This cycle will reward patience, discipline, and the ability to align with consensus, while also preparing for emerging narratives.

Written by: Tulip King

Translated by: Luffy, Foresight News

Alpha First:

Retail investors have not participated in this cycle.

Your trading counterparts are seasoned veterans.

Align with consensus.

The beginning of every war is strikingly similar. The elders engage in irreconcilable debates over faith, power, and resources, and the ultimate solution is to send the young to kill each other. We all know the saying "the elders declare war, the youth go to die," but no one talks about what happens after the war.

As the war drags on, manpower dwindles, and countries are forced to conscript from older age groups. Suddenly, teenagers and middle-aged men appear in the trenches. By the final stages, you will see children and the elderly trembling as they grip rifles. This is our current situation in the cryptocurrency trenches.

We have long passed the peak moment of 2021.

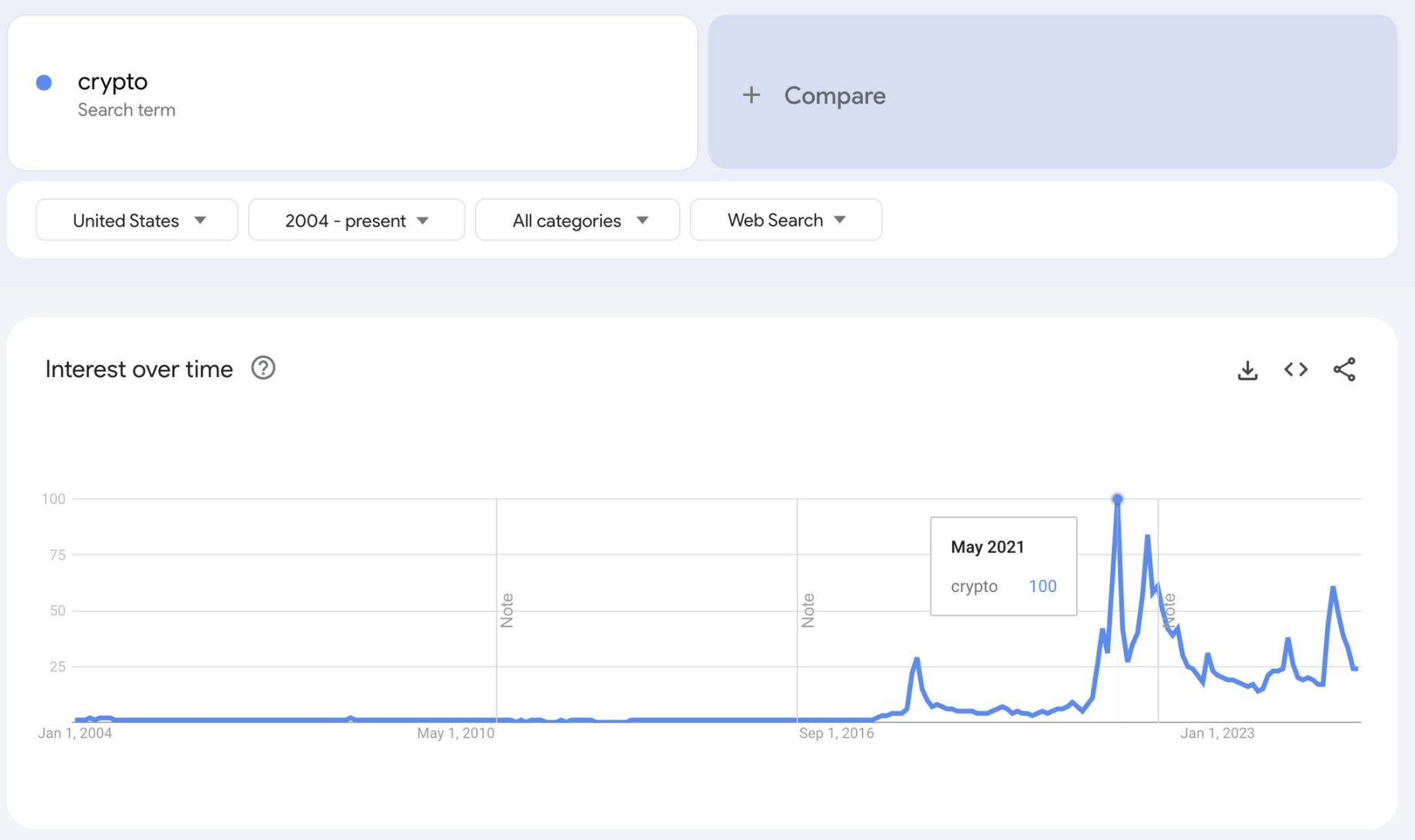

The Google search trend for "cryptocurrency" peaked during the summer of DeFi in 2021 and has not recovered since. Even though "crypto bros" helped Trump get elected, they could only pull the search interest for "cryptocurrency" back to 61% of its previous high. It must be said that there is almost no fresh blood in the crypto trenches. If you are reading this article, congratulations, you are one of the "elders" still fighting in the trenches. Next, let’s formulate a survival plan.

Do not fear aligning with consensus.

"The consensus is always wrong" is a common fallacy; knowing when to conform is a subtle art. Remember when Warren Buffett started buying Apple stock in 2016? It was already the largest publicly traded company in the world, not his typical "deep value investment." In this market, you need to be a compliant sheep, not go against the trend.

In past cycles, the influx of new retail investors lowered the overall IQ and experience level in the crypto trenches. This allowed you to easily leverage your experience to sell new Ponzi schemes to them. If we had retail participation on the scale of 2021, Launchcoin could easily break the $1 billion market cap, but now it has even failed to break $400 million before starting to decline.

Remember, crypto Twitter is just a niche corner of the industry. We are all reading the same articles and complaining, staring at the same 5-minute charts on DEX Screener, trading the same tokens. This also means that projects like Launchcoin are already the fifth generation of harvesting memecoins we have seen, and people are simply not interested in playing this game again.

The opposite phenomenon is equally valid. This is why Bitcoin and Hyperliquid outperform other networks. Everyone in the trenches has reached a consensus: we are indeed optimistic about these tokens. Bitcoin has never let us down, and Hyperliquid is also a truly excellent product. As long as these tokens maintain a positive consensus sentiment, you can continue to accumulate.

In this cycle, new capital inflows into consensus assets like Bitcoin and Hyperliquid will come from institutions and seasoned crypto traders who have given up on going against the trend.

Do not go against the trend; act early.

The market currently lacks inexperienced retail investors, which also means it is difficult for you to make money by going against the trend. In this cycle, your trading counterparts are just as smart as you. If your contrarian trades have not yet begun to gain consensus, they will not succeed.

Ethereum continues to underperform other networks.

This is why the supporters of .eth cannot change the narrative around Ethereum. We have heard Bankless drone on about the same clichés countless times. Unless I see Vitalik tattoo the Ethereum L1 scaling roadmap on his forehead, you will never convince me to buy that "cursed coin" again. I’m smart; I swapped Ethereum for Bitcoin before most of you (early 2023), but I still regret holding it for so long. I believe others in the market feel the same way.

Instead of going against the trend, it is better to get involved early in areas that have not yet been discussed. Do not bet on your ability to fight against the market; bet on your ability to research and uncover potential projects more diligently. The real advantage lies in identifying quality targets before consensus forms:

Invest in new networks with incomplete bridging functions.

Buy small-cap tokens with high slippage.

Look for projects with poor user experience but excellent ideas.

Reach out to your friends who are deeply involved in the Bitcoin and HyperEVM ecosystems, ask them which emerging projects they believe have not received enough attention, and dive deep into the project documentation. The strategy is not to fight against consensus but to delve into consensus faster than anyone else.

Where will institutional funds flow?

Although retail investors are watching from the sidelines, institutions are actually entering the market. The good news is: institutions are essentially "consensus market participants":

They cannot invest in illiquid assets and must focus on the largest assets.

They cannot justify "contrarian bets on memecoins" to their investors; they have a fiduciary duty to make reasonable decisions.

They act slowly but with large amounts of capital, creating predictable trends.

Moreover, the movements of institutions are relatively easy to predict because there are only two large-scale business models:

Asset management/custody: Institutions like BlackRock want to custody the largest assets to achieve the highest returns. Their ETF inflows will first benefit Bitcoin and may spill over to other large-cap assets like XRP.

Trading volume/volatility: Institutions like Citadel Securities make money by trading smarter than you on the order book. They need markets that are liquid and reasonably volatile, which is exactly what Hyperliquid provides in the derivatives space.

So ask yourself: what is the largest custodial asset by consensus? Bitcoin. Now ask yourself: where is the consensus venue for new assets on exchanges? Hyperliquid. Don’t try to outsmart institutions; sometimes it’s that simple to position yourself where institutional funds will flow, rather than where you think they should go.

Areas where retail investors might enter.

AI hype is still on the rise.

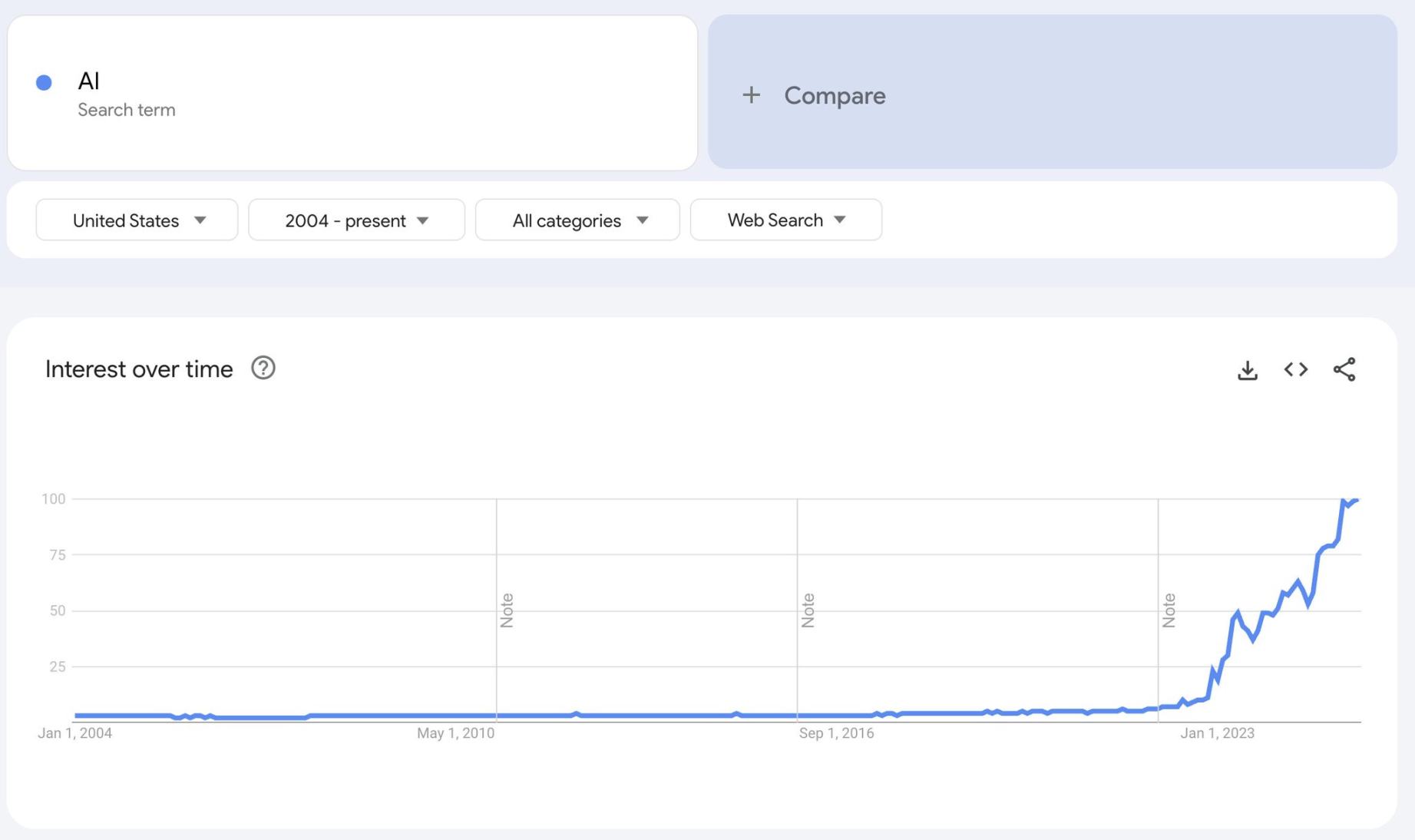

Finally, let’s leave a hedging strategy. The search interest for "AI" has been climbing to new highs nearly three years after the launch of ChatGPT. The intersection of cryptocurrency and AI has the potential to attract capital inflows.

However, how this will develop remains unclear. Will retail investors actually buy crypto projects, or will they continue to chase Nvidia? Will they buy crypto projects like Bittensor or Sam's Worldcoin? The AI narrative may be the only catalyst strong enough to bring retail investors back to the crypto market. But it may only benefit specific projects rather than a broad rise.

The advantages of veterans.

The absence of retail investors does not mean that this bull market cannot be profitable; it will simply reward different skills. Veterans still in the trenches have the following advantages:

The ability to identify trend shifts before the narrative is fully formed.

Understanding of market cycles and judgment on when to take profits.

A network for sharing information with other veterans.

Proven risk management strategies.

This cycle will reward patience, discipline, and the ability to align with consensus while preparing for emerging narratives. It will not reward contrarian bets against established trends or attempts to revive dead narratives.

Fighting in the crypto trenches is not easy, but for those who adapt to the new battlefield environment, the rewards will be substantial. The legion of veterans may be smaller than the retail army of 2021, but we are smarter, more experienced, and better at capturing value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。