $1 trillion, it would need to be multiplied by 5, and to reach the scale of U.S. debt, it would need to be expanded by 36 times. Then, on this basis, it would need to double again to provide greater support for the expansion of U.S. debt.

Even if we estimate the expansion based on the aforementioned 5 times leverage, multiplying these factors together gives us 5 * 36 * 5 = 900 times, nearly 1000 times.

Based on the current stablecoin amount of $200 billion and the $2 trillion market cap of BTC, if stablecoins successfully expand by 1000 times, the market cap of BTC could increase by 1000 * 10 = 10,000 times, from $2 trillion to $20 quadrillion. Correspondingly, one BTC could rise from $100,000 to $1 billion, meaning 1 Satoshi would equal $10.

If we consider that in the future, much of the liquidity will be diverted by RWA assets, so that unlike the current market where BTC attracts the vast majority of liquidity, we can apply a discount of 1/10 to 1/100 to the above numbers. This would mean a BTC market cap of $200 trillion to $2000 trillion, with one BTC valued at $1 million to $10 million, meaning 1 Satoshi would equal $0.1 to $1.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。