We are facing not a knowledge gap, but a design gap.

Written by: arndxt_xo

Translated by: Baihua Blockchain

Why I no longer suggest friends "learn cryptocurrency first"?

Last month, I tried again to guide a non-cryptocurrency user into the field. Ten minutes later, she was confused between "choosing a wallet" and "paying gas fees with another token." I realized: we are facing not a knowledge gap, but a design gap.

An obvious fact is that speculation brought the first wave of users, but it cannot attract the next billion users. True adoption will begin when cryptocurrency products become "invisible"—users can benefit from them without even realizing it. From the rise of stablecoins and institutional staking to the increasingly important role of artificial intelligence in shaping the digital economy, the foundation for mass adoption has been laid. But to unlock this future, we must stop expecting users to learn about cryptocurrency and instead create products that they don’t even notice they are using cryptocurrency.

Here are my views on eight major trends:

Next-Generation Wallets Will Win by Focusing on One Thing

We are witnessing a structural shift: users tend to use two complementary wallets—one like a "daily" fintech app and another like a "bank" vault.

Wallet experiences are diversifying. Developers trying to cram all functionalities into a single interface will lose to combination wallets focused on (a) frictionless onboarding and (b) high-security storage.

Current situation:

More than half of users use 2-5 wallets simultaneously, with nearly 48% stating this is because each blockchain network remains an isolated "walled garden."

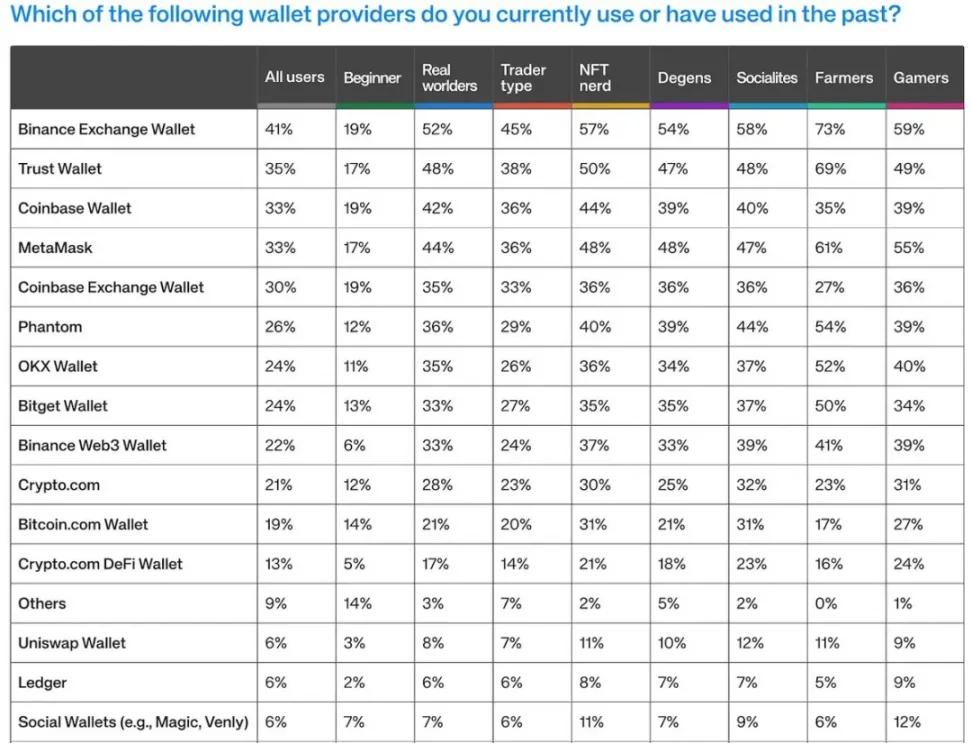

Concentration at the Top: Among users with over two years of experience, 54% are concentrated in Binance, Coinbase, MetaMask, or Trust Wallet, while the market share of a single wallet among novice users is less than 20%.

Self-custody remains daunting: Even within familiar brand ecosystems (like Binance's Web3 wallet), only 22% of users choose self-custody.

The frustration of multiple wallets: Users do not want to manage multiple wallets; they simply have no choice.

The "seamless multi-chain future" has yet to be realized, with 48% of users forced to use multiple wallets due to different blockchain ecosystems.

44% of users intentionally separate wallets for security reasons, up from 33% last year.

Insights:

The industry has failed to achieve true interoperability, pushing operational complexity onto end users.

Users are becoming increasingly savvy and no longer blindly trust a single wallet to handle all scenarios.

Discrepancy Between Behavior and Beliefs

54% of users have used cryptocurrency for payments or peer-to-peer transfers in the past quarter, but only 12% say payments are their favorite activity.

In contrast, trading (spot, meme, DeFi) remains the primary weekly activity for various users (with few exceptions).

Three major resistances suppressing practicality in speculation:

Cost resistance: 39% of users believe high gas fees on layer one (L1) networks are the biggest barrier to adoption.

User experience resistance: Only 11% of users believe the current onboarding experience is sufficient to attract the masses.

Network resistance: Payments need to flow smoothly between merchants and friends, but fragmented wallets and chains disrupt this cycle.

Blockchain as a New Layer of Infrastructure, but Users Should Not Perceive Its Existence

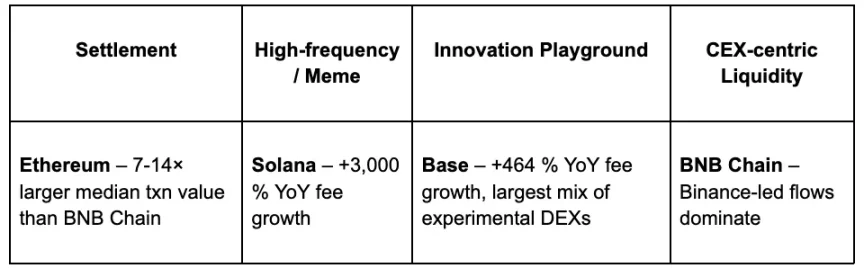

The multi-chain landscape is a division of labor:

Ethereum: Institutional-grade settlement layer.

Solana: Quickly becoming the preferred chain for high-frequency, high-participation retail activities due to its speed and low cost advantages.

Chain abstraction is the winning model: Wallet sessions smoothly route orders, balances, and identities to the backend with optimal latency, cost, and security, without users needing to manually select chains.

Data:

Solana performs exceptionally: Year-over-year fee growth of +3000%, total value locked (TVL) growth of +127%, the highest among all L1s.

User preferences: 43% primarily use Ethereum, 39% choose Solana, and only 10% primarily use L2—demonstrating that interoperability remains theoretical.

False Rise in User Confidence

Users claim to feel safer on-chain, but their wallet behaviors tell a different story.

Paradox reason: Users confuse personal security measures (like hardware wallets and multi-signature) with systemic risks.

Reality: Attackers have industrialized "phishing as a service," shortening the lifecycle of malicious contracts by four times.

Product priorities: Anti-phishing user experiences (clear signature interfaces, real-time transaction simulations, MPC transaction firewalls) must shift from advanced features to default settings in "everyday" wallets.

NFTs as the Infrastructure of Digital Culture

The NFT market is undergoing a necessary correction, shifting from speculative PFP projects to real digital goods and utility-driven experiences, appearing sustainable for the first time.

Trends:

Low-cost, high-frequency participation: The low-cost collectibles craze, like Rodeo.Club and Base, resembles in-game purchase models.

NFTs as the foundational infrastructure for participation in the digital economy: Loyalty points, badges, and membership benefits will be tokenized as NFTs, portable and tradable across platforms.

The rise of cultural capital: NFTs become a mechanism for users to express identity and cultural belonging in the digital space.

New metrics: The success of NFTs is no longer determined by floor prices but defined by user retention and engagement.

AI + NFTs: AI-generated dynamic NFTs will evolve based on user behavior, emotions, or community events, providing personalized experiences.

Bitcoin as a Macro Asset Class

Bitcoin has evolved from a speculative asset to a macro financial tool and is becoming the transaction layer for global settlements.

Trends:

From hedge to strategic reserve asset: Countries de-dollarizing are quietly exploring Bitcoin as part of their reserve diversification strategies.

L2 Unlocking Payment Practicality: The Lightning Network has matured into a scalable payment layer, with new protocols like Fedimint and Ark addressing privacy and user experience issues.

Bitcoin as collateral: Institutions are beginning to use Bitcoin for structured financial products, such as credit instruments and derivatives.

Global settlement network: Bitcoin serves as a neutral, censorship-resistant trade settlement layer, complementing rather than competing with fiat currencies.

Institutional Staking as a Strategic Capital Allocation Model

After Bitcoin established its macro hedge position, institutions began exploring how to generate returns from these assets.

Retail chases speculation, institutions choose staking: Institutional funds are steadily flowing into the staking ecosystems of Ethereum and Solana.

Bitcoin staking potential: Through protocols like Babylon, Bitcoin is also beginning to enter yield-generating strategies.

Infrastructure rather than validators: The next wave of institutional funds will flow to platforms providing institutional-grade custody, compliance reporting, and risk management staking products.

Yield diversification: In the context of declining attractiveness of traditional fixed-income products, staking yields are becoming a new category of risk-adjusted returns.

Regulation, Stablecoins, and AI: The Next Entry Point

Regulatory optimism: 86% of users believe clearer rules will accelerate adoption, while only 14% think it will hinder innovation.

The rise of stablecoins: Year-over-year holding rates nearly doubled to 37%, becoming the default payment rails in over 30 Stripe markets.

AI collaboration: 64% of users believe AI will accelerate cryptocurrency development, and 29% anticipate a bidirectional flywheel effect.

Summary

Users are no longer enamored with "Web3." They expect the simplicity of Web2, the ownership of Web3, and the intelligence of AI, all in one.

Teams that can abstract chain selection, eliminate fee pain points, and embed predictive safety nets will transform cryptocurrency from a speculative playground into a connective organization of the on-chain internet. The next billion users may not even know they are using Web3 products; this "invisibility" will be the ultimate victory in user experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。