In the past month, the DeFi sector seems to have quietly undergone a structural change. Unlike the previous state of fighting alone, some leading protocols are moving towards "collaboration" through cooperation, integration, and even direct binding of interests.

In this article, we will explore the most representative "collaborative actions" from three aspects: the integration of lending and trading, the evolution of the stablecoin landscape, and the fusion of RWA (Real World Assets). We will analyze the underlying logical changes and potential impacts.

Lending + Trading: Binding Interests Between Protocols

Cooperation among DeFi protocols is evolving from superficial asset integration to deeper structural fusion. The recent collaboration between Uniswap and Aave is a representative example of this trend.

The core upgrade of Uniswap V4 is not about saving gas fees, but rather the introduction of the Hook mechanism. This allows developers to insert custom logic at key points in the liquidity pool (such as adding or removing liquidity, before and after trade execution), enabling whitelist control, dynamic fees, customized price curves, and even embedding game rules. This transforms Uniswap from a trading protocol into a more open liquidity underlying architecture.

Based on this, Aave plans to support Uniswap V4's LP Token as collateral for lending, and will return the interest portion of the stablecoin GHO lent out to the Uniswap DAO. This creates a substantial binding in terms of assets, functions, and returns between the two. This collaboration enhances the capital efficiency of LPs and provides a more practically valuable template for complementary relationships between protocols.

From market data, this "collaborative effect" is releasing positive signals. Since May, Aave's TVL has risen from $19.708 billion to $23.347 billion, an increase of over 18%. Uniswap's TVL has also grown by about 11% during the same period, from $4.178 billion to $4.65 billion. The simultaneous strengthening of both may not be a coincidence.

Stablecoins: A New Stage of Differentiation and Specialization

The competition in the stablecoin space is no longer limited to "who is more centralized" or "who offers higher yields." More protocols are pushing stablecoin products towards specialized uses and structural layering.

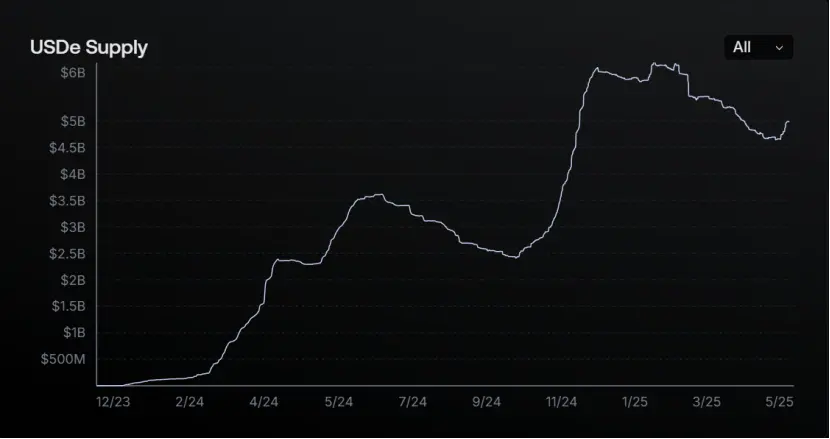

Taking Ethena as an example, the most active stablecoin in its ecosystem is USDe, which is deeply integrated with Aave and supports a maximum loan-to-value (LTV) ratio of 90%. However, since May, USDe's TVL has dropped from $5.725 billion to $4.993 billion, a decline of nearly 13%. Behind this, Ethena is launching another more conservative new product, USDtb.

The supply change of USDe can be found at https://app.ethena.fi

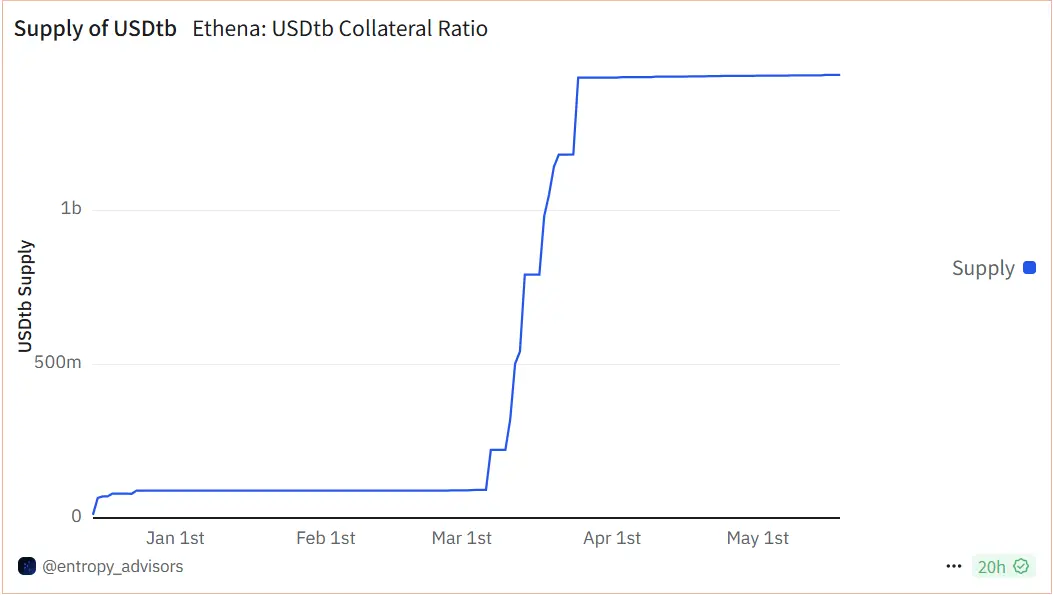

USDtb is a non-yielding but fully collateralized stablecoin, with assets composed of BlackRock's tokenized money market fund (BUIDL) and USDC. The current on-chain supply exceeds $1.44 billion, with a collateralization rate of 99.4%. Unlike the strategic hedging of USDe, USDtb is more like an "on-chain dollar," providing institutions with a reliable, non-volatile stable anchor. Especially when the market experiences negative interest rates, Ethena can transfer the hedging funds of USDe to USDtb to stabilize the entire asset pool structure.

The supply change of USDtb, source: Dune

Another variable in the stablecoin landscape is USDT₀. This full-chain stablecoin launched by Tether in collaboration with LayerZero circulates based on the OFT protocol and has currently expanded to multiple chains including Arbitrum, Unichain, and Hyperliquid, with its TVL increasing from $1.042 billion to $1.171 billion in May. In contrast, its goal is not financial innovation, but to facilitate multi-chain liquidity, becoming a stable "fuel" in DeFi.

This competition in stablecoins is no longer a single-dimensional efficiency battle, but has evolved into a structured and scenario-based product system. Products like GHO, USDe, USDtb, and USDT₀ occupy positions in lending, hedging, safety, cross-chain, and payment fields, reflecting that the stablecoin ecosystem is undergoing a reshuffle of "functional specialization" and "clarified application scenarios."

RWA: On-Chain Integration of Real World Assets

Once regarded as "ancillary to traditional finance," RWA is now becoming a strategic entry point for DeFi giants. In recent months, several protocols and organizations have formed a clear trend of collaboration around tokenized U.S. Treasury bonds and have begun actual deployment on-chain.

The most representative case is Arbitrum DAO. On May 8, the community passed a proposal to allocate 35 million ARB to three RWA issuance platforms: Franklin Templeton ($BENJI), Spiko ($USTBL), and WisdomTree. These three companies are heavyweight players in traditional finance and asset management, providing tokenized U.S. Treasury bills. This funding is allocated through the STEP (Stable Treasury Endowment Program), aiming to establish a stable, yield-generating treasury asset pool on-chain. According to official data, the first phase of this program has generated over $650,000 in revenue.

Aave's RWA platform, Horizon, takes a "use case first" approach. The main assets launched on Horizon are tokenized money market funds (MMFs), which institutions can use as collateral to borrow GHO or USDC. This means that RWA is no longer just an investment target but is actually integrated into the core functions of DeFi protocols, becoming financial components that can be circulated and lent.

Whether it is DAOs, lending platforms, or infrastructure providers, RWA is now seen as a key path to achieving real on-chain yields, connecting with traditional finance, and enhancing user confidence.

DeFi is Not Just a Warm Embrace, But an Evolution of Collaboration

On the surface, this round of collaboration among DeFi protocols may seem like a joint effort driven by "track anxiety," but from a structural perspective, it resembles a systematic integration and reconstruction.

These changes are not merely functional expansions but an upgrade in the way protocols collaborate. It signifies that the next stage of DeFi will transition from isolated single-point tools to an interconnected, mutually binding financial network system.

For ordinary investors, the focus may not be on whose TVL is higher, but rather on which combination structures are more stable, efficient, and capable of weathering volatility cycles. Collaboration does not equate to price increases, but it may very well be the foundation for the next round of growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。