In the early hours of today Beijing time, BTC briefly surged to $107,000 before pulling back, while ETH fell below $2,400 at one point, leading mainstream coins to generally enter a correction mode. Regarding the future market direction, large whales have begun to "speak with their positions." Some have splurged tens of millions of dollars to start their shorting journey, while others have long positions with unrealized profits nearing $30 million. Odaily Planet Daily will summarize the recent positions of large whales in this article for readers' reference.

Whale Jams Wynn: Long position unrealized profit once approached $30 million, currently retracing to around $18 million

On May 18, according to on-chain analyst @EmberCN, whale @JamesWynnReal used 40x leverage to go long on 3,788.7 BTC on Hyperliquid, with a position value of $391 million, an opening price of $103,083, and a liquidation price of $96,474. As BTC briefly broke through $105,000, James Wynn's long position unrealized profit exceeded $27.7 million, with a $8.38 million unrealized profit on the BTC 40x long and a $20.26 million unrealized profit on the kPEPE 40x long.

Latest data shows that whale @JamesWynnReal's BTC long position unrealized profit has retraced to $1.12 million; kPEPE long position unrealized profit has retraced to around $17 million; additionally, its XRP long position has an unrealized loss of about $2.42 million. On-chain data: https://hypurrscan.io/address/0x5078c2fbea2b2ad61bc840bc023e35fce56bedb6

Long representative

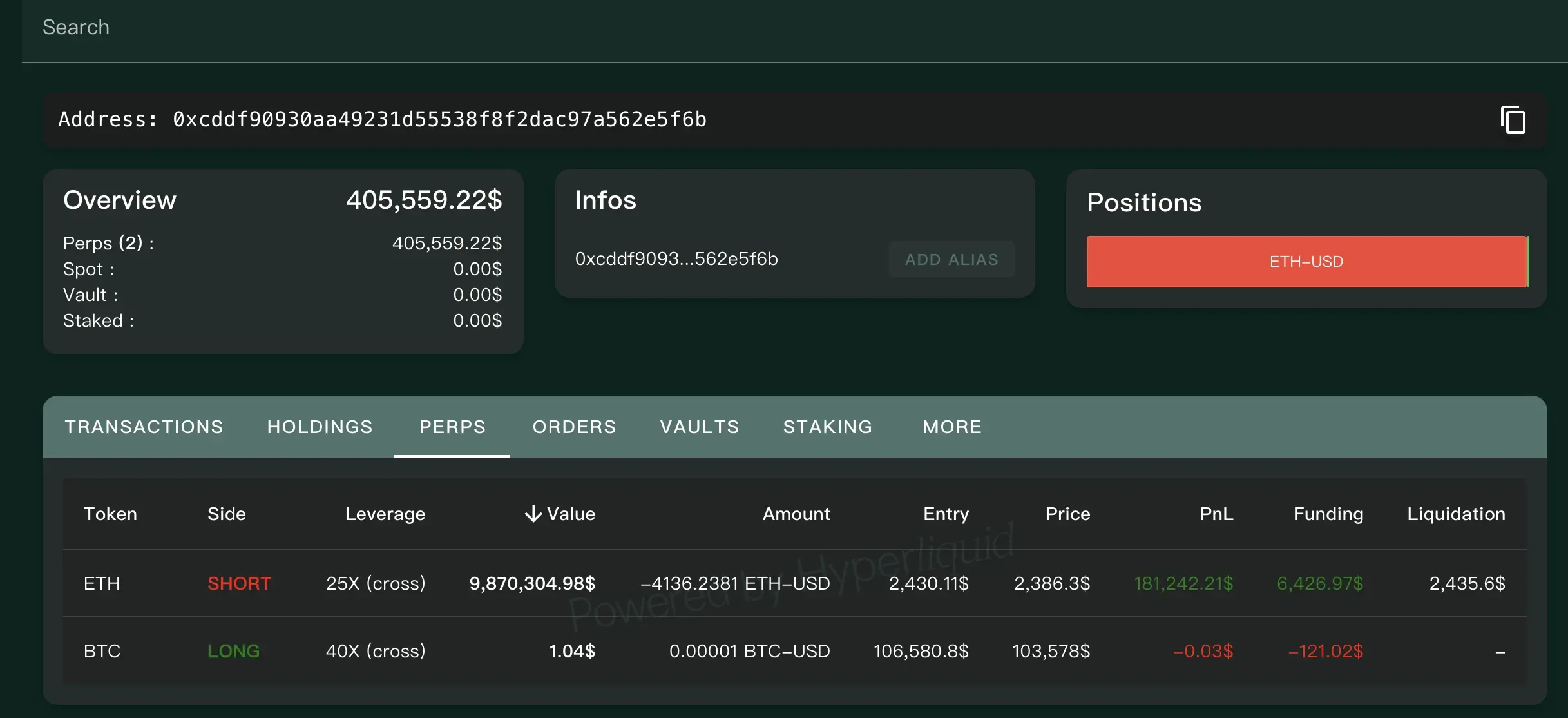

ETH Shorting Group: 25x short, position value once exceeded $100 million

Yesterday, the dormant address 0xcddf shorted 41,851 ETH with 25x leverage, with a position value of $103 million, an opening price of $2,514, and a liquidation price of $2,525; subsequently, due to ETH's rise, it ultimately incurred a loss of $2.46 million upon closing. After closing the ETH short, it turned to use the remaining funds to go long on BTC: opening a 40x long position on 166 BTC at a price of $106,580, with a position value of $17.6 million, ultimately losing $175,000 in just 45 minutes. However, it later opened another 25x short on ETH, rolling over after realizing profits, and the position has gradually increased to 4,136 ETH. Latest data shows that this address's 25x leverage short position has dropped to around $9.8 million, with an unrealized profit of about $180,000.

On-chain data: https://hypurrscan.io/address/0xcddf90930aa49231d55538f8f2dac97a562e5f6b

Caught in the middle representative

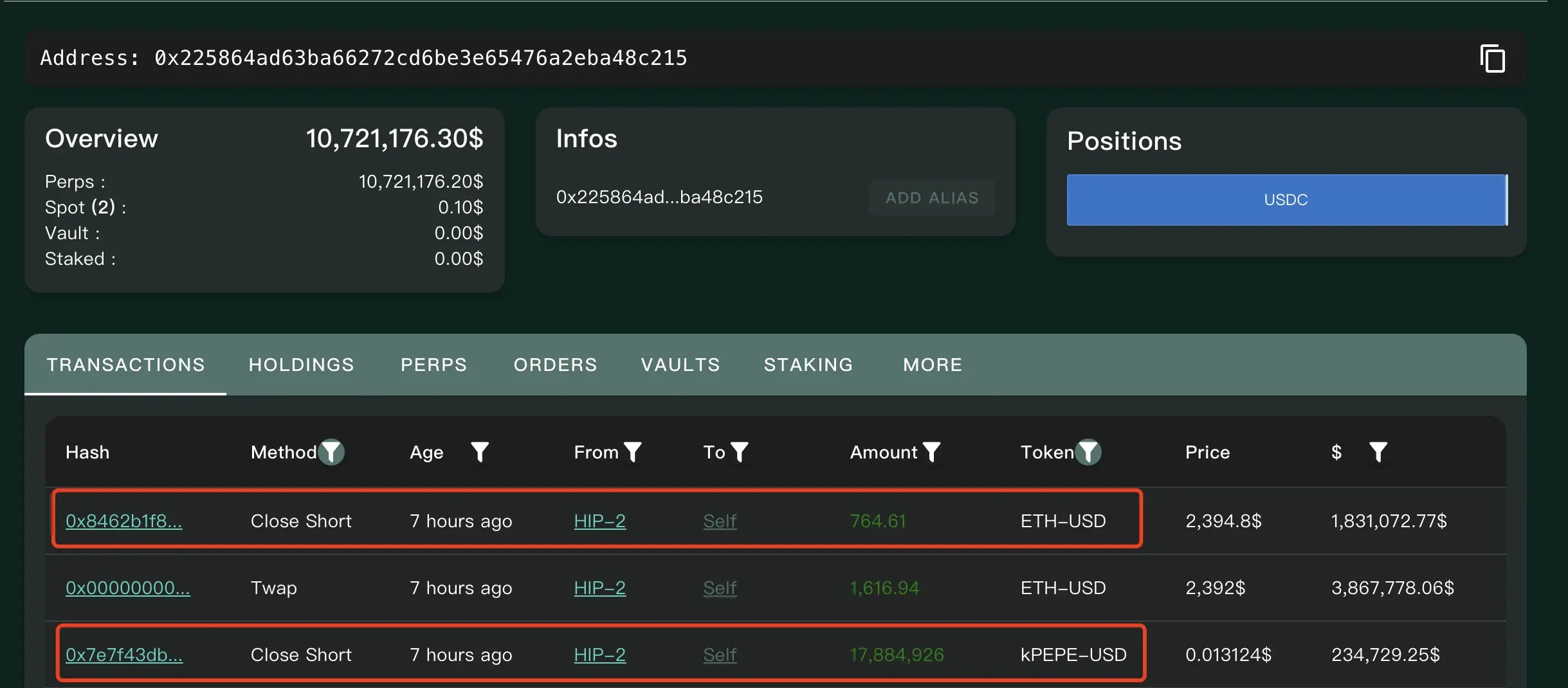

ETH Shorting Group: 20x short, position once reached $70 million

Address 0x2258 previously shorted 28,248 ETH with 20x leverage, with a position value of $70 million, an opening price of $2,561, and a liquidation price of $2,694. Seven hours ago, it closed all short positions, and this address is now fully liquidated.

On-chain information: https://hypurrscan.io/address/0x225864ad63ba66272cd6be3e65476a2eba48c215

Position closed

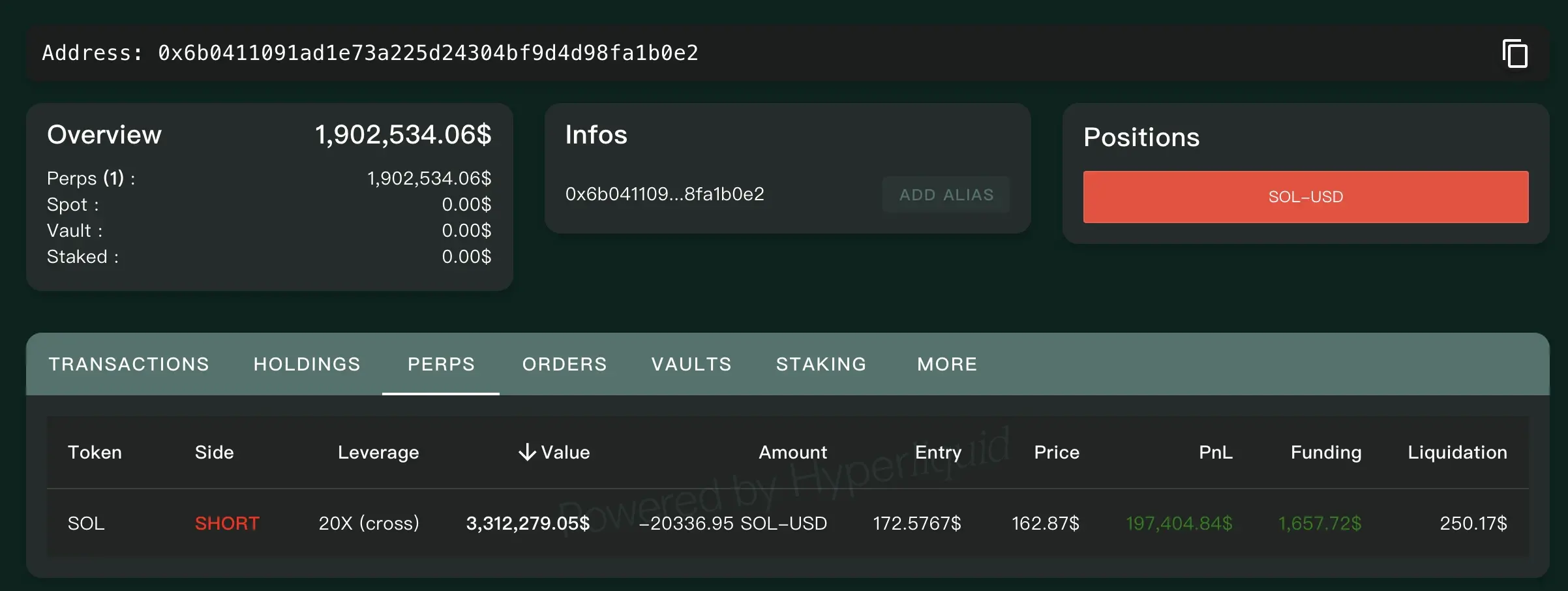

SOL Shorting Group: 20x short, holding over 20,000 SOL

On May 16, according to OnChain Lens monitoring, a whale deposited 1.7 million USDC into Hyperliquid to open a SOL short position with 20x leverage. Latest data shows that this address currently holds about 20,336 SOL, with a cumulative unrealized profit of about $197,400.

On-chain information: https://hypurrscan.io/address/0x6b0411091ad1e73a225d24304bf9d4d98fa1b0e2

Shorting continues

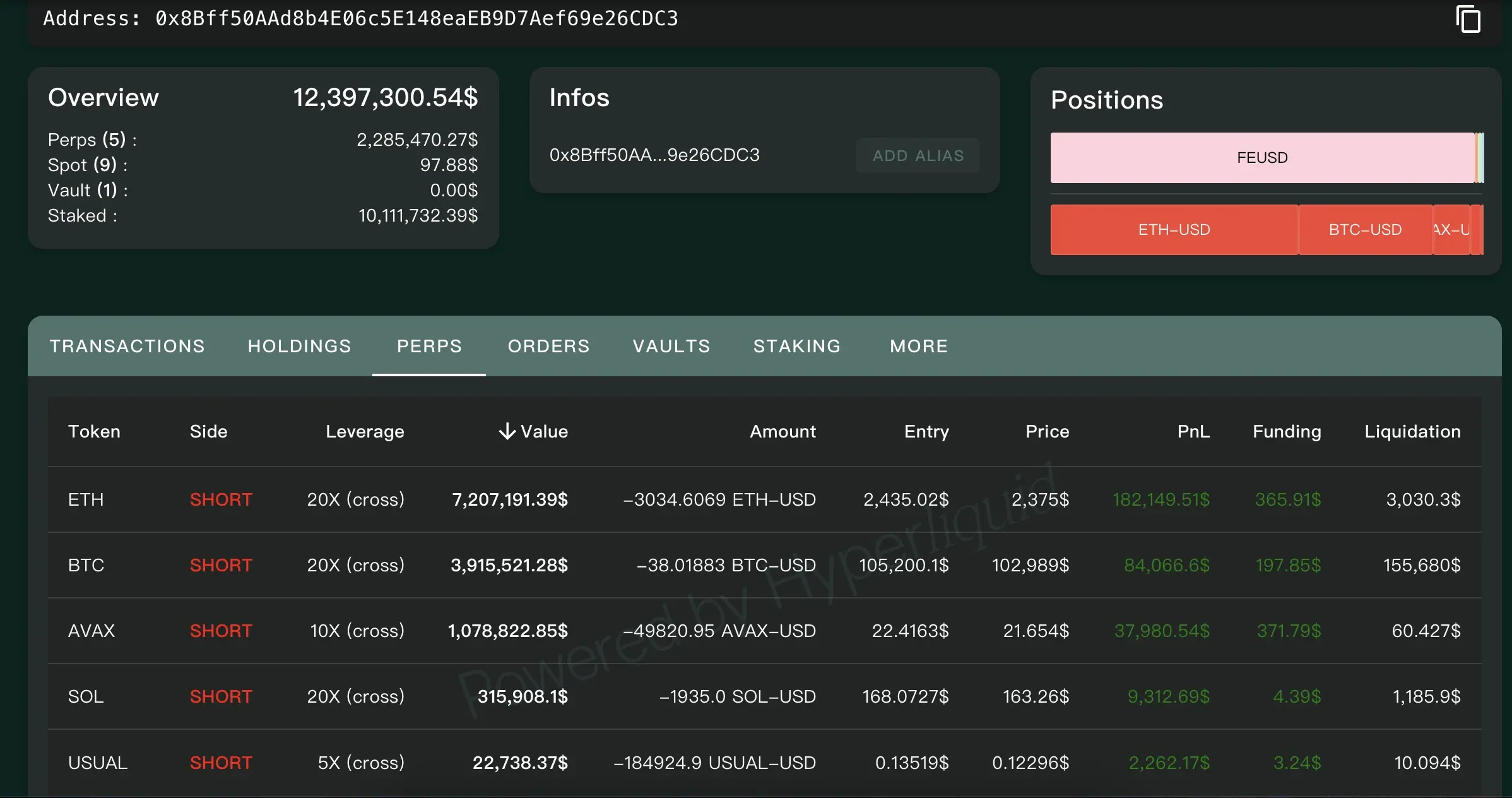

Mainstream Coin Shorting Group: Previously profited over $15 million on Hyperliquid, shorting 5 tokens

According to Lookonchain monitoring, a whale who profited over $15 million on the Hyperliquid platform began to heavily short ETH, BTC, AVAX, SOL, and USUAL. This trader set 100 limit orders in the $2,460-$2,480 range, preparing to continue shorting ETH.

Latest data shows that all short positions of this address are profitable, including a 20x short position of 3,034 ETH with an unrealized profit of about $182,000; a 20x short position of 38 BTC with an unrealized profit of about $84,000; a 20x short position of about 50,000 AVAX with an unrealized profit of about $38,000; a 20x short position of about 1,935 SOL with an unrealized profit of about $9,000; and a 5x short position of about 185,000 USUAL with an unrealized profit of about $2,000.

On-chain information: https://hypurrscan.io/address/0x8Bff50AAd8b4E06c5E148eaEB9D7Aef69e26CDC3

20x shorting ETH, BTC, AVAX, SOL, 5x shorting USUAL

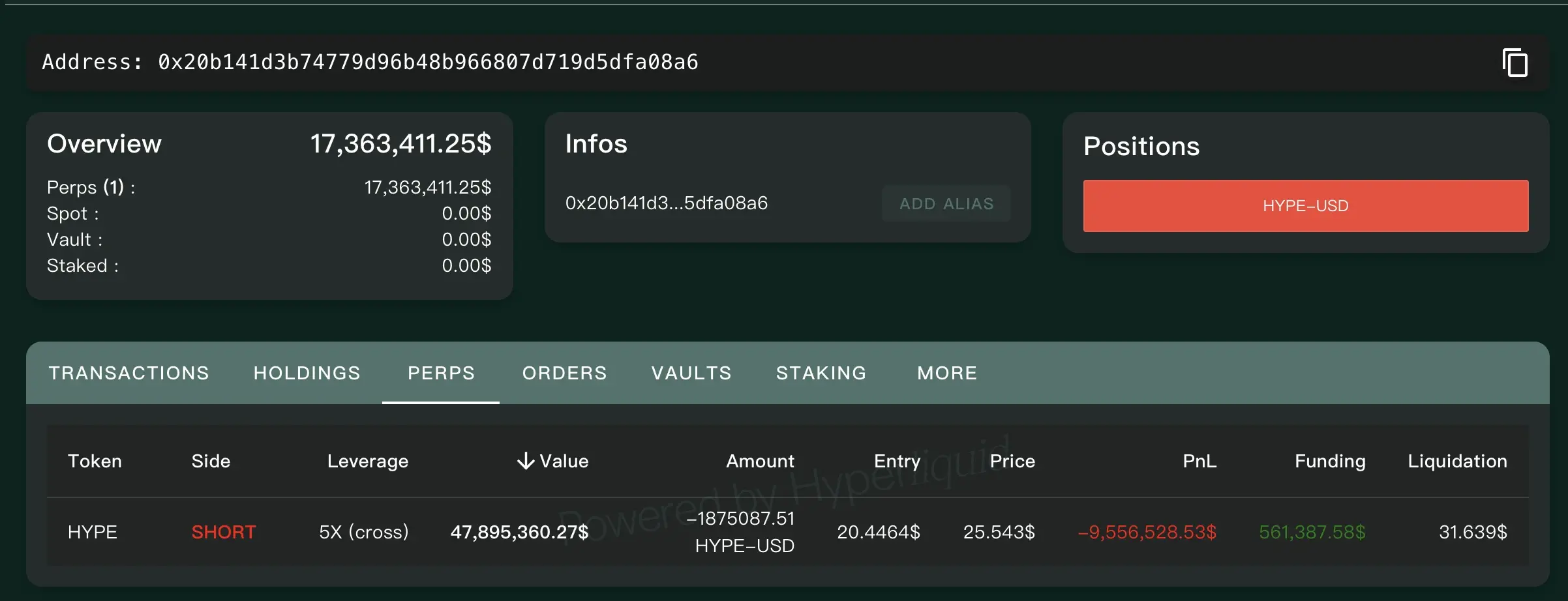

HYPE Shorting Group: 5x short, holding over 1.87 million HYPE

Previously, according to on-chain analyst Yu Jin's monitoring, a whale opened a 5x short position on 1.875 million HYPE on Hyperliquid; on the 17th, its unrealized loss reached as high as $12.06 million, and subsequently, it withdrew 3 million USDC from Binance as margin, with a liquidation price of $31.6. Latest data shows that this address currently has an unrealized loss of about $9.55 million.

On-chain information: https://hypurrscan.io/address/0x20b141d3b74779d96b48b966807d719d5dfa08a6

Firmly bearish

In addition to the above-mentioned whales with long and short contracts, there are also whales who took the opportunity to buy the dip in ETH, ultimately realizing millions in profit.

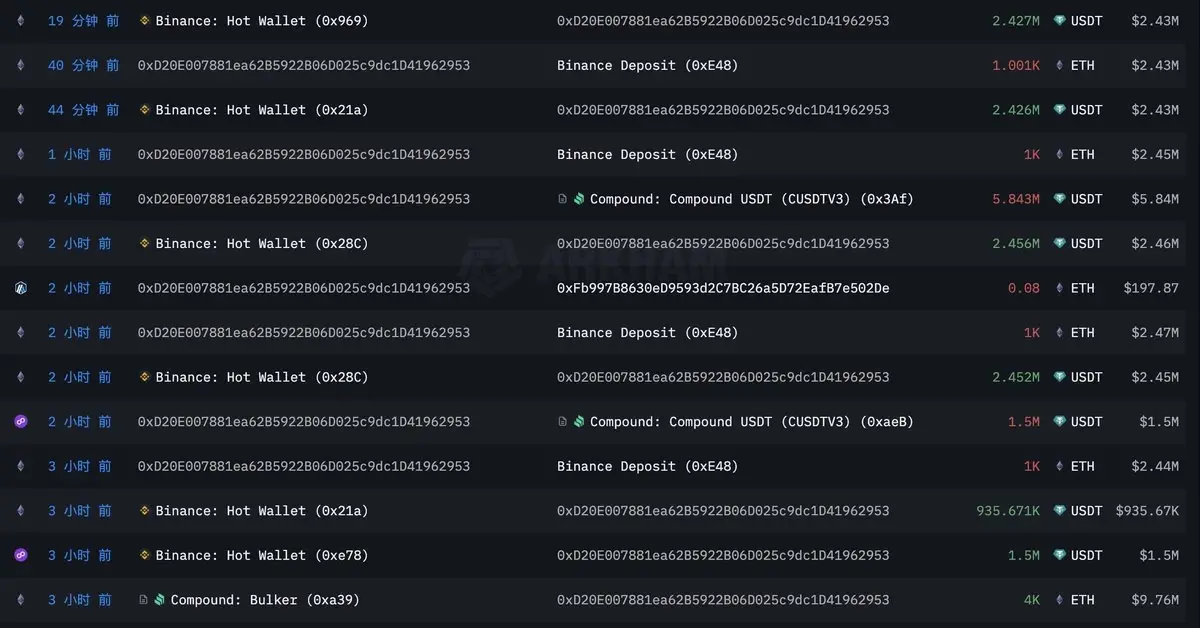

ETH Dip-Buying Whale: Bought over 6,700 ETH at the bottom, profiting over $4.26 million

According to on-chain analyst Yu Jin's monitoring, a whale transferred 6,384.5 ETH to Binance in the past 4 hours, receiving 15.549 million USDT, with an average selling price of about $2,435. This whale withdrew 6,710 ETH from Binance about a month ago, at a price of $1,768. Roughly estimated, it has made a profit of over $4.26 million in this round of operations.

On-chain information: https://intel.arkm.com/explorer/address/0xD20E007881ea62B5922B06D025c9dc1D41962953

Profits realized

Summary: The bears are temporarily ahead, but the bulls never give up

After a brief weekly rise, both BTC and ETH have experienced varying degrees of correction, with the bears currently holding the advantage. Additionally, the whales who previously bought the dip in BTC and ETH have also chosen to take profits. However, industry figures and analysts, including James Wynn and Arthur Hayes, generally believe that the price of BTC is unlikely to fall below $100,000, and the bulls remain hopeful. In the short term, the bears may have the upper hand, but the bulls never give up.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。