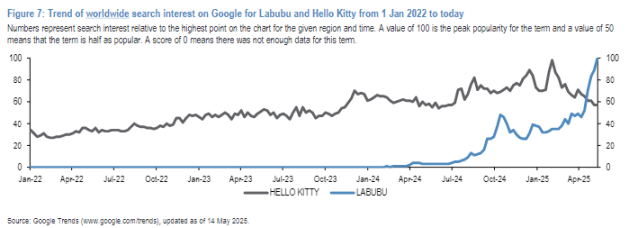

Labubu's search popularity has grown exponentially over the past year, surpassing Hello Kitty in May 2025.

Written by: Li Xiaoyin

Source: Wall Street News

After Hello Kitty, is Labubu the next global super IP?

According to news from the Chase Trading Platform, on May 20, JPMorgan analyst Kevin Yin and Yibo Wu released a research report stating that Labubu and Hello Kitty are very similar in character style and business model, with Labubu rapidly rising as a new generation super IP, and its search popularity has already begun to surpass Hello Kitty.

JPMorgan expects that the sales of THE MONSTERS series, which includes Labubu, are projected to grow from 3 billion RMB in 2024 to 14 billion RMB in 2027, demonstrating its immense potential as a super IP.

Labubu VS Hello Kitty

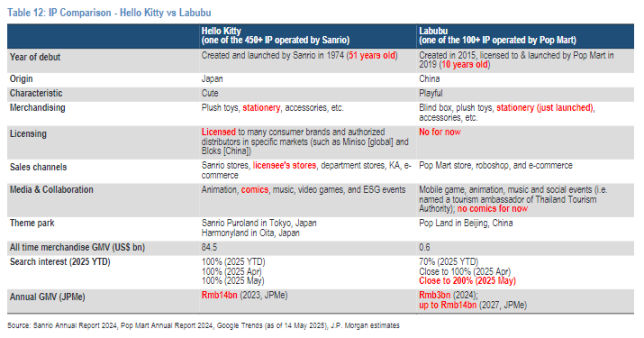

The report points out that the "Labubu" series from Pop Mart shares many similarities with Sanrio's "Hello Kitty."

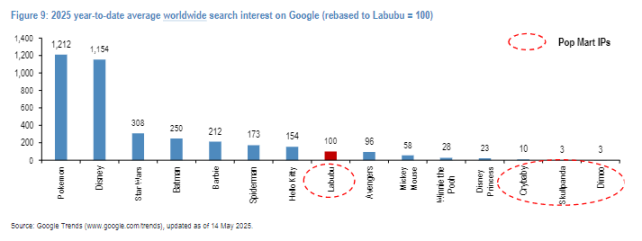

In terms of popularity, Google Trends data shows that Labubu's search popularity has grown exponentially over the past year, surpassing Hello Kitty in May 2025. This indicates that Labubu's brand influence is rapidly increasing globally, especially in regions like Southeast Asia (1-4 times the search popularity of Hello Kitty), Mexico (2 times), and Spain (1.4 times).

The report emphasizes that search interest is a strong indicator of consumer interest and a leading indicator of future sales momentum.

From an IP design perspective, Hello Kitty has deeply resonated with audiences through its simple and cute image, using straightforward lines and soft colors to evoke emotional connections with fans. In contrast, Labubu showcases a distinctly different style, with a more playful and whimsical image featuring big eyes, sharp teeth, and a fluffy tail, appealing to collectors seeking individuality.

In terms of commercialization, Hello Kitty has a well-established commercialization path, primarily through extensive licensing models, allowing its image to be licensed to numerous brands for the production of various products. This model not only brings considerable revenue to Sanrio but also greatly expands Hello Kitty's market influence.

Labubu, on the other hand, focuses more on self-operation and innovation. Pop Mart has introduced Labubu to the market through blind boxes, quickly attracting significant consumer attention. Additionally, Labubu has launched plush toys, stationery, and collaborated with well-known brands to further expand its product line. This self-operated model allows Pop Mart to better control product quality and brand image.

In terms of market performance, Hello Kitty has accumulated retail sales of up to 8.45 billion USD since its launch. Meanwhile, Labubu has achieved sales of 3 billion RMB in 2024 since its introduction in 2019.

Labubu's growth rate not only surpasses Hello Kitty's early growth rate but also demonstrates its enormous market potential.

Why is Labubu the next super IP star?

The report attributes Labubu's success to several key factors.

- Product innovation. Labubu uses unique vinyl plush as material to best showcase the character's softness, distinguishing it from most other IP characters.

- Celebrity influence. Well-known celebrities are attracted to the product and post about their Labubu plush toys on social media.

- Strategic marketing campaigns. In marketing activities organized by the Tourism Authority of Thailand and Pop Mart, life-sized Labubu dolls toured Bangkok last July as "Wonderful Thailand Experience Explorers," sparking social media discussions.

- Significant investment from Pop Mart. Hosting live performances of Labubu at the Pop Mart theme park in Beijing and opening its first offline retail store in Thailand in 2023.

Based on comparisons of search interest, consumer interviews, social media observations, and retail market visits, the report predicts that the annual sales of THE MONSTERS series, which includes LABUBU, are expected to reach 14 billion RMB.

In an optimistic scenario, by 2027, Labubu is expected to achieve 100% of Hello Kitty's search popularity (currently at 70% of Hello Kitty's since the beginning of 2025, close to 100% in April, and nearly 200% in May).

Future Growth Engines: New IP and AI Toys

JPMorgan believes that, in addition to existing IPs, new growth engines may emerge for Pop Mart in the next 1-3 years.

The report predicts that by 2027, THE MONSTERS series, which includes LABUBU, will contribute 27% of the group's annual revenue. Molly and Crybaby are expected to become the second and third largest IPs, with sales exceeding 5 billion RMB each.

In terms of product categories, the report anticipates that traditional blind box dolls will remain the main product category, but their sales contribution will decrease from 53% in 2024 to 43% in 2027. Other product categories will see an increase in sales contribution, including plush toys (from 22% to 27%), MEGA large dolls (from 13% to 14%), and other products (from 12% to 16%).

Additionally, although Pop Mart has not publicly disclosed its AI strategy, analysts believe that AI toys will become a new trend in the Chinese toy industry, with Pop Mart expected to lead this trend. AI can enable a more interactive and personalized toy experience, such as voice recognition, personalized learning experiences, and augmented reality features.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。