In the cryptocurrency world, being the target of criticism is not terrifying; being irreplaceable is the real ace.

Written by: Bright, Foresight News

In the first half of the year, Hyperliquid, which was once questioned and faced FUD, has risen again.

On May 22, as BTC broke the $110,000 mark, HYPE surpassed 30 USDT, with a 24-hour increase of 14.79%. Its total FDV stabilized at $29 billion, jumping to the 14th position in cryptocurrency market capitalization. In contrast, a giant whale has been shorting HYPE worth $57.14 million at around $20.4 with 5x leverage since May 8, and this position is currently facing an unrealized loss of $18.8 million. To prevent liquidation, this address has added margin three times, with the latest addition of $2.04 million USDC made two hours ago to avoid forced liquidation.

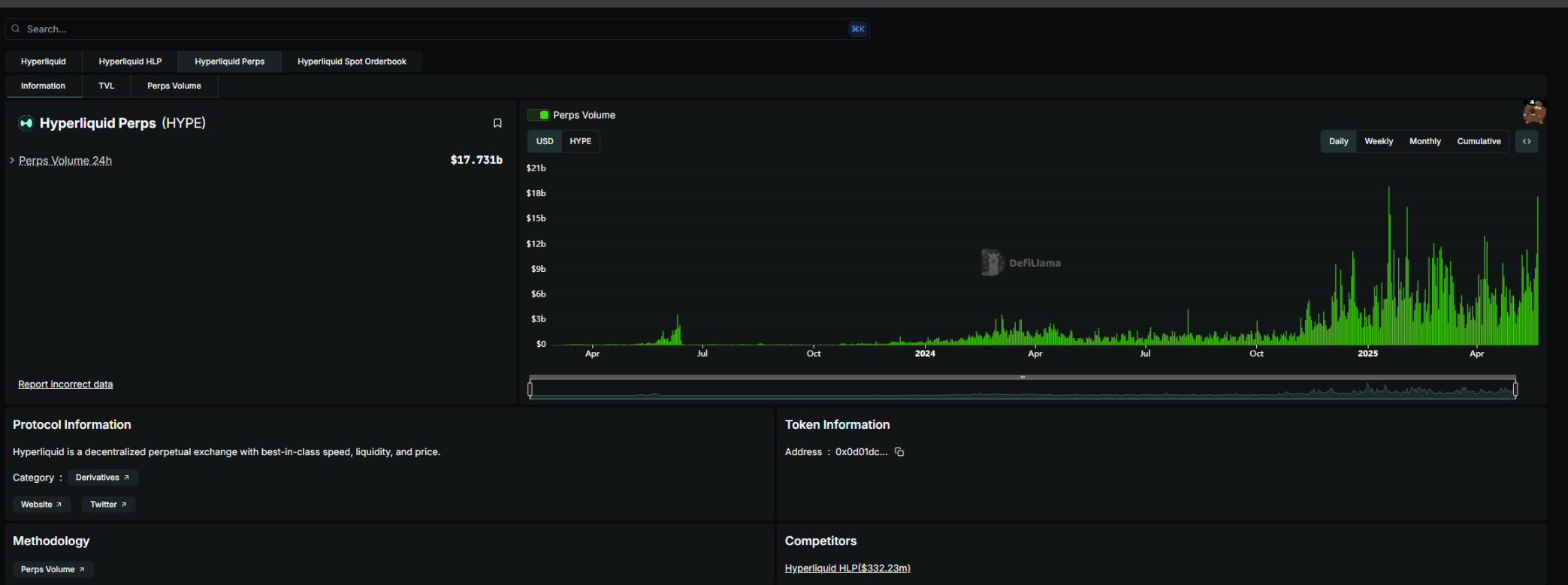

At the same time, Hyperliquid's official announcement stated that its platform data set multiple historical highs today, including a total open interest (OI) of $8.9 billion, 24-hour trading fees of $5.4 million, and a total locked amount of USDC reaching $3.2 billion.

It is worth noting that two months ago, Hyperliquid was still mired in a near liquidation crisis due to vault risks and "decentralization" FUD. Arthur Hayes, the founder of Bitmart, directly attacked Hyperliquid on X, stating, "HYPE will return to the starting point," and urged everyone to "stop pretending Hyperliquid is decentralized."

On-chain Perp Demand Remains Strong

After the JELLY short squeeze incident calmed down, more and more whales began to choose Hyperliquid. According to data from The Block, Hyperliquid had already accounted for about 9% of Binance's contract trading volume for two consecutive months before the short squeeze incident occurred.

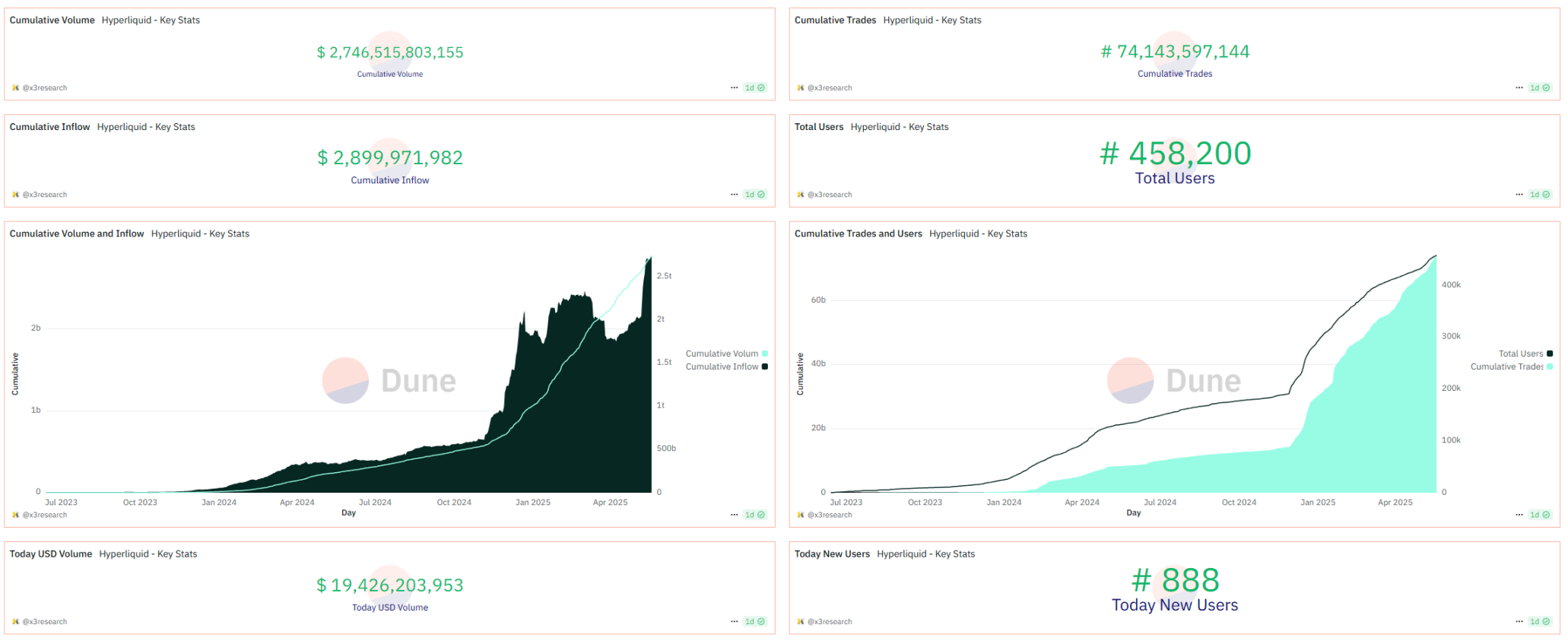

According to Dune data, Hyperliquid is experiencing rapid growth in both trading volume and user numbers. Have the whales forgotten about the short squeeze incident?

Hyperliquid's choice is not based on an absolute decentralization philosophy, but rather prioritizes capital efficiency and protocol security. As Zuo Ye wrote in the article "Hyperliquid: 9% of Binance, 78% Centralized"—in the sequence of Perp DEXs, Hyperliquid's innovation lies not in architectural innovation, but in adopting a "slightly centralized" approach to learn from GMX's LP tokenization, combined with listing and airdrop strategies to continuously incentivize market speculation, successfully capturing the derivatives market that CEXs firmly occupy. This is not a defense of Hyperliquid, but rather the underlying nature of Perp DEXs; absolute decentralized governance cannot respond to black swan events quickly enough, and to respond efficiently, a sword-bearer is necessary.

Thus, whales have chosen to trust Hyperliquid, which is primarily based on smart contracts and supplemented by staked node voting, rather than mature CEXs. The following three factors are key to Hyperliquid's emergence from the shadows.

Anonymity Demand. Many whales and large holders place great importance on personal privacy protection and do not want to be subject to potential withdrawal and transfer restrictions that centralized exchanges may impose.

Good Liquidity. Only large pools can accommodate whales flipping positions. In fact, only a few leading centralized exchanges can match Hyperliquid's liquidity.

Public Positions. Influencers like James can create a "money and influence" cycle—using Hyperliquid's publicly available large positions and profits to enhance their influence, which in turn encourages retail investors to follow suit, thereby influencing market direction. In traditional CEXs, influencers still need to connect to the exchange's API to display their positions.

In this round of price increase, whales in Hyperliquid have been very active. There was the "50x Insider" (before HYPE adjusted leverage) with extreme operations, followed by meme legend James Wynn making a large public long position. Especially the latter, who made over $40 million in profit through nearly $1 billion in long positions during BTC's surge to a new historical high.

At the same time, to address issues like stablecoin yield and outflow, Hyperliquid launched its native stablecoin HUSD, which integrates two core insights: unifying the pricing asset (stablecoin) used for trading and the cash flow it generates within the trading platform system. The end result is a stablecoin with the nature of a "public good," transforming the originally static reserve interest into proactive, compound growth within the Hyperliquid ecosystem.

Review: The JELLY Short Squeeze Shadow

Let’s rewind to the evening of March 26, when the meme coin JELLYJELLY faced a short squeeze, surging 429% within an hour. The Hyperliquid Vault took over a short position of JELLYJELLY after a self-liquidation, which at one point faced an unrealized loss of over $10.5 million. At that time, if JELLYJELLY reached $0.15374, the Hyperliquid Vault would lose all of its $230 million funds; as funds flowed out of the Hyperliquid Vault, it would further lower JELLYJELLY's liquidation price.

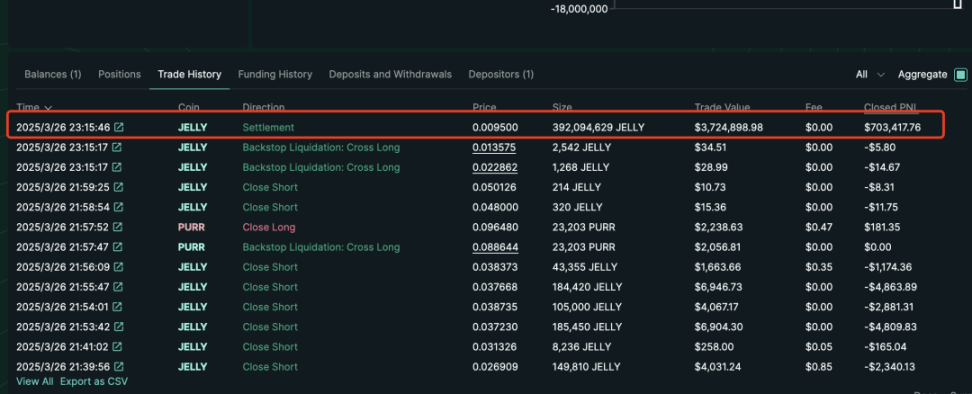

After the incident, OKX and Binance announced the launch of JELLYJELLY perpetual contracts that night, while Hyperliquid quickly delisted JELLYJELLY after the futures contracts were launched on Binance and OKX, and the massive loss short position in the Hyperliquid Vault for JELLYJELLY was settled.

Just when onlookers thought Hyperliquid was conceding defeat, the situation took an "unexpected yet reasonable" turn. According to historical data from Hyperliquid's official website, the JELLYJELLY short position taken over by the Hyperliquid Vault was closed at $0.0095 at 11:15 PM, and the anticipated loss of over $10 million did not occur; the HLP Vault even made a profit of $703,000 on that position. Subsequently, Hyperliquid announced that after discovering evidence of suspicious market activity, a meeting of validators was convened to vote on the delisting of the JELLY perpetual contract. All users, except for the marked addresses, would receive full compensation from the Hyper Foundation.

According to Parsec panel data, during the hours following the JELLY liquidation event, Hyperliquid experienced a net outflow of USDC amounting to $140 million. In contrast, during the four days surrounding the ETH whale long liquidation event on March 12, Hyperliquid's total net outflow of USDC approached $300 million. From February 26 to March 26, Hyperliquid's USDC balance also dropped from about $2.5 billion to $2.07 billion.

In response to this incident, many CEX CEOs and others raised questions about Hyperliquid, consistently stating that Hyperliquid, which claims to be a decentralized exchange, operates more like an offshore CEX without KYC/AML, and its immature operations could lead to FTX 2.0. However, some pointed out that the leading exchanges are the most suspicious instigators behind the attacks on Hyperliquid. A user named offthetarget even revealed on X that as early as March 24, someone contacted him to help push for JELLYJELLY's listing on Binance. After assisting in contacting the listing team, the feedback was that it was temporarily unlikely for some MEME coins to be listed. Yet, in less than two days, Binance decided to list the JELLY contract, indicating that there were clearly hidden circumstances.

Moreover, this is not the first time Hyperliquid has encountered similar issues. On March 13, a whale using 50x leverage opened a long position worth about $300 million in ETH on Hyperliquid, with a maximum unrealized profit of $8 million. However, the user subsequently withdrew most of the principal and profits, causing the liquidation price to rise, and ultimately the position was liquidated, netting about $1.8 million USDC. The platform's insurance fund (HLP Vault) thus bore a loss of about $4 million. Hyperliquid Vault data shows that after this whale actively triggered the liquidation mechanism, HLP collectively lost $3.45 million.

In response, Hyperliquid announced it would adjust leverage limits to optimize liquidation management and enhance market buffering capacity during large-scale liquidations, with the maximum leverage for BTC adjusted to 40x and for ETH to 25x.

Considering Hyperliquid's scale and HYPE's price performance, as a project with a TGE in 2024, its role as a Perp DEX is a genuine on-chain necessity. In the cryptocurrency world, being the target of criticism is not terrifying; being irreplaceable is the real ace.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。