The essence of investing is the art of storytelling.

Author: Byron Gilliam

Translation: Shen Chao TechFlow

"The social goal of skilled investing should be to overcome the dark forces of time and ignorance that loom over our future."

— John Maynard Keynes, renowned economist

Story Time for Crypto Investors

Although investing involves a lot of numbers, it is generally believed that investing is more of an art than a science.

"The selection of common stocks is a difficult art," Benjamin Graham once warned.

Warren Buffett, Graham's lifelong student, further clarified, "Investing is an art… putting cash to work now with the expectation of more cash in the future."

Almost all investments boil down to predicting future cash flows.

However, Peter Lynch cautioned that those "investors trained to rigidly quantify everything are at a significant disadvantage."

Yet, this does not mean, as some financial nihilists claim, that "valuation is just a meme."

On the contrary, it means that applying and interpreting quantifiable valuation metrics is itself a creative activity.

Choosing which valuation metric applies to which investment is a subjective decision—and knowing how to interpret those results is even more so.

For example, a low valuation does not necessarily mean a stock is cheap, and a high valuation does not necessarily mean a stock is expensive (the opposite is often true).

A stock may appear very cheap on some metrics but extremely expensive on others.

And there is no obvious correlation between these valuations and actual returns.

This often leads to frustration—if cheap stocks don’t go up and expensive stocks don’t go down, why bother figuring it all out?

I believe it is worth studying because this is what makes investing interesting and appealing—if that’s the case, the fun of crypto investing is just beginning.

Until recently, crypto investors had very limited choices in terms of data, with almost no available data beyond token prices and market caps.

This turned everything in the crypto space into a "story"—but that’s okay!

Investing is essentially the art of storytelling.

However, the best investment stories are often told with numbers, and the crypto space is gradually acquiring such conditions as more protocols begin to generate revenue, with a larger portion of that revenue being allocated to token holders.

Moreover, thanks to the efforts of institutions like Blockworks Research, these numbers have become more accessible. Their analysts package this data into easy-to-understand charts and reports for our reference.

This helps the crypto space move towards a higher narrative stage: telling stories with numbers.

Let’s take a look at some current numbers.

Ethereum vs. Solana

From crypto Twitter and podcasts, it seems that market sentiment around Ethereum has hit a new low, especially compared to Solana.

But if a newcomer from a traditional finance (TradFi) background looks directly at the data, they might draw a completely different conclusion.

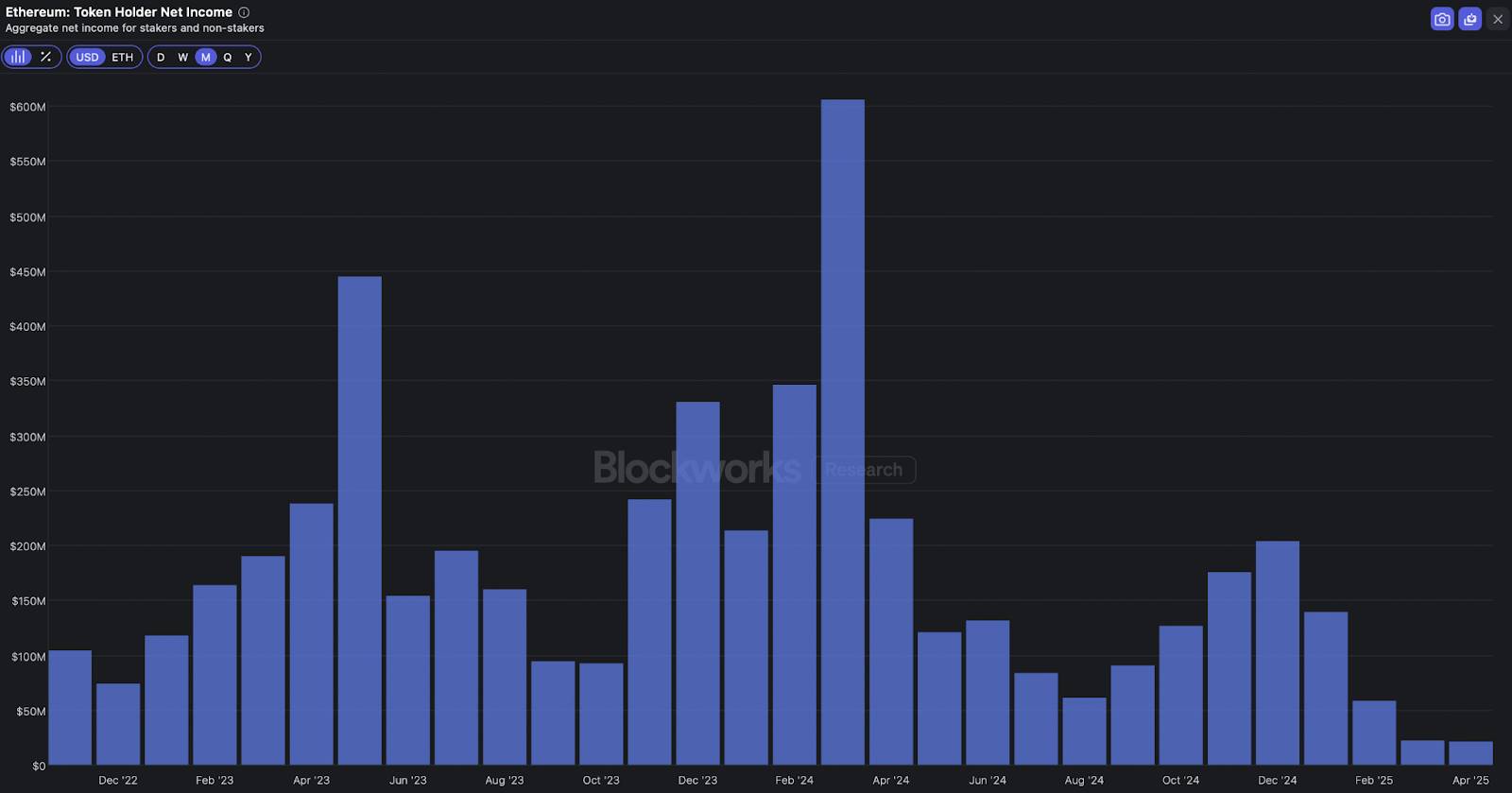

According to Blockworks Research, Solana recorded $36 million in "net income for token holders" in April, giving the SOL token an annualized earnings multiple of 178x—this multiple, while high, may be reasonable if one considers the current activity level to be low.

In contrast, Ethereum's net income for token holders in April was $21 million, resulting in an earnings multiple for the ETH token of up to 841x.

A traditional finance investor seeing that ETH's valuation multiple is 5 times that of SOL would not immediately think, "Wow, why is everyone so pessimistic about Ethereum?"

But they also wouldn’t immediately assume that the market views Solana as 5 times more positive than Ethereum.

Instead, they might conclude that Solana's income valuation is low, possibly because it mainly comes from "low-quality" memecoin trading activity; while Ethereum's income valuation is high, at least partly because it includes higher quality activities, such as income related to real-world assets (RWAs).

Now, we have some angles to analyze: if you believe that memecoin trading activity is not that low quality, then SOL may be undervalued; whereas if you believe that real-world assets are the trend of the future, then ETH may not be overvalued.

Of course, you can dig deeper for more information.

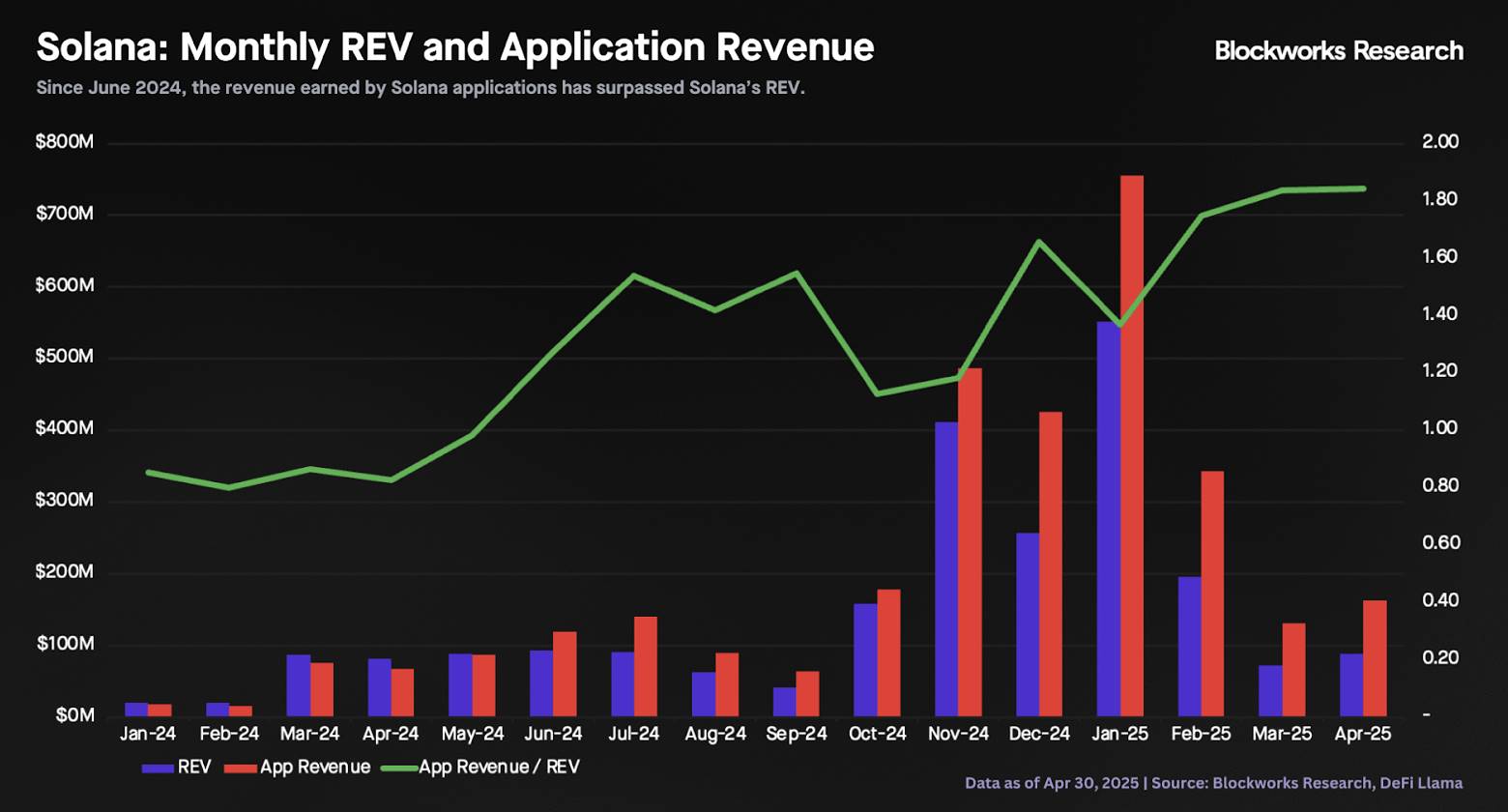

According to Blockworks Research, the total income of all Solana applications is only about 1.8 times Solana's own income.

For a platform business, this is a very high take rate—far exceeding Apple's 30% cap, which the U.S. government even considers to have monopolistic characteristics.

This could mean that Solana's income is too high, and therefore its token valuation multiple should be lower; or it could indicate that Solana has a business moat, and thus its token valuation multiple should be higher.

In either case, this is a story worth paying attention to.

Hyperliquid

Hyperliquid is a semi-decentralized crypto exchange with a somewhat unique story: this protocol generated up to $43 million in revenue in April and distributed almost all of that revenue to token holders.

Not surprisingly, this model has helped its token perform well recently. As Blockworks Research's Boccaccio pointed out in a recent report, "The aid fund uses trading fees for token buybacks every 10 minutes, creating sustained buying pressure."

Every 10 minutes!

It’s hard to make a clear judgment on this because, in traditional finance, no company would return 100% of its income to shareholders—let alone do so every 10 minutes.

From its valuation perspective, the crypto market also seems somewhat hesitant about this.

The trading valuation of the HYPE token is about 17 times its annualized income (based on market cap), which would typically be considered expensive.

But in this case, income and profit seem to be the same thing, so if you believe HYPE can continue to win business from centralized exchanges, such a valuation still looks quite reasonable.

Boccaccio reminds us that HYPE's trading valuation multiple is significantly higher than its decentralized peers, but those peers may not be appropriate comparables.

"Hyperliquid's L1 only needs to capture a small portion of Binance's daily trading volume to significantly boost its trading volume… capturing just 10-15% of the trading volume from Binance's BTC/USDT trading pair could increase HyperCore's trading volume by 50%."

"Therefore, the growth multiple is reasonable," Boccaccio concluded.

Of course, the size of this multiple depends on your level of trust in this story.

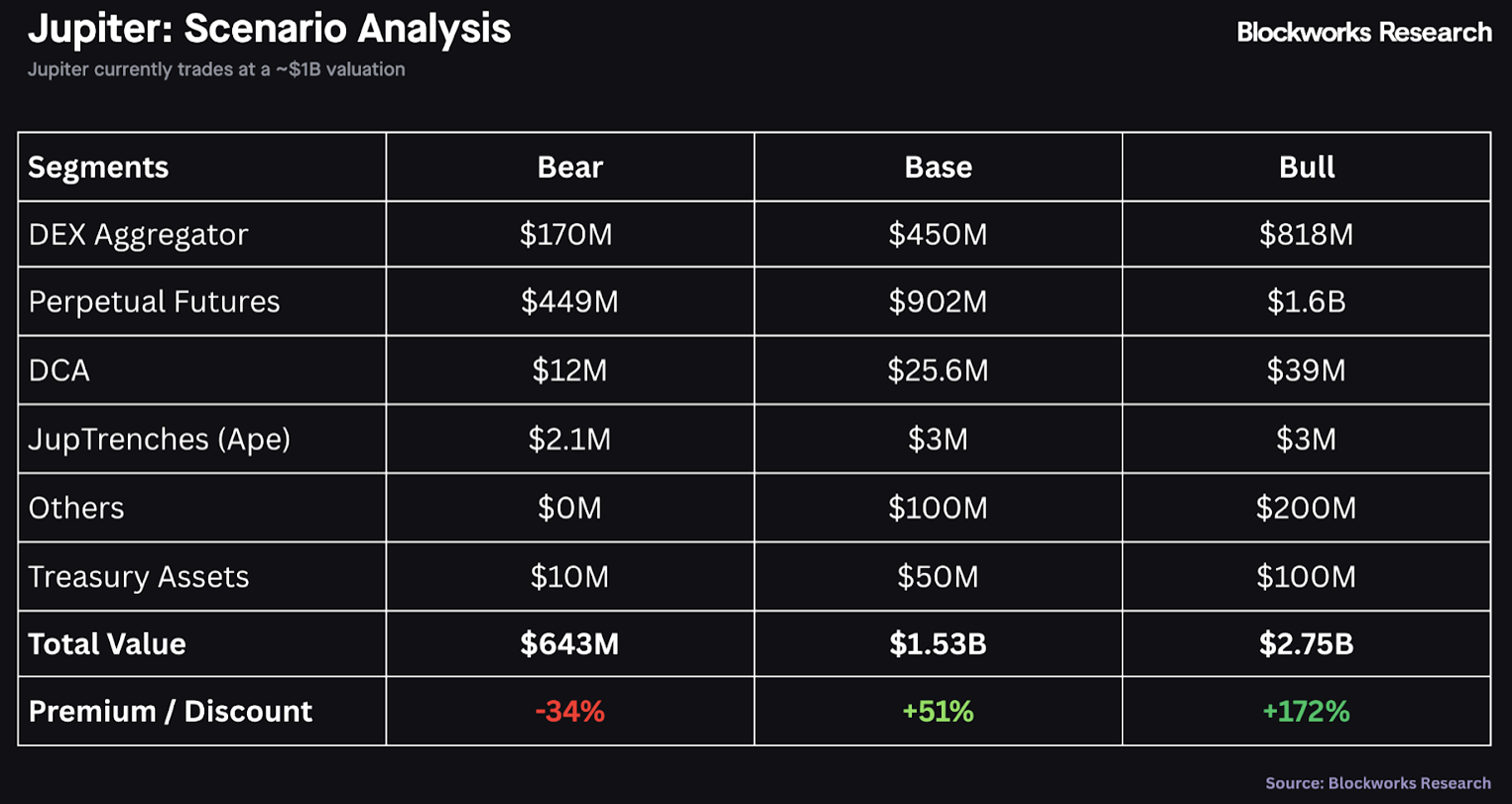

Jupiter

Jupiter is a decentralized exchange (DEX) aggregator on Solana that returns a relatively modest 50% of its income to token holders (also through buybacks)—but its income is still quite substantial.

Marc Arjoon estimates that Jupiter could generate $280 million in revenue over the next 12 months, which means that based on market cap, the JUP token's yield is about 11.5%.

In the stock market, an 11.5% yield typically indicates that the related business is in distress, but that doesn’t seem to be the case here.

Jupiter is "the default router on Solana," Arjoon writes, "currently unmatched in the aggregation space," and "is the fourth-ranked application in terms of revenue among all crypto dapps."

More importantly, it is operated like a real business: "Jupiter's strategic actions for 2024-2025 indicate that it is an organization actively entering a high-growth phase, ambitiously positioning itself as the top crypto super app on Solana."

This sounds nothing like a company that should have an 11.5% yield.

Of course, there are still many risks, which Arjoon detailed in his recent report.

But his conclusion is that "Jupiter's current trading valuation multiple is attractive compared to its peers, indicating that it still has considerable upside potential even without considering multiple expansion."

He even quantified this through a segment valuation analysis, which is reassuring for my traditional finance background:

This looks like a good story.

Helium

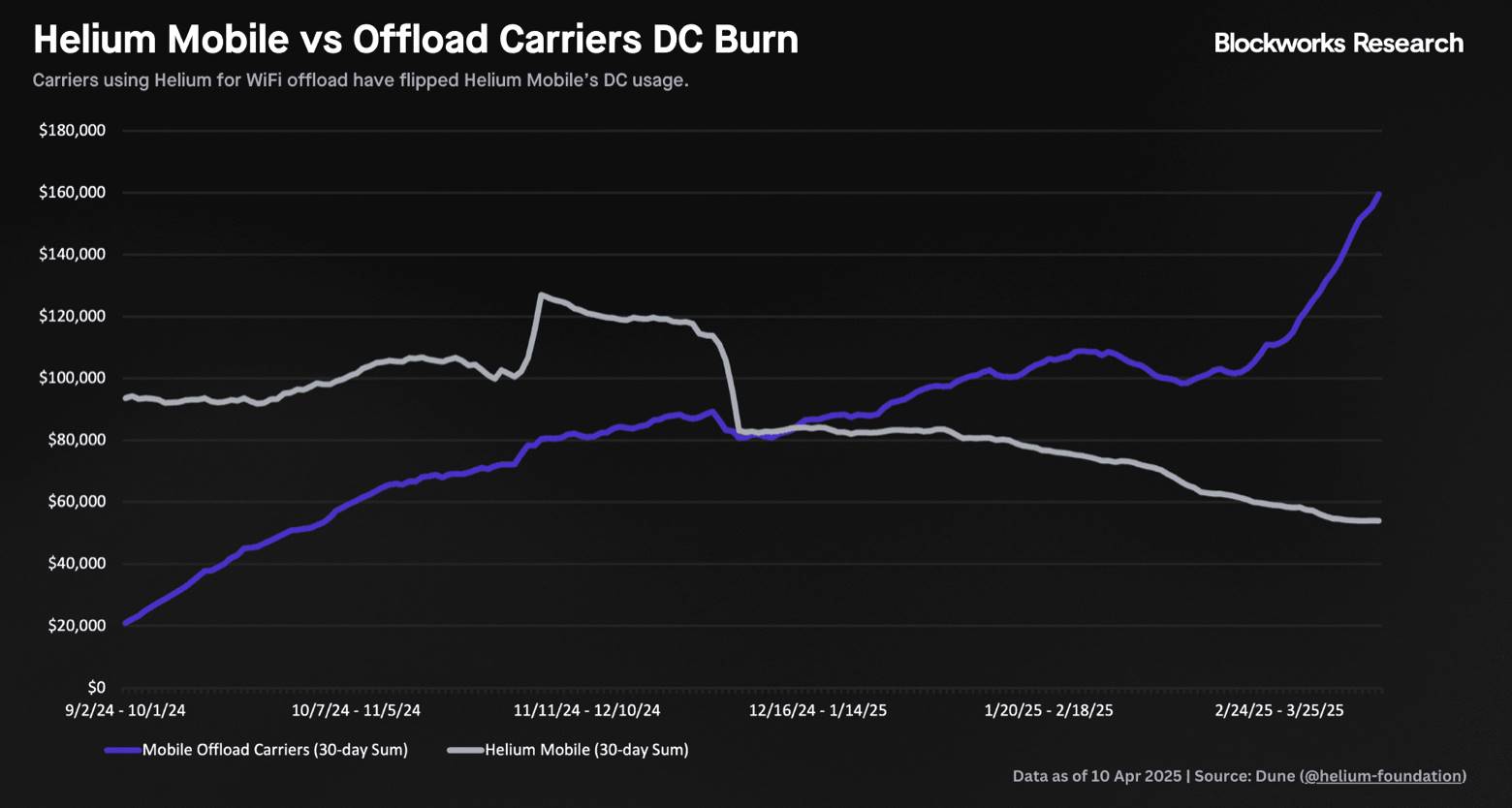

Helium, a decentralized telecom service provider, has long been a hot topic in the crypto space—it was established as early as 2013.

But now, it is no longer just a story; it is a story backed by data: "Revenue measured by Data Credit Burn is accelerating, with a month-over-month growth of 43%," wrote Blockworks Research's Nick Carpinito in a recent report.

"More importantly, Helium's revenue sources are gradually shifting from Helium Mobile to Mobile Offload, which now accounts for about three times the Data Credit Burn and has seen a month-over-month growth of nearly 180%, an astonishing growth rate for a DePIN (Decentralized Physical Infrastructure Network) protocol in the enterprise budget space."

"Mobile Offload" is represented by the blue line in the chart above, with a quarterly growth rate of up to 180%, a shocking number for anyone.

Helium's HNT token seems to have reflected this in its valuation, with the current trading price around 120 times its annual sales.

However, Carpinito mentioned in the 0xResearch podcast that he expects revenue to accelerate further, as "AT&T allows its U.S. users to connect to the Helium network, driving a surge in Data Credit usage."

Therefore, "in the next 12 months, we are likely to see an unprecedented rise in HNT prices, and this rise will be more stable than the speculative price fluctuations of Helium in the past."

In the crypto space, it is very rare to hear someone make such price predictions based on non-speculative factors.

And it is refreshing.

Pendle

Finally, Pendle is a "yield trading" protocol, and its new product "Boros" will allow users to speculate on any on-chain or off-chain yield, starting from the funding rate.

"This implementation is similar to the classic interest rate swap market, where traders can pay a floating rate to receive a fixed rate, or pay a fixed rate to receive a floating rate, and it supports leveraged trading," explained Blockworks Research's Luke Leasure.

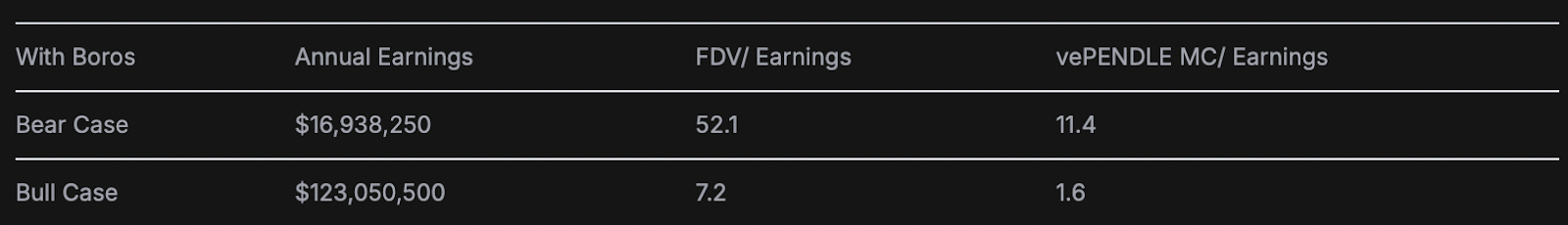

For someone like me from a traditional finance background, this sounds a bit complex, but it is clearly a huge market: "The perpetual futures market settles nearly $60 trillion annually, with open interest in the hundreds of billions. Boros will enter a brand new, massive, and untapped market." Leasure stated that he expects Boros could double Pendle's revenue.

This is rarely heard in traditional finance.

In an optimistic scenario, Leasure estimates that the "vote-escrowed" version of the Pendle token could trade at just 1.6 times earnings:

1.6 times!

In the stock market, a company's valuation only drops to 1.6 times earnings when it is on the verge of collapse, but clearly, this is not the case for Pendle.

Nevertheless, this is not investment advice (at least not from my side), as Pendle's story is quite complex—like most projects in the crypto space.

But at least now these stories can be told through numbers.

——Byron Gilliam

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。