AERGO Coin Massive Crash Follows Binance Futures Listing Despite Pump

AERGO Skyrockets Then Crashes 65% After Binance Futures Listing

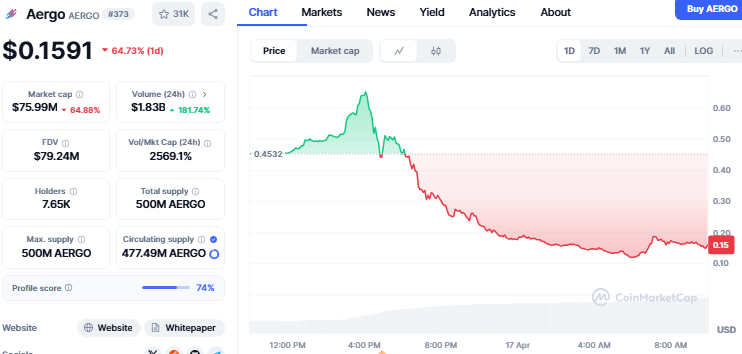

The token hit a new all-time high after two big exchange listings, Binance announced AERGO perpetual contracts, and DigiFinex listed the token for spot trading with USDT. These announcements sparked excitement in the crypto community. Its price jumped 23% to $0.51 in less than 24 hours. However, after the listing, the price quickly dropped 65%, falling to $0.15. What began as a positive move quickly turned into panic selling.

Shortly after the listing, its price experienced a sharp 65% decline, falling back to $0.15. The sudden crash raised concerns about the market's reaction to futures listings and fueled speculation that whales and short-sellers took advantage of the volatility.

The token is currently floating at $0.1591 after a drop of 64.73% in just 24 hours, its market cap has also dropped to $75.99 million. The trade volume is $1.83 billion after a rise of 181.74% in just 24 hours. The huge rise in trade volume, followed by a price drop, suggests a possible pump-and-dump scenario, where traders fueled the volume to push prices up before exiting, causing a sharp decline. This indicates short-term speculative activity and market manipulation.

Source: CoinMarketCap

This sudden drop caused concern in the crypto community. Analysts and traders criticized the exchange for listing the token in its market just a week after delisting it from spot markets. Investors even compare it with the MANTRA token .

Crypto analyst Crypto Gem called it a “dirty game,” saying Binance is taking advantage by listing tokens after big price pumps. Many traders questioned Binance’s motives, especially since AERGO had surged over 900% in a month.

Technical Indicators Turn Bearish After Futures Launch

Several key signals showed bearish sentiment after its price crash. The token became oversold when the RSI fell from 60 to 30. The MACD line crossed below the signal line, indicating a strong sell signal, and the MACD also went negative. The number of tokens traded on Huobi increased from 2 million to 7 million. Its volume increased 180% on Kraken , indicating a strong sell pressure on the exchanges.

These changes suggest that the market didn’t see the Binance Futures listing as good news. Instead, it looked like a chance for whales and short-sellers to exit. It isn’t the only one that crashed after the listing; ATA (Automata) also crashed after a Binance listing. This pattern is raising concerns about how tokens behave after such listings.

Binance Faces Backlash Over AERGO Listing

Exchange announced to list AERGO on April 16, 2025, via a tweet, revealing the introduction of perpetual contracts on its platform. Since many in the crypto community viewed the announcement as a major advancement for AERGO's market presence, it immediately attracted attention and excited them.

Source: X

Conclusion

The AERGO crash shows how fast market sentiment can shift from hype to panic in a single day. While major listings often signal growth, this event highlights the risks of listings, especially when tied to tokens with recent sharp price increases.

Traders are now more cautious, keeping an eye on listings that come after sudden price pumps. Many in the community are calling for more transparency from exchanges and better protection for retail investors.

Also read: Why Stratis Coin Price Jumped 70%? What’s Next for $STRAX Coin免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。