Original | Odaily Planet Daily (@OdailyChina_)

_

Author | Ethan (@ethanzhangweb3)_

On the evening of May 21, the Hong Kong Special Administrative Region government submitted the “Stablecoin Regulation Bill” to the Legislative Council, which was passed in the third reading. After being signed by the Chief Executive and published in the gazette, it will officially take effect. With this, Hong Kong becomes the first jurisdiction in the world to establish a comprehensive regulatory framework for fiat-backed stablecoins, and compliant Hong Kong stablecoins are expected to be officially launched by the end of this year.

At the same time, on May 19, the US Senate passed the procedural vote for the “2025 US Stablecoin Innovation and Establishment Act” (GENIUS Act) with a vote of 66 to 32, attempting to provide federal regulation for dollar-pegged stablecoins _ (Recommended reading: “The GENIUS Act is expected to pass the Senate, marking a historic breakthrough in stablecoin regulation”)._

In this article, the author will deconstruct the core content of Hong Kong's stablecoin bill based on the original text of the “Regulation” (Gazette No. C3116-C3684), compare it with the US stablecoin bill “GENIUS Act,” and gather industry opinions to discuss the similarities and differences between the two regulatory frameworks and their impacts.

Deconstruction of Hong Kong's Stablecoin Bill

Original text of the “Stablecoin Regulation Bill”

The “Stablecoin Regulation Bill” consists of 11 parts, 175 articles, and 8 schedules, covering licensing systems, licensee responsibilities, regulatory powers, and sanctions, among others. Below is a summary of some key points based on the original text:

- Definitions and Scope:

Definition of stablecoin: Refers to “fiat-backed stablecoins,” which are tokens pegged to fiat currencies (such as Hong Kong dollars, US dollars) to maintain stable value.

Regulated activities: Include issuing stablecoins, managing reserve assets, and providing services related to stablecoins.

- Licensing System:

Issuers must apply for a license from the Hong Kong Monetary Authority, with applicants limited to companies or recognized institutions outside Hong Kong.

Minimum registered capital of HKD 25 million to ensure financial strength.

Engaging in regulated activities without a license or false advertising is a criminal offense, with penalties including fines and imprisonment.

- Licensee Responsibilities:

Reserve management: Stablecoins must be pegged 1:1 to fiat currency, and reserve assets must be fully covered and audited regularly.

Consumer protection: Mandatory unconditional redemption rights, ensuring users can redeem at face value at any time.

Management requirements: Licensees must appoint a CEO, directors, and stablecoin managers, subject to approval by the Hong Kong Monetary Authority.

- Regulation and Sanctions:

The Hong Kong Monetary Authority can require licensees to provide information, conduct investigations, or appoint statutory managers.

Sanctions include fines, license revocation, and criminal liability; unlicensed activities and sales by non-recognized providers can lead to convictions with penalties of up to HKD 5 million and 7 years imprisonment; fraudulent activities can incur fines of up to HKD 10 million and 10 years imprisonment.

- Transitional Arrangements:

- Existing stablecoin issuers must apply for a license or exit the market before the effective date (expected to take effect in 2025).

Comparison with the US “GENIUS Act”

Overview of the “GENIUS Act”

The “GENIUS Act” (S. 394) aims to provide a federal regulatory framework for dollar-pegged payment stablecoins, promoting innovation and maintaining the global status of the dollar (as indicated in Section 1 of the bill). The bill was submitted on February 4, 2025, and passed the procedural vote on May 19, but has not yet been finally approved.

Comparative Analysis

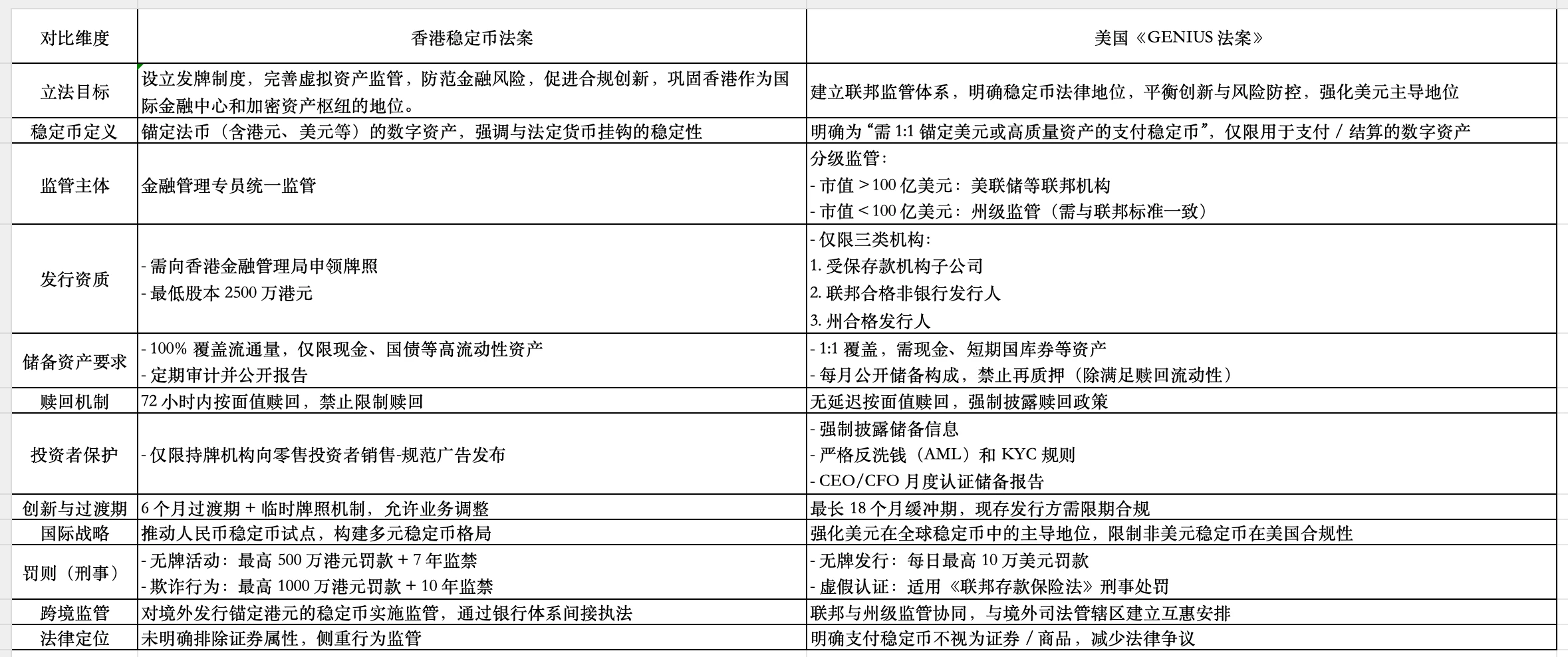

Summary of Core Differences and Strategic Positioning (Differences):

Regulatory Framework and Market Positioning

Hong Kong: Adopts a centralized regulatory model led by the Financial Commissioner, supporting the issuance of stablecoins pegged to multiple fiat currencies such as the Hong Kong dollar and US dollar, balancing financial stability and innovation based on a “risk-based” principle, aiming to create an international and diverse stablecoin ecosystem, enhancing Hong Kong's compatibility as an international financial center.

United States: Implements a tiered regulatory approach (federal and state collaboration), focusing on the dominant position of dollar stablecoins, requiring issuers with a market capitalization exceeding USD 10 billion to be subject to federal regulation, with a core focus on “protecting dollar hegemony + preventing systemic risks,” limiting compliance for non-dollar stablecoins, highlighting geopolitical strategic considerations.

Stringency of Regulation and Market Impact

Hong Kong: Sets strict requirements such as a minimum capital of HKD 25 million, 100% high liquidity reserve assets, and a 72-hour mandatory redemption period, which may enhance market stability but could increase compliance costs for small and medium-sized institutions, potentially stifling innovation in the short term, but beneficial for building investor trust in the long term.

United States: Allows reserve assets to include short-term government bonds, repurchase agreements, etc., providing higher investment flexibility, but with strict limitations on non-dollar stablecoins; the tiered regulatory approach offers small issuers state-level regulatory options, but may lead to inconsistent regulatory standards and higher execution complexity.

Consumer Protection and International Coordination

Hong Kong: Mandates licensed institutions to sell to retail investors, regulates advertising, and guides the market towards orderly compliance through a temporary licensing transition period (6 months), with more direct consumer protection measures.

United States: Focuses on monthly disclosure of reserve assets and anti-money laundering requirements, but consumer redemption rights protection and information disclosure frequency (Hong Kong requires regular audits, while the US requires monthly disclosures) are relatively weakened, and relies on collaboration between federal and state-level regulation, with international mutual recognition mechanisms still under exploration (such as establishing reciprocal arrangements with foreign jurisdictions).

Core Consensus and Industry Impact (Similarities):

Regulatory Consensus: Both require stablecoin reserve assets to fully cover circulation, prohibiting misappropriation or high-risk investments, reflecting the international principle of “same activity, same risk, same regulation.”

Industry Impact: The Hong Kong bill is more likely to promote offshore RMB stablecoin pilots, thus becoming a “digital bridge” for RMB cross-border payments; the US bill consolidates the dollar's dominant position in the stablecoin sector, with both approaches shaping different paradigms of global stablecoin regulation from “diversity and inclusiveness” and “dollar-centric” perspectives.

Overall, the Hong Kong bill attracts global capital and diverse stablecoin projects with a foundation of “compliance + open innovation,” while the US bill maintains local financial hegemony with a focus on “dollar dominance + risk prevention.” The differences essentially reflect the trade-offs of different economies in financial stability, monetary strategy, and innovation inclusiveness.

Various Opinions

GFF.eth, a member of the Hong Kong community (@GF41536085):

On May 19, the Senate procedurally passed the US stablecoin bill “GENIUS Act,” and immediately on May 21, Hong Kong passed its stablecoin bill. Regardless of whether it is just a performance to go through the motions, at least all the prerequisites for the internationalization of the RMB have been opened. Stablecoins are financial nuclear weapons, and now all the pre-launch insurance has been opened, fingerprints, passwords, irises, all have been lifted. Next, it depends on whether decision-makers dare to press the button. Do they dare to issue RMB on Ethereum? If after all this, they only issue a Hong Kong dollar stablecoin, that would be a joke. The Hong Kong dollar implements a linked exchange rate system, which is a US dollar stablecoin; turning the US dollar stablecoin into a stablecoin is truly a waste of effort.

Gary Tiu: Executive Director and Head of Regulatory Affairs at OSL Group

The OSL Group actively participates in discussions on Hong Kong's stablecoin policy formulation, witnessing and promoting the formation of the stablecoin framework. The Hong Kong stablecoin bill sets a unified standard for industry development, helping to enhance transparency and long-term stability.

Wu Jiezhang (@Johnnynkc_): Chinese People's Political Consultative Conference member, Hong Kong Legislative Council member, and head of the Hong Kong Web3 cryptocurrency leadership group

Hong Kong's promotion of crypto stablecoins makes it an international Web3 financial center, relying on the 1.4 billion population and dividends of mainland China. Not only will it launch a Hong Kong dollar stablecoin, but it will also introduce offshore RMB stablecoins and other stablecoins, embracing cryptocurrencies, Web3, and stablecoins. The passage rate of today's bill is just the first step in building Web3 infrastructure. I hope to work with everyone to promote: first, create application scenarios - issuing stablecoins is the first step, but the most important thing is to create more application scenarios for stablecoins. Whether in physical retail, cross-border trade, trading pairs, etc., I believe there is great potential and opportunity to promote the landing of stablecoins. I call on friends from various industries in traditional and physical scenarios to understand and embrace stablecoins, as this will be an important financial innovation; secondly, improve the stable market attributes, including releasing interest on stablecoin holdings. Releasing interest helps enhance the market competitiveness of stablecoins and can provide incentives for more people to participate, expanding the overall market share of stablecoins, thus aiding in their development.

Wall Street Journal:

On May 21, the Hong Kong Special Administrative Region Legislative Council passed the “Stablecoin Regulation Bill” in the third reading, marking the formal inclusion of stablecoins as virtual assets into the legal regulatory system. At the same time, the US government is also accelerating the promotion of stablecoin legislation. As major financial centers establish their own digital currency systems, ensuring greater monetary control in the digital financial era, this “digital currency sovereignty battle” may just be beginning.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。