Author: A Fox in Web3, Crypto KOL

Compiled by: Felix, PANews (This article has been edited)

Decentralized Finance (DeFi) is often compared to Traditional Finance (TradFi) and has become a vast and exponentially growing field within Web3. The goal of DeFi aligns closely with the often-heard phrase in the crypto space of "providing banking services to the unbanked."

The promise of providing global financial services without banks is a noble goal, and much of the allure of Web3 stems from this. This article aims to review the development of DeFi over the past year from the current perspective.

Overview

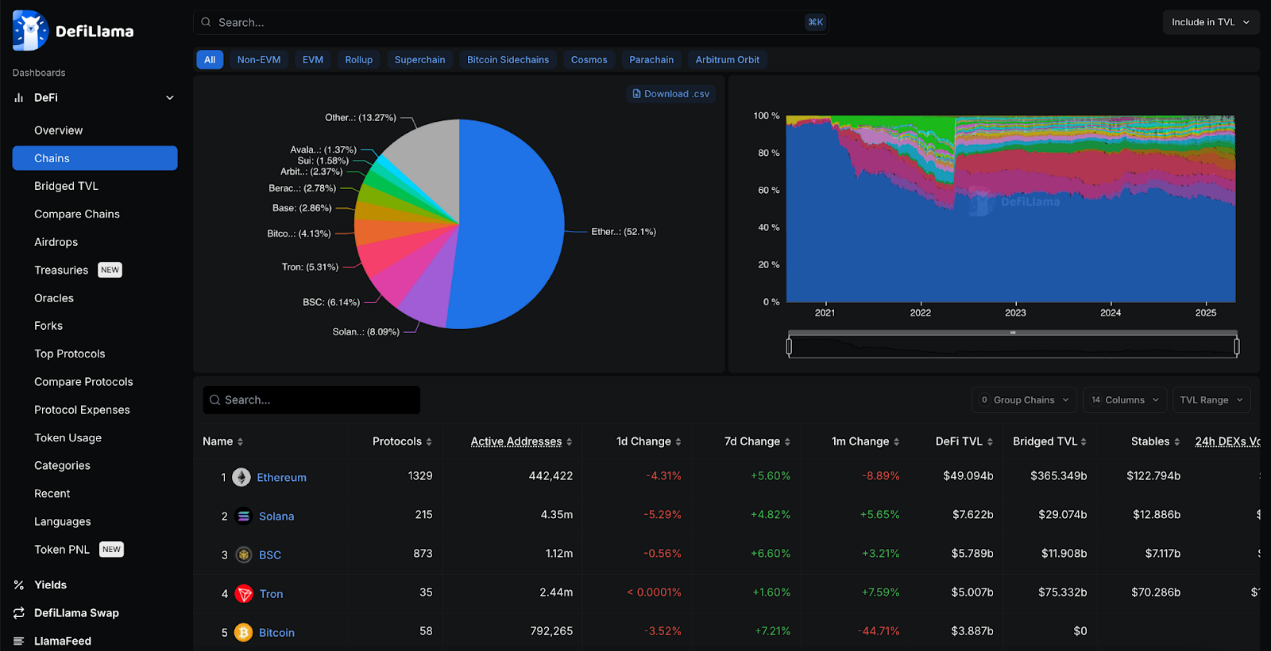

Total Value Locked (TVL) reaches $94.6 billion: The amount of locked funds across all DeFi protocols is substantial. However, considering the current total market capitalization of the crypto space is about $2.8 trillion, this still only accounts for around 3.3%, indicating significant room for growth. Since last year, TVL has grown by approximately 1.5 times, around $65.4 billion, but its share of the crypto space has remained relatively stable, previously at 3.5%.

The DeFiLlama chart starts from June 2018, showing that DeFi is still in its infancy, less than 7 years old. However, in November 2021, DeFi TVL reached an all-time high of $176 billion. We hope to see TVL reach this peak again.

Aave and Lido's TVL reaches $35.6 billion: Currently, over 37% of DeFi TVL is staked ETH in Aave and Lido. This indicates that both Aave and Lido hold dominant positions. Last year, Lido was in the lead, but Aave has since taken the top spot. Additionally, most DeFi activity occurs on Ethereum, which remains the most important blockchain.

Stablecoin market capitalization reaches $236 billion: Stablecoins account for over 8.3% of the $2.8 trillion crypto market, more than double that of DeFi. The growth rate of stablecoins continues to outpace DeFi TVL, indicating that they have truly achieved product-market fit.

The data in DeFiLlama is incredibly rich, making it somewhat overwhelming. Below, we further explore some of the categories and analyze key points.

Top Blockchains

Currently, Ethereum remains the primary participant in DeFi, accounting for 52% of TVL, though this is down from 58.3% last year. Solana, with 8% of TVL, has become the second-largest competitor, but is still more than six times smaller than Ethereum.

Solana and BSC have replaced Tron as the second and third largest public chains, pushing Tron from second to fourth place. The number of active addresses on these three chains far exceeds that of Ethereum, with Solana having over 4.3 million addresses compared to Ethereum's 442,000.

Ethereum has the most DeFi protocols, currently over 1,320, up from over 960 last year.

The Bitcoin network has 58 recorded DeFi protocols, up from 12 last year. Considering Bitcoin was not designed for smart contracts, it still accounts for over 4% of all DeFi TVL, approximately $3.8 billion.

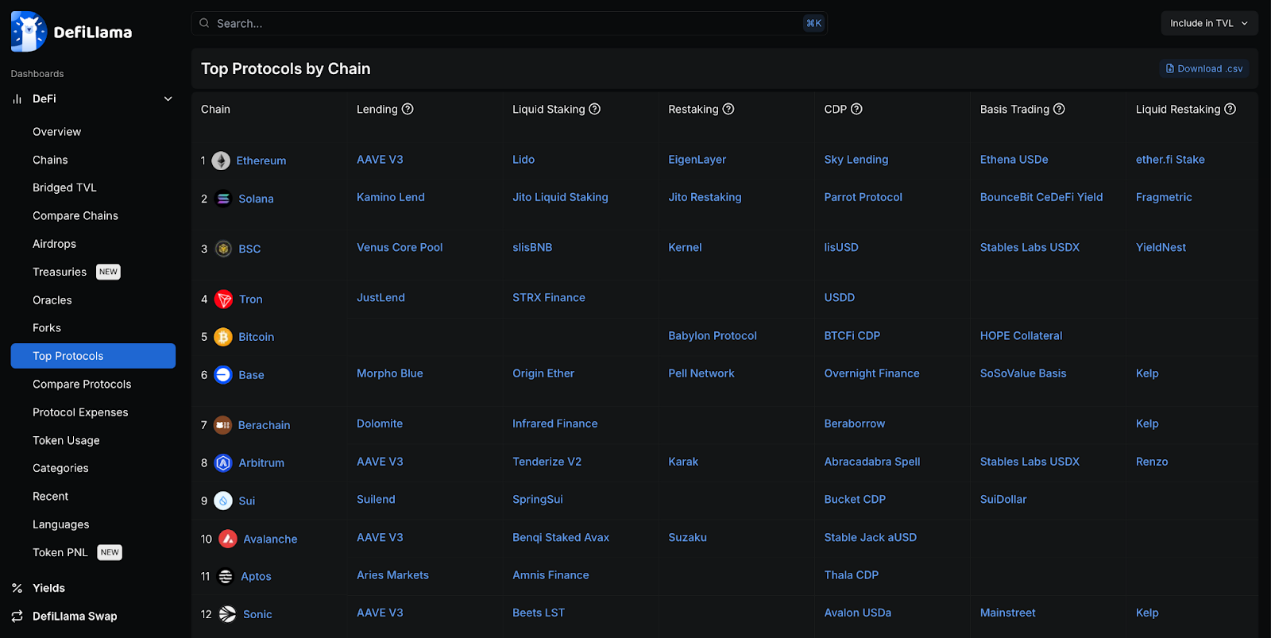

Top Protocols

Undoubtedly, Aave is the leading lending protocol among several EVM chains such as Ethereum, Sonic, Avalanche, and Arbitrum, but Morpho dominates on Base.

Most blockchains have their own lending and stablecoin projects. As many mainstream blockchains have their own protocols, restaking is also continuously evolving, with the largest participant being Eigen Layer, while Pell Network has the broadest coverage.

Stargate is the main cross-chain protocol in TVL across multiple chains.

Protocols on Ethereum dominate due to the massive trading volume of Ethereum DeFi.

Protocol Categories

Lending, cross-chain bridges, and liquid staking have the highest TVL, with relatively small gaps between them, ranging from $42 billion to $37 billion. Last year, liquid staking was far ahead, but the gap has narrowed, with lending and cross-chain bridges catching up.

Aave accounts for 44% of all lending, while Lido accounts for 43% of all liquid staking, making these two protocols the highest in TVL across the entire DeFi space.

The TVL of DEXs is much lower, around $18 billion, with leading protocols being Uniswap, Curve, and PancakeSwap, each operating on more than nine EVM chains. Even with lower TVL, this is the most profitable segment, with transaction fees reaching $5.9 million in the past 24 hours. Given this profitability, it is not surprising that there are over 1,600 DEX protocols.

The cross-chain bridge category is primarily dominated by wrapped Bitcoin equivalents like WBTC and Binance Bitcoin.

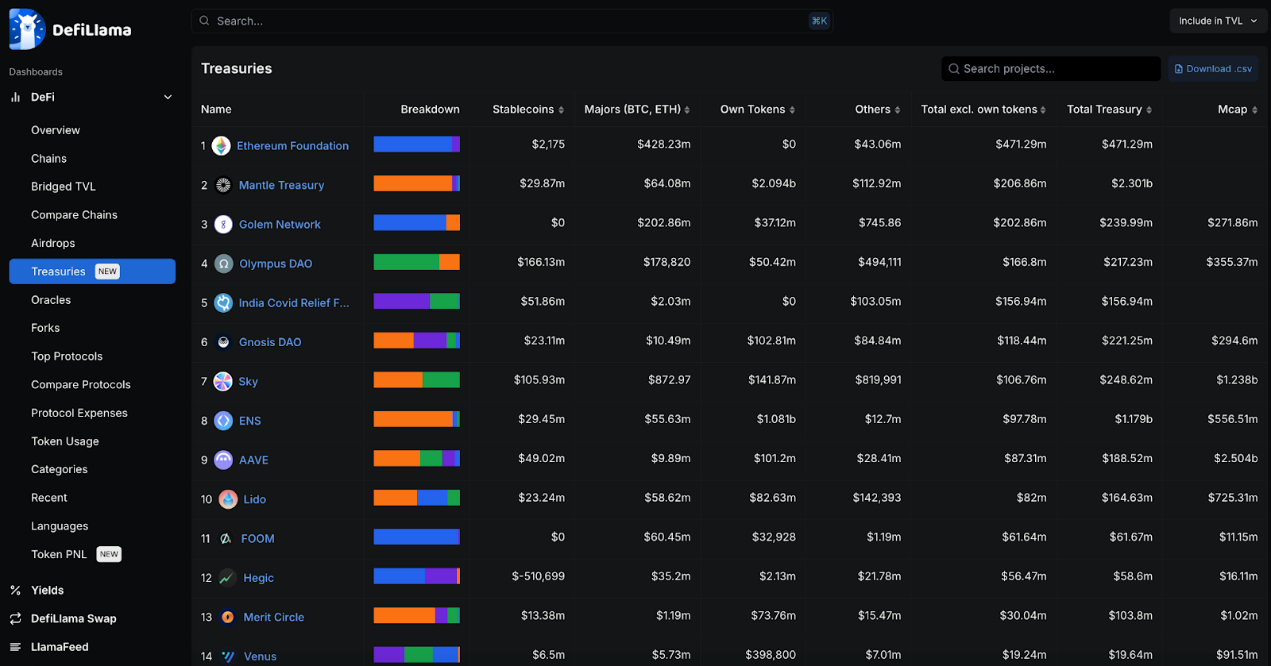

Foundations and Treasuries

The treasury held by the Ethereum Foundation is slightly above half of what it was a year ago and has seen a significant decline. Meanwhile, Mantle has a large treasury, but it is primarily valued in its own tokens.

Some Ethereum-related projects also dominate in terms of total treasury, such as Aave, ENS, Lido, and Sky. However, they mostly hold their own tokens.

When excluding their own tokens, the rankings become more varied. Few treasuries are primarily composed of stablecoins, so they are mainly affected by market fluctuations.

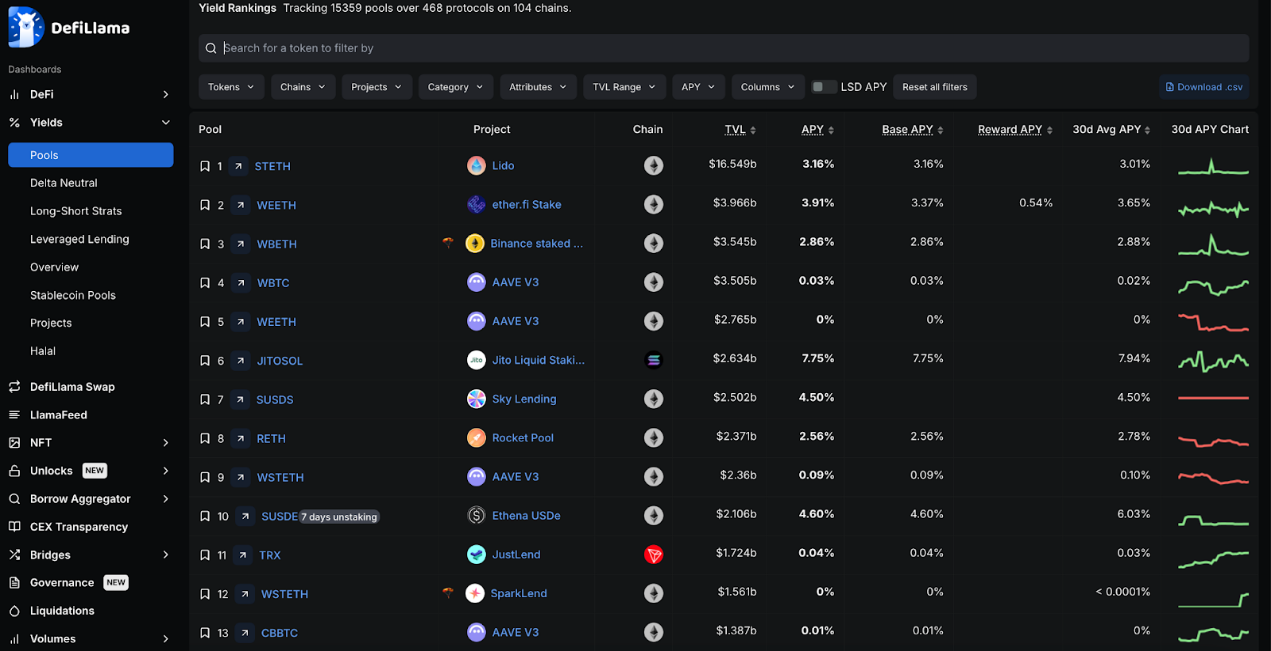

Yield

Most players deposit funds in Lido for yield, likely because most people have confidence in ETH as a long-term store of value, and Lido also dominates in liquid staking. Other ETH-based liquid staking protocols also hold significant positions, such as ether.fi.

JitoSOL's staked SOL yield reaches 7.75%, surpassing all other top yield products. Marinade and Jupiter's SOL annual interest rates are even higher, around 9%.

Sky Lending is the top low-risk stablecoin choice by TVL, with its SUSDS stablecoin holding over $2.5 billion and a yield of 4.5%.

DeFiLlama tracks over 15,000 liquidity pools across 468 protocols on 104 blockchains.

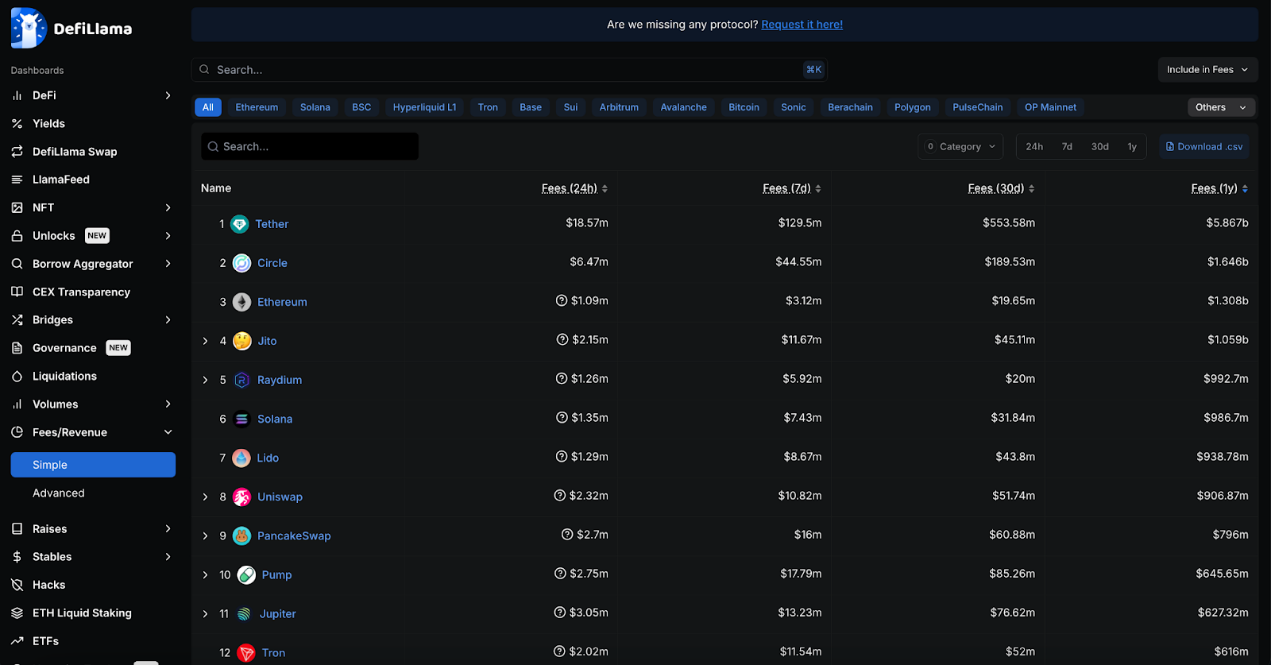

Fees

Tether and Circle's respective stablecoins are currently the largest fee-generating businesses in the crypto space. Tether alone generated over $5.8 billion in revenue over the past year.

Over the past year, gas fees on Ethereum remain one of the largest forms of fee expenditure, with total fees not far behind Circle, at $1.3 billion and $1.6 billion, respectively. However, Ethereum's fees are rapidly declining, and in the past 30 days, it hasn't even made it into the top 15. Nevertheless, Ethereum-based protocols Lido and Uniswap continue to earn high fees.

Solana's fee ecosystem has grown the fastest over the past year, with Jito, Raydium, and Pump.fun generating substantial fees. This is likely primarily due to the significant growth of memecoins on Solana.

Since last year, Bitcoin's fees have decreased by about half, and with the rise of many other competitors in the fee market, Bitcoin's ranking has dropped from second to fourteenth.

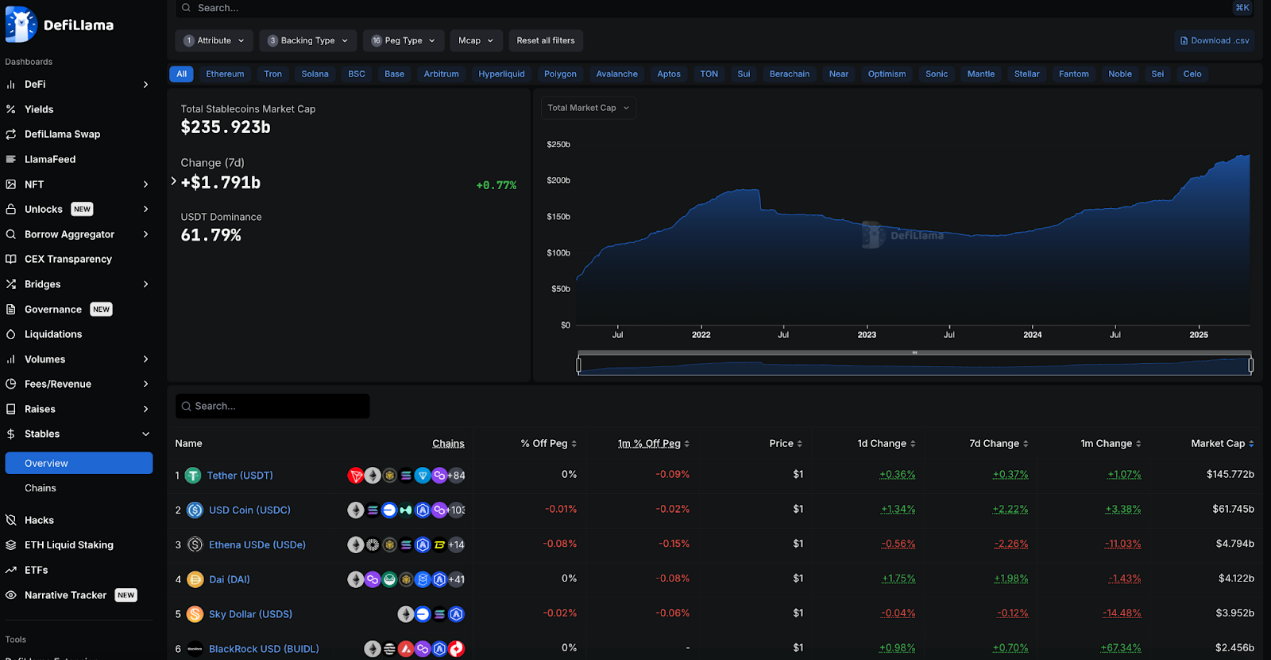

Stablecoins

The total market capitalization of stablecoins has nearly doubled, increasing from $136 billion last year to the current $235 billion. However, USDT and USDC still dominate, accounting for 62% and 26%, respectively, totaling 88% of the entire market.

The largest market share growth is seen in Ethena's USDe, which, despite not being launched a year ago, has now become the third-largest stablecoin, holding a 2% market share.

Sky issued the USDS token, breaking DAI's dominance. However, after merging the market capitalizations of DAI and USDS, Sky holds a 3.5% market share, still making it the third-largest market participant.

USDT, USDC, DAI/USDS, and USDe together account for approximately 93% of the stablecoin market, with a market capitalization exceeding $22 billion.

BlackRock's BUIDL fund represents a new entrant, indicating that TradFi also wants a piece of this market.

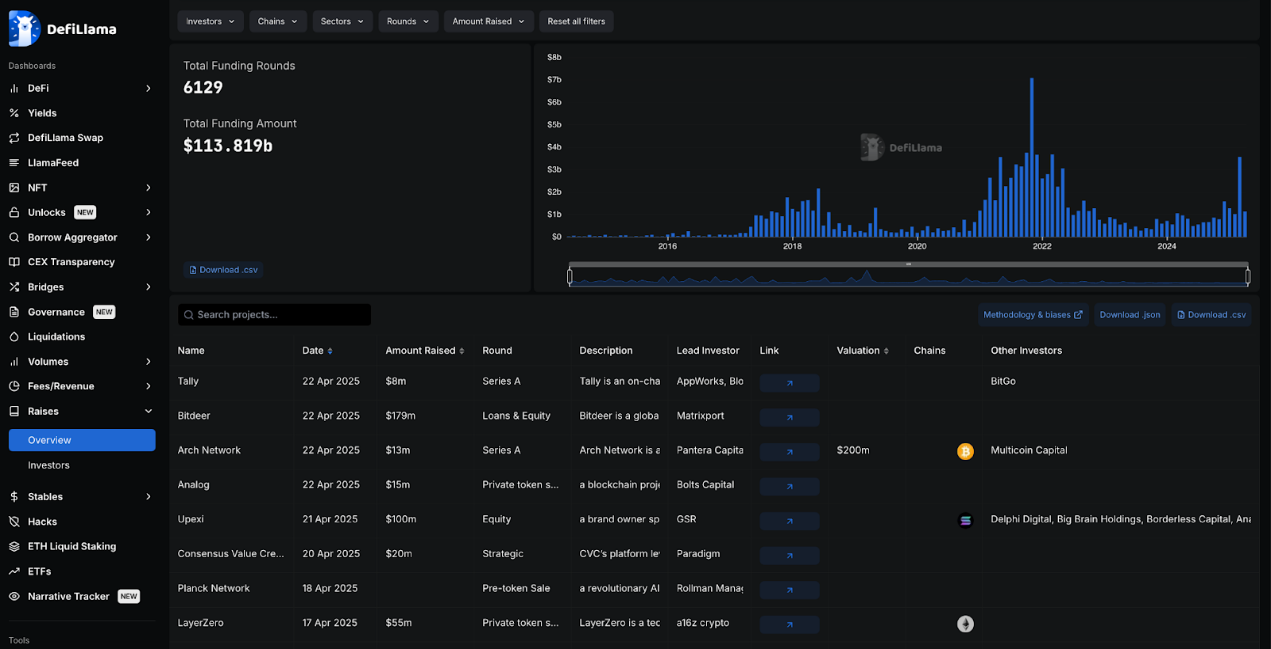

Financing

The DeFi sector has raised over $113 billion in financing, with a total of 6,129 funding rounds. The financing peaked from the end of 2021 to the beginning of 2022, but it is currently growing rapidly, exceeding $3.5 billion just last month.

FTX and Celsius are among the largest projects in the DeFi sector in terms of financing, raising $900 million and $750 million, respectively, while also being among the biggest failures in the field. EOS has a similar situation, with its $4 billion in financing nearly failing to materialize.

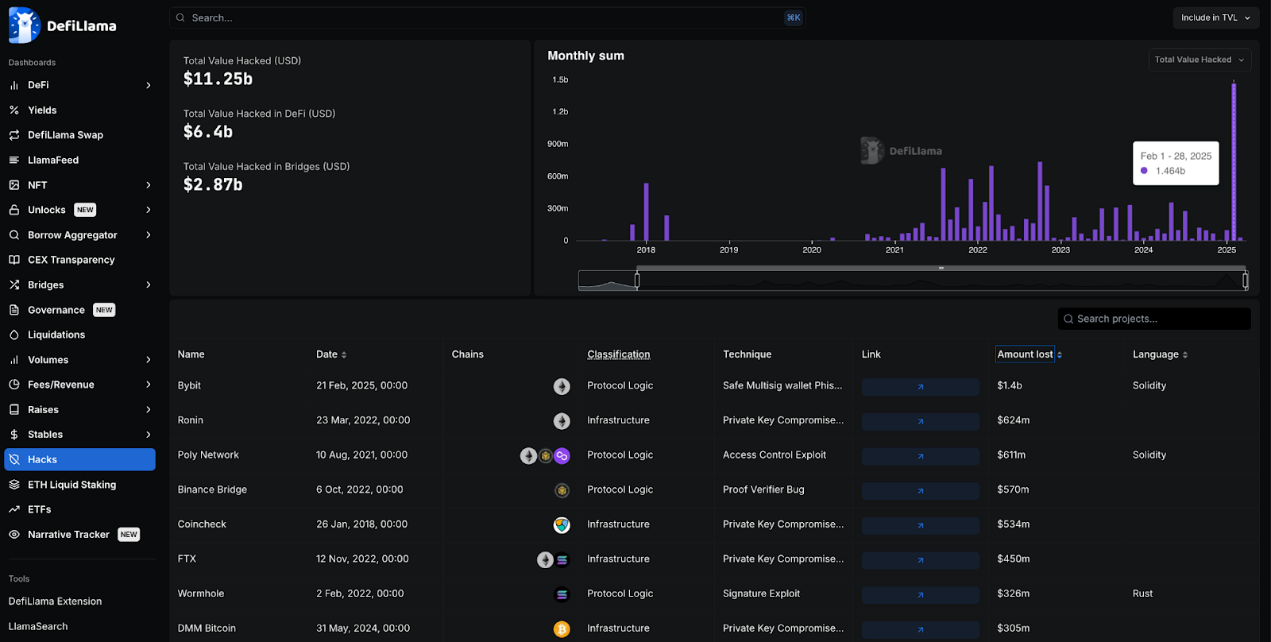

Hacks

The DeFi sector has suffered over $11.2 billion in hacks, with 25% coming from cross-chain bridges and the remainder from other DeFi companies and protocols.

In February of this year, ByBit was hacked in the largest single hack in crypto history, resulting in losses exceeding $1.4 billion. The second-largest hack occurred in 2022, targeting the Ronin network, leading to a loss of $624 million.

The North Korean organization Lazarus is responsible for both of these hacks, becoming the largest hacking organization in the crypto space.

Most large-scale hacks occur within the Ethereum ecosystem, likely because most of DeFi's liquidity is concentrated in the Ethereum ecosystem.

Conclusion

Overall, DeFi's trading volume is still primarily dominated by Ethereum and its EVM ecosystem (which has numerous L2s), from which DeFi has risen.

Solana has seen significant growth over the past year and is catching up, while Bitcoin has unexpectedly begun to develop its own DeFi ecosystem, even though it was not designed to be a smart contract platform. The Tron ecosystem seems to have fallen behind other ecosystems, but Tron remains an important hub for stablecoin activity.

Related articles: Brokerage Act repeal, CAKE governance attack… 10 recent thoughts on DeFi

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。