Cryptocurrency will once again become a part of the macroeconomy, no longer independent of the fluctuations in traditional markets.

Written by: Musol

Introduction: I still remember when Bitcoin first gained popularity; it was an exhilarating time, and people in the community were all talking about the "decentralized revolution," as if they held the key to the future. But how is it now? Open any crypto community, and the screen is filled with discussions about "how many basis points the Federal Reserve will raise" and "how CPI data exceeded expectations."

How did the crypto market we once envisioned as a technological utopia fall into being a mere echo of macroeconomics?

An asset class that claimed to disrupt the old world now seems like a spineless follower, constantly watching Powell's words to make a living, truly sad and laughable.

Pt.1. Where Does the Macro Color of the Crypto Market Come From?

We all know that the crypto market, as an emerging force in the financial sector, is closely linked to changes in macroeconomic policies. In the context of global economic integration, any shift in macroeconomic policy can create significant waves in the crypto market. Bitcoin, as the leader of the crypto market, is often seen as a barometer for market trends, and its price fluctuations are closely related to adjustments in macroeconomic policies. The Federal Reserve's monetary policy, the fiscal policies of various governments, and changes in international political situations all influence market capital flows, sentiment, and expectations to varying degrees.

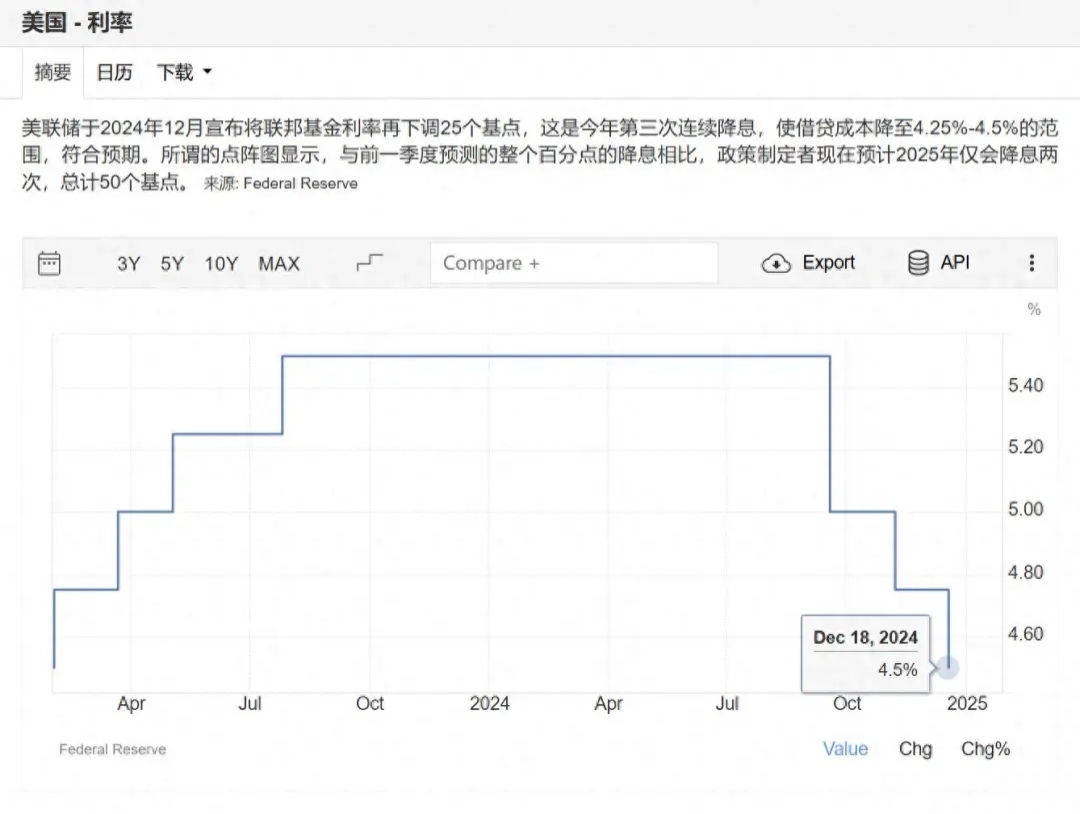

2023 - 2024: Federal Reserve Rate Cuts and Market Volatility

Using Bitcoin's halving cycle as a time reference, the Federal Reserve's rate-cutting cycle was originally expected to begin in Q4 of 2023. However, the Biden administration, in order to maintain the appearance of economic prosperity, adopted a series of unconventional measures. By allowing illegal immigrants to work, they increased the supply in the labor market, making employment data appear more favorable; at the same time, they expanded the government workforce, further distorting non-farm payroll data. These measures led the Federal Reserve to stubbornly resist rate cuts in Q4 of 2023, attempting to create the illusion of stable economic growth.

However, the U.S. Treasury needed to issue a large amount of government bonds to fund Biden's Keynesian policies. This resulted in a sharp decline in the yield on 10-year U.S. Treasury bonds. This change brought unexpected opportunities to the crypto market, creating a seasonal bull market that spanned Q4 of 2023 and Q1 of 2024. During this period, the capital activity in the crypto market surged, and the prices of mainstream cryptocurrencies like Bitcoin rose accordingly. Investors flocked to the market, hoping to get a piece of the action in this bull market.

Entering Q2 of 2024, the market situation reversed. As the Treasury's bond issuance slowed, the supply of market capital decreased. At the same time, systemic risks in non-U.S. countries erupted, such as instability in the East Asian real estate market and turmoil in the Japanese bond market, leading to a sharp increase in investors' demand for safe havens. In this context, the U.S. dollar, U.S. Treasury bonds, and gold became hot commodities in the eyes of investors, causing a large outflow of funds from the crypto market in search of safer havens. Coupled with the historical tradition of risk markets having no momentum in Q2, the entire crypto market entered a period of depression, with prices falling, trading volumes shrinking, and investor confidence severely impacted.

2024 - 2025: Election Dynamics, Rate Cuts, and Market Contradictions

By Q3 of 2024, in order to save the Biden/Harris election prospects, the Federal Reserve had to initiate the rate-cutting process. However, a peculiar phenomenon emerged in the market: the yield on 10-year U.S. Treasury bonds not only did not decrease with the rate cuts but instead rose strongly, resulting in a situation where nominal interest rates were lowered while real interest rates approached historical highs. This abnormal phenomenon complicated the market dynamics for cryptocurrencies. The market in Q4 of 2024 was not driven by external hot money but was influenced by the "Trump trade" combined with autumn restlessness. Since Trump's election as President of the United States, market sentiment has been greatly stirred, with various concept coins related to Trump emerging. When Trump issued a meme coin of the same name, it drained on-chain liquidity, tightening market capital and increasing price volatility.

As we entered Q1 of 2025, the main contradictions in the market underwent a fundamental shift. It was no longer a contradiction between non-farm payrolls, CPI data, and the Federal Reserve's expectations management, but rather a contradiction between the White House, the efficiency department of the government, and the Federal Reserve. The impact of this contradiction was extremely severe, compounded by DeepSeek piercing through U.S. AI hegemony, raising concerns about U.S. technological strength and economic prospects. This panic led to a massive sell-off of U.S. Treasury bonds, which faced a rapid wave of selling. However, this decline in real interest rates driven by panic did not, as usual, promote a spring rally; instead, it prompted a large outflow of funds. Investors, fearful of market uncertainty, withdrew their funds in droves, seeking safer investment channels.

Whether now or in the future, we witness and foresee that the crypto market is no longer an isolated island of asset classes. It is once again deeply intertwined with macroeconomic forces and regulatory changes, forming a new chessboard. In the future, what will dominate the cryptocurrency market will be regulation and macroeconomics, rather than the microeconomics or industry development within the sector.

Pt.2. Why Does the Crypto Market Respond to Tariffs?

Panic and Risk Aversion from Trade Wars

"The fear of trade wars triggered by tariffs usually dissipates quickly, but during this period, investors hedge through gold, government bonds, and the U.S. dollar."

The threat of a global trade war has led investors to flee risk assets. Traditional financial investors view Bitcoin as a high-risk asset and turn to safer assets like gold, bonds, and the U.S. dollar. A typical risk-averse trade is unfolding, and cryptocurrencies are naturally included in this category.

Inflation and Interest Rates Back in Focus

Tariffs increase the cost of imported goods, potentially leading to rising inflation. If inflation remains high, the Federal Reserve may delay or cancel expected rate cuts, thereby reducing liquidity in financial markets. Since Bitcoin does not generate income, higher interest rates make it less attractive compared to U.S. Treasury bonds or even cash deposits.

This dynamic sharply contrasts with the low-interest, liquidity-driven environment of 2020-2021, when cryptocurrencies thrived. Therefore, macro trends once again become the primary driving factors affecting cryptocurrency performance.

The Role of Regulation and Traditional Finance

Although tariffs and inflation dominate the short-term outlook, regulatory changes are equally crucial. Global regulatory agencies are intensifying scrutiny of the market, and the SEC and CFTC (Commodity Futures Trading Commission) have recently taken some industry-friendly actions, implicitly signaling the regulatory stance of the U.S. Meanwhile, traditional financial institutions are accelerating their adoption of cryptocurrencies and gradually recognizing their potential as a diversified asset class.

"The market is not afraid of extreme tariff measures; rather, it is adapting to Trump's negotiation strategy."

This means that while volatility may be high in the short term, long-term investors may continue to accumulate Bitcoin and other cryptocurrencies when prices fall.

Pt.3. About the Future

Cryptocurrency will once again become a part of the macroeconomy, no longer independent of the fluctuations in traditional markets. Economic policies, central bank decisions, and geopolitical events directly affect the performance of digital assets.

As inflation, interest rates, and trade policies dominate the dynamics of financial markets, digital assets are no longer detached from the broader economic environment. Institutional funds now view major cryptocurrencies as part of the traditional financial sector, meaning that regulatory changes and global economic trends will shape the trajectory of cryptocurrencies.

In the next 3-6 months, the market is expected to continue facing volatility as it digests updates on tariffs, Federal Reserve policy decisions, and upcoming regulatory measures. The question is not whether cryptocurrencies will decouple from the macroeconomy, but how they will respond to this new reality. What truly matters now includes macro events and what Trump says regarding regulation. The market is reacting sharply to trade policies, interest rate expectations, and regulatory decisions, and these factors may shape the development trajectory of the entire industry in the coming months.

Pt.4. Some Thoughts

The root of the fall from our ideal technological utopia is essentially the invasion of capital. In the early days, the crypto market was a niche utopia, populated by tech enthusiasts and libertarians, with a pitiful amount of capital, and the outside world had no interest in it. At that time, Bitcoin was still an island, spinning on the enthusiasm of the community. But since its market value broke a trillion, Wall Street vultures have caught the scent of blood. Institutional funds surged in like a tide, ETF applications sprang up like mushrooms after rain, and hedge funds entered with leverage, turning this small pond into a hunting ground for capital.

What was the result?

With a wave of the Federal Reserve's hand, the market's remaining dignity was obliterated. During the rate hike cycle of 2022, Bitcoin fell from 60,000 to 20,000, like a man stripped of his spine, leaving the entire crypto space in a river of blood. When the expectation of rate cuts in 2023 emerged, prices began to warm up again, and retail investors cheered, as if they had forgotten they were merely pawns on the chessboard. How can we still talk about "free currency"? They are clearly slaves shackled by the global financial system, with every move dependent on their master's mood.

What’s even more frustrating is that the crypto market's response to macro signals is particularly "vulgar." When U.S. stocks drop by 5%, it can drop by 15%, like a frightened rabbit running amok; when the Federal Reserve gives a dovish hint, altcoins double in a day, like gamblers on a high.

This "magnifying glass effect" exposes its essence: an immature market, fundamentally still a plaything of emotional trading. High sensitivity to liquidity is one reason—funds move in and out quickly, leverage is played aggressively, and any slight disturbance can cause an explosion.

But the deeper issue is that it has no roots at all. Without a technological narrative, without independent value, all that remains is the greed and fear of speculators.

Looking at those KOLs, shouting orders on X every day, retail investors follow suit faster than anyone else, but what’s the result?

Institutions harvest a wave of retail investors, while retail investors lick their wounds and shout "faith."

This is not a magnifying glass; it is clearly a funhouse mirror for speculators, reflecting the ugliest side of human nature.

Yet some still naively argue: this shows that crypto has been accepted by the mainstream and has become part of the asset class, how wonderful!

Isn’t it laughable?

This kind of "acceptance" is merely the taming of capital; crypto has transformed from a rebel into an accomplice of the system. Even if it survives the cold winter and finds its rhythm, it is nothing but a pipe dream. As long as the Federal Reserve's monetary policy remains the baton of the global economy, the crypto market can only continue to be a magnifying glass, amplifying panic, amplifying greed, but unable to magnify its original ideals.

It is no longer that youthful figure that made your heart race, but a failure beaten down by reality, searching for its teeth on the ground.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。