"Stablecoins" are becoming a support point for the US dollar.

Author: Zhao Ying

As the hegemony of the US dollar wavers, the stablecoin market is rapidly expanding, becoming a new support point for the dollar and reshaping the global financial system?

According to the Wind Trading Platform, Jim Reid, the head of global macro and thematic research at Deutsche Bank, mentioned in a recent report that stablecoins are expanding at an unprecedented speed, and corporate finance executives are feeling the wave of change. Reid stated:

This week, I attended a corporate finance conference on the US West Coast, and all the CFOs noticed the increase in stablecoin transactions in their businesses, which is a growing market.

The so-called "stablecoin" is a type of digital asset, with over 99% of the market value of stablecoins pegged to the US dollar, effectively acting as a money market fund supporting the US short-term debt market, with Tether now among the major holders of US Treasury securities.

Currently, the US is accelerating the advancement of stablecoin regulatory legislation, with payments being a significant use case, and regulation may open the door for broader adoption of payments. Recently, the GENIUS stablecoin bill was rejected, but Deutsche Bank expects significant progress on the bill this year.

Analysis suggests that the stablecoin market has enormous potential, and payment applications may lead to broader acceptance of crypto infrastructure. Citigroup expects that in the long term, the potential market size for stablecoins could reach $1.6 to $3.7 trillion by 2030 under both basic and optimistic scenarios.

What are stablecoins? How do they work?

Stablecoins are a type of digital asset used for payments, with low volatility compared to other cryptocurrencies due to their 1:1 peg to "stable" assets. Deutsche Bank's report points out that there are mainly four types of stablecoins: fiat-backed, asset-backed, crypto-backed, and algorithmic.

Currently, US dollar-backed stablecoins dominate the market, with over 99% of the market value of stablecoins pegged to the dollar. These stablecoins hold over $120 billion in US reserve assets, effectively acting as money market funds supporting the US short-term debt market.

Citigroup's report further explains that stablecoins have become an important part of the cryptocurrency ecosystem: first, they serve as an entry point for decentralized finance—tracking the growth of stablecoin issuance helps determine the overall health and growth of the digital asset environment; second, stablecoins can be seen as a means of value storage without the inherent volatility of native tokens.

One use case for stablecoins is reserves, with their "safe haven" characteristics increasing their appeal as a store of value amid current market volatility. Another potential use case is payments and cross-border transactions, where regulatory clarity can pave the way for broader adoption of payments.

Stablecoins—A digital extension of US dollar hegemony, a new source of demand for US Treasuries?

The impact of stablecoins on the US bond market is expanding, with Deutsche Bank data showing that,

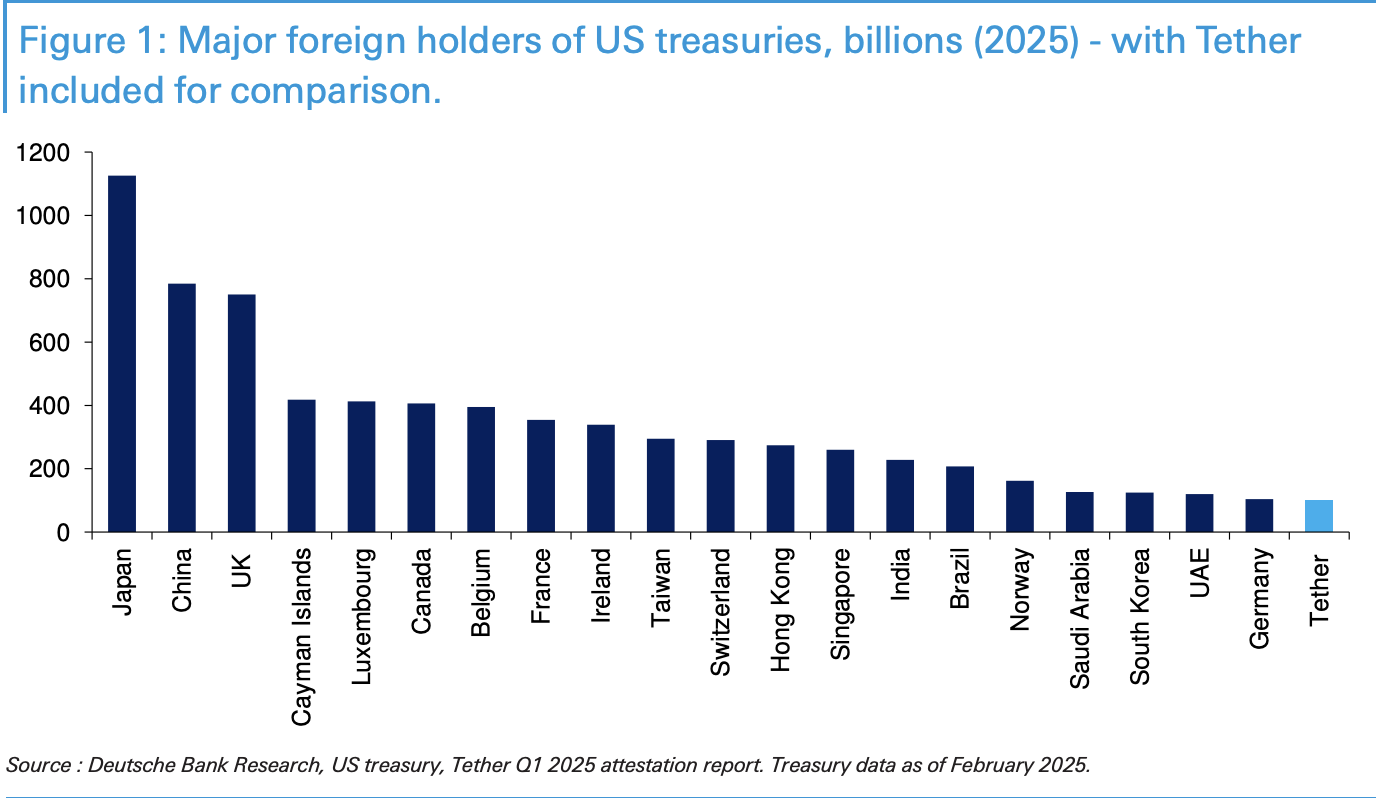

As of March 2025, Tether's holdings of US Treasuries have reached $98.5 billion, a figure that was nearly zero in 2020, now ranking among the major foreign holders of US Treasuries.

Citigroup also points out that large stablecoin providers have become larger holders of US Treasuries:

In particular, stablecoins pegged to the dollar are becoming a growing source of demand for US Treasury bills. The two main reasons proposed by the US Secretary of Commerce and the Secretary of the Treasury for legislation are: to increase demand for short-term Treasuries and to strengthen the dollar's position as a global reserve currency.

Large stablecoin providers, such as Tether, have become significant holders of US Treasuries. The proposed legislation requires stablecoin holders to hold short-term US Treasuries, creating a new source of demand for US short-term debt.

However, Citigroup analysts also pointed out two mitigating factors: first, if any inflow of funds comes from existing US Treasury holders, whether directly or indirectly, the demand effect will be weakened. For example, funds moving from money market funds to stablecoins would represent a substitution but would not have a net effect on overall demand. Second, while supporting short-term demand, long-term debt demand may not be affected.

Stablecoins are becoming increasingly important in the digital dollar infrastructure, with Deutsche Bank stating:

It is in the best interest of the US to increase the demand for stablecoins, thereby strengthening the dollar, especially as the adoption of stablecoins accelerates, making them an attractive means of value storage amid current market volatility due to their "safe haven" characteristics.

Citigroup's report notes:

Currently, the dollar still dominates the share of foreign exchange reserves, and the dominance of dollar stablecoins not only stems from first-mover advantage but also reflects the "excessive privilege" of the dollar as the preferred reserve currency. The stablecoin market has enormous potential, with Citigroup estimating it could reach a scale of $1.6 to $3.7 trillion by 2030.

At the same time, Citigroup reminds that since the launch of euro stablecoins under the European MiCA legislative framework, the market value of non-dollar stablecoins has increased, aligning with the weakening of the dollar and cracks in the "American exceptionalism" narrative. Although euro-based stablecoins currently account for only a small share, changes in this area could be a forward-looking indicator of shifts in the dollar's status.

US stablecoin legislation is accelerating

The US is accelerating the advancement of stablecoin regulatory legislation. According to media reports, the GENIUS bill in the US Senate failed to reach a full voting stage but is expected to gain bipartisan support. The House bill has passed committee and is awaiting a full vote.

Deutsche Bank's report indicates that the US is currently accelerating efforts to establish a regulated, dollar-backed stablecoin ecosystem by August this year. The stablecoin bill named GENIUS was recently rejected, but significant progress on the bill is expected this year.

Citigroup's analysis shows that there are currently two stablecoin bills in the US legislative process: the House's STABLE bill and the Senate's GENIUS bill. Both have similar provisions regarding consumer protection and reserves, but there are still differences that need to be coordinated and revised.

Both bills focus on payment functions, referred to as "payment stablecoins," and include provisions related to anti-money laundering (AML), national security, consumer protection, and reserve requirements. The reserve requirement is a 1:1 use of short-term US Treasury securities and reposited secured deposits.

Analysis suggests that a stable regulatory environment will clear the way for the widespread application of stablecoins, with the payment sector becoming an important use case for stablecoins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。