The surge relies on market hotspots and liquidity injection; future development requires technological realization and increased transparency, otherwise it may become a speculative bubble.

Written by: Oliver, Mars Finance

In the turbulent waters of the crypto market, few projects can rise like the $B token, which, in a "three-no" posture—no white paper, no audit, no clear team—pushed its market value to $20 million within hours. This new star on the BNB Chain, backed by the BUILDonBsc_AI project, has transformed from being "silent" a month ago to a speculative focus, thanks to the tailwind of the $USD1 liquidity pool and the AI narrative. You may have missed this wave of frenzy while driving, but the rise of $B is far from coincidental. Below, we will peel back its surface to explore the essence and operational strategy of the project, revealing the driving forces behind this market value carnival.

The Essence Behind the "Three-No" Facade: A Blurred Blueprint of AI and DeFi

The public information about BUILDonBsc_AI is like a fog, revealing the typical temperament of an early project: vague yet enticing. Its core positioning seems to lock onto the intersection of AI and DeFi, possibly aiming to leverage the low costs and high throughput of the BNB Chain to build an intelligent financial protocol. Speculating on its functions, it could be an AI-driven liquidity optimizer that dynamically adjusts pool weights through machine learning to maximize returns; or it could be a decentralized computing power market providing on-chain support for AI model training. This vision is not a fantasy—BNB Chain has recently promoted AI applications (such as Tutorial Agent navigating the ecosystem), providing ecological soil for similar projects.

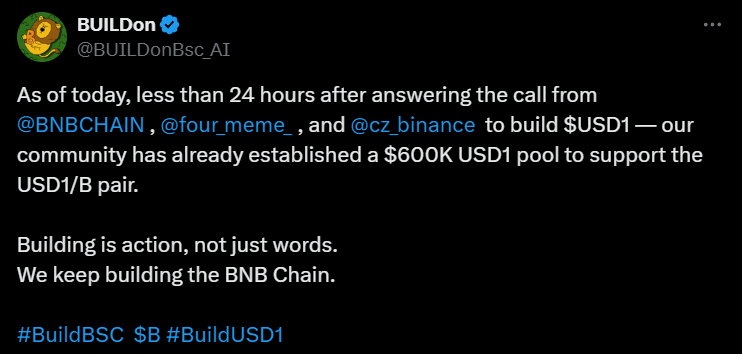

However, the "three-no" label of $B raises alarms. Without a white paper, the technical details cannot be verified; without an audit report, the security of the smart contract is questionable; and the team's background is blank, with anonymity leading to wild speculation. This information vacuum is both a paradise for speculators and a breeding ground for risks. BUILDonBsc_AI's X dynamics claim that "$USD1 has swept the BNB Chain, and $B is poised for growth," suggesting that its integration with $USD1 is a core selling point, but is this merely narrative packaging? The essence of $B may be an AI-DeFi experiment that has yet to take shape, or a carefully woven speculative story.

Operational Decoding: Leveraging $USD1 and Precision Marketing

The rapid rise of $B to a market value of $20 million is inseparable from the operational strategy of BUILDonBsc_AI, which focuses on leveraging, marketing, and incentivizing in a coordinated effort.

First, the $USD1 liquidity pool is the ignition point for the surge. As a stablecoin launched by World Liberty Financial, $USD1 reached a market value of $92.6 billion in May 2025, surging 30% in the past week, becoming the traffic engine of the BNB Chain. Its low slippage and high depth characteristics provide an ideal trading environment for $B. After the pool was opened, the $B/$USD1 pair likely attracted millions of dollars in TVL on PancakeSwap, with triple-digit APY further igniting the liquidity mining frenzy. This liquidity injection not only reduced trading friction but also attracted institutional and retail funds through the halo of stablecoins.

Secondly, BUILDonBsc_AI's marketing strategy accurately taps into the market pulse. The AI narrative remains a golden signboard in the crypto market in 2025, and $B combines it with the hotspot of $USD1 to weave a story of "future finance." Posts on the X platform are full of implications, with language that is both mysterious and provocative, such as "bridge completed, time-tested," stimulating FOMO emotions. You mentioned that a month ago you thought the project was "dead," which may reflect its deliberately low-key preheating phase, followed by a rapid explosion of attention through the opening of the $USD1 pool and social media hype.

Finally, community incentives are a key driving force behind the rise of $B. BUILDonBsc_AI may have attracted early participants through airdrops or mining rewards, but its distribution mechanism is opaque. You mentioned that the assistant's position was conservative, missing out on the gains, suggesting that rewards may favor high-risk speculators rather than long-term supporters. Assuming the total supply of $B is 1 billion tokens, if the circulation is too high, it may lay the groundwork for selling pressure; if the team's holdings are concentrated, it may raise "rug pull" suspicions. Without publicly available token economics, investors can only grope in the dark.

The Driving Force Behind the Market Carnival: The Fertile Ground of BNB Chain

The surge of $B is inseparable from the ecological support of the BNB Chain. As one of the world's leading blockchains, BNB Chain attracts countless DeFi and AI projects with low gas fees and EVM compatibility. In the fourth quarter of 2023, its market size surged by 48%, with an average daily trading volume of 4.6 million transactions, demonstrating strong network activity. The rise of $USD1 further solidified its position in the stablecoin market, providing a traffic entry point for $B. BUILDonBsc_AI's choice of BNB Chain is both a cost consideration and a precise bet on ecological dividends.

However, this fertile ground also hides speculative traps. Projects that quickly launch on the BNB Chain often lack deep verification, and community sentiment can easily be manipulated by marketing. The surge of $B is a chemical reaction between hotspot narratives (AI + $USD1) and liquidity influx. But similar AI projects are not without flaws—on April 1, the Act I The AI Prophecy token plummeted 58% within minutes, evaporating $96 million in market value, exposing the volatility risks of low market cap tokens. If $B lacks substantial technical support, it may repeat this fate.

Opportunities and Hidden Reefs: The Potential and Concerns of $B

The short-term performance of $B is eye-catching, but its long-term value requires calm scrutiny.

From a potential perspective, if BUILDonBsc_AI can deliver on its AI-DeFi promises, such as launching intelligent yield optimization protocols or computing power markets, it may secure a place in the $10 billion DeFi market of the BNB Chain. The continued expansion of $USD1 provides it with stable trading pairs, while the ecological support of the BNB Chain (such as integration with PancakeSwap) paves the way for its growth. If a white paper is subsequently released or an audit is conducted, $B may usher in a new round of catalysts.

But concerns loom large. The lack of transparency is the biggest risk: no white paper, no audit, no team background raises serious questions about the legitimacy of $B, and cases of "rug pulls" in AI-themed projects are not uncommon. In the market, the surge of $B relies on the hotspot of $USD1; if funds withdraw from the pool, the price may quickly correct. Technical indicators (based on DexTools assumptions) suggest that $B's RSI may already be overbought, indicating short-term adjustment pressure. Additionally, $USD1 may face regulatory uncertainties due to political backgrounds; if sanctions occur, the liquidity of $B will be severely impacted.

Investor's Breakthrough Strategy

You missed the first wave of the rise of $B while driving, but the market is never short of opportunities. Here are some follow-up action suggestions to help you capture potential and avoid risks:

Delve into BUILDonBsc_AI's X, Telegram, or Discord to track technical updates and request a white paper or contract audit. Projects without transparency should be approached with caution. Monitor the TVL and APY of the $B/$USD1 pool on PancakeSwap; if the pool size shrinks or yields decline, it may signal a withdrawal. Observe $B's trading volume and RSI through BscScan or DexTools; overbought signals or bearish divergences may indicate a correction, and you can look for entry points at Fibonacci retracement levels (such as 38.2%). Pay attention to regulatory dynamics surrounding $USD1; any negative news may impact $B, and you should set stop-loss orders to protect your funds.

Conclusion: Cold Reflections Behind the Frenzy

The market value surge of the $B token and BUILDonBsc_AI is a microcosm of the 2025 crypto market: the dazzling narrative of AI, the liquidity wave of $USD1, and the fertile ground of the BNB Chain together create a speculative feast. Beneath its "three-no" facade, there may be a grand experiment of AI-DeFi; but it could also just be a bubble in the midst of a craze. What you missed is not only the price surge but also the ever-changing pulse of the crypto market.

The future of $B is like a gamble. If it can deliver on its narrative through technology, it may become the next star of the BNB Chain; if it is merely an illusion of hype, it will ultimately be drowned out in the market's clamor. For investors, the key to chasing $B lies not in blindly following the trend, but in peeling back the "three-no" exterior to understand its essence and risks. On the fertile ground of the BNB Chain, every surge is a dance of opportunities and traps, and the outcome depends on whether you can remain clear-headed amidst the frenzy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。