Author: Fairy, ChainCatcher

Editor: TB, ChainCatcher

Last night, as Bitcoin was gearing up to break its historical high, a "billion-level showdown" unfolded on-chain with a fierce battle between bulls and bears.

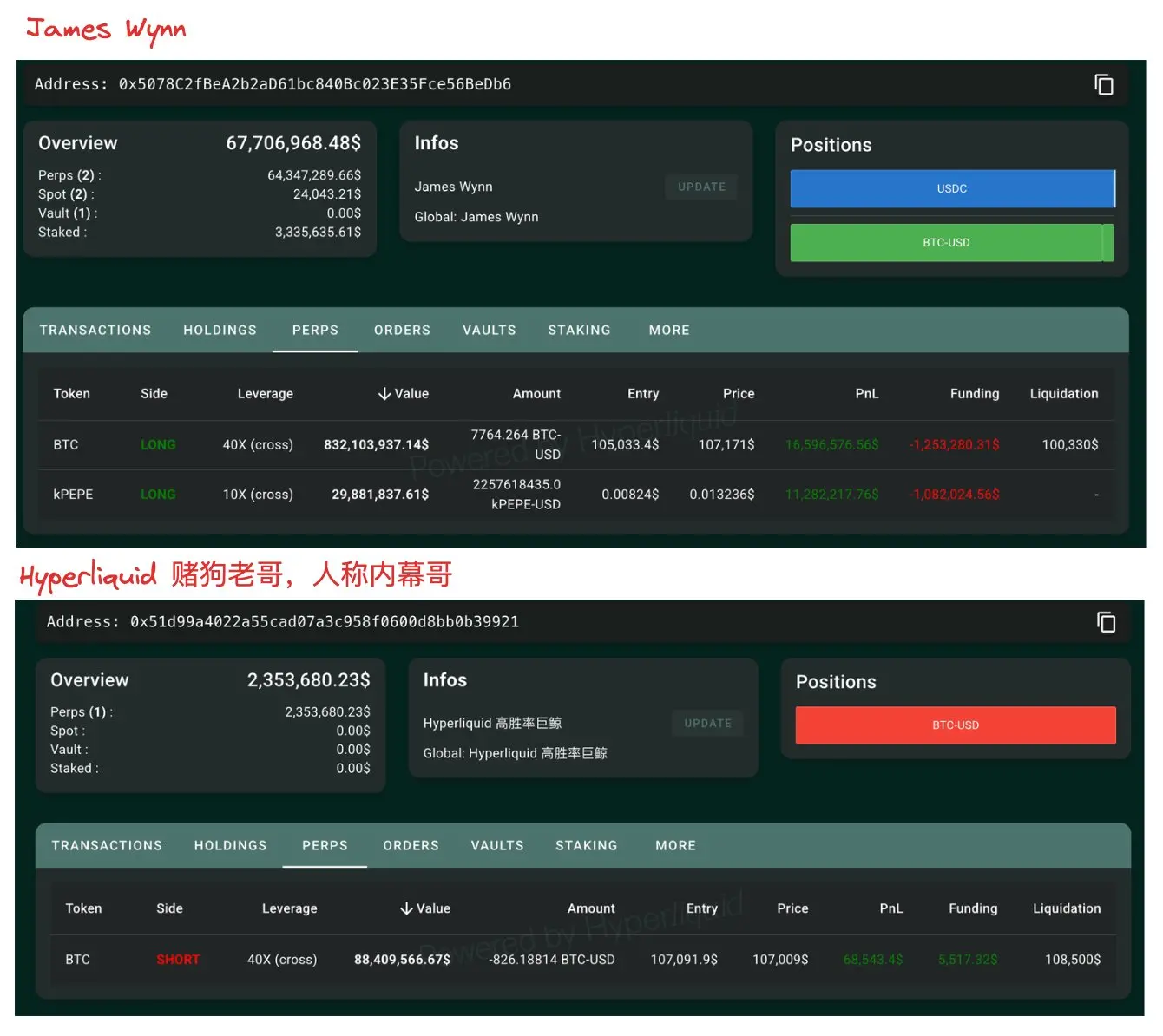

Two aggressive trading giants, both heavily invested, faced off: on one side was the legendary trader James Wynn, and on the other was the high-win-rate player known as "Hyperliquid 50x Insider." They both placed 40x leveraged BTC bets, instantly attracting significant market attention.

Leverage amplifies profits but also magnifies greed. Let’s review the ins and outs of this late-night battle.

Who Are They?

Bullish player James Wynn has been hailed as the "legendary meme coin hunter" on-chain. His trading beginnings were quite low-key, initially just a "10U warrior," with wallet interactions hovering around a few dozen dollars. However, during the PEPE craze, his style suddenly shifted to aggressive heavy positions, making a name for himself. James Wynn earned over $25 million from an initial investment of $7,644 during the PEPE surge.

James Wynn's contract style can be summarized in three keywords: large positions, high leverage, and high frequency. Each of his entries is almost always accompanied by a call. Recently, in BTC long positions, he repeatedly stated, "Bitcoin at $100,000 is very cheap."

The background of the bearish player "Hyperliquid 50x Insider" is even more bizarre. Since January of this year, multiple addresses behind him have frequently used high leverage on GMX, accumulating profits of about $2.53 million. He is active on the gambling platform Roobet and AlphaPo, has interaction records with the hacker-favored exchange ChangeNOW, and single-handedly withdrew $1.8 million from the Hyperliquid platform, achieving legendary status. (Related reading: When it gets tough, even exchanges get cut! A deep dive into how Hyperliquid was drained of $1.8 million.)

Regarding his true identity, ZachXBT has pointed out that this "Insider" is likely related to William Parker (WP). WP is a "professional gambler" with a history of fraud, having been arrested in Finland in 2023 for stealing a total of $1 million from two online casinos. He has repeatedly made headlines in British media for involvement in hacking and gambling-related fraud.

Battle Recap

According to data provided by on-chain analyst Ai Yi, a legendary showdown quietly began on May 21 at midnight.

⏰ 2 AM - 4 AM: Both players increase their positions

At 2 AM, James Wynn took the lead, increasing his 40x leveraged BTC long position to 7,764.26 BTC (worth about $832 million).

- Opening price: $105,033.4

- Liquidation price: $100,330

- Unrealized profit at the time: about $16.59 million

At 4 AM, the Insider entered the market short, fully embracing his gambling nature. As BTC reached a temporary high, he opened a 40x short position:

- Position size: 18 BTC (about $88.41 million)

- Opening price: $107,091.9

- Liquidation price: $108,500

- Unrealized profit at the time: $80,000

Image source: Ai Yi

⏰ 2 PM: BTC breaks $107,500, divergence begins to show

The performance of both positions began to diverge:

- James Wynn: Unrealized profit on long position rises to $19.83 million

- Insider: Unrealized loss on short position of $50,000

⏰ 3 PM to 6:30 PM: James Wynn takes profits in batches, position decreases

- 3 PM: Long position reduced to 43 BTC, unrealized profit $9.43 million, realized profit $10.48 million

- 4 PM: Continued to reduce to 26 BTC, unrealized profit $7.68 million, realized profit $11.92 million

- 6:30 PM: Further closed part of the position, leaving only 86 BTC, unrealized profit down to $2.72 million, cumulative realized profit $14.57 million

At this point, James Wynn's long position had decreased from a peak of $832 million to $268 million, gradually securing profits.

⏰ 9 PM: The front stabilizes, James Wynn holds low-key, Insider remains inactive

BTC retraced to $106,500.

- James Wynn did not immediately increase his position, holding a long position of 58 BTC ($19.3 million), unrealized profit $2.65 million, realized profit $15.42 million

- Insider's short position: 18 BTC, unrealized profit $542,000

⏰ After 11 PM: Peak collision, both increase positions, tension rises

As BTC broke $108,000, James Wynn heavily increased his position to a historical high, while Insider also added margin to open another short:

James Wynn

- Increased to 97 BTC ($815 million)

- New average opening price: $107,726.7

- Liquidation price: $101,420

- Current unrealized profit: $13.46 million

Insider

- Increased short position to 4 BTC ($65.43 million)

- New opening price: $108,185.5

- Liquidation price raised to: $112,320 (added $2 million USDC margin)

- Current unrealized loss: $60,000

⏰ 11:30 PM to midnight: A historic face-off, positions exceed a billion

Close to 11:30, James Wynn's long position surpassed $860 million, raising the liquidation price to $101,980; Insider's short position expanded to $101 million, liquidation price $110,780.

Close to 11:45, James Wynn's long position approached $900 million.

Close to midnight: James Wynn's position broke a billion, reaching the peak of this round, and the confrontation between the two reached its climax.

Morning report on May 22: James wins decisively

BTC fluctuated significantly and broke $110,000, reaching a historical high.

James Wynn's long position increased to 10,200 BTC, worth $1.12 billion, with an unrealized profit of $20.19 million.

Insider's originally profitable short position saw significant unrealized losses, as he continuously added to his position in the $106,670-$107,410 range, missing the opportunity to take profits, with a cumulative loss expanding to $5.61 million, still holding a 40x short position of 449.43 BTC.

Between Victory and Defeat, Understanding the Edge of Leverage

James Wynn wrote down the victory, while Insider paid the price for greed and hesitation. This "billion-level showdown" not only exploded the data front but also sounded a dual alarm for risk and discipline in the market.

And similar games may be unfolding right beside you and me. Currently, the BTC contract open interest has soared to a historical high of $80.263 billion. In the past 24 hours, the total liquidation in the crypto market reached $407 million, with $240 million from short liquidations and $167 million from long liquidations.

Under high leverage, unrealized profits and liquidations are just a line apart.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。