The global financial system is undergoing profound changes, with Bitcoin gradually being viewed as a "new type of government bond" used to hedge against sovereign credit risk, highlighting a crisis of trust in the traditional financial system.

Written by: White55, Mars Finance

On May 20, 2025, the electronic screens in the Tokyo bond trading hall flashed a set of glaring red numbers—Japan's 40-year government bond yield surpassed 3.5%, reaching a historic high. This figure was only 0.25% seven years ago and just 1.3% two years ago, but has now skyrocketed like a rocket.

Almost simultaneously, the price of Bitcoin on global cryptocurrency exchanges broke through $112,000, setting a new historical record.

At this moment, the safest haven asset in the traditional financial system and the most controversial new asset formed a dramatic mirror relationship: the soaring government bond yields revealed the shaky foundation of sovereign credit, while the surge in Bitcoin showcased its recognized value as a hedging tool.

Japanese Government Bonds: The Black Swan Takes Flight

The Japanese government bond market is witnessing an epic crisis of trust. In May 2025, the yield on Japan's 40-year government bonds broke the historic high of 3.5%, and the yield on 30-year bonds also surged to the highest level since 2004. Bond yields and prices are inversely related; a spike in yields means a sharp drop in bond prices, and investors are voting with their feet, abandoning what was once considered the safest debt market in the world.

The core of Japan's debt problem lies in the fundamental imbalance between its debt scale and repayment capacity. Japan's debt-to-GDP ratio has exceeded 250%, far surpassing Germany's 62%, yet it maintains a similar level of bond yields.

Figure 1: Yield on Japan's 30-year government bonds on the London Stock Exchange.

This distorted market pricing stems from decades of ultra-loose monetary policy by the Bank of Japan. As inflation in Japan continues to heat up, the central bank is forced to abandon its yield curve control policy, and the long-suppressed market forces erupt like a volcano.

Bond auction data reveals the severity of the crisis. The government bond auction in May 2025 faced a cliff-like drop in demand, pushing yields even higher. Weak auction results create a vicious cycle with economic slowdown: economic stagnation forces the government to increase borrowing, rising bond supply depresses prices and pushes up yields, while rising yields further burden the government's repayment capacity, dragging the economy down further.

The turmoil in the Japanese government bond market quickly spreads to the global financial market. On May 25, 2025, Bitcoin's price fell 1.2% to $67,500 after the yield surge, the S&P 500 futures dropped 0.7%, and the tech-heavy Nasdaq index fell 0.9%.

In contrast, traditional safe-haven asset gold rose against the trend, with the stablecoin PAXG increasing by 0.5%. Global capital is reassessing risks, and a sovereign debt trust crisis ignited by Japan has begun.

Bitcoin: The Rise of a New Hedging Logic

As traditional safe-haven assets find themselves in crisis, the narrative of Bitcoin as a risk-averse asset is being redefined. From "digital gold" to "sovereign risk hedging tool," Bitcoin's role evolution reflects the widening cracks in the traditional financial system.

André Dragosch, Head of European Research at Bitwise, pointedly stated: "Bitcoin is an immutable asset. It has no counterparty risk. It can hedge against sovereign risk and the risk of sovereign default." This statement accurately summarizes Bitcoin's core value proposition in the new financial environment.

The logic chain of sovereign risk hedging is clear: when the sustainability of debt in countries like Japan is questioned → government bond yields soar → the government's repayment capacity further deteriorates → a "fiscal debt vicious cycle" forms → investors seek reserve assets that decouple from sovereign credit.

In this context, Bitcoin's unique attributes—fixed supply of 21 million coins, decentralized network, and absence of an issuing entity—precisely fill the hedging void left by the collapse of traditional government bonds.

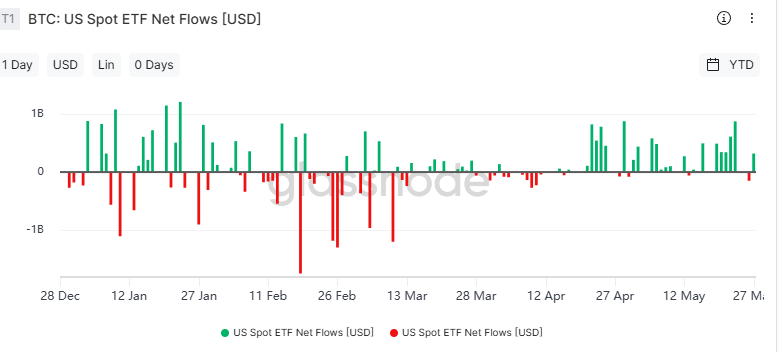

Market data validates this logical shift. In January 2025, the monthly inflow of Bitcoin spot ETFs reached $4.94 billion, setting a historical record. On April 22, the inflow for U.S. Bitcoin spot ETFs reached $912 million in a single day, equivalent to over 500 times the average daily level for 2025.

Figure 2: Recent BTC/USD price chart.

Institutional funds are flooding into the Bitcoin market at an unprecedented pace, with BlackRock's IBIT ETF holding 582,870 Bitcoins, surpassing all other competitors.

On a national level, actions are also being taken. Czech National Bank Governor Aleš Michl announced plans to diversify reserves into Bitcoin. The Trump administration proposed the establishment of a "strategic Bitcoin reserve," which, if realized, would transform Bitcoin from an investment tool into a national strategic asset.

Bitcoin is undergoing a qualitative change from a speculative asset on the fringes to a mainstream hedging tool.

Macroeconomic Changes: Three Engines Driving BTC Value Reassessment

Behind Bitcoin's breakthrough of historical highs is a profound restructuring of the global macroeconomic landscape. Three engines are jointly driving the reassessment of Bitcoin's value:

The Federal Reserve's monetary policy and inflation tug-of-war dominate market sentiment. Although the Fed has cut rates by 100 basis points in 2024, it paused rate cuts in early 2025 due to a rebound in inflation. The Trump administration's policy of imposing a 25% tariff on imported goods further raised inflation expectations and weakened the purchasing power of the dollar.

Under the dual pressure of high inflation and high interest rates, Bitcoin's appeal as an anti-inflation asset has significantly increased.

Bitunix Research Institute analysis points out: "In the context of global economic instability, the market's demand for anti-inflation assets (such as Bitcoin) may increase, and Bitcoin's positioning as 'digital gold' will be further solidified."

Geopolitical risks and policy shifts have become key variables. In February 2025, Trump's tariffs on imported goods from multiple countries triggered global market turbulence, causing Bitcoin to plummet 17.5% that month. However, dramatically, the Trump administration's pro-crypto policy expectations injected new momentum into Bitcoin.

If the White House's plan to include Bitcoin in strategic reserves is realized, it will reshape Bitcoin's positioning in the global financial system. The shift in policy direction allows Bitcoin to benefit from both safe-haven demand and institutional acceptance.

Technological adoption and on-chain activity provide fundamental support. The Bitcoin ecosystem is undergoing significant upgrades in 2025: Layer 2 solutions improve transaction speeds, reduce transaction costs, and Web3 application users exceed 50 million.

Glassnode on-chain data shows that in May 2025, Bitcoin's on-chain transaction volume increased by 30% year-on-year, and the number of addresses holding over 1,000 BTC increased by 15%. Technological evolution and increased adoption rates add pragmatic support to Bitcoin's narrative as a store of value.

Institutional Actions: ETFs Rewrite Market Structure

The approval and listing of Bitcoin spot ETFs have completely rewritten the market structure, paving a highway for traditional capital to enter the cryptocurrency space. In January 2025, the monthly inflow of Bitcoin spot ETFs reached $4.94 billion, a 226.67% increase compared to the same period last year.

As of April 2025, 11 U.S. spot Bitcoin ETFs held 1.1 million Bitcoins, accounting for 5.5% of the circulating supply, becoming the most important marginal buyers in the market.

Figure 3: Net flow chart of U.S. spot ETFs.

ETF flow data has become a leading indicator for Bitcoin prices. On April 22, 2025, Bitcoin ETFs saw an inflow of $912 million in a single day, pushing BTC/USD to a six-week high.

Bloomberg analyst Eric Balchunas described that day as Bitcoin ETFs entering "Pac-Man mode," with most products among the 11 ETFs experiencing increased fund inflows, breaking BlackRock's IBIT's dominance.

Andre Dragosh, Head of European Research at Bitwise Asset Management, pointed out: "Since January 2024, ETFs have become the 'marginal buyers' of Bitcoin, effectively determining whether Bitcoin spot exchanges present net buying or net selling conditions."

This structural change greatly enhances Bitcoin's price stability.

The distribution of institutional holdings shows a trend of centralization. By early 2025, BlackRock's IBIT held 582,870 Bitcoins, Fidelity's FBTC held 205,510, and ARK 21Shares Bitcoin ETF held about 100,000.

The combined holdings of these three ETF institutions approached 900,000 Bitcoins, accounting for over 80% of total ETF holdings. This highly concentrated holding structure gives leading institutions significant market influence and also brings the risk of market volatility triggered by the actions of a single large holder.

On-chain data shows that in May 2025, the number of Bitcoins flowing from exchanges to cold wallets increased by 10%, indicating that investors are choosing long-term holding strategies amid uncertainty. The activity of addresses holding over 1,000 BTC decreased by 15%, reflecting institutional caution during periods of yield volatility. These behavioral changes are reshaping the liquidity structure of the Bitcoin market.

Reconstructing the Financial Paradigm

The national strategic reserves now contain not only gold and dollars but also a string of cryptographic keys— the Czech central bank announced it would include Bitcoin in its reserves, the Trump administration is considering establishing a "strategic Bitcoin reserve," and BlackRock's Bitcoin ETF holdings have exceeded 550,000.

A recent Wall Street Journal survey shows that over 60% of institutional investors now view Bitcoin as a "new type of government bond" used to hedge against sovereign credit risk. When Japan's 40-year government bond yield surpassed 3.5%, global capital did not flock to traditional safe havens but chose the new asset coded as BTC.

The underlying logic of the global financial system is being rewritten, and the recognition of Bitcoin as a tool for hedging sovereign risk is not only a victory for cryptocurrencies but also a significant vote of confidence against the traditional financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。