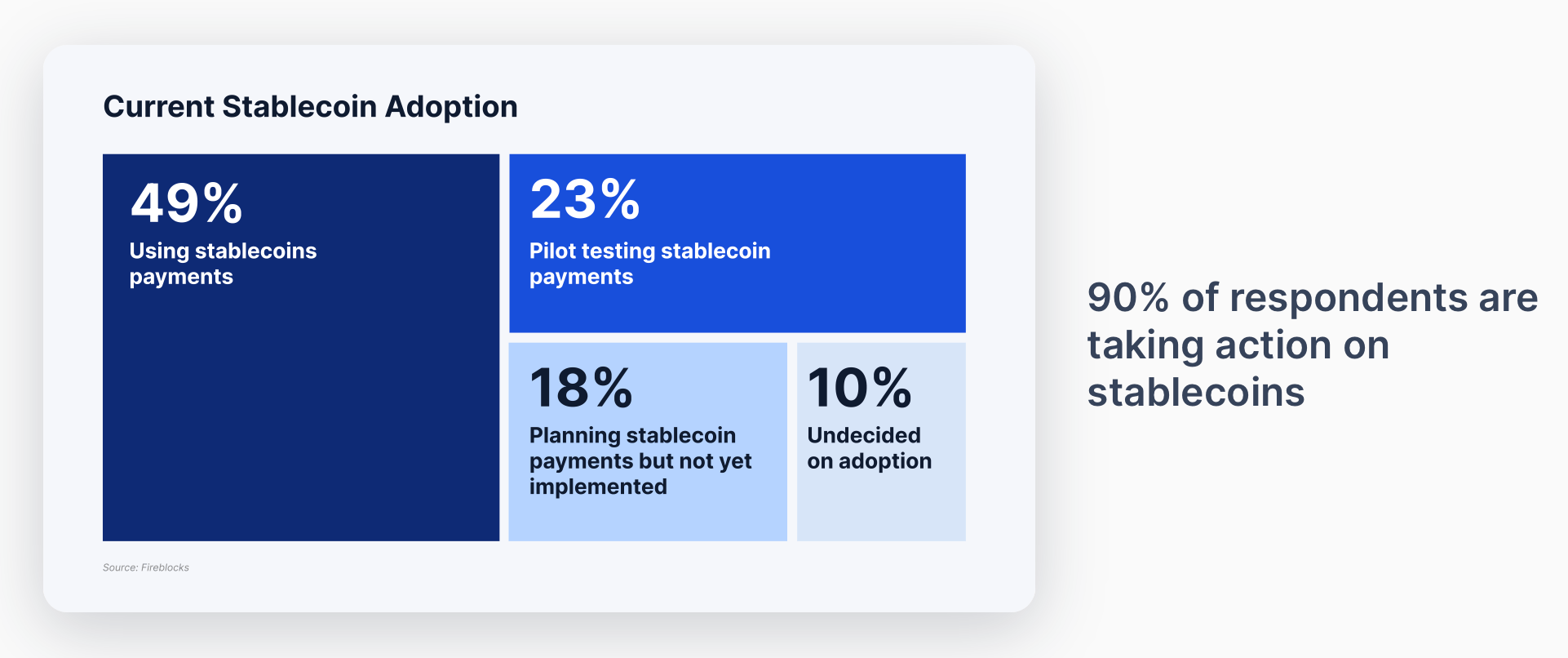

这份基于对295名金融高管的调查的报告显示,90%的公司正在积极实施稳定币,预计到2024年,Fireblocks平台上近一半的交易将涉及这一资产类别。银行和支付提供商每月处理超过3500万笔稳定币交易,突显了它们在主流金融中的整合。跨境支付在用例中占主导地位,特别是在新兴市场的B2B流动中,因为传统支付渠道面临延迟和高成本的挑战。

来源:Fireblocks调查《2025年稳定币现状》。

速度和流动性在主要动机中优于成本节约,48%的受访者指出更快的结算是最大的好处。收入增长——而非效率——推动了采用,因为机构利用稳定币重新夺回市场份额并进入新市场。监管担忧大幅下降,少于20%的公司将合规视为障碍,较2023年的80%大幅减少,这得益于政策的明确和反洗钱工具的改善。

Fireblocks的分析指出,地区采用情况差异显著。拉丁美洲以71%的公司使用稳定币进行跨境支付领先,而亚洲则专注于市场扩展。北美虽然在39%的采用率上落后,但88%的公司对即将出台的法规持积极态度。欧洲则优先考虑安全,37%的公司要求更安全的支付渠道,尽管其在MiCA下的监管框架已相对成熟。

基础设施的准备情况至关重要:86%的公司报告称技术准备充分,但可扩展性要求企业级解决方案,Fireblocks的研究人员指出。安全性仍然是一个障碍,36%的公司呼吁提供更好的保护以支持增长。Fireblocks强调了与Zeebu等公司的合作,后者使用稳定币处理了57亿美元的电信结算,证明了可扩展性。

报告总结认为,稳定币对金融机构而言不再是可选项。竞争压力和日益成熟的用例——从即时结算到可编程金融——使得采用成为战略上的必要。现在投资于合规、安全基础设施的公司将有望引领数字金融的下一个阶段。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。