Funding of $21 million, valuation of $600 million, what is the principle behind IKA, the hottest project in the Sui ecosystem, and how to participate?

Written by: Alex Liu, Foresight News

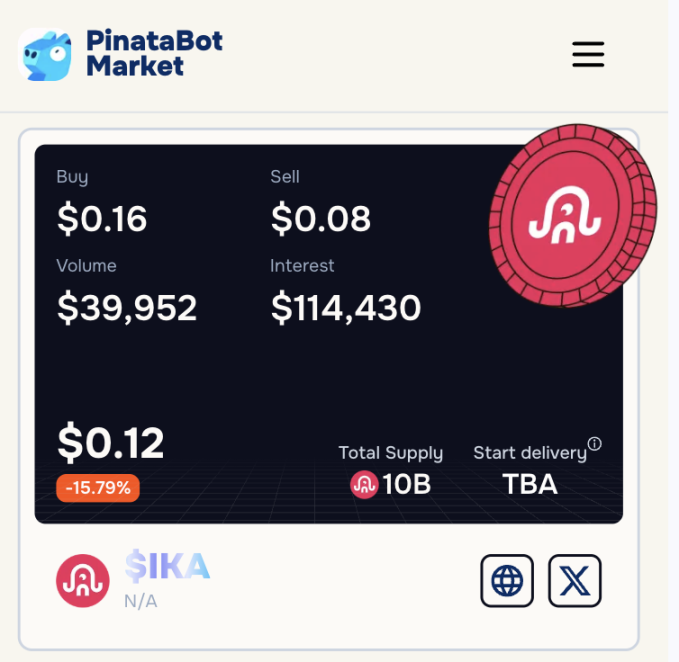

Funding Information and Pre-Market Price

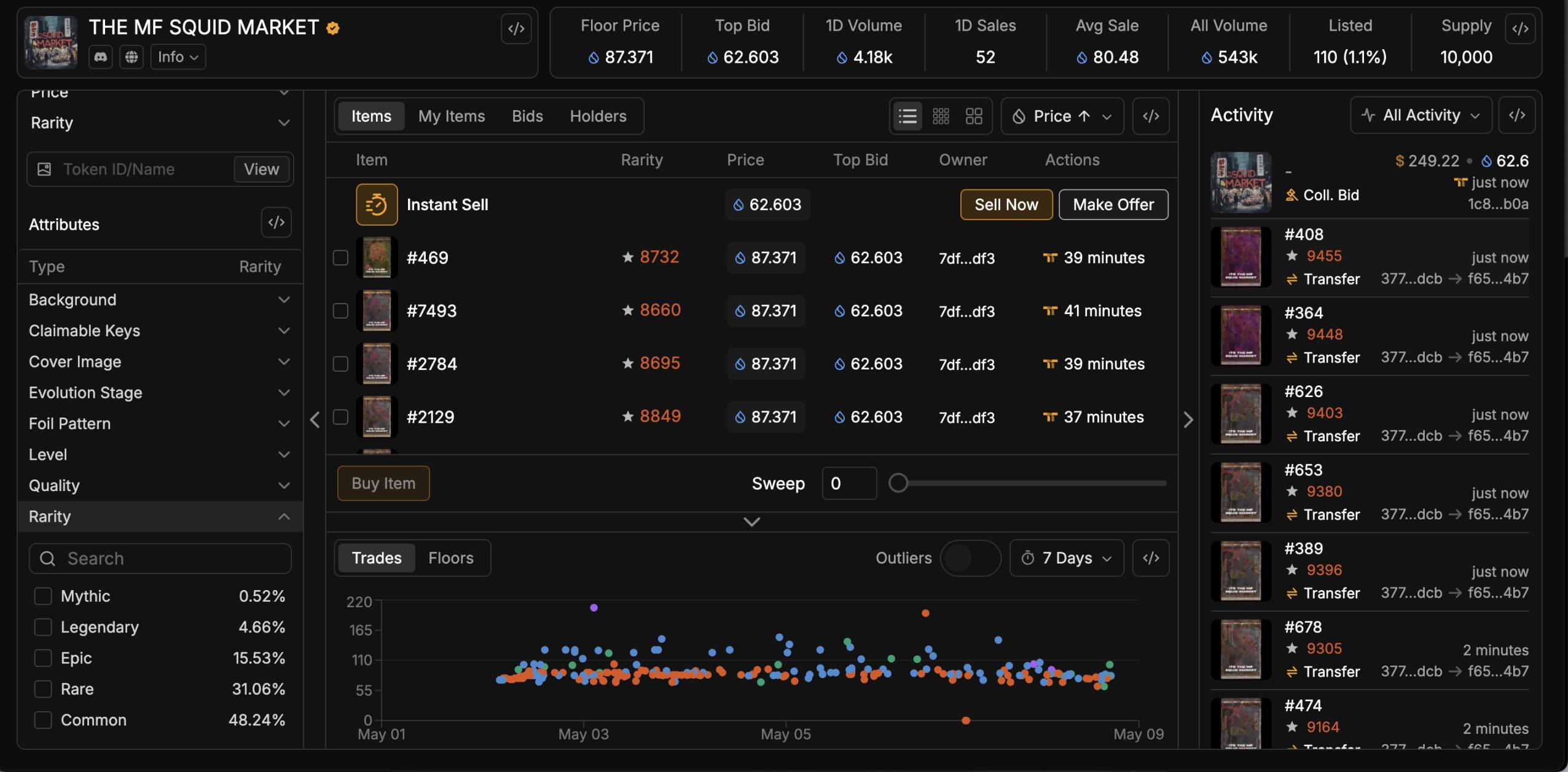

On April 28, 2025, IKA announced a strategic investment from the Sui Foundation, bringing the total funding for the project to over $21 million. Previously, IKA raised over 1.4 million SUI tokens by issuing the THE MF SQUID MARKET series NFTs on Sui, receiving support from institutions including DCG, Big Brain Holdings, Blockchange, Node Capital, Amplify Partners, Liquid2 Ventures, and FalconX.

As of now, the project's highest funding valuation is $600 million. Meanwhile, on the pre-market token OTC trading platform PinataBot Market, the fully diluted market capitalization of the IKA token has reached $1.2 billion (with low trading volume).

What kind of project is IKA, and how has it achieved such funding and valuation?

Project Background and Introduction

IKA was formerly known as "dWallet Network" and is set to launch a parallel MPC (Multi-Party Computation) network based on Sui. With the slogan "We make all chains Sui chains," IKA addresses the cross-chain interoperability of assets.

Conventional cross-chain asset transfers typically rely on bridging protocols and wrapped assets (such as wrapping BTC as an ERC-20 token for use on Ethereum or bringing USDC to Solana). However, this method has fundamental flaws:

Non-native asset risk: Users only hold wrapped tokens, not real BTC or ETH;

Bridging security risks: If a bridging protocol is attacked (such as the Ronin bridge hack of $624 million in 2022), users could lose all their assets;

Decoupling crisis: Wrapped tokens may lose their price peg due to liquidity issues.

Applications built on IKA as the underlying protocol can avoid these inconveniences of cross-chain assets. Taking cross-chain lending of BTC as an example, the operational process is as follows:

Create a dWallet (which will be detailed later) and bind a BTC address;

Initiate a lending request through a smart contract;

BTC is locked on the Bitcoin chain (not wrapped);

Loan funds are received in real-time on the Ethereum chain.

This achieves:

Asset Locking: BTC cannot be moved until repayment;

Automatic Liquidation: If the BTC price plummets or repayment is overdue, collateral is automatically liquidated;

Zero Trust Guarantee: The entire process is secured by the 2PC-MPC protocol, preventing anyone from misappropriating assets.

IKA is a B2B underlying interoperability protocol, and the above use case is just one of the applications it can build. In fact, there are already over ten projects (mostly from the Sui ecosystem or those that have established partnerships with Sui) integrated with IKA, covering four core scenarios:

- DeFi Interoperability

Protocols like Full Sail achieve real-time liquidity injection of BTC/ETH into DEX on the Sui chain through IKA, allowing users to directly participate in staking and lending with native BTC;

- Institutional Custody

Aeon provides institutional investors with a multi-signature asset management solution based on IKA, with private key shards distributed across hundreds of nodes globally, balancing the issue of "self-custody vs compliance";

- Chain Abstraction Experience

Covault utilizes IKA+zkLogin to create a "seamless cross-chain" wallet, allowing users to directly operate Solana NFTs and Ethereum DeFi on the Sui chain;

- Bitcoin Financialization

The Native protocol develops a BTC options market based on IKA, achieving programmatic yield strategies for native Bitcoin for the first time.

Also noteworthy is the integration of AI and Web3: Teams like Atoma use IKA to set up trading firewalls for AI agents, ensuring that automated investment decisions cannot overreach and transfer assets, providing a secure foundation for the AI+DeFi market.

So how does IKA achieve cross-chain asset interoperability and attract these applications?

Technical Principles

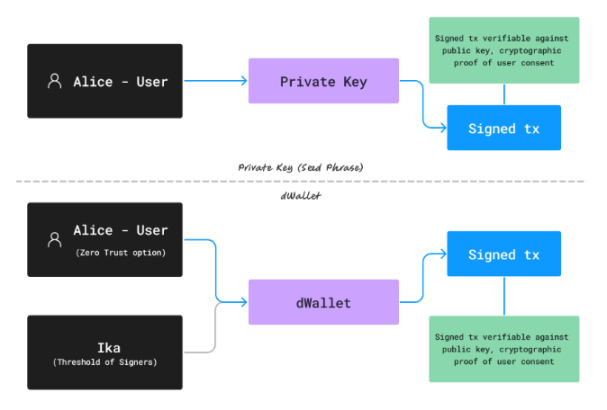

The core technology of IKA can be summarized into two main modules—dWallet (decentralized wallet) and 2PC-MPC (Two-Party Computation - Multi-Party Computation) protocol, allowing users to directly use native assets like BTC and ETH to participate in a multi-chain ecosystem without relying on wrapped tokens.

dWallet: The "Universal" Wallet for Cross-Chain

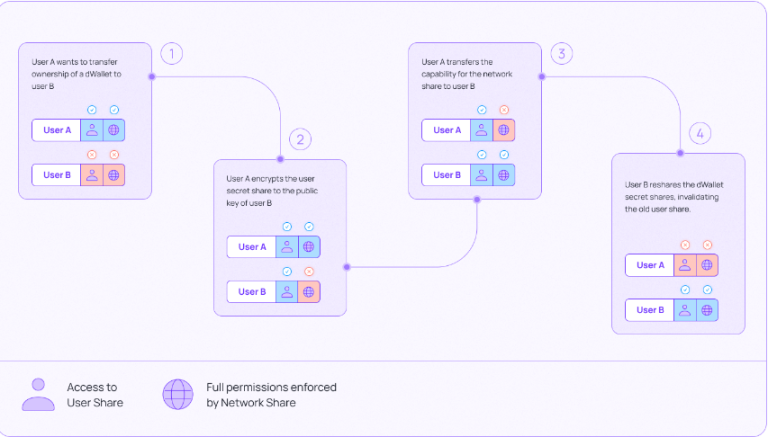

dWallets act as the "universal key" in the cross-chain world: users can manage multi-chain assets through a single interface. The private key of each dWallet is split into multiple "key shares," which are stored across different nodes in the network. When a user initiates a cross-chain transaction, the network nodes and the user each hold a share of the key to participate in the signing operation without ever reconstructing the complete private key. This means there is no risk of single-point private key leakage under any circumstances.

dWallet features programmability and transferability, allowing developers to set multi-signature, spending limits, conditional payments, and other strategies; DAOs can also achieve seamless handover of governance wallets. Combined with Sui's zkLogin feature, users can log in to any chain using their Google/Apple accounts, completely eliminating the burden of managing multiple wallets.

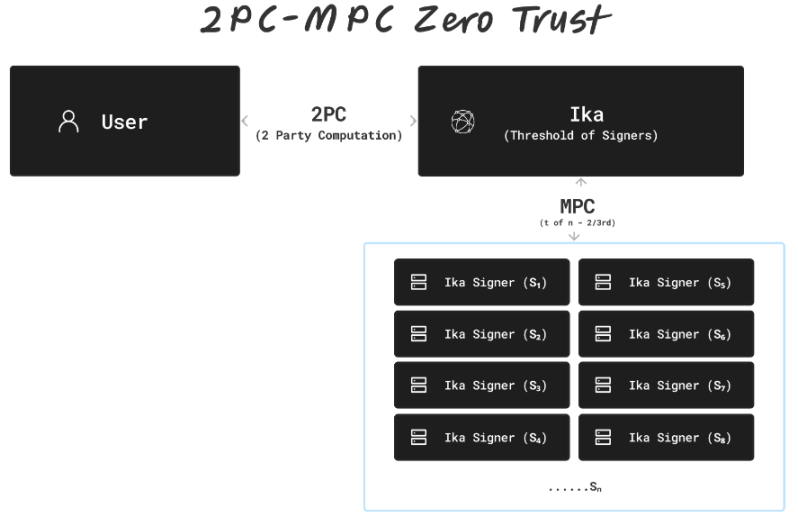

2PC-MPC Protocol: Sub-second Parallel Signing

IKA employs a unique 2PC-MPC solution: first, the user and the network each generate a share of the "encrypted key" (Two-Party Computation), and then hundreds to thousands of nodes perform the MPC signing process in parallel (Multi-Party Computation). With the help of Sui's Mysticeti consensus, the signing nodes can scale horizontally to thousands, achieving a throughput that is ten thousand times that of existing MPC networks; the signing delay remains stable at sub-second levels while maintaining a high degree of decentralization and resistance to censorship.

In simple terms: the 2PC-MPC protocol breaks the "security-efficiency" paradox of traditional MPC.

Token Economics

IKA announced its initial token economics on May 8. The native token IKA (with a total issuance of 10 billion tokens) is the core vehicle for the network's economic operations, with its main functions including:

Payment Function: Users use IKA to pay for network service fees, including creating dWallets, requesting signatures, redistributing key shares, and other operations.

Security Incentives: Through a Delegated Proof of Stake (DPoS) mechanism, nodes compete for signing and consensus verification rights and earn corresponding rewards by staking IKA; improper or malicious behavior will be penalized to ensure network security.

Governance Weight: IKA holders can participate in voting on network governance proposals, deciding on protocol parameters, economic model adjustments, and the use of community funds, achieving decentralized autonomy.

Token Distribution

IKA promises to allocate more than 50% of the tokens to the community, with 6% (600 million tokens) designated for the first round of community airdrops and incentives at the launch of the mainnet.

The official statement indicates that further details on token distribution will be announced closer to the TGE.

Participate in Airdrop

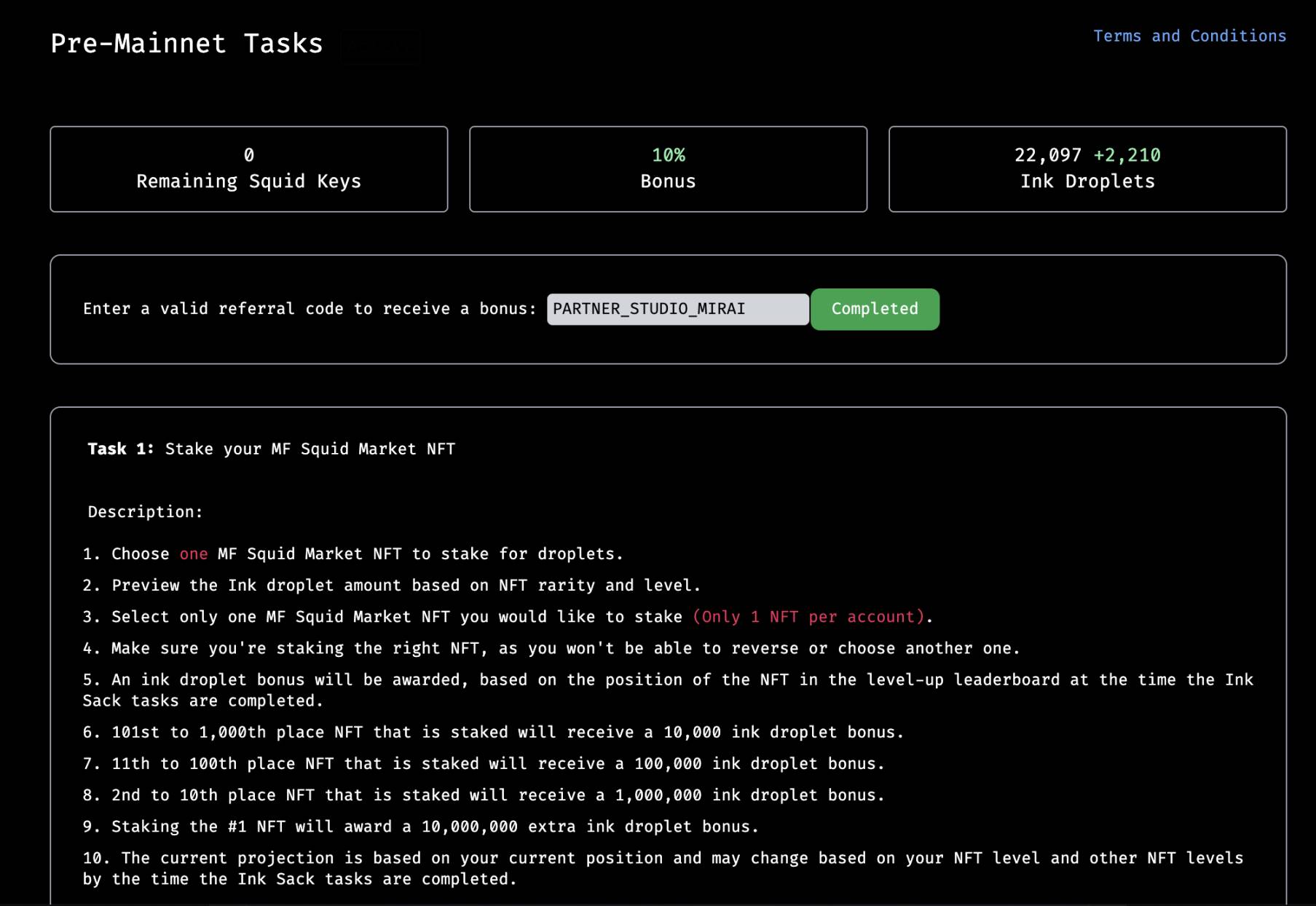

IKA currently has Pre-Mainnet tasks that can be completed to earn droplets, likely related to its subsequent token airdrop.

Many tasks require staking the NFTs from the THE MF SQUID MARKET series issued on Sui (currently with a floor price of 87 SUI) to participate.

Note that the rarity and level of the NFT determine the number of droplets obtained, with specific information detailed on the official page. Users who do not hold NFTs can participate in activities such as staking SUI for iSUI and locking it up to earn droplets daily (staking NFTs is a one-time gain and will not increase daily), generating dWallets (showing a need to consume 5 SUI, but the actual fee is only the Gas fee), and registering Sui, EVM, and Bitcoin chain addresses (only consuming Gas), etc.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。