The yield on the benchmark 10‑year U.S. Treasury note stood at 4.45% on Thursday, May 15, 2025, while the 30‑year bond yield was 5%, a level not seen since 2007. Shorter‑term yields moved more sharply: the 2‑year note reached 3.96%, leaving the 10‑2 spread at 0.49% and underscoring concerns over a flattening curve.

Market speculators note that such movements often reflect investor expectations of a hawkish central bank, continued high rates, and the reality of a recession, which could further strain households and businesses through higher borrowing costs. Rising yields typically signal falling bond prices, pressuring portfolios of institutional investors like pension funds.

Market speculators note that such movements often reflect investor expectations of a hawkish central bank, continued high rates, and the reality of a recession, which could further strain households and businesses through higher borrowing costs. Rising yields typically signal falling bond prices, pressuring portfolios of institutional investors like pension funds.

More critically, the narrowing gap between short- and long-term yields—a potential precursor to another inversion—has historically preceded recessions. The 2-year yield’s faster climb compared to the 30-year suggests markets anticipate near-term economic cooling despite long-term uncertainty. Higher yields also translate directly to costlier mortgages, auto loans, and corporate debt.

The average 30-year fixed mortgage rate is around 7% in May 2025, according to Federal Reserve data. Global markets face collateral damage as U.S. Treasuries serve as a benchmark for sovereign debt. Emerging economies, particularly those with dollar-denominated debt, risk capital flight and currency depreciation as investors pivot to safer haven assets.

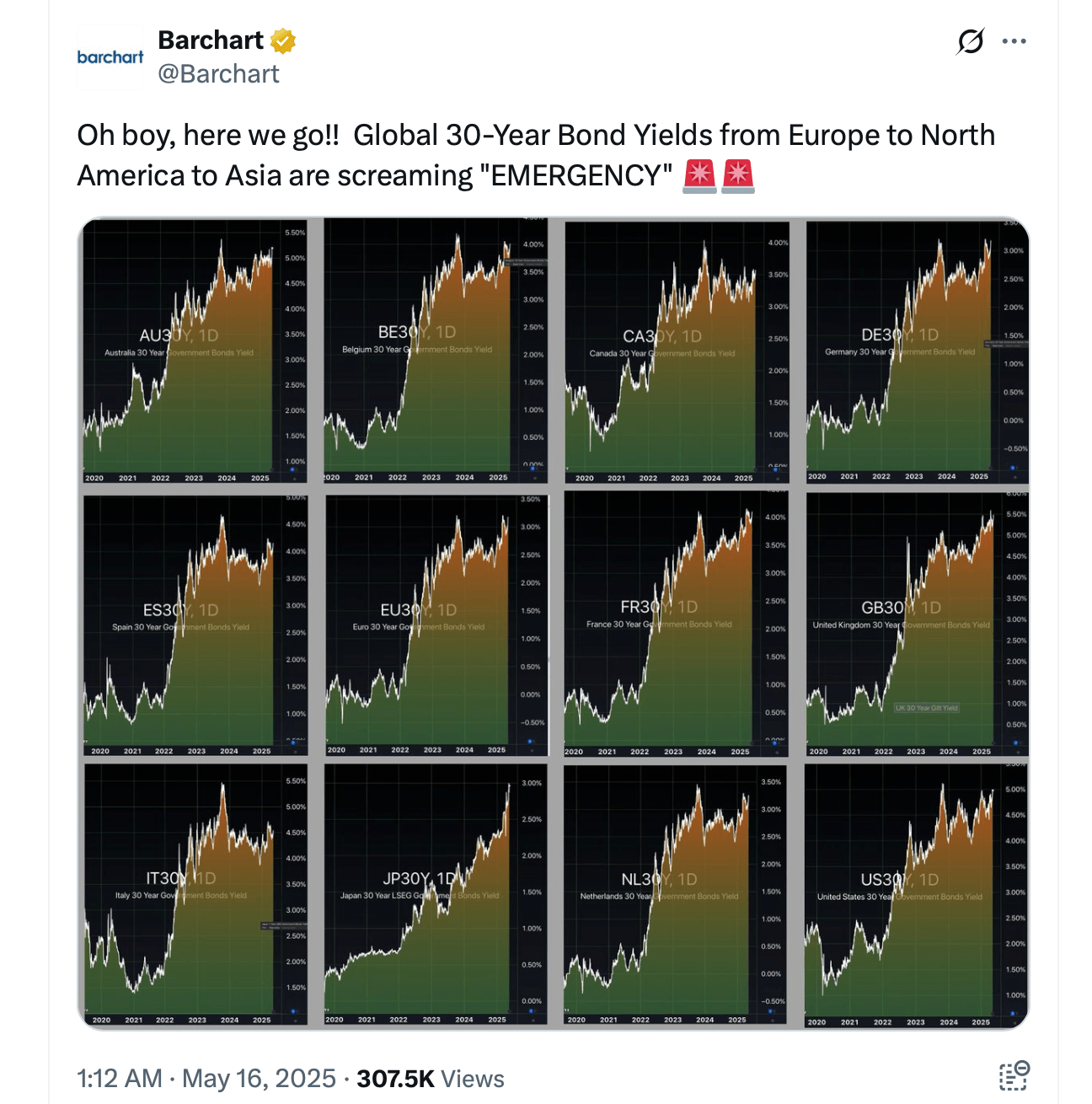

Yields in Australia and the U.K. mirrored the U.S. spike, while Japan’s 30-year bond yield hit a 21-year high. Central banks worldwide confront a policy tightrope. The Federal Reserve faces pressure to cut rates and ease borrowing costs but risks reigniting inflation. Similar dilemmas plague the European Central Bank and Bank of England dealing with threats exacerbated by recent U.S. tariff policies.

Trade tensions, including proposed tariffs on imported goods by the Trump administration, have further muddied the outlook, spooking investors and amplifying bond market swings. While some analysts argue the yield surge reflects transient volatility, others warn it may foreshadow a protracted economic slowdown.

The X account Endgame Macro told its 29,000 social media followers that global 30-year bond yields are surging to multi-year highs, signaling a structural shift—not inflation or growth optimism, but a rejection of long-term debt. Endgame Macro argues that investors distrust fiscal paths and central banks, demanding higher yields. This exposes fragile demand, cornered policymakers, and risks to assets reliant on cheap money.

“This is not the end of the debt cycle. It’s the part where the illusion of infinite demand dies and real yield premiums return with a vengeance,” the account stressed. “If you’re not watching the 30Y yield right now, you’re missing the most honest signal in the market.”

With global growth forecasts trimmed and stock markets wobbling as capital shifts to bonds, investors remain vigilant. Movements in yield levels—and the cascading impacts they set in motion—are poised to reshape the trajectory of global finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。