Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Inflow of $608 Million

Last week, the U.S. Bitcoin spot ETF saw a net inflow over four days, totaling $608 million, with total assets under management reaching $12.267 billion.

Three ETFs experienced net inflows last week, primarily from IBIT, BTC, and HODL, which saw inflows of $841 million, $39.8 million, and $7.3 million, respectively.

Data Source: Farside Investors

U.S. Ethereum Spot ETF Net Inflow of $41.8 Million

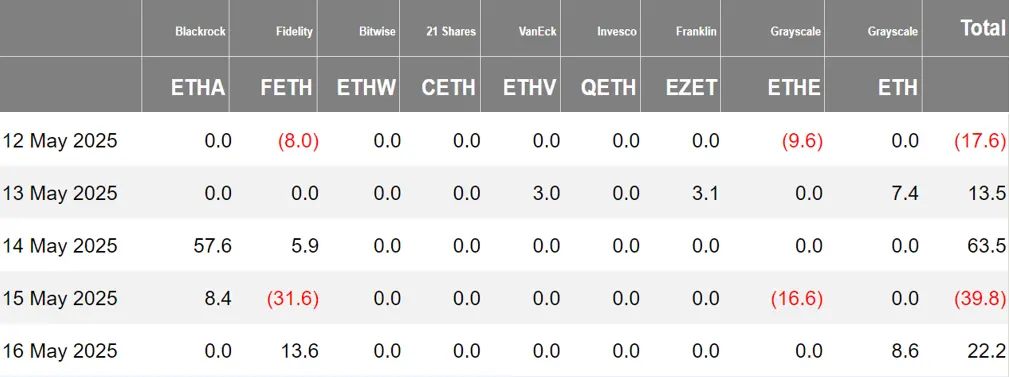

Last week, the U.S. Ethereum spot ETF experienced a net outflow over three days, with a total net inflow of $41.8 million and total assets under management reaching $897 million.

The inflow last week primarily came from BlackRock's ETHA, which had a net inflow of $66 million. A total of three Ethereum spot ETFs had no fund movement.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Inflow of 56.89 Bitcoins

Last week, the Hong Kong Bitcoin spot ETF had a net inflow of 56.89 Bitcoins, with total assets under management reaching $43.6 million. The holdings of the issuer, Harvest Bitcoin, decreased to 302.08 Bitcoins, while Huaxia increased to 2,250 Bitcoins.

The Hong Kong Ethereum spot ETF had a net inflow of 2,241.67 Ethereum, with total assets under management of $5.808 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of May 16, the nominal total trading volume of U.S. Bitcoin spot ETF options was $769 million, with a nominal total long-short ratio of 2.41.

As of May 15, the nominal total open interest of U.S. Bitcoin spot ETF options reached $16.34 billion, with a nominal total open interest long-short ratio of 2.03.

The market's short-term trading activity for Bitcoin spot ETF options has decreased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 48.07%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

Wisconsin Sells Over $300 Million of BlackRock's Bitcoin ETF

According to The Block, the latest 13F filing from the Wisconsin Investment Board shows that the agency has completely liquidated its position in BlackRock's spot Bitcoin ETF (IBIT), valued at $321 million.

The filing indicates that as of the end of March, the board no longer held any shares of IBIT. The investment board has not fully exited crypto-related investments, as the filing shows it still holds approximately $19 million in Coinbase stock. Previously, the agency had liquidated its position in the Grayscale Bitcoin Trust (GBTC). Notably, the BlackRock IBIT fund recently set a record for 20 consecutive days of net inflows, with over $5 billion in inflows.

Abu Dhabi Sovereign Wealth Fund Mubadala Discloses Over $400 Million in BlackRock's Spot Bitcoin ETF

According to Bitcoin Magazine, the latest 13F filing from Abu Dhabi's sovereign wealth fund Mubadala shows that its position in BlackRock's spot Bitcoin ETF (IBIT) has increased to 8.727 million shares, valued at $408.5 million, a 6% increase from the end of 2024. This investment coincides with high-level interactions on U.S.-UAE crypto policy. David Sacks, an AI and crypto advisor appointed by President Trump, discussed opportunities for the integration of digital currencies and artificial intelligence with UAE officials on March 20.

Li Lin Family Office Avenir Group Holds Approximately $691 Million in BlackRock's Bitcoin ETF

According to the 13F filing submitted by Hong Kong-based Li Lin Family Office Avenir Group, it currently holds $691 million in BlackRock's Bitcoin ETF, approximately 14.7 million shares. This is an increase from the 11.3 million shares reported as of December 31, 2024.

According to The Block, the U.S. Securities and Exchange Commission (SEC) announced it would delay its decision on BlackRock's Bitcoin ETF physical purchase mechanism and has begun soliciting public comments. If approved, this mechanism would allow investors to directly purchase and redeem ETF shares with Bitcoin instead of cash, enhancing trading efficiency.

A rule amendment submitted by Nasdaq in January indicated that iShares Bitcoin Trust intended to adopt this model, but the SEC had previously favored a cash settlement mechanism. On the same day, the SEC also delayed the approval of Grayscale Litecoin Trust and Grayscale Solana Trust, requesting public comments. The SEC also sought public comments on the 21Shares Dogecoin ETF.

According to The Block, the presidential candidate from South Korea's right-wing party, Kim Moon-soo, officially announced support for the adoption of spot cryptocurrency ETFs in South Korea as part of his campaign promises.

Previously, left-wing Democratic Party candidate Lee Jae-myung also promised to introduce spot crypto ETFs. The two major party candidates have formed a bipartisan consensus aimed at promoting wealth accumulation for the middle class and providing more opportunities for the younger generation. The chairman of the Financial Services Commission of South Korea stated that he would discuss implementation plans with the new government. The success of U.S. spot crypto ETFs (with net inflows exceeding $43 billion) has been a key factor in prompting South Korea to reconsider such products. The South Korean presidential election is scheduled for June 3, 2025.

JPMorgan's Bitcoin ETF Holdings Rise to $1.7 Billion

According to Crypto Rover, JPMorgan's total investment in Bitcoin ETFs has surpassed $1.7 billion (approximately 12.2 billion yuan).

According to Decrypt, Tokyo-listed company Beat Holdings announced it would raise its investment cap in Bitcoin-related assets from $6.8 million to $34 million.

The company has purchased 131,230 shares of BlackRock's iShares Bitcoin Trust (IBIT), with an average purchase price of $49.49 per unit. As of May 9, the unrealized gains from the holdings have exceeded $681,000. To support further investments, Beat Holdings has drawn $2.8 million from its revolving credit facility, expecting to incur approximately $150,000 in interest this year.

Market News: U.S. SEC Delays Decision on 21Shares Spot Polkadot ETF Application

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。