For people living in Africa, Web3 wallets are not just a medium of money, but a possibility to move from the economic margins to the center.

Written by: Liu Honglin, Zheng Hongde

The Gap in Financial Inclusion

Living in the second decade of the 21st century, we can transfer money instantly, purchase funds, and make payments with our phones, with bank accounts seamlessly integrated into our lives, making everything seem taken for granted. Quality financial tools mean better risk management, expansion capabilities, and wealth appreciation. However, on the vast lands of emerging markets—Africa, Latin America, South Asia—billions of adults have never owned a bank account. These "emerging" regions often develop later, lack financial services, and the sheer number of people in an "unbanked" state is perhaps rarely noticed.

In these areas, bank branches are scarce, fees are high, and processes are cumbersome. A lack of trust makes stable financial services a privilege for a few. In mobile payments, while there are local solutions like Kenya's M-Pesa to meet local payment needs, cross-border transfers are still limited by high fees and daily channel limits, and many regions struggle to access services.

More severely, the fragility of local sovereign currencies in many areas: Zimbabwe's inflation rate has remained high, even issuing currency with a face value of 100 trillion, plagued by hyperinflation; Angola's kwanza has nearly collapsed, with residents' wealth evaporating in devaluation. Many ordinary people exchange dollars at high prices on the black market to preserve value, facing high risks and additional costs, while stable financial services seem out of reach.

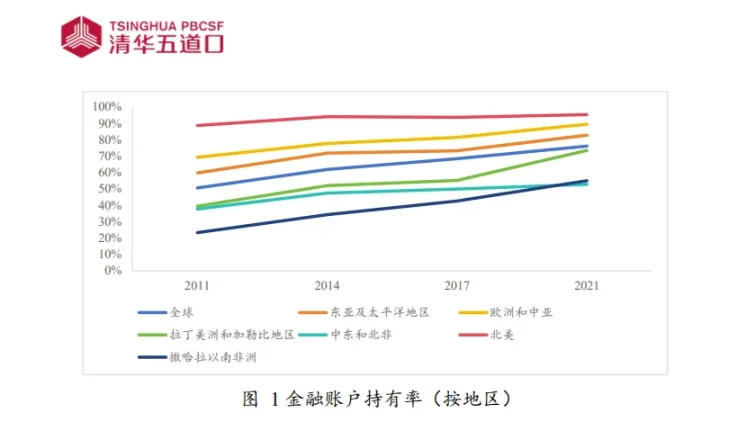

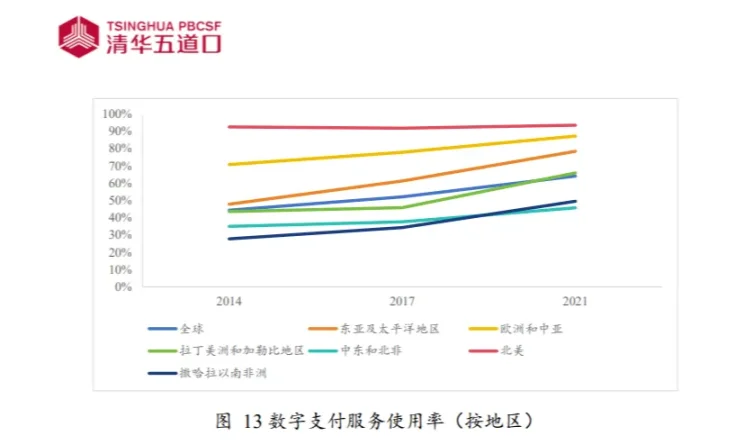

Let's look at a set of data from the 2023 Global Financial Inclusion Development Trends Report:

North America benefits from its developed financial system, with financial account ownership rates nearing saturation, while the financial account ownership rate in Sub-Saharan Africa is only 55%, far below the global average. Similarly, the usage rate of digital payment services in North America is as high as 92%, while the gap is evident in the Middle East, North Africa, and Sub-Saharan Africa, where many still cannot enjoy inclusive finance, let alone improve their lives through bank accounts.

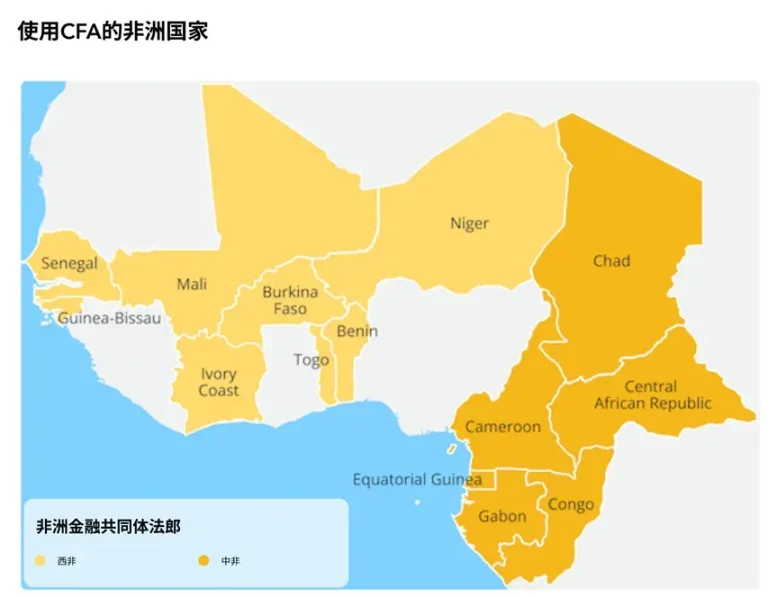

Additionally, did you know that many places in Africa use the African franc created by the French, rather than their own national currency?

After France approved the Bretton Woods Agreement in December 1945, the CFA (West African Franc) currency system was created under General de Gaulle's decree, controlling exchange rates and even designing and printing the banknotes used in Africa. The African franc became the official currency in various French colonies in Africa and is still used in 14 countries in Sub-Saharan Africa, known as the "African Financial Community Franc Zone."

Imagine a country requiring your country to deposit half of its foreign exchange reserves in that country in exchange for allowing your country to issue its own currency. Now imagine that this country controls the value of your country's currency and has veto power over its exchange rate. This sounds like a form of financial occupation, but for the 14 Sub-Saharan African countries, it is a reality: half of the foreign exchange reserves are stored in the former colonial power, France, which seems to achieve "new hegemony" in this way.

Alex Gladstein from the Human Rights Foundation once mentioned: "Unlike typical fiat currency systems, the CFA system is much more insidious. The CFA is monetary colonialism." Journalist Joseph expressed this sentiment after field investigations: "From Cuba to Turkey, from South Africa to Serbia, I have never seen a greater need for monetary liberation than in Central or West Africa."

After understanding all of this, we naturally think that blockchain and Web3 seem to be tailor-made remedies for these pain points. The decentralized trust mechanism bypasses the barriers of traditional banks, eliminating dependence on traditional financial institutions. Web3 wallets serve as the entry point for users to interact with the blockchain, protecting privacy while avoiding identity or geographical restrictions. Ordinary people only need a mobile phone to control digital assets through non-custodial wallets, participate in savings, lending, and investment, breaking down the barriers to financial service access, holding the keys to finance, and even achieving monetary liberation.

For people living in these regions, Web3 wallets are not just a medium of money, but a possibility to move from the economic margins to the center. The potential of blockchain inclusive finance may help billions connect from financial isolation to the global economy. This is a financial equality revolution; opening this door allows ordinary people to stand on the world stage.

Case Studies Show Potential: Web3 in Africa

Jambo: A Chinese Entrepreneur Growing Up in Africa Selling Web3 Phones

Jambo founder James Zhang is a third-generation Chinese living in the Democratic Republic of the Congo, who has witnessed the inefficiency of the local financial system: workers need to settle wages daily due to a lack of trust; cross-border payments rely solely on church channels; corrupt intermediaries hinder the flow of money. While studying computer science at New York University, he encountered Bitcoin and Ethereum, realizing the potential of blockchain. In 2021, 26-year-old James founded Jambo, aiming to solve three major pain points in emerging markets: cross-border payments, remittances, and the "unbanked" issue.

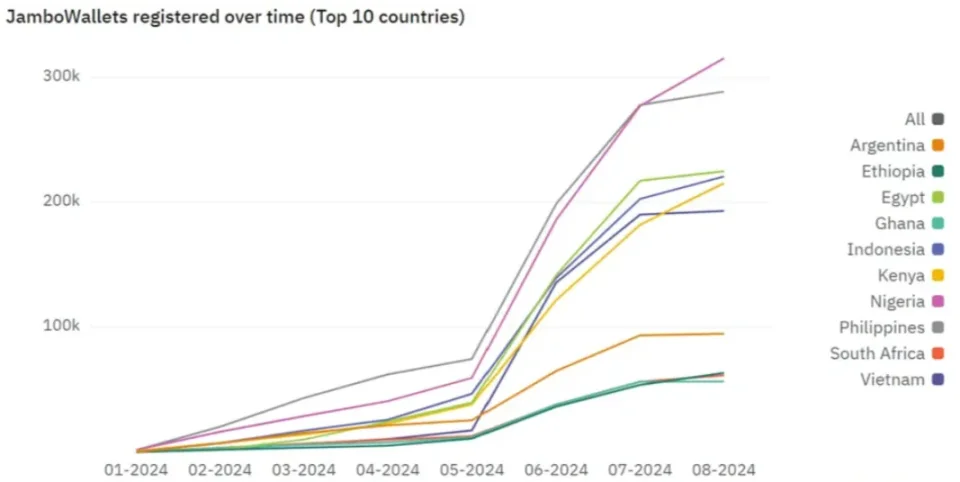

The launched JamboPhone smartphone comes pre-installed with 20 Web3 applications (wallets, games, DeFi), and as of today, 870,000 units have been sold, activating nearly 10 million non-custodial wallets, covering 128 countries, and gaining popularity in emerging markets.

Founder James Zhang has stated: "I believe in Africa, there is no money to save because only 1% are super-rich and 99% are poor. Therefore, we took a different approach, which is to help ordinary people make money." Based on this idea, Jambo built the Jambo Super APP, allowing local young people who may not even have bank accounts and lack job opportunities to earn income through this super application by "learning, playing, and earning."

Beyond Africa, vast emerging markets in Latin America and Southeast Asia also crave Web3 and cryptocurrencies to bring them stable currencies and financial systems. After accumulating successful experience in the African market, Jambo is gradually venturing into more "blue oceans," aiming to become a pioneer in mobile infrastructure for Web3, promoting the large-scale adoption of Web3 through emerging markets.

Yellow Card: Promoting the Stablecoin Revolution in Africa

Founded in 2019, Yellow Card has grown from a small team in Nigeria to the largest stablecoin exchange in Africa, covering 20 African countries. As the first licensed stablecoin platform, Yellow Card integrates local banks and mobile payment systems through its payment API and "Africa as a Service" suite, providing secure, low-cost stablecoin trading services for businesses and individuals. In October 2024, it secured $33 million in Series C funding, bringing its total funding to $85 million.

Chris Maurice, CEO of Yellow Card Exchange, pointed out that in Africa, many national currencies are extremely unstable, with about 70% of countries facing foreign exchange shortages, making it difficult for many businesses to obtain enough dollars for operations. Stablecoins like USDT and USDC have become alternatives to the dollar, providing businesses with tools for value storage, international supplier payments, and coping with currency devaluation.

For example, Ethiopia, the second most populous country in Africa, saw its local currency, the birr (ETB), depreciate significantly by 30% in July 2024 after the government relaxed currency controls in pursuit of a $10.7 billion loan from the International Monetary Fund and the World Bank. The instability of the local currency further fueled demand for stablecoins.

Many African businesses are already obtaining stablecoins through platforms like Yellow Card. Yellow Card's platform, with transaction costs as low as $0.05, helps about 30,000 businesses optimize cross-border payments and fund management, with transaction volumes exceeding $3 billion in 2024. Maurice emphasized: "Stablecoins in Africa are not just financial tools, but necessities for survival." Stablecoins are continuously empowering businesses, breaking down traditional financial barriers, and aiding the modernization of finance in Africa.

Xend Finance: DeFi Empowering African Finance

The currency devaluation crisis in Nigeria also inspired Xend Finance founder Aronu. Aronu and his mother participated in credit cooperatives in Nigeria, hoping to withstand economic difficulties through regular savings and mutual assistance, but gradually realized that even with their savings behavior, they were watching their money become less valuable, and everyone was getting poorer, sometimes even incurring significant economic losses.

The weak banking system in Africa and the strong demand for value preservation gave rise to Xend Finance—a DeFi platform aimed at credit cooperatives. Xend aggregates DeFi lending protocols to provide users with multi-tiered interest returns, striving to allow ordinary people to enjoy the dividends of DeFi.

Not only focused on aggregation and lending, Xend's uniqueness lies in bringing DeFi to the scenarios that truly need it. Aronu stated: "We provide value to people living in unstable economic environments where their assets are unprotected." Xend not only offers alternative savings options for credit cooperative members but also helps low-income individuals combat currency devaluation through optimized returns, filling the gaps left by traditional finance.

Through partnerships with giants like Binance, Google, and Polygon, Xend has expanded into Ghana and Kenya, gradually bringing previously inaccessible financial lending services to more regions in Africa. The plan aims to attract more non-crypto users to join DeFi, targeting the demand for savings preservation amid currency devaluation. It not only provides alternative savings solutions for credit cooperative members but also brings hope to low-income populations in Africa to withstand economic fluctuations.

Ejara: Popularizing Crypto Investment and Payments, Starting from "1 Dollar" in Francophone Africa

Ejara is a Web3 platform based in Cameroon, founded in 2020, focusing on providing cryptocurrency investment and payment services for Francophone African users. Inspired by local financial exclusion and currency devaluation, the founder developed the Ejara mobile app, allowing users to invest in stablecoins, Bitcoin, and other assets with amounts as low as $1, and supporting cross-border payments and local currency exchanges.

In 2023, Ejara completed an $8 million Series A funding round led by Dragonfly Capital and Circle Ventures, achieving a valuation of $50 million. As of 2024, Ejara has over 300,000 users, covering Cameroon, Senegal, and Côte d'Ivoire, with a monthly transaction volume of $20 million.

Ejara's uniqueness lies in its low entry barriers and localization strategy. The platform supports a French interface and integrates mobile wallets like Orange Money, reducing the technical barriers for users entering Web3. In 2024, Ejara launched the "Ejara Earn" program, allowing users to earn annualized returns of 8-12% through stablecoin staking, attracting a large number of first-time female crypto users in Africa (accounting for 40% of users). Ejara's active performance and sustained growth in 2023-2024 have made it a benchmark in the Francophone African Web3 space. Tayim stated: "We hope to democratize investment and savings products across the region using blockchain technology, allowing ordinary Africans to participate in the global financial market."

African Web3 Regulation: Compliance is Essential

We note that the rapid development of Web3 in Africa is also inseparable from regulation; the operation of enterprises is always tied to compliance. Currently, countries like Nigeria, Botswana, Mauritius, Namibia, South Africa, and Seychelles have passed legislation governing digital assets, while only Algeria, Egypt, Morocco, and Tunisia explicitly prohibit digital assets. Other countries and regions on the African continent have not established legislation to manage digital assets, nor do they have any laws prohibiting digital assets, existing in a "regulatory vacuum." Let's look at regulatory examples from several countries:

South Africa

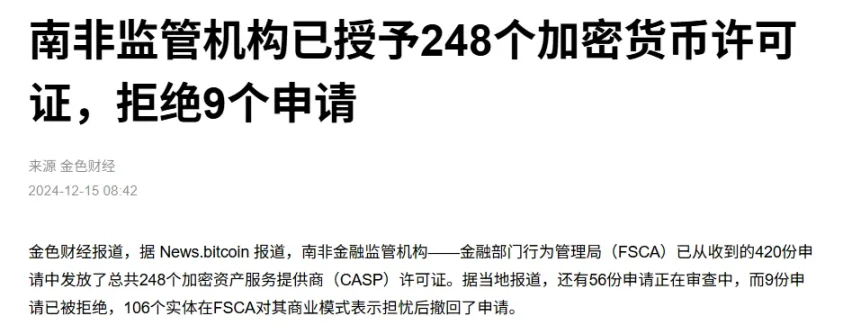

South Africa is a leading country in digital asset regulation in Africa. In 2022, the Financial Sector Conduct Authority (FSCA) of South Africa launched a crypto asset declaration, marking an important milestone in South Africa's cryptocurrency regulatory approach. The declaration defines crypto assets as "financial products," requiring crypto asset service providers to register and comply with the Financial Advisory and Intermediary Services Act (FAIS). In 2023, the FSCA released a regulatory framework for crypto assets, covering anti-money laundering (AML) and customer protection requirements. As of 2024, over 300 crypto enterprises have obtained licenses or are in the process of applying for licenses.

Mauritius

The Mauritian government is continuously committed to attracting investors, building a resilient economy, and establishing Mauritius as a hub for emerging technologies. To this end, the Mauritian government took a step forward by enacting the Virtual Assets Bill, which came into effect on February 7, 2022. At the same time, the Financial Services Commission (FSC) of Mauritius published anti-money laundering/anti-terrorist financing guidelines for virtual asset service providers (VASP) and initial token issuers based on the conclusions of the national risk assessment. In 2023, Mauritius further updated its AML/CFT regulations, strengthening oversight of digital assets. With its advancing regulations, Mauritius is also regarded as one of Africa's crypto-friendly countries.

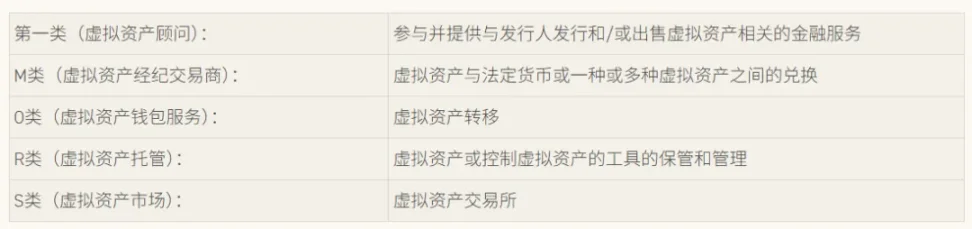

* The Virtual Assets Act specifies five types of licenses for VASPs.

Nigeria

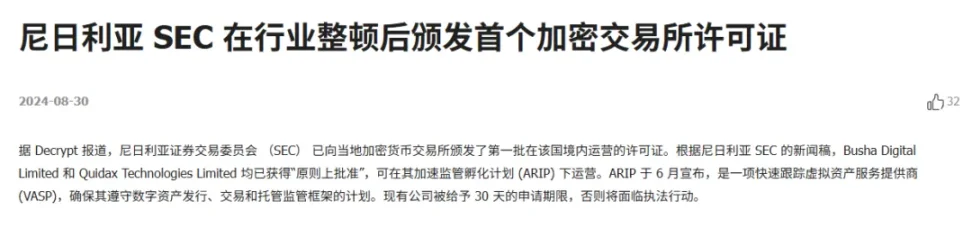

According to a report by Chainalysis, Nigeria ranks second in the world for cryptocurrency adoption rates. In 2023, the Nigerian Securities and Exchange Commission (SEC) released the Digital Asset Rules, bringing crypto assets under regulation, requiring exchanges and VASPs to register and comply with AML/CFT requirements. According to a report by Decrypt in August 2024, the Nigerian SEC has issued the first batch of licenses for local cryptocurrency exchanges to operate within the country.

It can be observed that many African countries are beginning to embrace blockchain. Nigeria's crypto regulatory framework allows Yellow Card to operate legally; South Africa views crypto assets as financial products, enabling Ejara to comply; Kenya's sandbox model gives the green light to Jambo; Botswana and Mauritius attract investment through virtual asset legislation. This land, rich in financial demand and entrepreneurial opportunities, emphasizes compliance as a priority for startups.

Emerging Market Hotspot: The Next Blue Ocean for Web3 Entrepreneurship

The Web3 boom in Africa is just the tip of the iceberg of the potential in emerging markets. Many regions in Latin America, South Asia, and Southeast Asia face similar challenges of insufficient financial inclusion as Africa, also demonstrating strong financial demand.

In Latin America, the inflation crises in Brazil and Argentina are driving the adoption of stablecoins, with platform transaction volumes continuously increasing. In South Asia, India and Pakistan are experiencing rapid expansion of small loan projects empowered by DeFi platforms due to financial exclusion and high remittance costs. In Southeast Asia, crypto payment applications like Coins.ph serve over 20 million users, meeting cross-border remittance needs.

* Philippine cryptocurrency exchange Coins.ph

The decentralization, low cost, and high inclusivity of Web3 blockchain are the remedies for the financial pain points in emerging markets. From stablecoin trading, DeFi lending to crypto payments and NFT assetization, Web3 provides diverse entry points to meet needs for savings, investment, and payments. In 2024, global Web3 startups raised over $12 billion, with emerging markets accounting for 30%, showcasing the immense potential of this entrepreneurial blue ocean. Whether it is Jambo's mobile infrastructure, Yellow Card's stablecoin trading, Xend's DeFi empowerment, or Ejara's investment popularization, the multi-scenario applications of Web3 are reshaping the financial landscape. This vast, underexplored cake is waiting for more innovators to join, and relevant government departments are gradually establishing regulatory frameworks to promote financial equality in a legal and compliant manner.

Summary by Mankun Law Firm

In the context of a significant global financial inclusion gap, emerging markets like Africa face issues such as a lack of banking services, currency fragility, and difficulties in cross-border payments. Web3, with its decentralized trust mechanism and the convenience of Web3 wallets, breaks down barriers to financial services, bringing hope for financial equality to these regions. African Web3 enterprises represented by Jambo and Yellow Card are meeting local financial needs through innovative models, achieving remarkable results in cross-border payments, stablecoin trading, and DeFi lending. At the same time, many African countries are actively exploring regulatory pathways, with countries like South Africa, Mauritius, and Nigeria having introduced regulations related to digital assets, delineating compliance boundaries for Web3 development.

In fact, the Web3 boom in Africa is just the tip of the iceberg of potential in emerging markets, where significant financial demand also exists in Latin America, South Asia, and Southeast Asia, undoubtedly representing a blue ocean for Web3 entrepreneurship, filled with infinite opportunities.

Many domestic entrepreneurs are eager to seize the opportunity to venture abroad. However, starting Web3 businesses in emerging markets also emphasizes compliance as a priority. Entrepreneurs need to closely monitor regulatory dynamics in various regions, innovate within compliance frameworks, and seize opportunities while avoiding pitfalls to successfully capture their share of the cake.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。