Isn’t it curious how people reminisce about the past, casually recalling that a candy bar once cost 50 cents—as if prices rising over time were some cosmic inevitability? Rarely does anyone interrupt this nostalgia to point out that what they’ve witnessed is not nature’s doing but a calculated deception that has endured for generations.

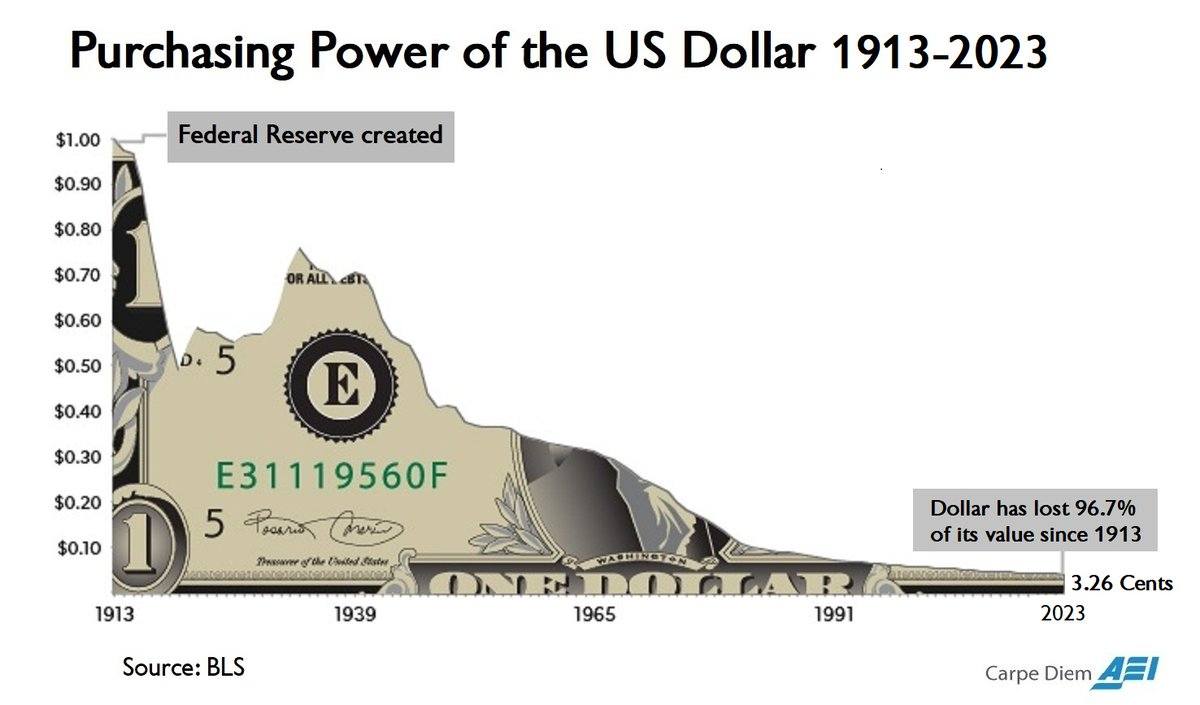

Between 1913 to 2023, or 110 years, the U.S. dollar lost 96.7% of its purchasing power. $1 in 2025 only buys about 3.1% of what it could buy in 1913, meaning its value has declined to roughly $0.03 in 1913 terms. What happens at zero?

Inflation is not an accident. It is not the result of mysterious market forces beyond comprehension. It is a deliberate consequence of a system designed to dilute the value of money by allowing the supply of currency to grow faster than the production of actual goods and services. That is its only definition and inflation’s only cause. Meanwhile, technology—man’s tool for mastery over nature—has made production faster, cheaper, and more efficient than ever before.

So why should prices rise, if not because someone is tampering with the money?

And yet, society accepts this ongoing theft with a shrug. They repeat “back in my day” like a lullaby, blind to the confession hidden in their nostalgia: that they have been robbed. Robbed by political and banking institutions, they were taught to trust. The government has drained their wealth slowly, silently, and with cold precision. The central bank has engineered this betrayal in plain sight, not just once, but over generations since its creation.

This is the moral context in which we must understand the gravitation toward gold, now priced at $3,356 per ounce, and bitcoin, trading over $109,000 per coin at 10 a.m. Eastern time on Friday. These are not mere commodities—they are acts of defiance. They represent a growing recognition of what hard money truly means: money that cannot be conjured out of political convenience or central planning.

Money backed by scarcity, rooted in objective value, and immune to manipulation.

Gold and bitcoin are not relics of the past or speculative whims of the future; they are the direct consequence of a moral rebellion. They reflect a refusal to be enslaved by a dishonest monetary regime. People are not just seeking safety—they are seeking justice.

Both gold and bitcoin possess a rare and powerful attribute in a world dominated by centralized authority: they are fundamentally resistant to censorship and manipulation. Gold, by its very nature, is a physical asset beyond the reach of political decree. It cannot be printed, duplicated, or forged into existence. It requires effort—mining, refining, and safeguarding.

No bureaucrat can simply will more gold into circulation with a signature.

Bitcoin, though digital, is governed by the same principle of incorruptibility. Its code is public, its supply is fixed, and its network is decentralized—run by thousands of independent nodes and miners across the globe. No single government, institution, or cartel can alter its issuance schedule or freeze a transaction without consensus from a global community. In Bitcoin, the main consensus rules are transparent and immutable; they apply equally to all.

This is why these hard assets matter—not merely as alternatives, but as lifelines for economic integrity. They represent systems that refuse to bend to coercion, cronyism, or inflationary deceit.

They are the financial instruments of free men and women, the individual who demands the right to own, trade, and save without begging permission.

When a monetary system can be twisted to serve political interests, it ceases to serve the people. In contrast, gold and bitcoin offer a realm where voluntary exchange, property rights, and objective value still prevail. To understand them is to understand freedom itself.

The flight to hard money is not about profits. It is about principle. It is a sign that individuals are waking up to a truth that has long been obscured by jargon, bureaucracy, and lies: that the only way to fix the world is to fix the money.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。