Bitcoin is breaking away from the early speculative logic and entering a new cycle that is more mature, stable, and capital-driven.

Written by: Rhythm BlockBeats

With multiple drivers such as regulatory breakthroughs, structural capital inflows, and a recovery in market confidence, Bitcoin is once again approaching its historical high. As the "GENIUS Stablecoin Act" moves to the final voting stage in the Senate, a channel for hundreds of billions of dollars to flow into the crypto market is about to open. The U.S. SEC is also launching a new round of crypto rule drafting, releasing unprecedented policy-friendly signals.

At the same time, on-chain data shows that Bitcoin's illiquid supply has reached a new high, with chips steadily migrating from short-term speculators to long-term holders. The continuous inflow of spot ETFs and low funding rates indicate that this round of price increase is not overheated but driven by institutional buying and structural tightening.

Bitcoin is breaking away from the early speculative logic and entering a new cycle that is more mature, stable, and capital-driven. While market sentiment remains restrained and volatility has not yet expanded, traders and institutions have differing judgments on new highs. BlockBeats has compiled this for readers' reference.

Trader Analysis

Positions not breaking new highs, price breaks first = Healthy rise?

@CryptoPainter_X

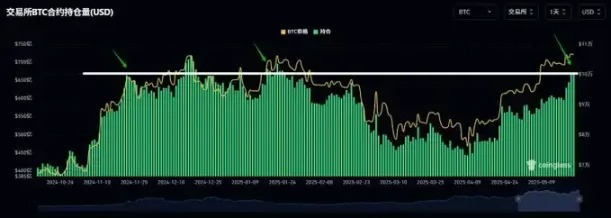

BTC's current total network positions are finally approaching historical highs!

There is still a potential increase of $2.9 billion from the previous position of $69.568 billion when the price broke new highs;

The current price is only $2,000 away from breaking new highs, so even if it is completely driven by futures, it may not necessarily lead to a $2.9 billion increase in positions, meaning it is difficult to form a divergence between positions and price here;

If the price experiences a pullback, and after the pullback, positions begin to gradually increase or even exceed historical highs, then a divergence in positions may form. This type of large structural bull top divergence occurred at the end of 2021.

So the current logic is simple: if the price breaks new highs before positions do, it indicates that the market is still not overly FOMO, which is very healthy!

However, if positions break new highs before the price does, it indicates that speculative sentiment is too strong, and a liquidation of positions could easily occur.

"Rising instead of falling": Active buying alleviates selling pressure

@biupa

From the Coinkarma indicator, Bitcoin's "rising instead of falling" is ongoing

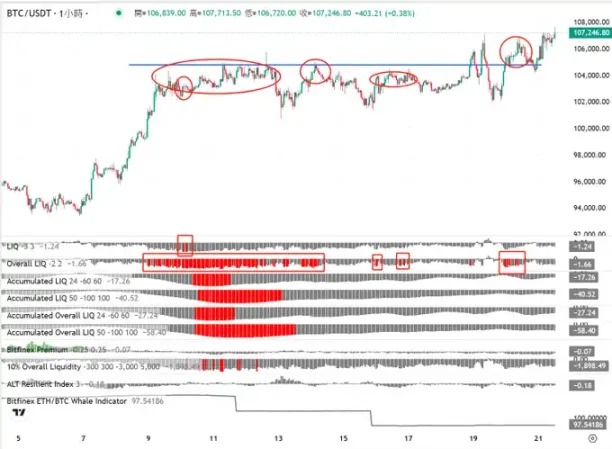

Yesterday, during a Tencent meeting live broadcast, I believed that there would be a wave of upward breakthroughs testing previous highs in late May. On one hand, there is the expectation of a price surge before the Bitcoin conference, and on the other hand, from the CoinKarma indicator, Bitcoin's LIQ is continuously improving. LIQ measures the difference between the buy and sell orders. A "red" signal means that the sell orders above far exceed the buy orders below (the limit orders). Generally, this is a "dangerous" signal.

After the first breakthrough of 100,000 (from May 9 to 14), both Bitcoin and Overall (i.e., the "market") showed red - which is usually referred to as a "danger signal." However, we also provided expectations for a main upward wave, referencing BTCUSDLONGS and ETHBTCLONGS. Therefore, we continue to observe, and we can see that there are still a few "scattered reds" later, but the frequency is decreasing, while Bitcoin remains above 102,000.

The most recent appearance of red was in the 106,000 range. It can be seen that although the price has risen, the red LIQ signal has significantly decreased. What is the reason for this? This is what I refer to as the "rising instead of falling" market, which is also key evidence of strong bullish momentum.

Generally speaking, LIQ red needs to be resolved through a decline. When there are too many sell orders at a certain position (for example, 105,000), Bitcoin moves in the direction of less resistance (downward). When Bitcoin falls back to 99,000, the sell orders above decrease, and the buy orders below increase, allowing both sides to rebalance, which is why Bitcoin stops falling, and the LIQ indicator returns to normal values.

The understanding of "rising instead of falling" is that active buying has always existed, continuously impacting the sell walls, causing the limit orders at the critical position of 105,000 to decrease until they are completely absorbed. Therefore, when the price continues to rise, the LIQ actually shows improvement.

Upon observing that red only appeared at 106,000 the day before yesterday, and that LIQ significantly improved when it pulled back to the 105,000 range, I am very confident in going long. This also helped me hold onto a series of long positions like PEPE MOODENG, thus making a profit.

For the subsequent trend, based on seasonal and event-driven principles, I believe there is a possibility of continued upward movement at least until the 26th. After the 26th, caution is needed. (Regardless of whether it is a main upward wave, we must be pragmatic)

In addition, altcoins still need Bitcoin to stabilize above 110,000 to have hopes of significant rebounds; before that, only short-term longs can be made.

Limited contract outflows, main force has not left, cautiously bullish

@roger73005305

Let's talk about the market situation. Just now, the U.S. stock market opened, and the S&P 500 fell by 1%, but Bitcoin did not follow suit.

Currently, the accumulation data of Bitcoin contracts peaked between 6.6B-7B, with a maximum outflow of 1.7B, which is not a large proportion. Additionally, there is still a net inflow of 5.65B. I tend to believe that the main force has not left, so at this time, I still lean towards being bullish.

Many friends say that BTC's main force drew many doors yesterday, but in fact, there is only one real door, which is the one I marked with an arrow. You need to look at the larger level of doors, not just the 15min and 1h charts; at least look at the 4h or 1D charts.

So before the main force wants to break through, they might create a false breakdown to trigger stop losses for longs and liquidate shorts, and then their true intention will emerge, which is to rise. Moreover, we have always said that the main force's bottom chips have not exited, so it is highly likely to rise.

Therefore, the overall direction is upward, and I will not short; I will always look for opportunities to go long on quality coins.

Key points must stabilize; cannot be bearish before historical highs

@Cato_CryptoM

Last night's judgment seems to have been "hasty." Bitcoin initially synchronized with the U.S. stock market, but then started its independent trend at 11 PM, currently overturning my two viewpoints from yesterday:

Short-term topping signals, hourly and daily levels have been overturned.

The stablecoin legislation's impact on the market is still ongoing; previously, the market did not fully anticipate or price it in.

Conclusion:

The price has broken through and stabilized at 106,450, which is the second-highest point of 2025. The price breakthrough means that the accumulated chips here have formed effective turnover, and the price will further push upward, so it cannot be bearish in the short term.

The stablecoin legislation is not considered a favorable landing until Trump signs it and it becomes law. Once Trump signs the bill into law, attention should be paid to the favorable landing.

The next key turnover resistance is the historical new high, which is a key psychological expectation and a major turnover area.

Of course, my friends must ask if my short position is still there; the answer is yes, I am waiting for the historical high to see.

Chip concentration pauses: Direction is critical, volatility is imminent

@Murphychen888

From May 7 to May 14, BTC's chip concentration dropped from a high of 15.5% to 8.2% in just 7 days. This indicates that as the price rises, it has gradually moved away from the chip concentration area. If the concentration curve continues to decline, it is likely accompanied by a continued price rise.

However, we found that after May 14, the concentration curve suddenly stopped declining around 8.2% and seems to be turning upward again. An 8.2% concentration is neither high nor low.

If the price falls back into the concentration area, the concentration curve will rise rapidly again, brewing greater volatility. Similar to the marked point in the chart on January 23, 2025, where the price pullback caused the concentration to drop from a high position and then turned upward again, leading to amplified price volatility.

Another possibility is that the price continues to rise, and the concentration curve only pauses briefly before continuing downward, similar to the situation marked in the chart on November 3, 2024.

In summary, the current concentration curve has not smoothly declined but has paused midway, bringing uncertainty to the market direction. Through this indicator, it is difficult to guess whether to be bullish or bearish; it only tells us that the market may be about to choose a direction again.

However, when the concentration rises to a certain height, considering going long on volatility would be a good choice.

Institutional Observations

CryptoQuant: No signs of market overheating

Whenever the price of a coin experiences a strong rise, causing a large number of tokens that were originally at a loss to quickly turn profitable, the 30-day simple moving average (SMA) of the unspent transaction output (UTXO) profit and loss ratio will rise above 200. The higher this indicator spikes, the more likely the market is approaching the "overheated" or "selling pressure release" stage.

Currently, this indicator is at 99, so there are no signs of market overheating yet. If this moving average continues to break above 200, it will be a clear signal that market sentiment has entered a new round of frenzy. In other words, the market may still continue to reach new highs, but the "easy fuel" that drives the profit and loss ratio higher has basically been exhausted, and stronger price momentum or severe volatility will be needed to push this indicator higher again.

As I mentioned yesterday, the third "compression period" of this cycle is the key elasticity that drives this indicator to break above 200 and enter the overheating stage.

Matrixport: Spot buying drives, long-term capital gradually replaces short-term speculation

Bitcoin's market is showing historical trends again: the price is approaching new highs, and the open contracts have also risen to a historical high of $34 billion. However, the funding rate remains close to zero. This indicates that this trend is driven by spot buying rather than leveraged contracts.

The low funding rate means that there is limited market speculation bubble, and the risk of severe pullbacks triggered by leverage is low. As a result, volatility has remained low in this cycle, and the likelihood of significant fluctuations in the short term is low.

The structure of the Bitcoin market is evolving, with long-term capital gradually replacing short-term speculation as the dominant driving force.

10x Research: The amount held by long-term holders is still increasing; the cycle is not over yet.

On-chain data analysis shows that in 2025, Bitcoin's "OG" wallets—those belonging to early investors, miners, and established exchanges—have been continuously distributing Bitcoin. This is not a panic sell-off, but a planned and rhythmic asset rotation, with Bitcoin steadily flowing to high-net-worth individuals, hedge funds, and corporate treasuries like MicroStrategy. Meanwhile, the amount of Bitcoin held on trading platforms remains low, and market volatility is being suppressed. This round is not characterized by the rapid rise driven by retail impulse seen in 2017 or 2021.

This market trend is slow, strategic, and institutionally driven. As long as large holders can continue to absorb selling pressure, there is still room for Bitcoin to rise. Historical patterns of Bitcoin indicate that the real risk is not when long-term holders start selling, but when they stop selling. That is when demand begins to weaken, absorption fails, and early investors are forced to revert to being "passive holders." We saw this situation in March 2024 and it played out again in January 2025. The signals during those two instances were very clear—we also timely turned bearish at that time.

Currently, the amount held by long-term holders is still increasing, indicating that this cycle has not yet ended. We accurately predicted Bitcoin breaking through $84,500, followed by rises to $95,000 and $106,000. Our next target is $122,000, and this judgment is still based on our analysis model of macro cycles and behavioral capital flows, which has successfully identified significant turning points multiple times.

QCP: Further FOMO After New Highs

The yield on 30-year Japanese government bonds (JGB) has broken through 3%, surpassing historical thresholds. Japan's ever-expanding debt problem has long been a potential concern and is now approaching a critical point. If this wave of bond selling continues and fiscal worries escalate, the market's reassessment of Japanese risk may drive the yen to appreciate in the short term. The turbulence in the Japanese market has already begun to affect global markets. The yield on U.S. 30-year government bonds has re-broken 5%, and investors are turning their attention to the U.S. debt trajectory.

Meanwhile, Bitcoin attempted to break through the $108,000 mark today but failed to maintain momentum. The current price trend is closely related to the increased holdings from Strategy and Metaplanet, which remain the main sources of buying pressure. However, the market is increasingly concerned that they may represent the last wave of "marginal buyers." If their purchasing slows down, it could trigger other investors to take profits, reversing the current upward trend.

Despite facing ongoing macro headwinds, including soaring bond yields, escalating tariffs, and potential stagflation risks in the U.S. in the third and fourth quarters of 2024, Bitcoin has shown remarkable resilience over the past month. That said, once the price successfully breaks through historical highs, it could trigger a new wave of FOMO, pulling sidelined funds into the market and further driving up the price.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。