撰文:Token Dispatch, Prathik Desai

编译:Block unicorn

前言

随着华尔街巨头迅速扩大部署规模,代币化正在蓬勃发展,而几年前,这个概念还只是测试阶段。

多家金融巨头同时推出平台、建立基础设施并创造产品,将传统市场与区块链技术连接起来。

仅在上周,贝莱德(BlackRock)、VanEck 和摩根大通(JP Morgan)就做出了重大举措,表明现实世界资产代币化已超越概念验证,成为机构战略的基石。

在今天的文章中,我们将向您展示为何代币化期待已久的拐点可能已经到来,以及即使您从未购买过加密货币,这为何仍然重要。

万亿级潜力

「每一只股票、每一只债券、每一个基金——每一种资产——都可以被代币化。如果实现了,将彻底改变投资,」贝莱德首席执行官兼董事长拉里·芬克(Larry Fink)在 2025 年致投资者的年度信中表示。

芬克谈到的是一项机会,允许基金公司将全球资产行业中价值超过一万亿美元的资产进行代币化。

传统金融巨头们已经抓住了这一机会,过去 12 个月内采用率激增。

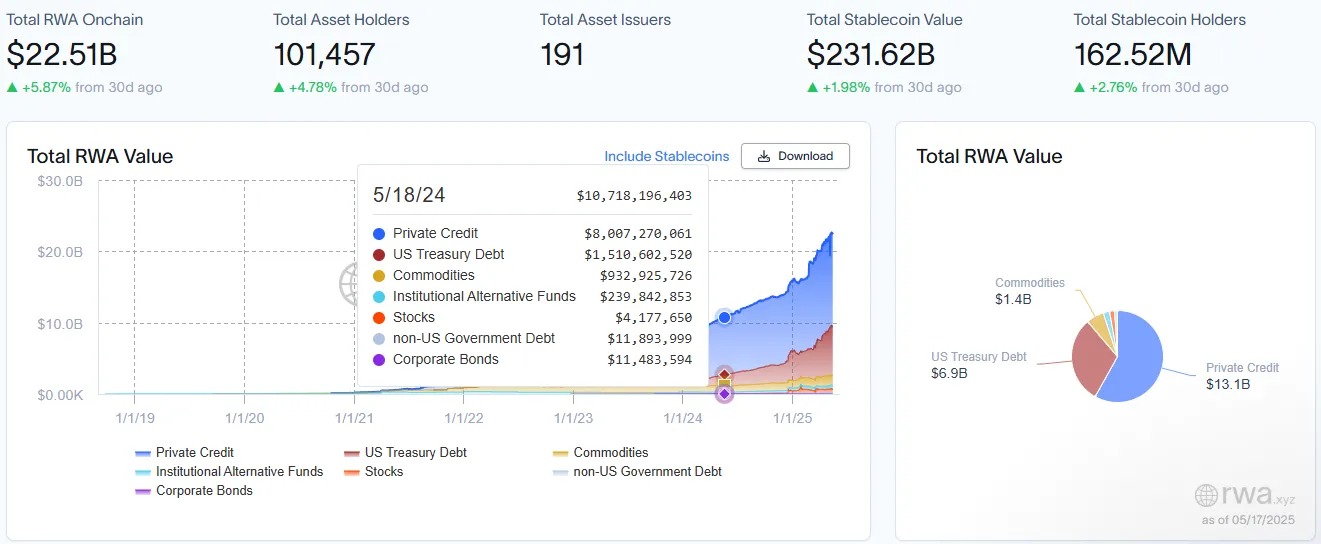

代币化的现实世界资产(RWA,不包括稳定币)已超过 220 亿美元,仅今年就增长了 40%。然而,这只是冰山一角。

咨询公司罗兰贝格(Roland Berger)预测,到 2030 年,代币化 RWA 市场将达到 10 万亿美元,而波士顿咨询集团(Boston Consulting Group)估计为 16.1 万亿美元。

为了便于理解,即使按较低估计,这也意味着比今天增长 500 倍。如果全球金融资产的 5% 转移到链上,我们讨论的是一个数万亿美元的转变。

在探讨基金公司的代币化举措之前,让我们先了解什么是代币化以及它对投资者的意义。

实体资产与区块链的结合

三个简单步骤:选择一种现实世界的资产,创建代表该资产(部分或全部)所有权的数字代币,并在区块链上使其可交易。这就是代币化。

资产本身(国债、房地产、股票)并未改变。改变的是其所有权的记录和交易方式。

为何要代币化?四个关键优势:

-

部分所有权:只需 100 美元即可拥有商业建筑的一部分,而非需要数百万美元。

-

全天候交易:无需等待市场开盘或结算清算。

-

降低成本:更少的中间商意味着更低的费用。

-

全球访问:此前受地理限制的投资机会如今在全球范围内变得触手可及。

「如果说 SWIFT 是邮政服务,那么代币化就是电子邮件本身——资产可以绕过中介机构,直接即时转移。」贝莱德的芬克在信中说道。

无声的革命

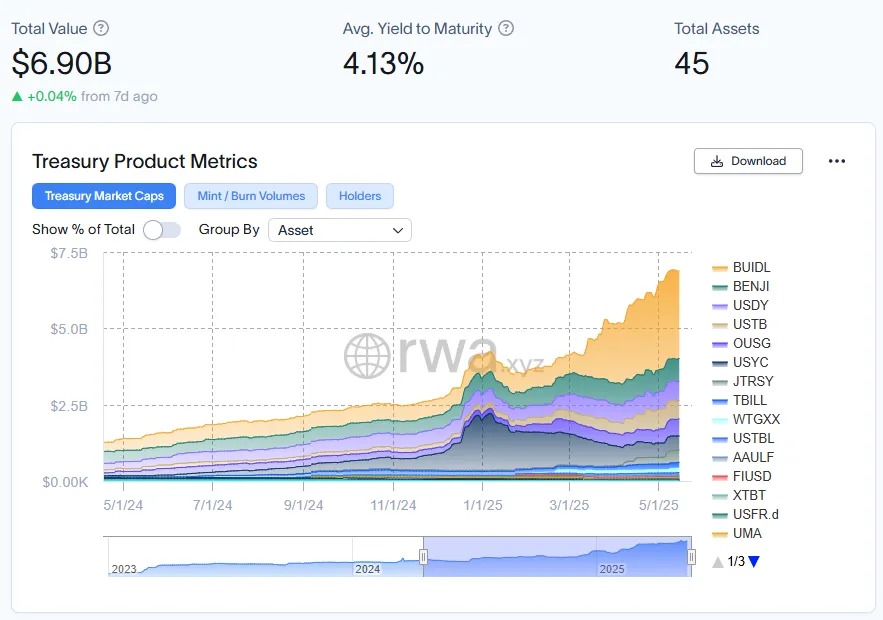

贝莱德的代币化国债基金 BUIDL 已激增至 28.7 亿美元,仅在 2025 年就增长了 4 倍多。富兰克林邓普顿(Franklin Templeton)的 BENJI 持有超过 7.5 亿美元。摩根大通的最新举措将其私有区块链 Kinexys 与公共区块链世界连接起来。

代币化美国国债的价值现已接近 70 亿美元,较一年前的不到 20 亿美元大幅增长,进一步印证了这一增长故事。

越来越多的巨头公司正凭借独特的产品加入这一潮流。

本周,VanEck 推出了一只可在四个区块链上访问的代币化美国国债基金,加剧了快速扩张的链上现实世界资产(RWA)市场的竞争。

本月早些时候,全球最大的金融衍生品机构、总部位于迪拜的 MultiBank 集团与总部位于阿联酋的房地产巨头 MAG 和区块链基础设施供应商 Mavryk 签署了一项价值 30 亿美元的现实世界资产(RWA)代币化协议。

较小的国家也在加入这一行列。据《曼谷邮报》报道,泰国政府通过代币化向散户投资者提供债券,入门门槛从传统的 1000 美元以上降至 3 美元。

甚至政府机构也没有错过这场革命。

美国证券交易委员会(SEC)刚刚与九家金融巨头举办了一场圆桌会议,讨论代币化的未来,这与前几届政府的态度截然相反。

对投资者而言,这意味着全天候的访问、近乎即时的结算和部分所有权。

将其想象为购买整张专辑 CD 与仅流媒体播放您想听的歌曲之间的区别。代币化将资产拆分为可负担的一小份,使其对每个人都触手可及。

为何现在发生?

-

监管清晰度:在美国总统唐纳德·特朗普的领导下,其政府从执法转向促进创新,多位支持加密货币的人士领导政府机构。

-

机构采用:传统金融巨头为代币化提供合法性和基础设施支持。

-

技术成熟:区块链平台已发展到满足机构需求。

-

市场需求:投资者寻求更高效、更易获取的金融产品。

美国证券交易委员会(SEC)主席保罗·阿特金斯将代币化视为金融市场的自然演变,类比为「几十年前音频从模拟黑胶唱片到磁带再到数字软件的过渡」。

未来之路

尽管势头强劲,但挑战依然存在。

监管碎片化:全球监管格局仍不统一。SEC 的圆桌会议显示美国的态度开放,但国际协调不足。日本、新加坡和欧盟以不同速度推进,框架不兼容,这为全球代币化平台带来合规难题。

标准化缺失:行业缺乏针对不同资产类别代币化的统一技术标准。以太坊上的代币化国债是否应与 Solana 上的兼容?谁来验证代币与底层资产的关联?没有标准化,可能会形成孤立的流动性池,而非统一市场。

托管与安全担忧:传统机构仍对区块链安全性持谨慎态度。今年早些时候,价值 14 亿美元的 Bybit 黑客攻击事件引发了关于不可篡改与可恢复性的棘手问题。

市场教育的差距:华尔街(「Wall Street」)可能在加速前进,但普通民众(「Main Street」)对代币化的理解仍普遍不足。

我们的观点

代币化可能是将区块链技术与主流金融连接起来的桥梁。对于关注区块链演变的人来说,这可能是该领域迄今最大的影响——不是创造新货币,而是改变我们访问和交易已有资产的方式。

大多数人不关心区块链。他们关心的是更早拿到工资、访问原本为富人保留的投资机会,以及在转移资金时不被高额费用压榨。代币化提供了这些好处,且无需用户理解底层技术。

随着这一领域的发展,代币化可能成为「隐形基础设施」——就像发送电子邮件时你不会想到 SMTP 协议。你将能更轻松地访问投资,费用更低,限制更少。

传统金融花了数个世纪发展出有利于机构、排斥普通人的系统。几十年来,我们接受了一个围绕机构便利而非人类体验设计的金融系统。想在下班后交易?抱歉不行。只有 50 美元的投资?不值得我们关注。想国际转账不损失 7% 的费用?那就慢慢等吧。

代币化可能在短短几年内打破这种不平等。

随着代币化体验的普及,「传统金融」与「去中心化金融」之间的概念壁垒将自然消融。以 3 美元的价格从泰国政府购买代币化债券的人,以后可能会探索能够产生收益的 DeFi 协议。通过贝莱德的 BUIDL 首次接触区块链的机构投资者,最终可能会投资原生加密资产。

这种模式推动了真正的应用,并非通过意识形态的转变,而是通过实际优势,相比之下,旧的做法显得极其低效。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。