CoinW Research Institute

Key Points

The total market capitalization of global cryptocurrencies is $3.07 trillion, up from $3.02 trillion last week, representing a 1.65% increase this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $40.24 billion, with a net inflow of $1.81 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.51 billion, with a net outflow of $20.1 million this week.

The total market capitalization of stablecoins is $217.7 billion, with USDT having a market cap of $149.3 billion, accounting for 68.58% of the total stablecoin market cap; followed by USDC with a market cap of $61.5 billion, accounting for 28.25%; and DAI with a market cap of $5.37 billion, accounting for 2.47%.

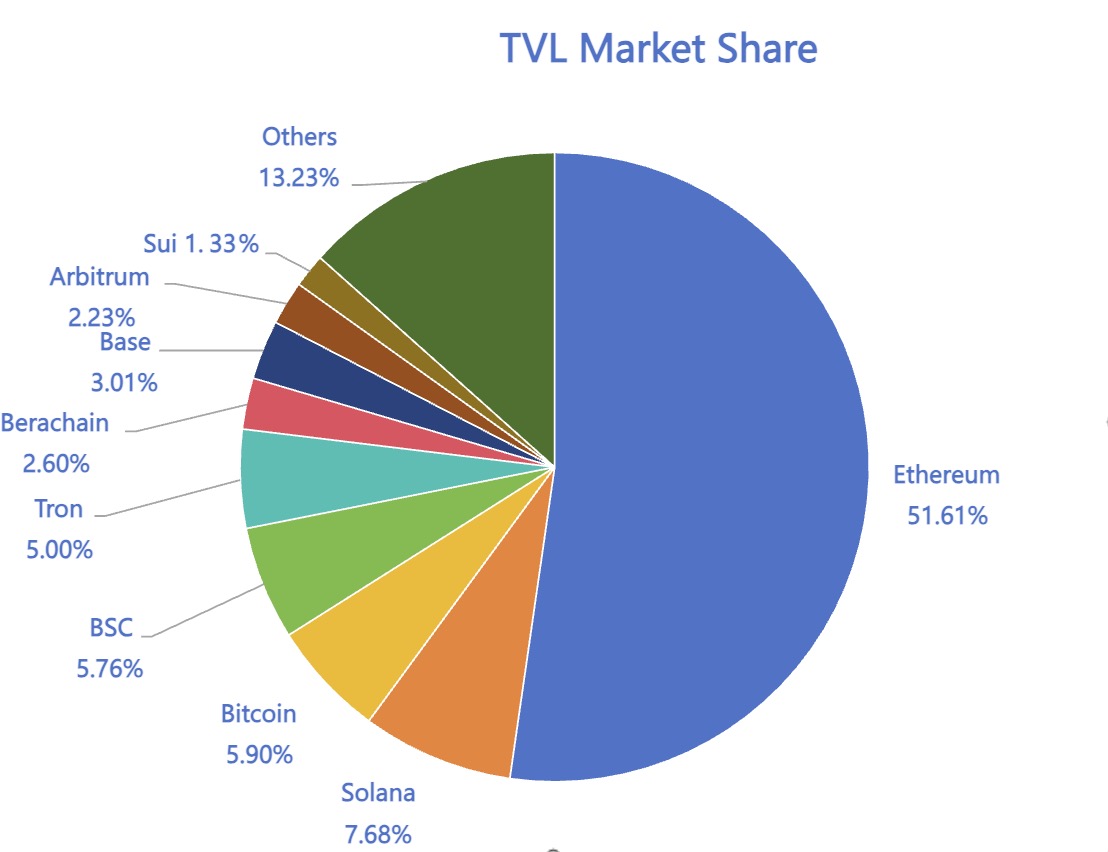

According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $101.55 billion, an increase of approximately 0.94% from last week ($100.6 billion). By public chain, the top three chains by TVL are Ethereum, accounting for 51.61%; Solana, accounting for 7.68%; and Bitcoin, accounting for 5.9%.

On-chain data shows that the daily transaction volume on the TON chain plummeted by 56.76% this week, with transaction fees dropping by 86%, the most significant decline; daily transaction volumes on Aptos and BNB Chain also fell by over 20%, with ETH down 24.29%. The transaction volume and daily active users on the Solana chain were relatively less affected, but transaction fees dropped sharply by 80%. In terms of daily active addresses, only BNB Chain saw an increase of about 20%, while the others declined, with SUI experiencing a drop of 90.5%. In terms of TVL, ETH and Aptos saw slight increases (3.5% and 4.48%), while other public chains saw slight declines.

New projects of interest: ROVR Network is a decentralized ultra-high-precision multi-dimensional digital twin platform aimed at supporting next-generation transportation systems and 3D AI engines. ZAR (https://www.zarpay.app/) is a digital dollar wallet that allows users to find nearby merchants, conveniently and securely convert cash into digital currency, and use the ZAR debit card for purchases at Visa-supported merchants worldwide. Boop (https://boop.fun/) is a Solana-based MemeCoin launch platform initiated by NFT whale dingaling, designed to provide users with a simple and fun experience for issuing Meme tokens.

Table of Contents

1. Total Market Capitalization of Cryptocurrencies/Bitcoin Market Cap Proportion

3. ETF Inflow and Outflow Data

4. ETH/BTC and ETH/USD Exchange Rates

5. Decentralized Finance (DeFi)

7. Stablecoin Market Cap and Issuance Status

II. This Week's Hot Money Trends

1. Top Five VC Coins and Meme Coins by Growth This Week

1. Major Industry Events This Week

2. Major Events Happening Next Week

3. Important Financing and Investment from Last Week

I. Market Overview

- Total Market Capitalization of Cryptocurrencies/Bitcoin Market Cap Proportion

The total market capitalization of global cryptocurrencies is $3.07 trillion, up from $3.02 trillion last week, representing a 1.65% increase this week.

Data Source: cryptorank

Data as of May 4, 2025

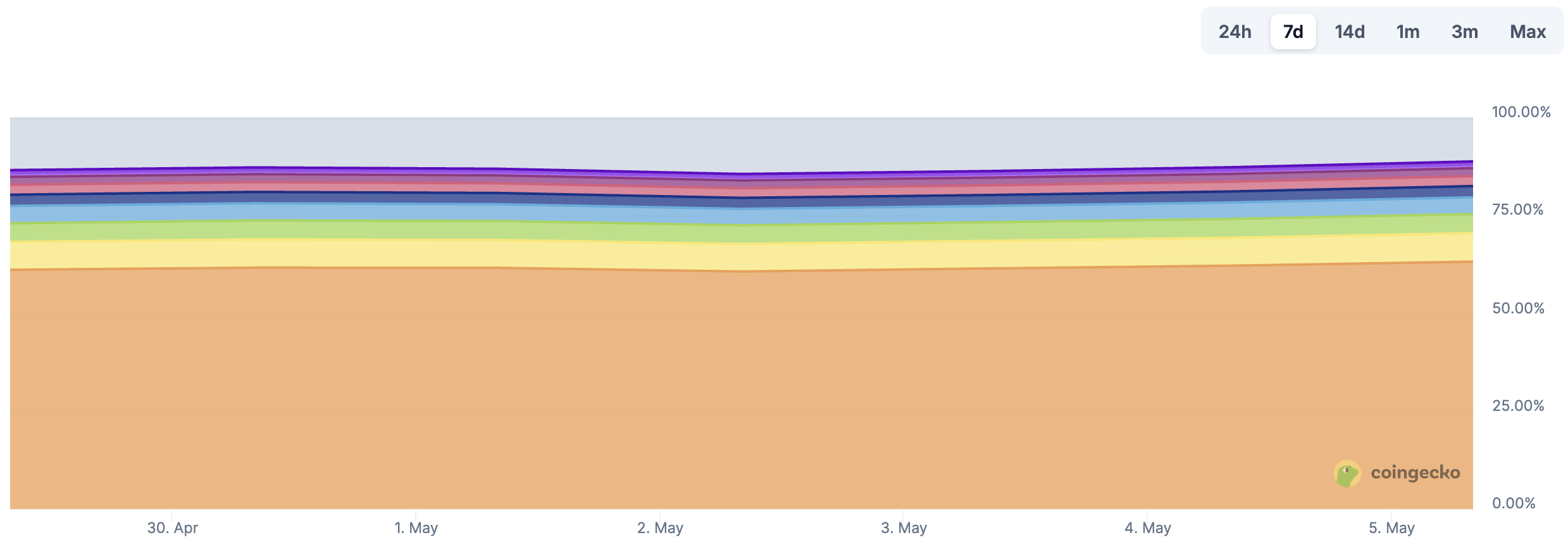

As of the time of writing, Bitcoin's market cap is $1.88 trillion, accounting for 61.2% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $217.7 billion, accounting for 7.09% of the total cryptocurrency market cap.

Data Source: coingeck

Data as of May 4, 2025

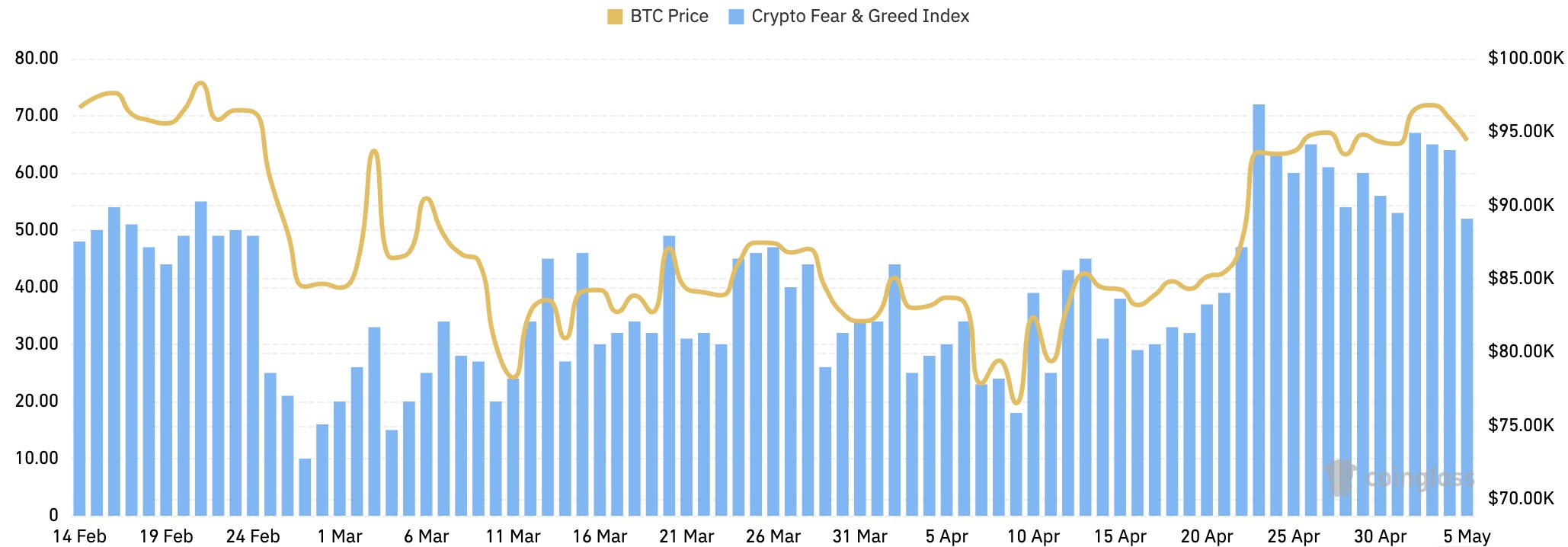

- Fear Index

The cryptocurrency fear index is 52, indicating a neutral sentiment.

Data Source: coinglass

Data as of May 4, 2025

- ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $40.24 billion, with a net inflow of $1.81 billion this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $2.51 billion, with a net outflow of $20.1 million this week.

Data Source: sosovalue

Data as of May 4, 2025

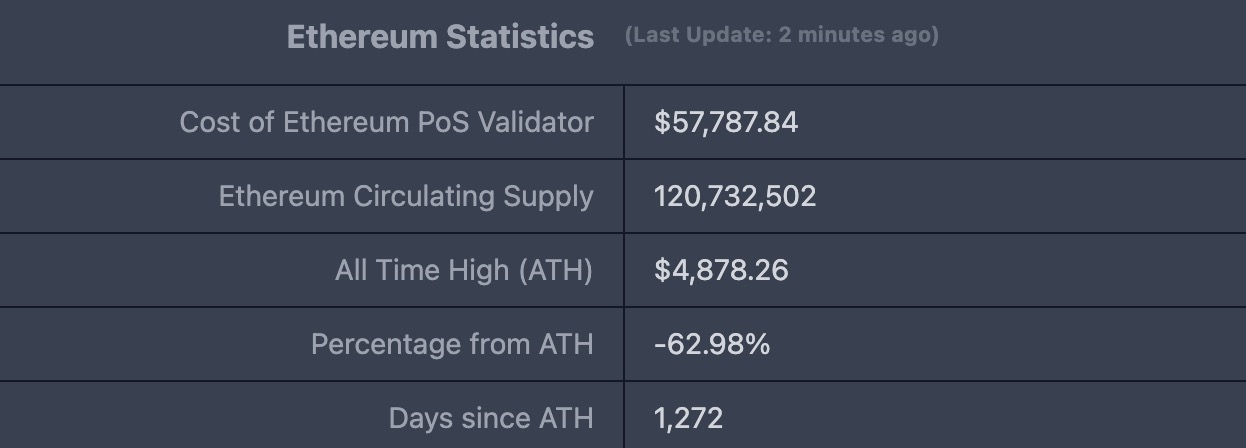

- ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $1,805.33, all-time high $4,878, down approximately 62.98% from the highest price.

ETHBTC: Currently at 0.019105, all-time high 0.1238.

Data Source: ratiogang

Data as of May 4, 2025

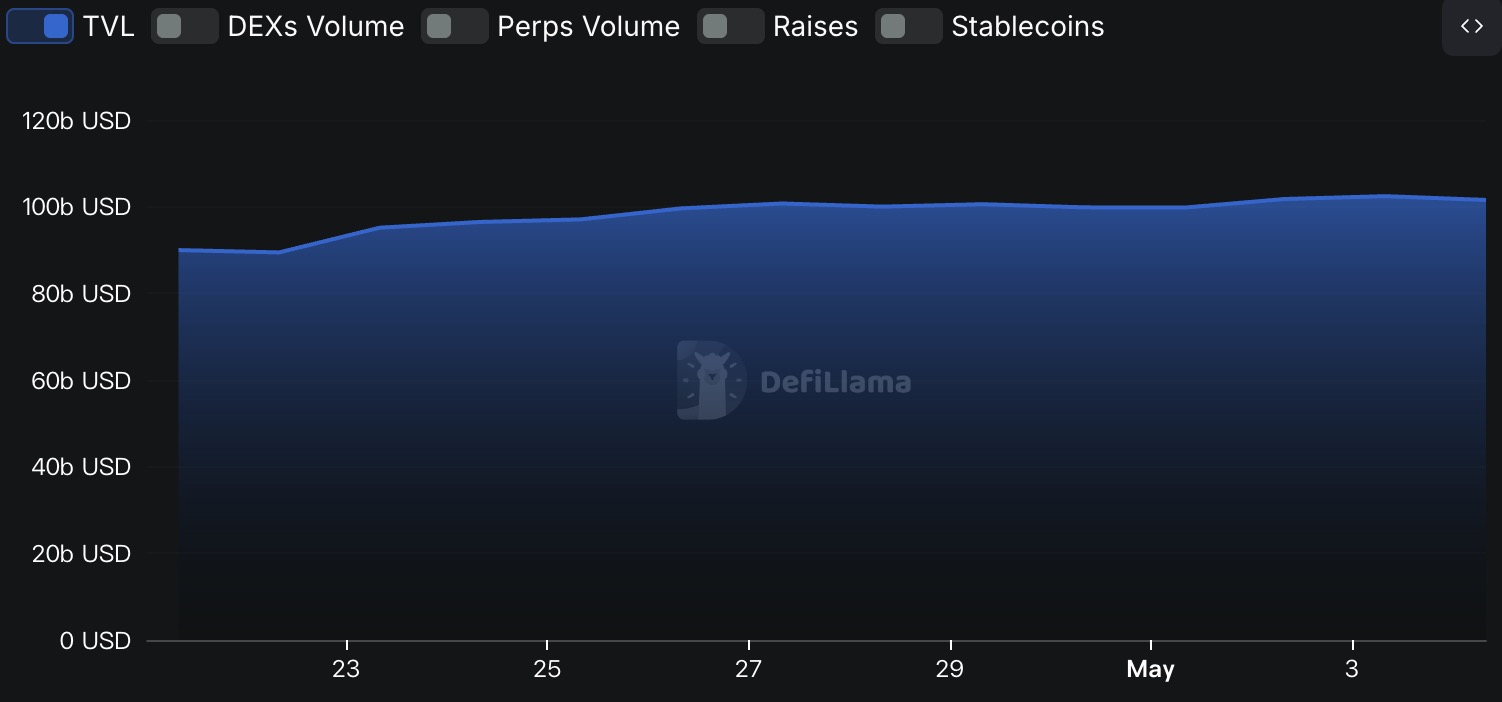

- Decentralized Finance (DeFi)

According to DeFiLlama, the total TVL (Total Value Locked) in DeFi this week is $101.55 billion, an increase of approximately 0.94% from last week ($100.6 billion).

Data Source: defillama

Data as of May 4, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 51.61%; Solana, accounting for 7.68%; and Bitcoin, accounting for 5.9%.

Data Source: CoinW Research Institute, defillama

Data as of May 4, 2025

- On-Chain Data

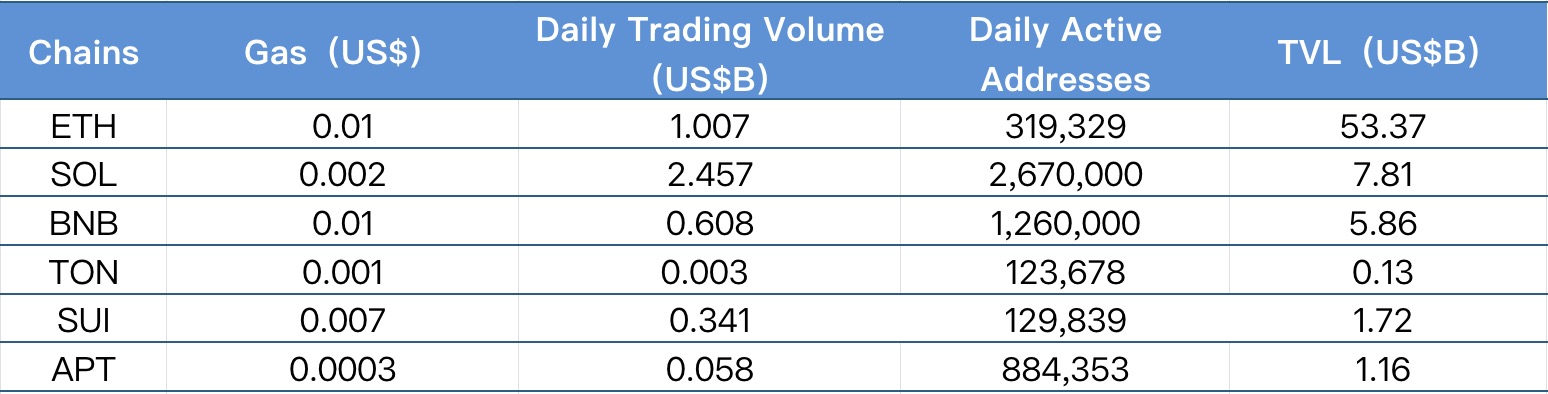

Layer 1 Related Data

Mainly analyzing the current Layer 1 data including ETH, SOL, BNB, TON, SUI, and APT based on daily transaction volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, defillama, Nansen

Data as of May 4, 2025

Daily Transaction Volume and Transaction Fees: Daily transaction volume and transaction fees are core indicators of public chain activity and user experience. This week, daily transaction volumes have decreased to varying degrees, with TON dropping 56.76%, the most significant decline; followed by Aptos down 22.41%, SUI down 20.69%, BNB Chain down 24%, ETH down 24.29%, and Solana chain showing a less noticeable decline. In terms of transaction fees, this week Solana chain decreased by 80%, TON chain decreased by 86%, Aptos increased by approximately 45 times, while other chains showed little change.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of the public chain, while TVL reflects the level of user trust in the platform. In terms of daily active addresses, only BNB Chain saw a significant increase of about 20%. The other chains experienced declines, with SUI chain down 90.5%, TON down 23.35%, Aptos down 7.8%, and ETH and SOL showing slight declines. In terms of TVL, this week ETH and Aptos chains increased by 3.5% and 4.48%, while the other chains experienced slight declines, which were not significant.

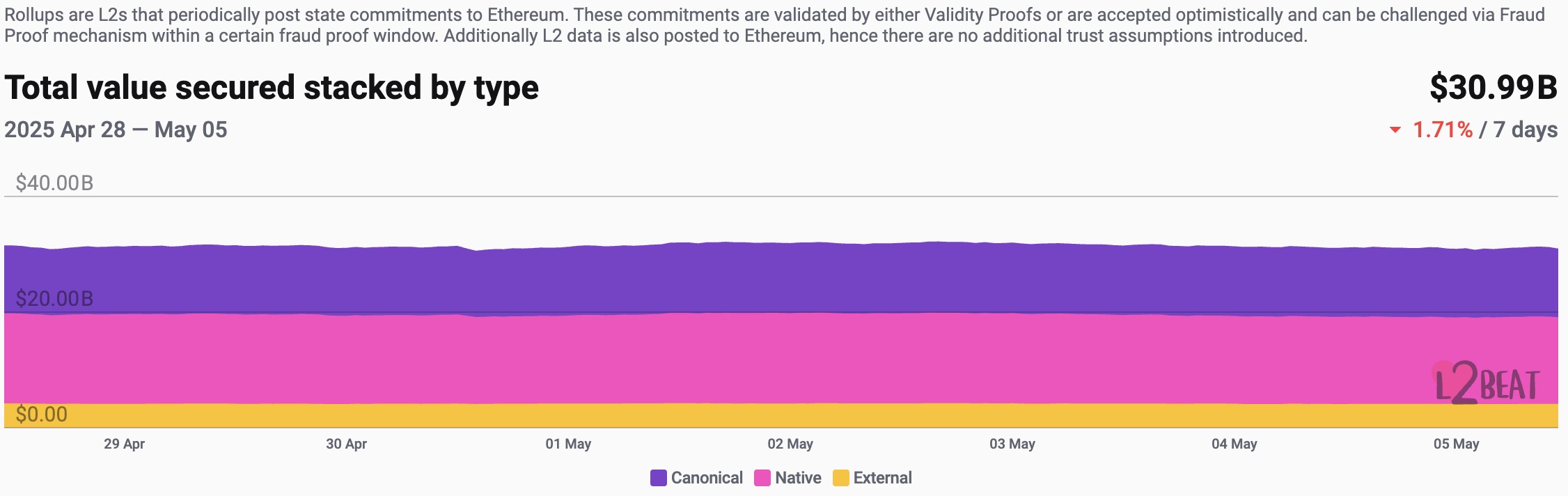

Layer 2 Related Data

According to L2Beat, the total TVL of Ethereum Layer 2 is $30.94 billion, an overall increase of 1.05% from last week ($30.62 billion).

Data Source: L2Beat

Data as of May 4, 2025

Arbitrum and Base occupy the top positions with market shares of 36.62% and 33.24%, respectively, but overall proportions have increased.

Data Source: footprint

Data as of May 4, 2025

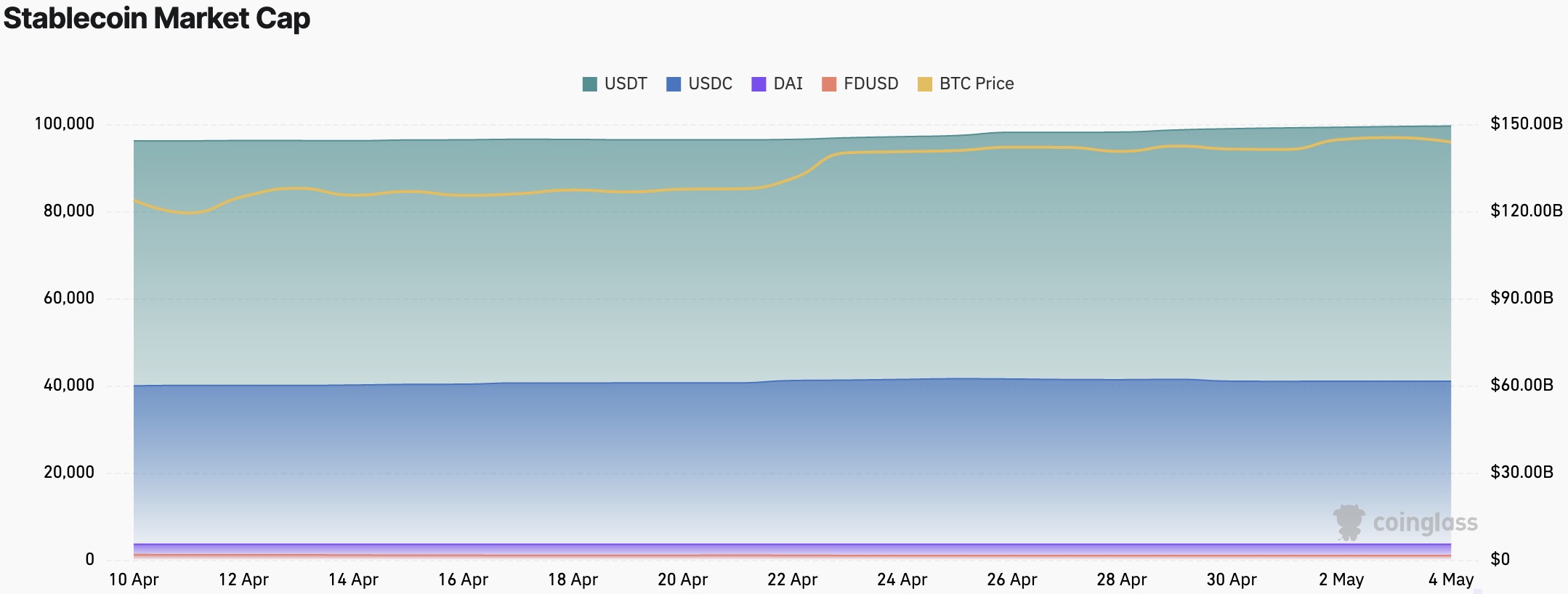

- Stablecoin Market Cap and Issuance Status

According to Coinglass, the total market capitalization of stablecoins is $217.7 billion, with USDT having a market cap of $149.3 billion, accounting for 68.58% of the total stablecoin market cap; followed by USDC with a market cap of $61.5 billion, accounting for 28.25%; and DAI with a market cap of $5.37 billion, accounting for 2.47%.

Data Source: CoinW Research Institute, Coinglass

Data as of May 4, 2025

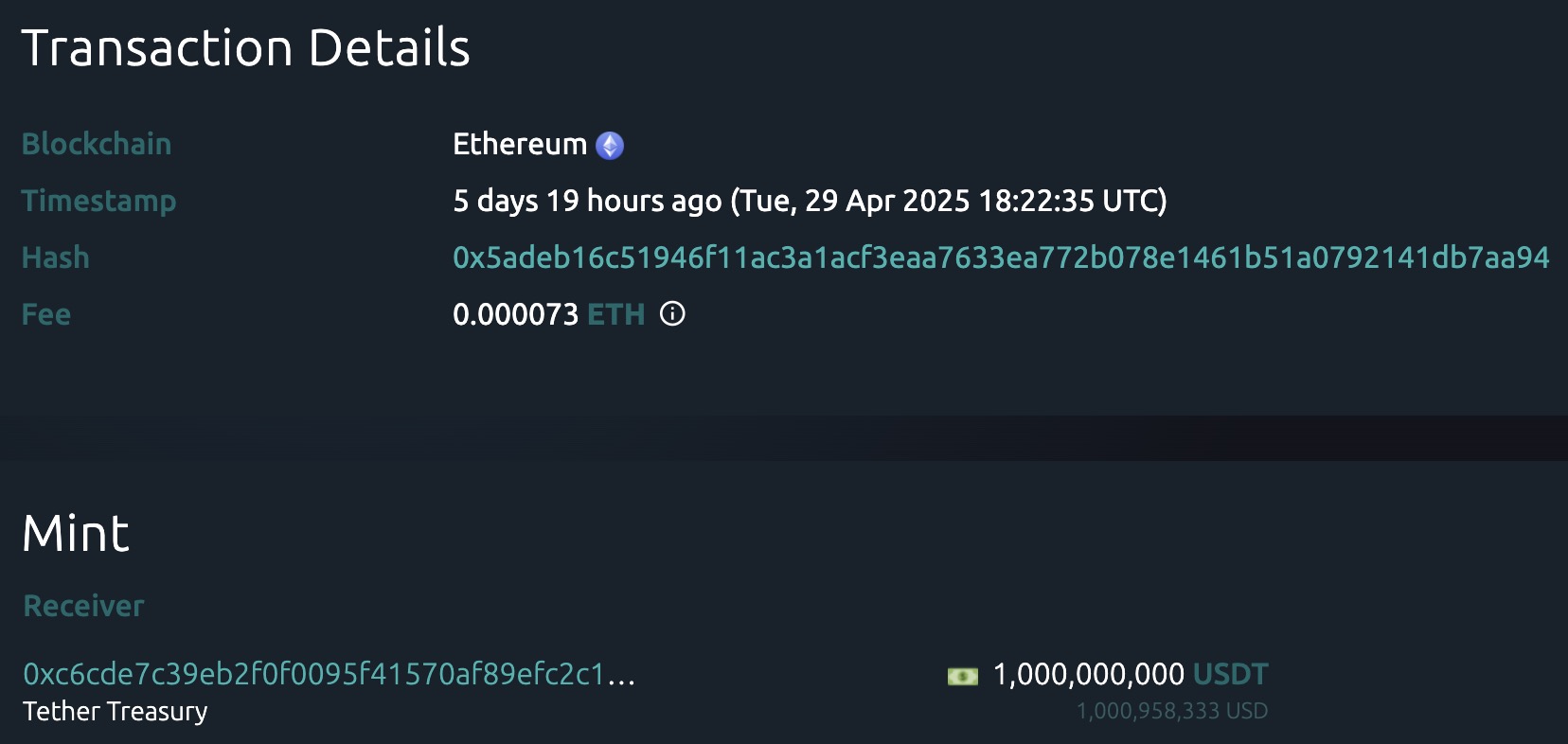

According to Whale Alert, this week USDC Treasury issued a total of 322 million USDC, and Tether Treasury issued a total of 3 billion USDT this week. The total issuance of stablecoins this week was 3.322 billion, an increase of approximately 16.92% compared to last week's total issuance of stablecoins (2.76 billion).

Data Source: Whale Alert

Data as of May 4, 2025

II. This Week's Hot Money Trends

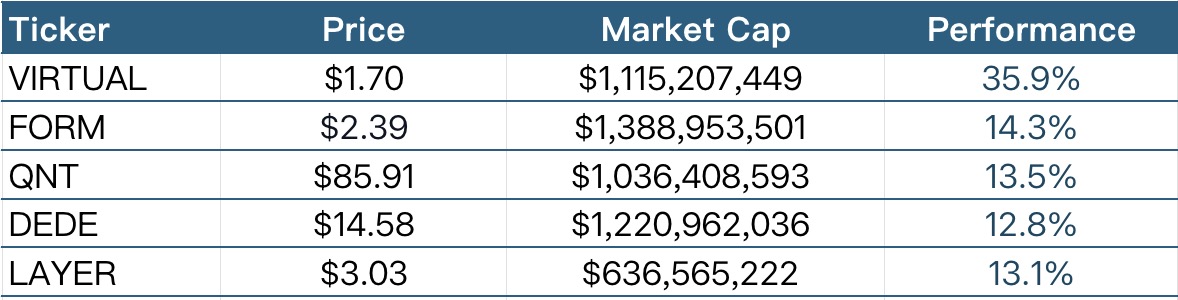

- Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of May 4, 2025

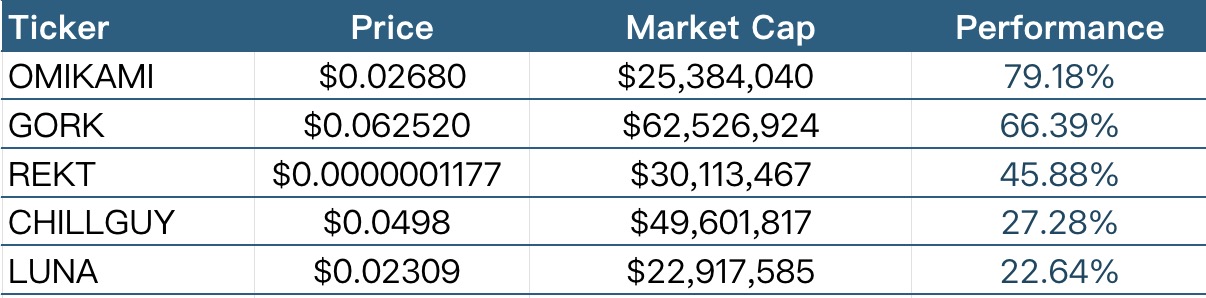

The top five Meme coins by growth in the past week

Data Source: CoinW Research Institute, coinmarketcap

Data as of May 4, 2025

- New Project Insights

ROVR Network (https://rovr.network/) is a decentralized, ultra-high-precision multi-dimensional digital twin platform designed to support next-generation transportation systems and 3D AI engines. The platform lays a solid foundation for training 3D AI models by generating a large amount of ultra-high-definition geospatial data. ROVR's digital twin technology can be widely applied in fields such as autonomous driving, augmented reality, and smart cities, promoting the integrated development of Web2 and Web3.

ZAR (https://www.zarpay.app/) is a digital dollar wallet that allows users to find nearby merchants on its platform, conveniently and securely exchange cash for digital currency, and use the ZAR debit card for purchases at Visa-supported merchants worldwide. ZAR recently completed a $7 million financing round, with investors including Dragonfly Capital, a16z, and VanEck Ventures.

Boop (https://boop.fun/) is a Solana-based MemeCoin launch platform initiated by NFT whale dingaling, aimed at providing users with a simple and fun experience for issuing Meme tokens. Users can create and explore Meme projects through boop.fun without complex processes, emphasizing fun and community participation.

III. Industry News

- Major Industry Events This Week

Ethena Labs officially launched the third season ENA airdrop on May 1, distributing 3.5% of the total supply with no qualification check period, and rewards were instantly distributed at 16:00 (UTC) on the same day. This round of rewards eliminated the token lock-up requirement, with only one-third of the sENA rewards for the first 2000 wallet addresses being locked, reduced from one-half in the previous season. The remaining addresses will have all rewards released immediately. Based on the current ENA price, the total value of the third season airdrop is approximately $178.5 million, similar to the second season's $202.5 million.

The Sui ecosystem liquidity staking protocol Haedal officially opened airdrop claims at 20:00 Beijing time on April 29, with this airdrop distributing 5% of the total supply of HAEDAL. Haedal aims to provide efficient liquidity staking infrastructure for Sui users, supporting users to stake SUI to validators for consensus rewards while unlocking the potential of liquidity staking tokens (LST) for participation in the DeFi ecosystem.

MilkyWay (MILK) held its TGE on April 29 at Binance Wallet and PancakeSwap, requiring users to have an Alpha score of 75 to participate. The event will also be used for subsequent airdrops and marketing, releasing a total of 20 million MILK tokens.

B² Network's TGE event was held on April 30 from 8:00 to 10:00 UTC via PancakeSwap, with users needing to meet specified Alpha Points thresholds. In terms of airdrops, users who registered before the TGE will receive B² airdrops at 20:00 (UTC+8) on April 30, while users who registered after the TGE will receive airdrop rewards within 24 hours. An additional 8.4 million B² tokens will be used for subsequent market activities.

- Major Events Happening Next Week

The decentralized validation coordination infrastructure project Obol Network will launch the OBOL token incentive event on May 7, allowing users to participate by locking BGB or OBOL to share a total of 1.782 million OBOL rewards. Additionally, a recharge event will be launched simultaneously, distributing an extra 120,000 OBOL. The event will last until mid-May, aiming to promote community participation and token circulation.

The Bitcoin Pizza Day celebrates its 15th anniversary, and BTSE will airdrop thousands of "retro film cameras" to Bitcoin supporters before May 10, along with a limited pizza gift giveaway through the #BTSEPizzaDay hashtag. Additionally, BTSE is hosting a month-long Bitcoin-themed trading festival from April 26 to May 26, with a prize pool of up to 5.22 million USDT, allowing users to participate in prize distribution through trading and financial management.

The DeFi lending protocol Soul announced that it will launch a public offering of the SO token on May 16, distributing 25% of the total token supply, with all tokens fully unlocked at the token generation event (TGE). The SO token is used for protocol governance, yield enhancement, and value sharing, allowing holders to earn additional income through staking and participate in yield distribution and buyback mechanisms. Currently, the Soul testnet is live.

NFT community leader dingaling announced the upcoming launch of the Solana-based token issuance platform boop, which will conduct an airdrop at launch to reward trading users. The airdrop will be directly aimed at trading users and will not involve a points system; specific activity times and participation details will be announced later.

- Important Financing and Investment from Last Week

Unto Labs completed a $14.4 million financing round, with notable institutions such as Framework Ventures and Electric Capital investing, which will be used to promote the technical development and ecosystem construction of its next-generation Layer 1 blockchain project Thru ([https://www.thru.xyz/]). Thru is a next-generation Layer 1 blockchain focused on performance and developer experience, utilizing a self-developed smart contract runtime, ThruVM, based on an open RISC-V instruction set architecture. ThruVM natively supports languages such as Rust, C, and C++, compatible with all programming languages adapted to RISC-V, significantly enhancing development flexibility and execution efficiency. (April 29, 2025)

Camp Network ([https://www.campnetwork.xyz/]) completed a $25 million Series A financing round, led by 1kx and Blockchain Capital, with participation from OKX, Lattice, Paper Ventures, and others, reaching a valuation of up to $400 million. Camp Network is a modular Layer 2 network that utilizes off-chain data from Web2 social platforms to achieve value transformation on-chain, serving users and creators in social media, music, and entertainment fields. (April 29, 2025)

Polygon Miden ([https://miden.xyz/]) announced the completion of a $25 million seed round financing, led by a16z crypto, Hack VC, and 1kx, with participation from Finality Capital Partners, Symbolic Capital, and several crypto angel investors. Miden is a privacy blockchain project co-founded by former Meta engineers and is Polygon's zk-STARK-based Ethereum Layer 2 scaling solution, aiming to enhance blockchain performance and decentralization while achieving transaction privacy through zero-knowledge proofs. Although Polygon Labs did not directly invest, an agreement has been reached to allocate approximately 10% of Miden's future tokens to Polygon token holders. (April 29, 2025)

Dinari (https://www.dinari.com/) announced the completion of a $12.7 million Series A financing round, led by Hack VC and Blockchange Ventures, with participation from VanEck Ventures, F-Prime, and Avalanche Fund, bringing the total financing amount to $22.65 million. Dinari is a Web3 stock trading platform focused on the tokenization of real-world assets, providing non-U.S. investors with access to purchase stocks of U.S. companies through its dShare platform, with all tokens backed 1:1 by real securities and publicly trading asset vault data to enhance transparency. (May 1, 2025)

IV. Reference Links

ROVR Network: https://rovr.network/

Boop: https://boop.fun/

Thru: https://www.thru.xyz/

Camp Network: https://www.campnetwork.xyz/

Polygon Miden: https://miden.xyz/

Dinari: https://www.dinari.com/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。