Blurred CRO, Real NFT Diamond Hands

Written by: Deep Tide TechFlow

Welcome to the first day after the May Day holiday, where the crypto market is still full of gossip and hot topics.

During the May Day holiday, the native token $BOOP of the new token launch platform Boop.fun was clearly one of the standout performers, with its market cap briefly surpassing $500 million. With the launch of $BOOP on Binance Alpha yesterday, the community's attention towards this token has intensified.

However, amidst the excitement of new tokens launching, a post by CZ quickly sparked discussions in the community regarding Boop.fun's founder, dingaling.

On May 5, CZ replied on X, hinting that a former employee was fired for "mouse trading" (insider trading) and claimed to have been "Binance's CXO," a position that Binance has never had.

Although CZ emphasized not to take it personally, the description in the original post he replied to, "a founder recently launched a platform project on Solana claiming to disrupt the Meme play," was quite straightforward.

If you've been keeping an eye on market trends lately, you can easily deduce that this is actually referring to Boop.fun and dingaling.

The most interesting part is that dingaling's personal profile (with 250,000 followers) not only states that he is the founder of Pancakeswap but also indeed carries a former Binance "CRO" title. Coupled with CZ's statement that Binance has never had such a CXO title, the insinuation becomes quite evident.

When there is a connection to the facts, the verbal caution against taking it personally seems more like a protective cover and armor; although the two parties have not directly confronted each other, the community has already erupted in speculation.

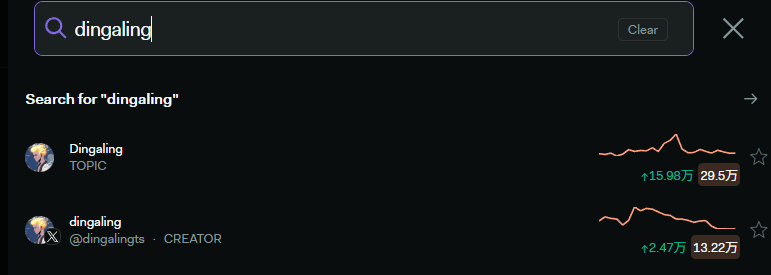

If you search for dingaling on crypto social media sentiment websites, you'll find that discussions about him have rapidly increased in a short time, with many users passionately debating this matter.

Among these discussions, aside from some defenses influenced by Boop positions leading to biased opinions, the more valuable information revolves around dingaling's past and the future development of Boop.

Blurred CRO, Real NFT Diamond Hands

Who exactly is dingaling?

The title CRO is somewhat ambiguous; some speculate it stands for Chief Risk Officer, others say Chief Revenue Officer, and some suggest Chief Research Officer.

Dingaling himself seems to have not clarified what the CRO abbreviation refers to, and with CZ's insinuating post, some netizens jokingly suggested that this CRO stands for Chief Rat Officer (implying he was fired for involvement in mouse trading).

But jokes aside, amidst the ambiguity of the title, some traces of the past can still be seen.

Crypto blogger NFT Ethics revealed that dingaling's early Twitter handle was @DinghuaXiao, which seems to correspond with his full name. Although most of his associations with Binance have been removed from the internet, some community members' screenshots show that at one time, you could directly chat with him on Telegram for help with issues related to using Binance.

This seems more like a customer complaint response or customer relationship management role.

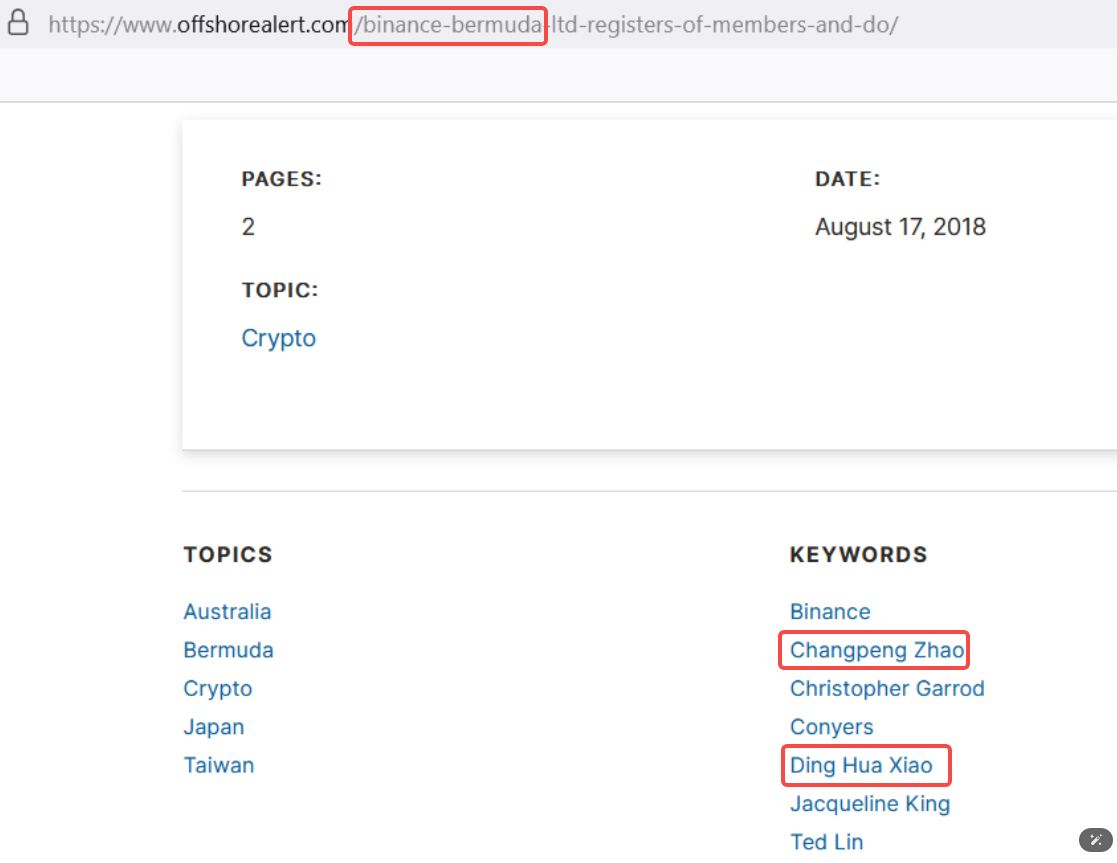

Beyond the surface of direct customer interaction, NFT Ethics pointed out that dingaling's lesser-known connection to Binance is that he was one of the heads of Binance's offshore entity (Bermuda), and there are screenshots of the company's website (which may have been taken down) showing CZ and Ding Hua Xiao listed together.

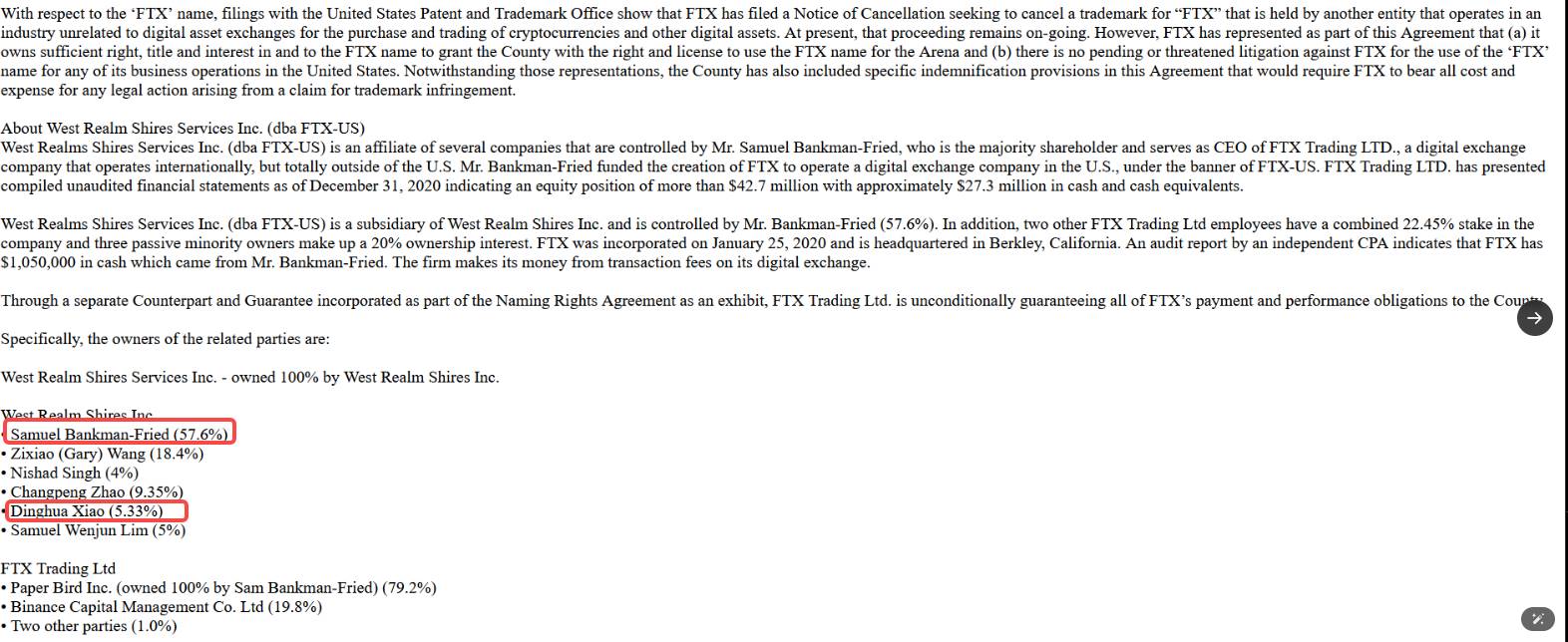

Additionally, more information indicates that Ding Hua Xiao was also a member of Binance's joint venture with FTX, West Realm Shires Inc, which is a key entity controlling FTX's operations in the U.S. (i.e., FTX-US).

Documents also show the shareholding ratios among SBF, CZ, and him, with Ding holding 5.33%; although this is not a high percentage, it still reflects his relationship with FTX's core team and CZ.

Most of the information revealed by NFT Ethics was released in 2022, and the validity of the content is now uncertain. It is difficult to accurately determine Ding's position at Binance, and we can only glean insights from these summarized pieces of information.

However, one thing is certain: dingaling is definitely not just an ordinary employee.

Despite the ambiguity of his title, dingaling's actions in the crypto market are traceable, which is why the community is so fervently discussing him:

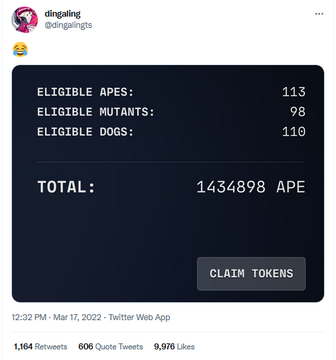

An OG player in the NFT circle, a well-known diamond hand.

He is considered one of the most successful "NFT investors," having held 113 Bored Ape Yacht Club (BAYC) NFTs and over 70 Azuki NFTs in the early days, accumulating 1.4 million Ape airdrops, with a current market value exceeding ten million dollars.

Additionally, he was an early investor in CryptoKitties and one of the largest investors in NBA Top Shots.

The community refers to him as an "NFT OG" and "diamond hands" because he rarely engages in short-term "pump-and-dump" schemes; instead, he prefers to sweep the floor, buying up floor-priced NFTs and holding them long-term.

In the popular version of NFTs, players often use dingaling's purchases as a standard for whether an NFT is a blue-chip quality, and his floor-sweeping strategy can easily drive up NFT prices, benefiting other holders of the same NFTs, thus earning him widespread trust in the community.

Lessons from LooksRare: Can Boop Succeed?

As an NFT trader, dingaling is undoubtedly successful, even considered a big shot; however, his track record in product investment or development is not as impressive.

In 2022, dingaling entered LooksRare as a high-profile advisor and investor. At that time, OpenSea was firmly established as the dominant player in the NFT space, while LooksRare aimed to disrupt this leading NFT market and carve out a niche for itself.

During the same period, LooksRare launched the $LOOKS reward mechanism to incentivize user trading, and initial trading volumes nearly approached OpenSea. However, the good times didn't last long; as the overall market weakened and phenomena like wash trading (buying and selling to oneself) became prevalent, the NFT market collapsed, and LooksRare failed to gain traction.

From a price perspective, $LOOKS reached a historical high of around $7, but its current price is about $0.01, effectively having gone to zero, belonging to the series of tears of an era.

The rhythm of history is strikingly similar; in this cycle, Pump.fun has been in the spotlight, and a batch of challengers and innovators has emerged in the market, attempting to pull it down from its throne; Boop.fun is one of them.

With a similar launch mechanism and a slightly different reward mechanism, will this replicate the script of LooksRare challenging OpenSea?

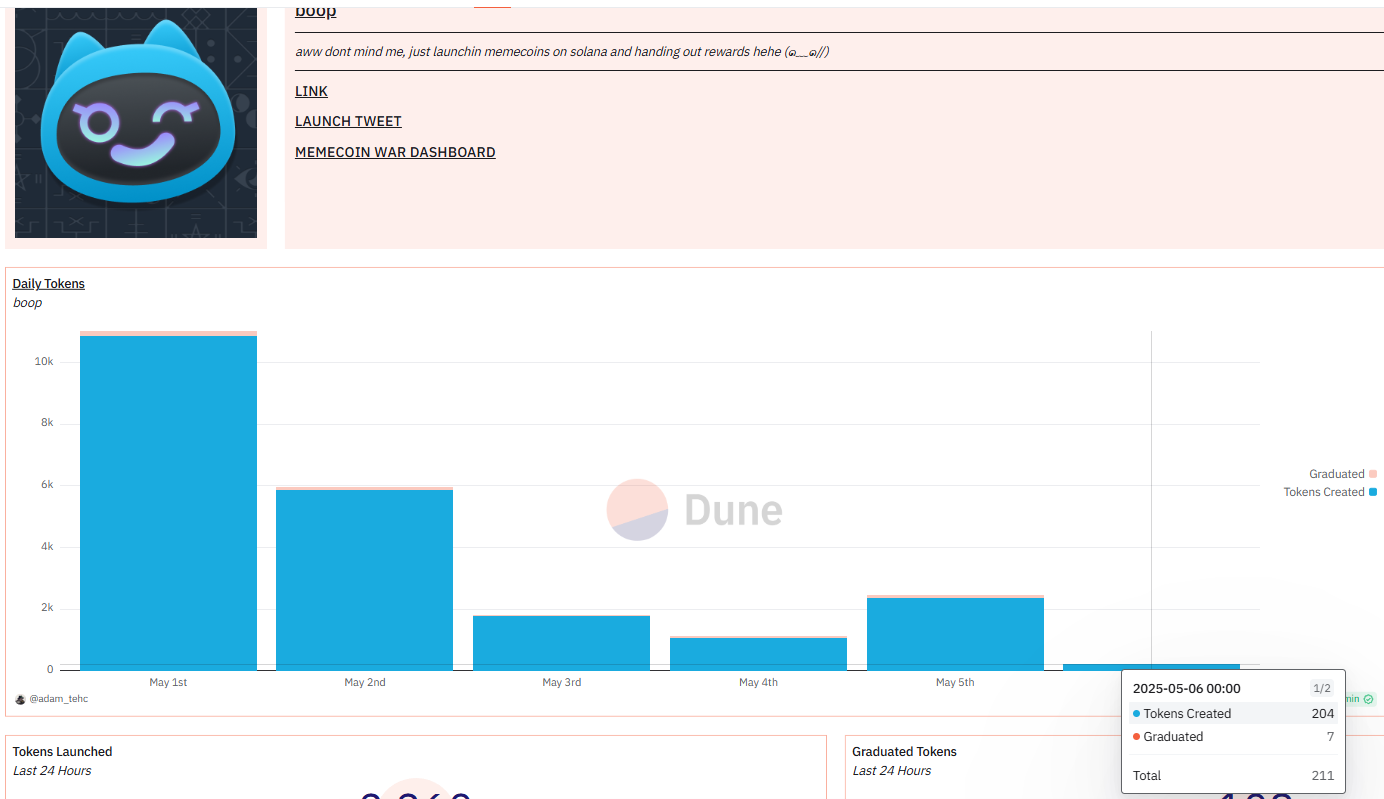

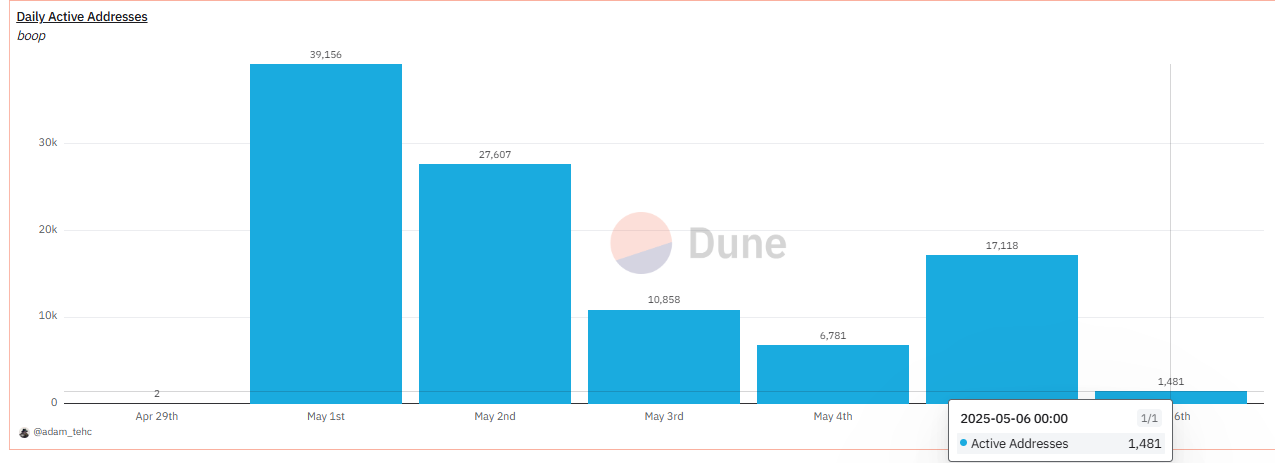

Dune's data dashboard on Boop.fun shows a clear downward trend in the number of tokens launched daily within the first five days of the platform's launch; as of the day before this article was published, the number of tokens launched on Boop had dropped from an initial 10,000 to 1,000-2,000, while the number of active addresses has also shown a daily decreasing trend.

In an environment of insufficient liquidity and severe PVP, whether Boop.fun is viable remains to be seen.

Community Fermentation: Ants Shaking Trees

No one knows the future of Boop.fun, but at this moment, some are already speaking out for dingaling, directing their criticism towards CZ.

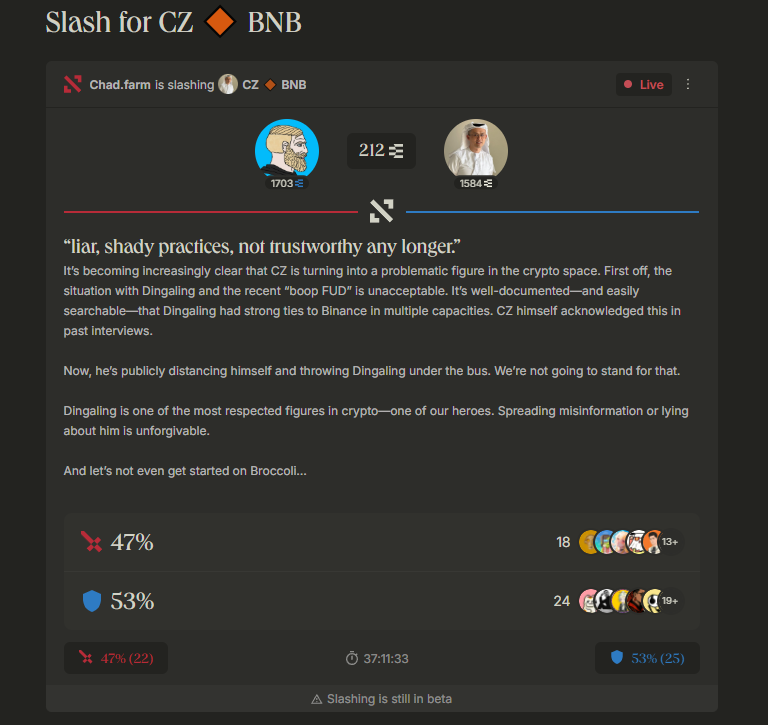

On Ethos Network, a small user with only 215 followers, @chadstrdaumus0, initiated a "Slash" proposal attempting to punish CZ for the FUD regarding Boop through decentralized governance.

The mechanism here is that Ethos Network is a decentralized social platform aimed at creating a reputation system for the crypto economy. Users can generate reputation scores by staking Ethereum, which allows them to review others (positively or negatively) or initiate "Slash" proposals to punish bad behavior, such as spreading FUD or committing fraud. Slashes require community voting to pass, and if successful, the slashed individual's staked assets may be confiscated, and their reputation score may be damaged.

@chadstrdaumus0's proposal directly targets CZ, arguing that his "insinuating post" makes false accusations against Boop and dingaling, harming the project's prospects.

This is very Web3; everyone can challenge others' statements based on their own logic and judgment, even if the other party is CZ.

However, currently, not many people are participating in the discussion and comments, and some have pointed out that such accusations need to be based on clear evidence to be valid. The accuser needs to provide very specific and detailed evidence, such as whether this CRO position actually exists and whether dingaling ever held the CRO title, rather than just using vague statements to label CZ with an "unfounded" crime.

Looking back, CZ's vague insinuations almost name names, while dingaling has yet to drop his title as former Binance CRO. What are the motivations behind both?

CZ's "insinuating post" seems casual, but upon deeper reflection, it may represent a cutting of interests.

If dingaling claims to be the "former Binance CRO," especially after Boop's launch on Binance Alpha, any price collapse or negative association could damage Binance's credibility, leading the market to question whether there are interests at play and so-called mouse trading involved.

As the world's largest exchange, Binance has faced significant controversy due to regulatory pressures (such as the U.S. investigation in 2022), making CZ's sensitivity to brand image quite evident.

Moreover, unless dingaling is unaware of CZ's statements and related hot discussions, he has not changed his personal profile until now, which may express a certain attitude.

While he hasn't actively used the "CXO" title to promote Boop, all publicly available information, including his past as an NFT OG and even this ambiguous CRO position, can be considered a form of reputation. Silently leveraging this reputation to endorse the new project and help Boop go further is also a clever choice.

We cannot know the private grievances behind this, but one thing is certain:

There are no baseless expressions; every voice in the crypto market is defending the interests they believe are worthwhile.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。