Original Title: "Binance Alpha Scoring Guide: How to Efficiently Accumulate Points at Low Cost"

Original Author: Luke, Mars Finance

The Binance Alpha points system is a tool for assessing user activity, with the level of points determining eligibility for participation in Web3 token generation events (TGE) and airdrops. Points are composed of balance and trading volume, and double points events enhance scoring efficiency. By optimizing trading strategies, selecting low-cost chains, and potential tokens, players can accumulate points efficiently and at low cost, seizing Web3 dividend opportunities.

Introduction: The "New Track" of the Points World

The Binance Alpha points system resembles a "points world" competition in the cryptocurrency realm. Since the rule update in May 2025, competition has intensified. The threshold for the $BOOP airdrop has skyrocketed to 137 points, with some players reaching 150 points in just 15 days, averaging 10-12 points per day, truly embodying the "scoring king." These points are not just a simple number game; they directly determine whether you can obtain a "ticket" to the Web3 world—whether participating in token generation events (TGE) or capitalizing on airdrop opportunities, the level of points is the hard truth.

Today, we will delve into the rules of Binance Alpha points, combining on-chain data to outline a low-cost, high-efficiency scoring strategy to help you stand out in this points race and firmly grasp Web3 dividends.

Chapter 1: Breakdown of Points Rules, Know Yourself and Your Opponent

1.1 What is Binance Alpha Points?

Binance Alpha points are a dedicated points system for assessing user activity, primarily used to measure your participation in the Binance Alpha section and the Binance wallet ecosystem. The level of points directly determines your eligibility to participate in token generation events (TGE) or Alpha token airdrops. In simple terms, points are your "ticket"; the higher the points, the more opportunities you have.

1.2 What are Binance Alpha Tokens?

Binance Alpha tokens refer to a special category of tokens displayed in the Binance Alpha section. Binance Alpha officially launched on December 17, 2024, aiming to discover early projects with growth potential in the Web3 ecosystem. These tokens are typically from emerging projects, some of which may have the opportunity to be listed on the Binance spot market in the future, but not all tokens will successfully list, so investment should be approached with caution.

1.3 How are Points Calculated?

Binance Alpha points consist of two parts: balance points and trading volume points, with the final score being the average total over the past 15 days. Daily points are calculated based on your asset balance and trading behavior, with snapshots taken in UTC time to ensure fair participation for global users.

· Balance Points: Based on your total asset balance in your Binance CEX account (main account) and non-custodial wallets (including Alpha tokens and tokens that were previously displayed in the Alpha section and are now listed on the spot market). The balances of sub-accounts are merged into the main account for calculation, and points cannot be accumulated by dispersing funds.

· Trading Volume Points: Based on the total amount spent on purchasing Alpha tokens in the Binance Alpha platform and non-custodial wallets (only purchases are counted, sales are not included). Trading volume points only consider the purchase amount and are not affected by subsequent sales. For example, if you buy tokens worth $600 and later sell $500, the points are still calculated based on the $600. The token value is calculated at the market price equivalent in USD at the time of the transaction to ensure fairness in points.

Even more enticing, starting May 1, Binance launched a double points event. If you purchase Alpha tokens through the Binance Smart Chain (BSC) or use limit orders to buy any Alpha tokens, the trading volume is directly counted as double. For instance, a $10 BSC transaction will be counted as $20, directly earning you 10 points. This "buy one get one free" benefit is a boon for scoring players.

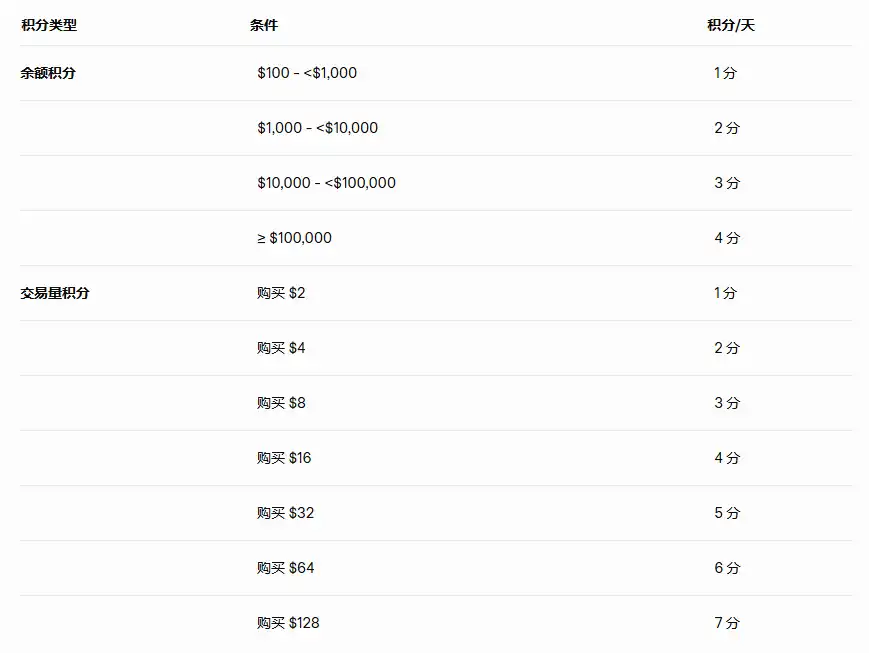

To better understand the points rules, we have organized the following table to show the specific calculation methods for balance points and trading volume points:

Note: Trading volume points earn an additional point for each doubling, and balance snapshots are taken in UTC.

From this table, you can clearly see that balance points grow slowly, while the doubling mechanism for trading volume points makes it the main force for scoring.

Chapter 2: What are Points Useful For? The Returns Can Be Significant

You might be wondering, what's the point of all this effort to accumulate points? The answer is: it's very useful! Alpha points directly determine whether you can participate in TGE and airdrop activities. TGE is an opportunity for early investment in high-potential projects, with returns often being several times or even dozens of times. Airdrops are synonymous with "freebies"; for example, the recent $BOOP airdrop allows you to receive tokens for free as long as you meet the points threshold, which could be worth hundreds of dollars.

Not to mention some cases from April. Some players, with a precise grasp of the points rules, scored points and participated in activities, directly earning over $2,000 in profit. Such returns are hard to resist! Especially with the launch of the double points event, the threshold has been significantly lowered, providing everyone with a great opportunity to "get on board." If you miss this wave, the subsequent competition will only become fiercer.

Chapter 3: Upgrading Scoring Strategies, Low Cost is Key

Now we get to the main topic: how to efficiently accumulate points without making your wallet "cry"? The goal is to average 10-12 points per day, aiming to reach 150-180 points within 30 days, while keeping trading costs (fees and slippage) within a reasonable range. Here are three optimization strategies that combine the latest rules and on-chain trends to help you achieve more with less effort.

3.1 Double Points Benefits: The Clever Use of BSC and Limit Orders

The double points event is currently the biggest benefit, especially suitable for operations on the BSC chain. BSC's gas fees are extremely low, usually only $0.01 to $0.03 per transaction, making it very cost-effective. On-chain data shows that tokens like $B2 have a trading volume share of up to 13%, with good liquidity and low price volatility, making them ideal for high-frequency trading.

How to operate specifically? Suppose you trade $10 daily on BSC; during the event, this will be counted as $20, directly earning you 10 points, easily achieving your daily goal. If you use limit orders, the effect is even better. A limit order means you set a buy price (slightly lower than the market price) and a sell price (slightly higher than the market price). For example, buy at $5 and sell at $5.02, repeating the operation, which can accumulate trading volume while keeping slippage between 0.1% and 0.2%. This way, over 30 days, you could accumulate 300 points with trading costs around $30 to $60, which is quite economical.

3.2 Cost-Effectiveness of Low Gas Chains: Solana and Sonic Working Together

If you are more focused on cost control, Solana and Sonic are two chains worth trying. Solana's gas fees are usually less than $0.01, and the trading volume share of the popular on-chain token $KMNO exceeds 30%, with excellent liquidity, suitable for small, high-frequency trading. The Sonic chain has even lower fees and recently has promotional bonuses, making the token $Anon a good choice.

A feasible plan is to trade $100 to $200 daily on the Sonic chain. Each transaction could be $2 to $5, completing 50 to 100 transactions, resulting in a base score of 50 to 100 points. With the double bonus, this could reach 100 to 200 points. Slippage can be controlled at 0.1%, with daily costs around $2, totaling $60 over 30 days, allowing you to score 3,000 points. The operational logic for Solana is similar, but its tokens are more mature, making it suitable for novice players.

3.3 Scoring While Investing: A Win-Win Approach with Potential Tokens

If you have a certain judgment of the market, you can try the "scoring + investing" approach. Choose some tokens with appreciation potential, such as $gork, which has recently ranked in the top three for trading volume and has considerable market interest. When operating, trade $5 to $10 each time, accumulating purchases and holding some while waiting for appreciation. You can also use limit orders to set low buy and high sell prices to reduce costs.

The beauty of this method is that you can not only earn points but also potentially gain from token appreciation. For example, if you invest $300 to buy $gork and score 300 points in 30 days, if the token appreciates by 50%, you could earn an additional $150, easily covering the $60 trading cost. However, be cautious to choose tokens with stable K-line trends to avoid chasing highs and prevent sudden price drops that could lead to losses.

To help you choose the strategy that suits you best, we have compared the three methods:

From the table, it can be seen that the BSC strategy is suitable for players pursuing stable efficiency, the Solana/Sonic strategy has low costs and high points, while the potential token strategy may bring additional returns but carries slightly higher risks. You can choose the most suitable plan based on your needs.

Chapter 4: Breaking Through Bottlenecks, Sprinting Towards Higher Goals

The points world has never been smooth sailing. Currently, many players are approaching 150 points, and the average of 10-12 points per day seems stable, but trying to sprint to 180 points or even higher feels like hitting an "invisible wall." Don't panic; here are a few tricks to help you break through the bottleneck and move towards higher goals.

Increase Trading Volume, Sprint for High Daily Points

Currently, the average of 10-12 points per day is mainly based on a daily trading volume of $20-24 (after double bonuses). If you want to break through the bottleneck, try increasing your daily trading volume to $200. With the double bonus, this equates to a trading volume of $400, allowing you to earn 200 points in a single day. Maintaining this pace for a few days will quickly widen the gap in points. However, be aware that as trading volume increases, costs will also rise; it is advisable to operate in batches, trading $5-10 each time to avoid the slippage risk associated with large one-time trades.

Multi-Chain Collaboration, Doubling Efficiency

Operating on a single chain may lead to an efficiency bottleneck; consider trying multi-chain collaboration. For example, simultaneously scoring on BSC, Solana, and Sonic, trading $50-70 on each chain daily adds up to $150-210, easily reaching an average of 200 points per day. BSC is suitable for high-frequency trading, Solana has low costs, and Sonic may have promotional bonuses. Each has its advantages, and combining them not only diversifies risk but also enhances overall efficiency. Especially on the Sonic chain, recent activities may bring additional point rewards, making it worthwhile to invest more effort.

Optimize Trading Time, Seize Low Volatility Windows

Market fluctuations significantly impact scoring efficiency. If you trade during periods of severe price volatility, slippage may increase dramatically, affecting cost control. It is advisable to choose relatively calm market periods, such as avoiding the volatility following major news releases or trading during the Asian session (8 AM to 2 PM Beijing time), when market liquidity is more stable and slippage can usually be kept within 0.1%. Properly scheduling your trading time can elevate your scoring efficiency.

Utilize Tools to Enhance Operational Efficiency

If you are manually trading every day, the time cost may leave you feeling fatigued. Consider trying some automation tools, such as setting up automated trading scripts through the Binance API, pre-setting limit order buy and sell prices, allowing the program to handle high-frequency trading for you. This method is particularly suitable for players with a certain technical foundation, as it can save a significant amount of time while ensuring trading stability. However, be sure to test your strategy before using tools to avoid losses due to incorrect settings.

Chapter 5: Risk Control, Seeking Victory with Stability

While scoring can be exciting, it shouldn't leave your wallet "drained." In the points world, seeking victory with stability is the long-term strategy. Here are several key risk control points to ensure your scoring journey is both efficient and safe.

· Cost Management: Keep Wear and Tear to a Minimum: The core of scoring lies in cost control. Ideally, daily fees and slippage costs should be kept below $2, with total costs over 30 days not exceeding $60. How to achieve this? First, choose tokens with high liquidity, such as $KMNO or $B2; trading $1,024 in volume may incur only $2 in slippage, offering excellent cost-effectiveness. Second, make good use of limit orders, setting reasonable buy and sell price spreads (e.g., 0.1%-0.2%) to avoid additional losses from market orders. Finally, try to operate on chains with low gas fees, such as Solana and Sonic, to avoid high gas fees associated with Ethereum.

· Market Risk: Don’t Let Volatility "Steal" Your Profits: Market fluctuations are the arch-nemesis of scoring. If you buy at a price peak and encounter a sudden drop, you could lose several points, making it not worth it. How to avoid this? First, don’t chase highs and lows; choose tokens with stable K-line trends for trading, such as $KMNO, which has high trading volume and low volatility. Second, pay attention to market sentiment by observing token trading volume and price trends through on-chain data dashboards (like Dune), avoiding periods of abnormal volatility. If you are a beginner, start with small trades to gradually familiarize yourself with market rhythms.

· Fund Safety: Diversified Operations for Greater Peace of Mind: Focusing all your efforts on a single token may be simple, but it also carries greater risk. If that token suddenly plummets or the project faces a black swan event, your funds could take a significant hit. A better approach is to diversify your operations, allocating funds across multiple tokens, such as trading $B2, $KMNO, and $gork simultaneously, with 30%-40% of funds allocated to each token. This way, even if one token encounters issues, the others can help "cushion" the blow, making overall risk more manageable.

· Compliance and Efficiency: Dual Assurance of Rules and Tools: Always adhere to platform rules while scoring to avoid account restrictions due to abnormal operations. For example, excessively frequent trading may trigger risk control; it is advisable to limit trading frequency to no more than 5 trades per minute. Additionally, if time is limited, consider using the Binance API to set up automated trading, pre-setting your trading strategy to save time and enhance efficiency. However, be sure to read the platform's terms of use carefully to ensure compliance; otherwise, it may lead to losses.

Chapter 6: Future Trends, Seize the Window of Opportunity

The competition for Alpha points will only become more intense, and future trends are worth planning for in advance. The current points rules and activities may represent your last chance for a "curve overtaking." Here are several trends and suggestions worth paying attention to.

Points Threshold: Likely to Exceed 200 Points

As more players join, the points threshold will inevitably rise. Currently, the $BOOP airdrop requires 137 points, and some popular projects' TGEs may demand even higher. It is expected that within the next month, the points threshold may exceed 180-200 points. If your current points are around 150, the next 30 days are crucial. Maintain an average of 10-12 points per day while taking advantage of double points activities to strive for a higher position before the threshold increases.

Activity Window: Don’t Miss the Double Points Opportunity

The double points event that started on May 1 is currently the biggest window of opportunity. However, such events will not last indefinitely and may end in the coming weeks. Once the event concludes, scoring efficiency will drop significantly, and the points gap will widen further. Therefore, now is the perfect time to accelerate your scoring. Prioritize utilizing the BSC chain and limit orders to maximize the advantages of doubling your trading volume, laying a solid foundation for future competition.

Emerging Chain Opportunities: Sonic’s Potential is Not Exhausted

As an emerging ecosystem, the Sonic chain has recently launched activities that have attracted many players. On-chain data shows that the trading volume of the Sonic chain token $Anon is rapidly increasing, and there may be more incentive activities in the future, such as additional point bonuses or token airdrops. If you want to gain additional returns beyond points, consider increasing your trading volume on the Sonic chain while keeping an eye on official announcements to participate in new activities promptly.

Strategy Adjustments: Flexibly Respond to New Changes

The points world is ever-changing, and rules and market conditions may adjust at any time. For example, Binance may introduce new token support or adjust the calculation method for double points. It is advisable to regularly check official announcements and monitor on-chain data dashboards like Dune to understand the latest trading volumes and token trends. Flexibly adjust your strategy based on market changes, such as switching to other chains or tokens when trading volumes for popular tokens decline, to maintain an efficient scoring rhythm.

Conclusion: In the Points Arena, Wisdom Wins

The Binance Alpha points system opens a door to Web3 opportunities for players. Whether leveraging BSC's double bonuses, choosing low-cost trading on Solana and Sonic, or achieving a win-win through potential tokens, the core of success lies in low costs and sustained action. There are no shortcuts in the points arena, but with strategy and wisdom, you can go further in this game. May your points steadily rise, unlocking the Web3 dividends that belong to you!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。