Trump's Major Announcement Combined with the Fed's Policy Shift: An In-Depth Analysis of Bitcoin's Path to $100,000

Macroeconomic Interpretation: The global financial market is currently undergoing multiple transformations, with the recalibration of the Federal Reserve's monetary policy path, rising expectations for U.S. fiscal expansion, and innovative asset forms emerging from geopolitical games, all constituting the core variables driving structural changes in the crypto market. Bitcoin's price has approached the $100,000 mark for the first time since February, with cryptocurrency-related stocks also strengthening. This phenomenon intertwines three driving forces: macroeconomic policy, the reconstruction of sovereign credit systems, and breakthroughs in the practical application of on-chain assets.

At the May FOMC meeting, the Federal Reserve maintained interest rates for the third consecutive time, with the policy statement explicitly acknowledging for the first time that "tariffs exacerbate inflation and unemployment risks," marking a subtle shift in the monetary policy framework. Powell mentioned "waiting" 22 times during the press conference, emphasizing that the current interest rate level is sufficiently restrictive, but the tariff policies implemented by the Trump administration have had a far greater impact on the economy than expected. Estimates suggest that if current tariff levels persist, they could raise the U.S. core PCE inflation rate by an additional 0.3-0.5 percentage points, forcing the Fed to delay rate cuts until the first quarter of 2025. This policy dilemma is historically rare—when fiscal stimulus (such as the tax cuts 2.0 being contemplated by the Trump team) runs parallel to trade protectionism, monetary authorities must contend with both inflationary pressures and the risk of an economic hard landing. This "stagflationary balance" objectively enhances Bitcoin's strategic value as a non-sovereign asset.

It is noteworthy that the latest policy deregulation by the Office of the Comptroller of the Currency (OCC) has cleared obstacles for traditional financial institutions to deeply engage in the crypto market. National banks are not only permitted to directly conduct crypto asset custody and trading but can also outsource related services to specialized institutions through risk isolation mechanisms. This regulatory breakthrough resonates with the continued buying by publicly listed companies like MicroStrategy: data shows that the Bitcoin ETF positions held by the top ten U.S. banks increased by $720 million within 24 hours of the policy announcement, with BlackRock's IBIT seeing its highest net inflow since March in a single day. This large-scale entry of institutional funds is changing the market structure of Bitcoin—on-chain data indicates that the number of addresses holding over 1,000 BTC has increased by 18% year-on-year, while exchange reserves have dropped to their lowest level since 2018, fundamentally reversing the supply-demand relationship that supports coin prices.

The dual catalytic effect of the political cycle and technological innovation cannot be overlooked. The Trump team's upcoming "most significant announcement in history" is interpreted by the market as a prelude to a new round of fiscal stimulus. The derivatives strategy department of JPMorgan estimates that if this policy involves infrastructure investment or capital gains tax cuts, it could push the S&P 500 volatility index (VIX) down by 15-20 basis points, a risk appetite increase that often forms a positive correlation with crypto assets. More significantly, the launch of the DJT utility token by the Trump Media & Technology Group (TMTG) represents a milestone, achieving a deep integration of a U.S. publicly listed company with the on-chain ecosystem. Its social platform, Truth Social, combines a user points system with a token economic model, creating a new business paradigm of "traffic-data-finance" in the Web 3.0 era. The market shows high enthusiasm for such crypto assets with real application scenarios, with institutional subscriptions during the DJT presale exceeding 23 times, indicating a trend of capital migrating from purely speculative meme tokens to utility tokens with clear value support.

From a broader perspective, Bitcoin is completing a cognitive leap from "digital gold" to "sovereign alternative asset." The strong statements from the Chinese Embassy in the U.S. regarding U.S.-China economic and trade negotiations, along with the trend of multiple central banks increasing their BTC holdings as a substitute for foreign exchange reserves, reflect a deep trust crisis facing the traditional fiat currency system. The yield on the U.S. 10-year Treasury bond may hit a historical high of 6% within 18 months, contrasting sharply with the ongoing enhancement of Bitcoin network security (current network hash rate has increased by 41% compared to the peak in 2023). As institutional investors begin to reassess the allocation value of crypto assets using the Sharpe ratio, Bitcoin's volatility premium becomes an effective hedge against fiat currency depreciation.

Looking ahead, three key variables will dominate the direction of the crypto market: first, the dynamic interplay between the Fed's policy path and inflation data; if the June CPI month-on-month growth rate falls below 0.2%, it may open a window for rate cuts in the third quarter; second, the timing and scale of the specific U.S. fiscal expansion plan, with a stimulus plan exceeding $500 billion potentially triggering concerns about "monetizing the fiscal deficit," accelerating capital's shift towards anti-inflation assets; finally, the compliance process of on-chain infrastructure, as the SEC's approval of Ethereum ETFs enters a countdown, the integration of traditional finance and the crypto ecosystem will enter a qualitative change phase. Under the combined influence of these factors, Bitcoin breaking through $100,000 may become the starting point for a new round of value reassessment, but caution is still needed regarding the volatility amplification risk brought by short-term liquidity disturbances. Historical experience shows that when the cracks in the sovereign credit system meet the wave of technological innovation, it often gives rise to a paradigm revolution in asset classes, and we may be at the critical point of this transformation.

BTC Data Analysis:

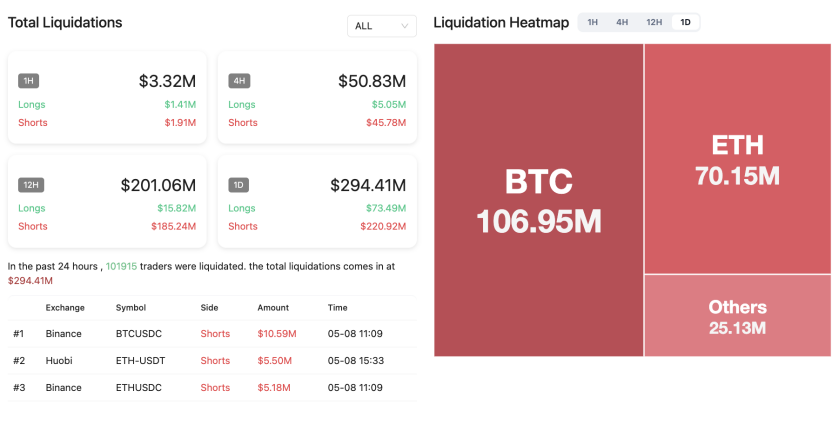

According to Coinank data, $294 million in liquidations occurred across the network in the past 24 hours, with long positions liquidating $73.49 million and short positions liquidating $222 million. Among these, Bitcoin saw $107 million in liquidations, while Ethereum experienced $70.15 million.

We believe that of the $294 million in liquidations across the network, short positions accounted for 75.5%, with Bitcoin and Ethereum contributing $107 million and $70.15 million in liquidation amounts, respectively, reflecting that the current market is primarily driven by short squeezes. This phenomenon reveals three major market characteristics:

Vulnerability of Leverage Structure: As Bitcoin's price approaches the critical psychological level of $100,000, it triggers concentrated liquidations of high-leverage short positions. The CME Bitcoin futures open interest has reached a historical peak of $12 billion, but the funding rate remains low (0.01%), indicating that market makers are suppressing volatility through delta hedging, and the actual leverage risk in the market is underestimated;

Divergence in Institutional and Retail Behavior: Bitcoin spot ETFs have seen net inflows for eight consecutive days (with a single-day inflow of $142 million), with institutions like BlackRock continuously increasing their holdings, while retail investors participate in short-term speculation through high leverage, exacerbating the differences in risk exposure management strategies and increasing market volatility;

Derivatives Dominating Pricing: The liquidation volume of Ethereum accounts for 23.8%, significantly higher than its market cap share (17.2%), reflecting ETH's characteristic as the highest leveraged asset among mainstream coins, reinforcing the transmission effect of the derivatives market on spot prices.

In the short term, large-scale short liquidations may accelerate the price's breakthrough of key resistance levels. If Bitcoin stabilizes above $100,000, it could trigger a short squeeze of approximately $1.17 billion, creating positive feedback for price increases. However, caution is needed regarding the risk of insufficient market depth—exchange BTC reserves have dropped to their lowest level since 2018, and a 5% price fluctuation in extreme market conditions could lead to $2 billion in cascading liquidations. In the medium to long term, institutional funds' continuous accumulation through ETFs (totaling over $40.7 billion) is reshaping the market's microstructure, and Bitcoin's volatility center may gradually converge from the historical average of 80% to 50%, moving closer to mature assets like gold. Investors should pay close attention to the Fed's policy expectations and the evolution of geopolitical conflicts, as these two variables may become key catalysts for breaking the current long-short balance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。