Author: Matti, Zee Prime Capital

Translated by: Yangz, Techub News

I am back with another thought piece inspired by Peter Thiel. As a self-proclaimed follower of the "Thiel School," I often examine the future through his "Bible" (Zero to One: Notes on Startups, or How to Build the Future). Thiel's framework is highly extensible, capable of precisely dissecting viewpoints, trends, and movements. But sometimes it resembles Wittgenstein's ruler—its reliability heavily depends on the observational perspective—rather than a consistently clear lens. (Note: The "Wittgenstein's ruler" theory posits that unless you have confidence in the ruler's reliability, if you use a ruler to measure a table, you might also be using the table to measure the ruler.)

As a cryptocurrency investor, I often capture opportunities through narrative analysis. The industry is at a turning point, with the arbitrage opportunities in emerging technology markets about to close, and I can't help but ponder: how can we discover and stimulate more exceptional ideas and products?

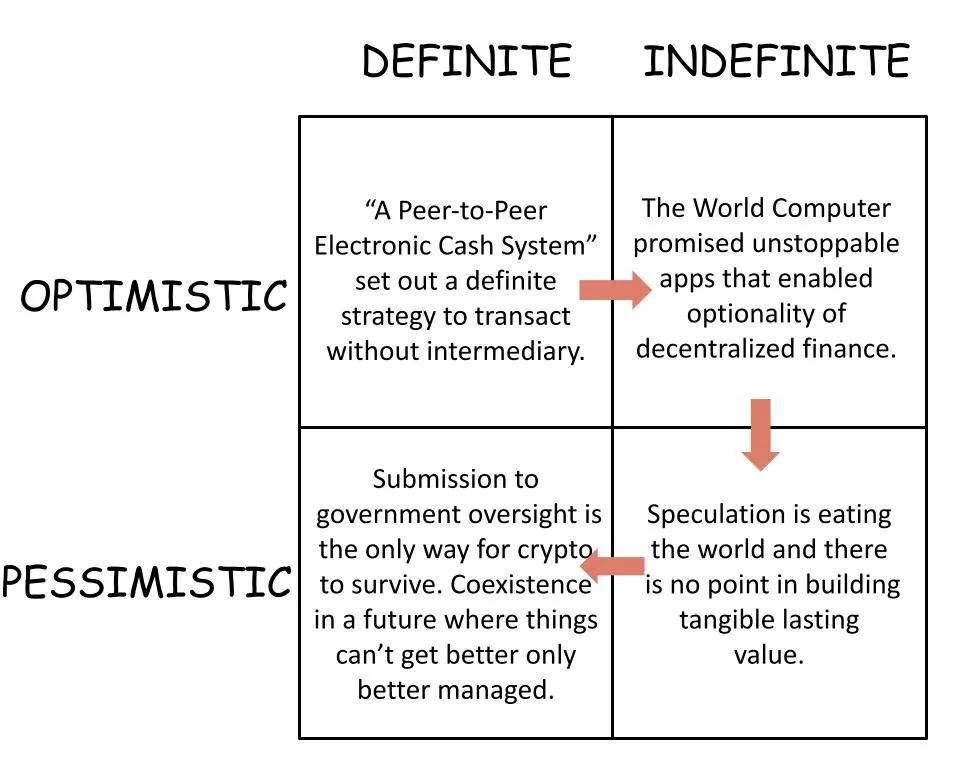

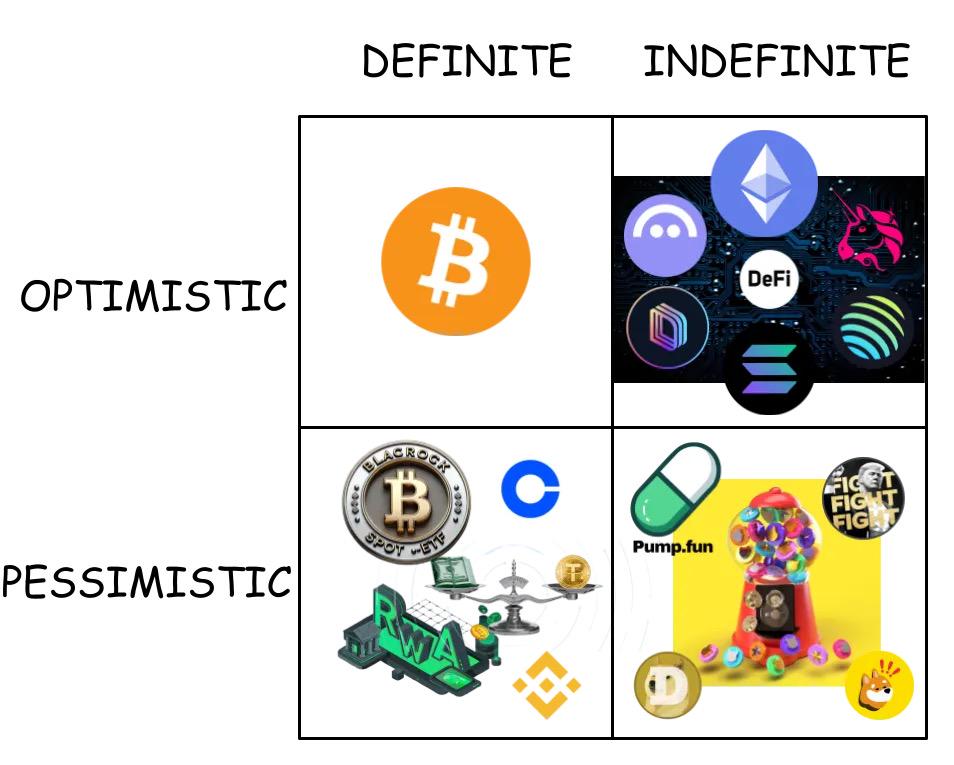

Through Thiel's prism, the timeline of the cryptocurrency industry presents an arc: from the early "clear optimism" of Bitcoin, to the "fuzzy optimism" in the grand vision of Web3 (where finance ultimately becomes the killer app), to the "fuzzy pessimism" of the Memecoin casino era, and now to the "clear pessimism" regarding regulatory compromises. This arc starts from the ideals of cypherpunks, traverses the entrepreneurial frenzy, falls into degen culture, and ultimately leads to standardization.

However, is this arc universal to all trends? A revolutionary idea, once partially validated, can become a hyped "universal remedy"; when it fails to meet overly high expectations, it is scorned and ultimately returns to normalcy. As it stands, the revolution has not been fully realized, but we have still completed a satisfying cycle along Gartner's technology maturity curve (hype cycle) for some.

In the cryptocurrency realm, the grand technology maturity curve is often obscured by price fluctuations. Each cycle—Bitcoin, the ICOs promising a "world computer," DeFi, Memecoin, and now the integration of regulation and traditional finance (TradFi)—resembles a fractal of a larger pattern. Currently, we are in the trough of disillusionment. According to Carlotta Perez's theory of technological revolutionary waves, we are at a turning point.

Web3 once promised to achieve the profit explosion of Web2 through on-chain, decentralization, and tokenization. However, Web2 and Web3 are not specific "places"—they are not discrete "things." As I mentioned two years ago, they should be understood more as "user preferences," which still remain niche today. If you constantly need to reference old things to explain new things, it indicates that you have not built something truly new.

The cryptocurrency industry is no longer a frontier market, but opportunities still exist in the leading edge of this increasingly mature space. At this stage, where are the biggest opportunities? Intuitively, they will come from growth-stage dividends or latecomer advantages.

Notably, centralized exchanges (CEX), once the vanguard of cryptocurrency adoption, have now devolved into "conservatives," focused solely on defending market share rather than promoting on-chain adoption. Ironically, it is these exchanges and L1 public chains that have created the most substantial returns for investors. In these fiercely competitive arenas, where idealism gives way to pragmatism, the biggest winners have emerged.

So, does this mean there are no "secrets" left to uncover in the industry? I firmly believe that "secrets" still exist, and today's "secret" is precisely the revelation of the past: how many truly innovative enterprises and networks have we built?

The low-hanging fruit has long been picked. Most projects either poorly imitate previous patterns or repackage old elements as so-called innovations. Too many solutions address fundamentally non-existent needs, while others simply replicate traditional financial models on-chain.

Crypto is essentially an unfinished revolution, ultimately devolving into a revisionist force. It is now mired in a core (perhaps false) dilemma: "Is it the right path to adhere to idealism, or to succumb to the reality of 'making money'?" In other words, are you willing to sell your ideals for the price set by the old system? After crying dry in the Memecoin casino, more and more revolutionaries are accepting this deal.

Those vague concepts based on the builders' wishful thinking (no, users do not care about data sovereignty) combined with the tangible commercial success of centralized service providers have collectively created the current predicament. Today, it is nearly impossible to find "clear optimists" in the cryptocurrency space, but the word "nearly" leaves investment opportunities for those willing to stand firm in the leading edge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。