Author: 0xShinChan, Crypto KOL

Compiled by: Felix, PANews

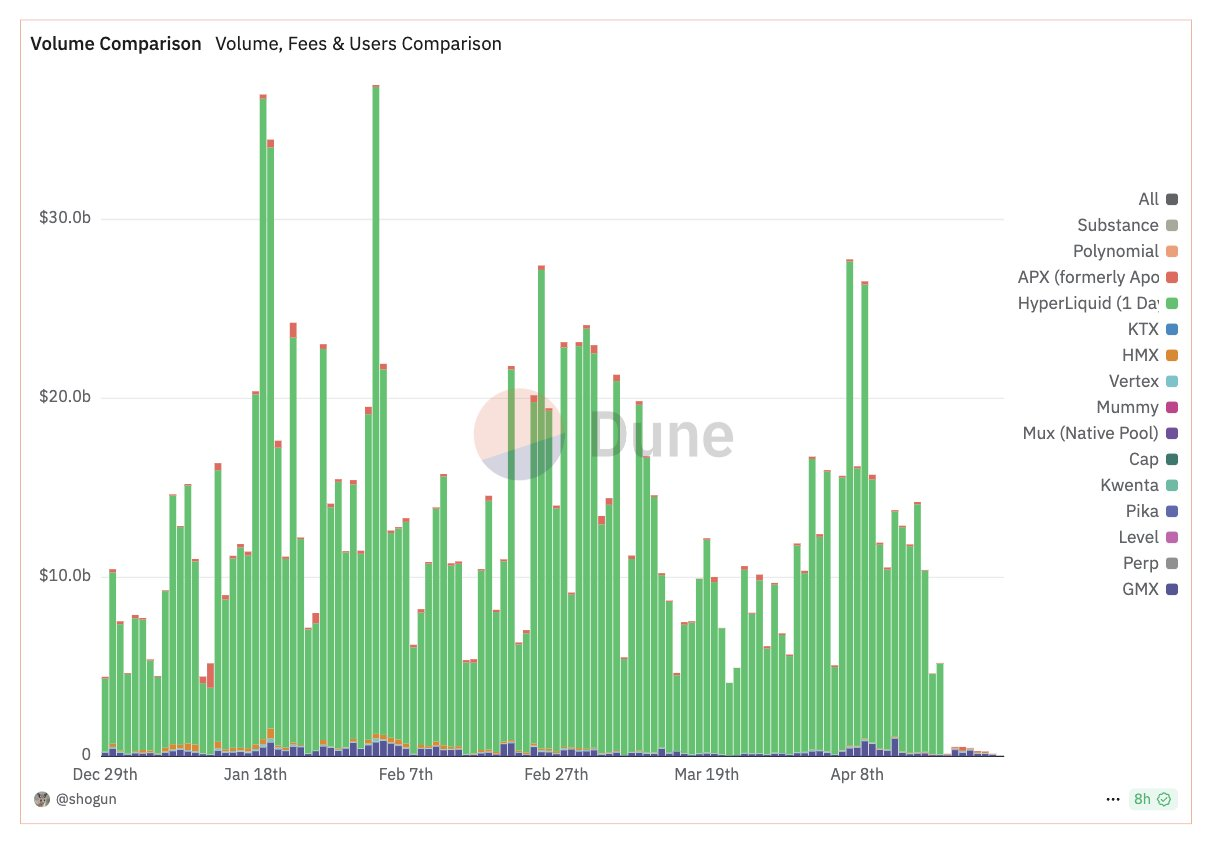

The post-FTX era has completely changed the trading landscape, driving a large number of users towards decentralized perpetual contract exchanges (Perp DEX). The daily trading volume on these platforms now often exceeds $30 billion, indicating a significant demand for decentralized derivatives.

However, the fragmented nature of early Perp DEXs was often affected by UI/UX (user interface/user experience) usability, liquidity depth, and the reliability of price feeds, hindering their widespread adoption. Starting in 2024, the market landscape began to change, marked by the emergence of innovative models such as GMX PVP and dYdX order books. Today, lending, DEX, and yield trading protocol teams on the Sui Network are enriching their product lines, including perpetual contract trading.

Advantages of Sui in Perp DEX

Sui actually offers several compelling features that make it a strong contender for building perpetual DEXs.

High performance and low latency: Sui's parallel transaction processing enables high throughput and low latency, which are crucial for efficient order matching and a smooth trading experience on DEXs.

Object-centric data model: Sui's unique data model supports efficient storage and parallel processing of account and asset data.

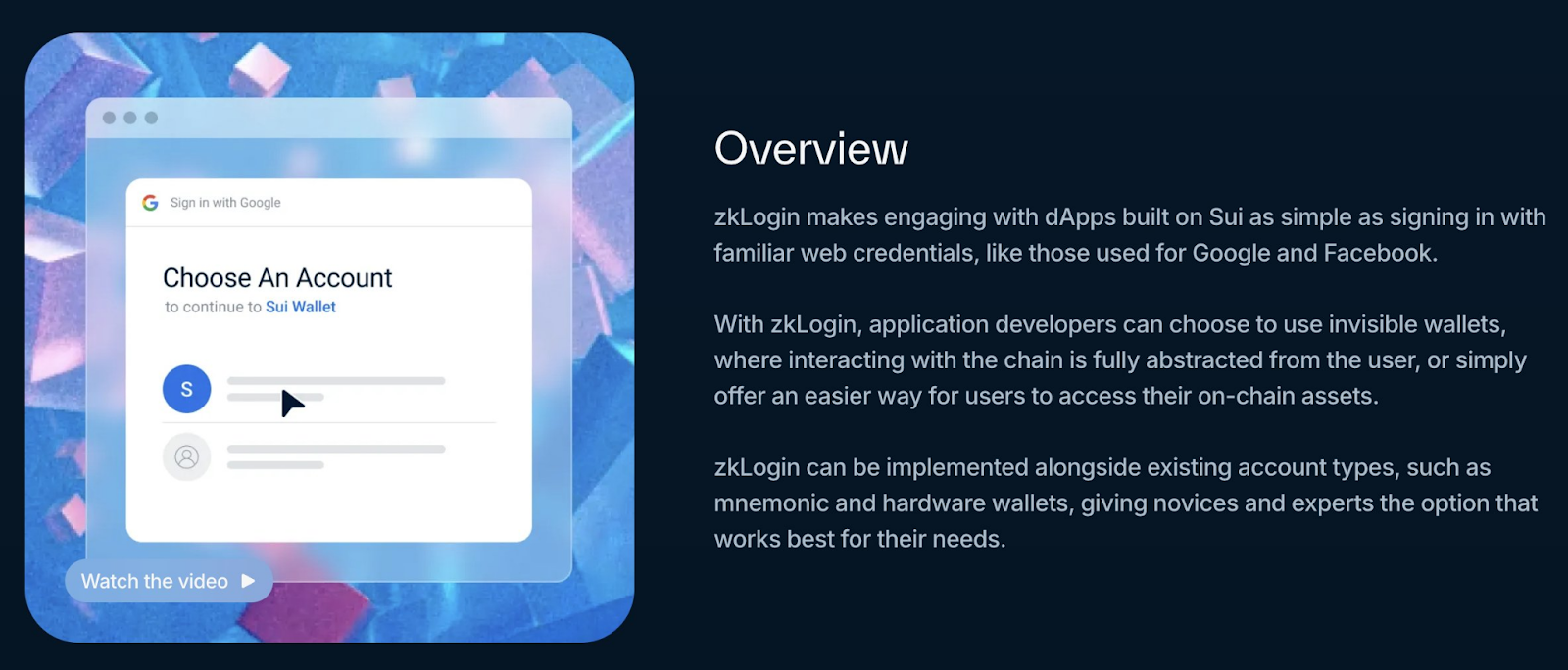

zkLogin enables seamless onboarding: The zkLogin feature simplifies the onboarding process for users, allowing them to create accounts using familiar Web2 credentials, reducing the experience barrier for new traders.

- Sponsored trading: Sui's sponsored trading feature can lower user costs and enhance the overall trading experience.

Here are the early builders of Sui:

Bluefin

Astros powered by NAVI Protocol

Aftermath Finance

Typus Finance GLP trading model

Kriya is also set to launch its Perp DEX soon.

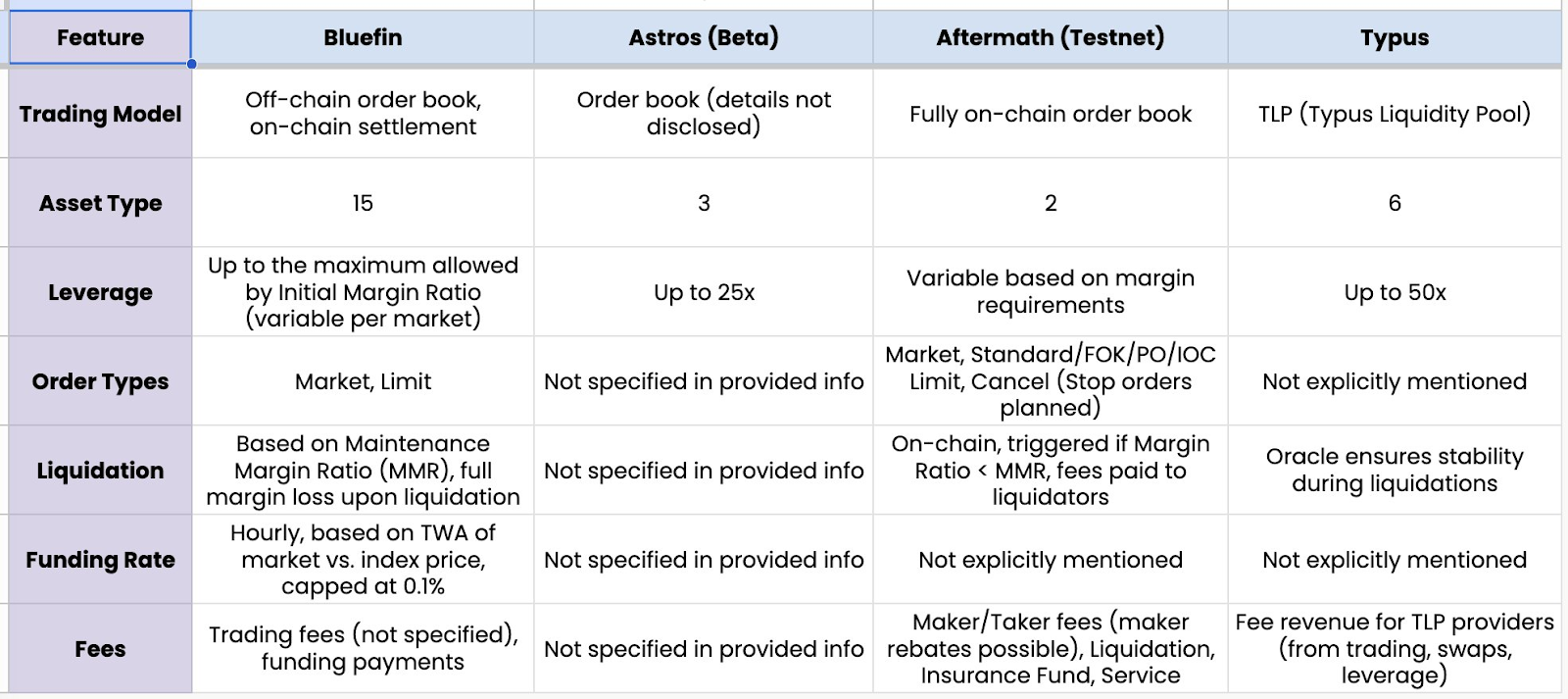

Before diving into each one, here is an overall comparison table.

Next, we will compare and study each protocol, analyzing their trading characteristics, protocol mechanisms, and performance.

Bluefin

As a veteran Perp DEX on Sui, Bluefin combines a fast-matching off-chain order book with a secure on-chain settlement engine. The protocol's liquidity is managed by professional market makers (MM):

Leveraging Sui's parallel transaction processing capabilities, Bluefin boasts extremely low order execution latency and fast on-chain final confirmation (under 500 milliseconds). Additionally, it supports nearly all perpetual contract assets on Sui, covering a wide range including $DEEP, $WAL, and $TRUMP.

Bluefin's platform sees a 24-hour perpetual contract trading volume between $40 million and $70 million, indicating high trading activity on the platform.

The BTC-PERP trading pair typically accounts for the largest share of daily trading volume (about 60%), followed by SUI-PERP and ETH-PERP.

According to Defi Llama data, the annual fees generated are approximately $4 million.

Excellent UI/UX. Users can utilize the trading view feature, with a clear interface that includes everything needed. Notably, Bluefin's zkLogin integration is supported by Sui. This simplifies the onboarding process for users and eliminates the complexity of wallets and mnemonic phrases.

Aftermath (Testnet)

Aftermath launched its Perp DEX testnet in November 2024. It operates entirely on-chain, unlike many Perp DEXs that rely on off-chain order book matching, Aftermath places the entire order book on-chain. As it is still in the testnet phase, statistical data is limited.

Aftermath focuses more on enhancing the liquidity/TVL of its DEX and existing liquidity pools. Future potential incentives and the official release of the Perp DEX may occur later.

Astros (Beta)

Astros is a DEX aggregator + Perp DEX built by the NAVI Protocol team. Like Bluefin and Aftermath, NAVI Protocol also employs an order book mechanism in its Perp DEX. Since it is currently in the testing phase, information about cooperative market makers (MM) and specific mechanisms is not yet detailed. Its 24-hour trading volume reaches $300 million, likely driven by its ongoing trader incentive program.

Typus Perp

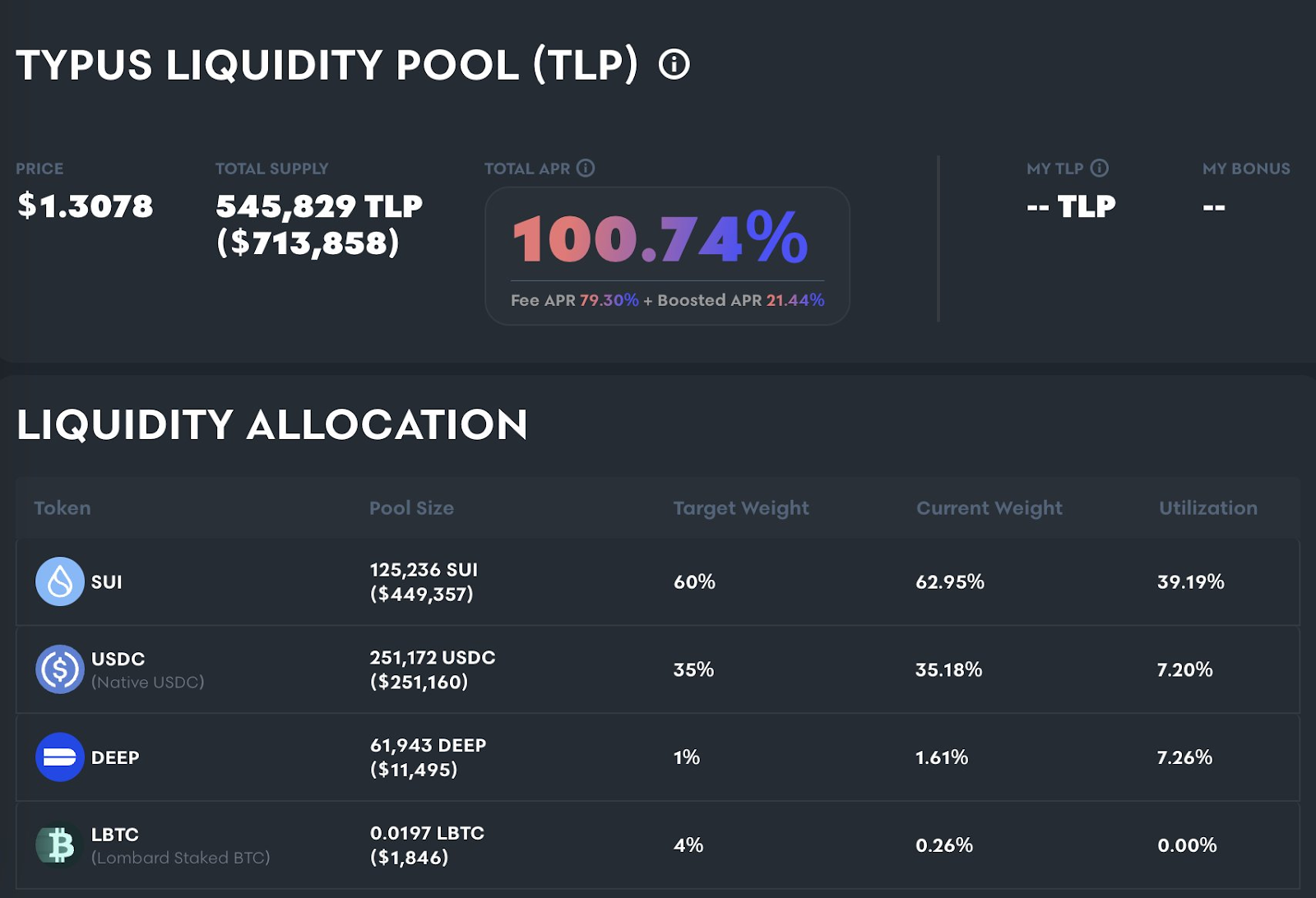

Typus Finance launched its GMX-style Perp DEX about two weeks ago. According to Defi Llama data, the 24-hour trading volume is approximately $200,000, with the TLP pool's TVL exceeding $700,000.

Assets in the TLP pool include $SUI, $USDC, $DEEP, and $LBTC, with an APR currently exceeding 100%.

Some Observations and Conclusions

The rise of order books: The Sui Perp DEX ecosystem currently shows a clear preference for the order book model, reflected both in protocol design choices and its dominant position in trading volume. This suggests that the order book mechanism either has inherent applicability within Sui's architecture or has gained market recognition from its user base.

Asset scarcity and the allure of memes: The range of assets supported by Sui Network Perp DEX is noticeably limited, representing potential opportunities. If a protocol can quickly embrace the highly volatile yet profitable memecoin trading space (which has a growing cultural foundation on Sui), leveraging the inherent speculation of these assets could drive an increase in platform trading volume.

The nascent stage and the necessity of incentive mechanisms: Compared to the mature and highly liquid Perp DEX ecosystems on EVM and Solana, Sui's cumulative trading volume and TVL are still in their infancy. Given the existing functionality sets and available features of these alternative chains, attracting traders to Sui Network's Perp DEX may require more than just technical innovation; highly attractive incentive mechanisms may be the key driver to attract speculative capital and significantly boost the growth of the Perp DEX ecosystem.

Related reading: Overview of Three Perp Dex Mechanisms: Hyperliquid vs. Jupiter vs. GMX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。