本周预览(5.5-5.11),美联储利率决议来袭,BTC ETF单周流入量达矿工产量6倍!

目录:

1.本周大额代币解锁数据;

2.加密市场全览,速读一周热门币种涨跌/板块资金流;

3.比特币现货ETF动态;

4.BTC清算地图数据解读;

5.本周重点宏观事件与加密市场重点预告及解读。

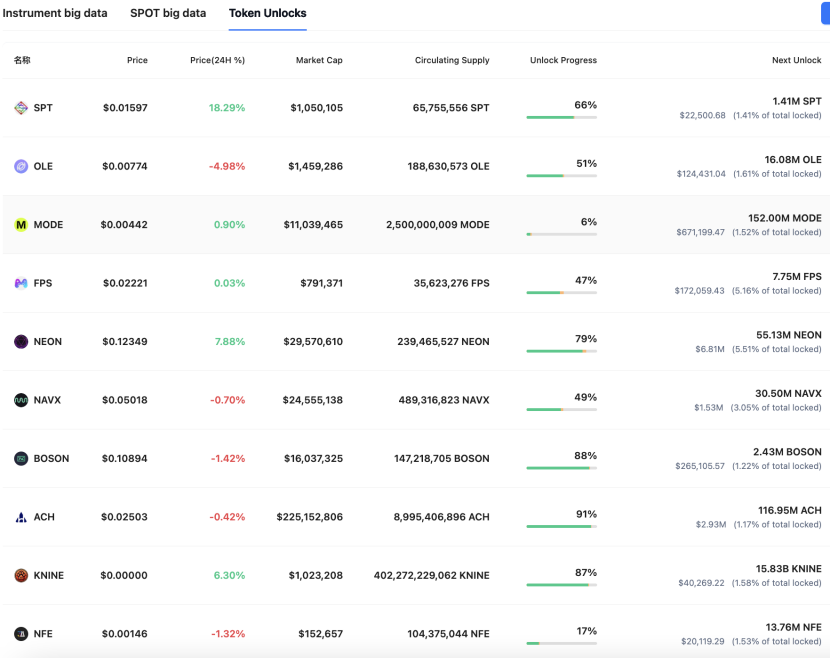

1.本周大额代币解锁数据;

本周多种代币将迎来一次性解锁。按解锁价值排序如下:

Movement(MOVE)将于5月9日20:00解锁5000万枚代币,价值约822万美元,占流通量2%;

Solayer(LAYER)将于5月11日22:00解锁2702万枚代币,价值约7835万美元,占流通量12.87%;

Aptos(APT)将于5月13日2:00解锁1131万枚代币,价值约5587万美元,占流通量1.82%。

这些项目的解锁情况或许会对相关市场产生不同程度的影响。以上为UTC+8时间,图为coinank 数据。

我们认为,本周多个代币的大额解锁事件需结合流通量占比、项目基本面及市场情绪综合评估其潜在影响:

MOVE将于5月9日解锁5000万枚代币(占流通量2%),价值约822万美元。尽管首次解锁可能引发社区对抛压的担忧,但解锁资金明确用于生态发展和社区支持。若项目能通过模块化应用链的扩展性吸引开发者(如连接EVM与Move生态的技术优势),短期抛压或部分被市场对应用落地的预期抵消。然而,当前流通量低且FDV(完全稀释估值)较高的特性,仍需警惕长期解锁对价格的压力。

LAYER在5月11日解锁2702万枚代币,价值7835万美元,占流通量12.87%,为三者中最高比例。如此大规模的集中释放可能显著增加市场供应,若项目缺乏短期利好(如生态进展或合作),代币价格面临较大下行风险。此外,高FDV背景下,投资者需关注解锁代币的接收方(如团队或机构)是否存在抛售动机。

APT将于5月13日解锁1131万枚(占流通量1.82%),价值5587万美元。尽管解锁规模绝对值较高,但其流通量占比相对较低,且Aptos近期链上日交易量突破3亿笔,显示生态活跃度强劲。此次解锁对象包括核心贡献者、社区及投资者,需观察主要持有者的动向。若解锁代币用于质押或生态激励而非抛售,市场影响或有限。但需注意APT历史解锁后价格波动较大,需结合大盘走势判断。

市场启示:流通量管理成关键变量,代币解锁本质是供需关系的再平衡。高流通量项目(如APT)因市场流动性充足,短期波动可控;而低流通量项目(如LAYER)因流动性薄弱,价格更易受冲击。此外,牛市中的解锁可能被市场解读为“利好出尽”,若项目缺乏实际价值支撑,解锁后或面临回调压力。投资者应关注代币经济模型透明度及解锁资金用途,警惕流通量操纵风险。

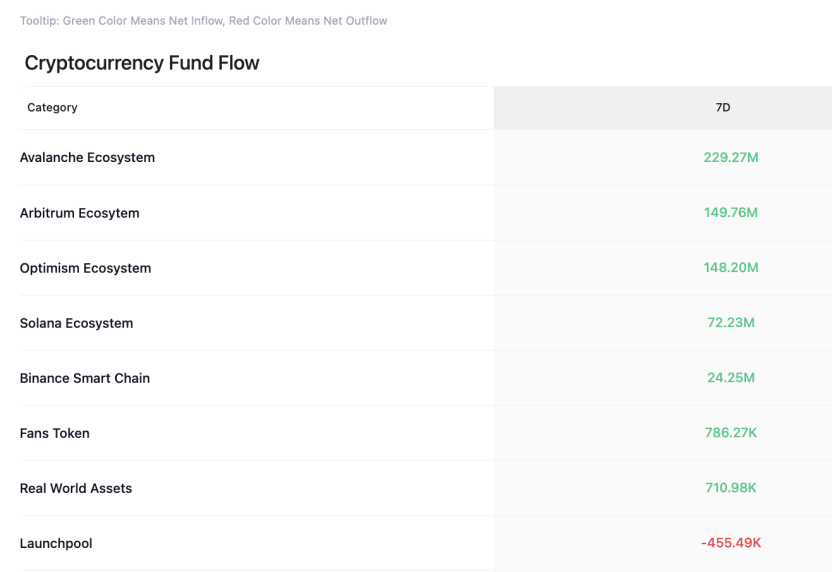

2.加密市场全览,速读一周热门币种涨跌/板块资金流

CoinAnk数据显示,过去一周,加密市场按概念板块划分,雪崩生态、Arbitrum生态、Optimism生态、Solana生态、币安智能合约、粉丝代币和Real World Assets这些板块实现资金净流入。

近7天,币种涨幅榜单如下(选取市值前500),VRA、FX、ABT、KMNO 和FORM等代币涨幅相对靠前,本周可继续优先关注强势币种交易机会。

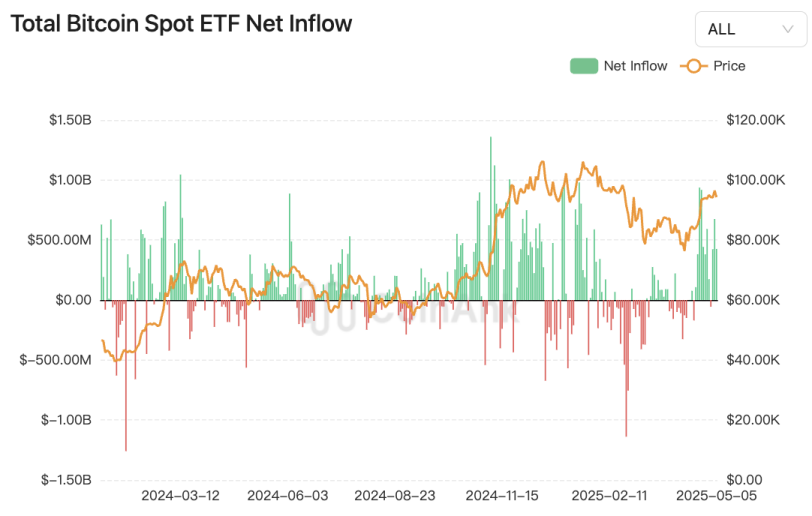

3.比特币现货ETF资金动态。

CoinAnk数据显示,上周美国比特币现货ETF累计净流入18.051亿美元,其中4个交易日为资金净流入状态。在过去一周内,美国上市的现货比特币ETF总计购买了约18644枚比特币。而同期,考虑到比特币减半后的挖矿效率(约每日450枚),全球矿工总共仅产出了约3150枚比特币。这意味着,ETF的购买量几乎达到了矿工同期产量的6倍。比特币ETF的总净流入再次突破400亿美元,达402.07亿美元。比特币ETF总净流入最高点出现在2月7日,达407.8亿美元。

我们认为,近期美国比特币现货ETF的资金流入数据揭示了市场供需结构的显著失衡及机构投资者的主导作用。数据显示,上周ETF累计净流入换算购买量是矿工产量的近6倍。这一差距凸显了市场需求远超新增供应,可能加剧比特币的稀缺性预期,从而对价格形成支撑。

从资金规模看,比特币ETF总净流入已突破402亿美元,接近历史峰值(2025年2月7日的407.8亿美元)。贝莱德旗下的IBIT基金持续领跑,反映出机构投资者通过合规渠道配置比特币的倾向增强。值得注意的是,ETF的持续净流入与矿工产量间的剪刀差可能引发市场对中长期流动性的担忧。若需求端维持高位,而供应受限于减半后的低效挖矿(日产量约450枚),供需矛盾或进一步激化。

然而,ETF对价格的实际影响存在局限性。尽管ETF持有比特币总量已占流通量的5%以上,但历史数据显示,资金流入并不必然推动价格突破前高。例如,2024年6月ETF连续18天净流入时,比特币价格仍受制于宏观政策及地缘风险。此外,部分资金可能源于套利策略(如现货做多与期货溢价交易),而非纯粹看涨预期。因此,ETF的资金动态需结合宏观经济周期(如美联储利率政策)及市场结构(如长期持有者抛售压力)综合评估。

比特币ETF的活跃度印证了其作为主流资产类别的认可度提升,但市场需警惕短期资金驱动的波动风险及供需失衡下的流动性挑战。未来,若ETF资金流入持续超越矿工产出,叠加降息周期开启,或为比特币价格突破提供更坚实支撑。

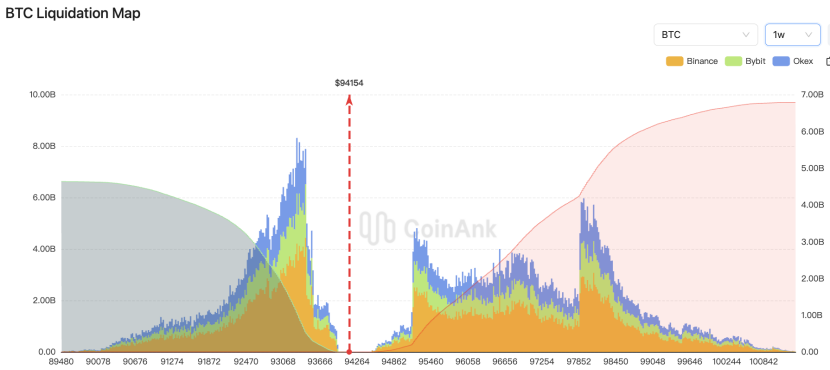

4. BTC清算地图数据。

CoinAnk 清算地图数据显示,如果BTC突破97900美元,主流CEX累计空单清算强度将达43.89亿美元。 反之,如果比特币跌破89480美元,主流CEX累计多单清算强度将达46.36亿美元。

我们认为,根据市场数据及清算机制,比特币当前面临的关键价格区间存在显著的流动性风险。若BTC突破97900美元,可能导致主流交易所累计空单清算强度达到43.89亿美元,这反映了空头在该价格上方存在密集的杠杆头寸,一旦突破或引发空头集中平仓,推动价格进一步上行。相反,若价格跌破89480美元,多单清算强度将达46.36亿美元,表明多头在此支撑位下方积累了高风险仓位,跌破后可能触发连锁平仓并加剧下跌趋势。

从机制上看,清算强度并非绝对值,而是反映特定价格区间的市场脆弱性。高清算强度意味着该点位附近的流动性分布更集中,价格突破后易引发“踩踏效应”。例如,空头在高位被强平时需买入回补,可能形成正反馈循环;而多头的强制卖出则可能放大下行波动。当前数据也显示,随着比特币逼近历史高位,多空双方的杠杆博弈进入白热化阶段,关键点位的攻守将直接影响短期市场方向。值得注意的是,不同时期数据差异(如与问题中阈值悬殊)表明,市场风险结构会随价格波动动态调整,需结合实时仓位分布分析。

5.本周重点宏观事件与加密市场重点预告及解读。

周一:美国 4 月 ISM 非制造业 PMI;

周二:欧洲央行举行中央银行论坛,至 5 月 7 日;

周四:美联储 FOMC 将于 2:00 公布利率决议;美联储主席鲍威尔将于 2:30 召开货币政策新闻发布会(UTC+8);

周五:FOMC 永久票委、纽约联储主席威廉姆斯在 2025 年雷克雅未克经济会议上发表主旨讲话;美联储理事库格勒发表讲话;2025 年 FOMC 票委、1 芝加哥联储主席古尔斯比美联储一个活动上致欢迎词和开幕词;美联储理事巴尔发表讲话。

我们认为,本周宏观事件的核心在于美联储政策信号与经济数据间的博弈,或加剧加密市场波动。首先,美国4月ISM非制造业PMI升至51.6,创两年新高,显示服务业扩张超预期,物价指数跳涨至65.1,暗示通胀压力升温。这一数据可能强化美联储维持鹰派立场的必要性,抑制市场对降息的押注,从而对加密资产形成短期压制。

周四的FOMC利率决议与鲍威尔发布会尤为关键。历史经验表明,鲍威尔言论的鸽鹰倾向直接影响市场情绪,例如2024年其释放降息信号后加密资产单日大涨,但鹰派表态则引发抛售。若本次会议释放对通胀粘性的担忧或推迟降息信号,可能引发加密市场回调。反之,若提及经济放缓风险,或缓解流动性收紧预期,成为短期利多因素。

此外,周五多位联储官员密集讲话可能传递分歧信号。威廉姆斯等“永久票委”的表态若偏向紧缩,或抵消鲍威尔可能的温和措辞,导致市场预期混乱。当前加密市场与美股联动性较强,流动性预期变化或放大波动。

综合来看,强劲的PMI数据已为美联储“更高更久”的利率政策提供支撑,加密市场短期或面临回调压力,但若鲍威尔意外释放鸽派信号,可能触发空头回补。建议关注政策措辞细微变化及市场情绪指标的实时转向。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。