Source: Cointelegraph Original: "{title}"

Bitcoin (BTC) mining hash rate price — the daily revenue per unit of hash power consumed by miners to mine blocks — remains stable at around $48 per petahash per second (PH/s), despite a slight increase of 1.4% in Bitcoin mining difficulty.

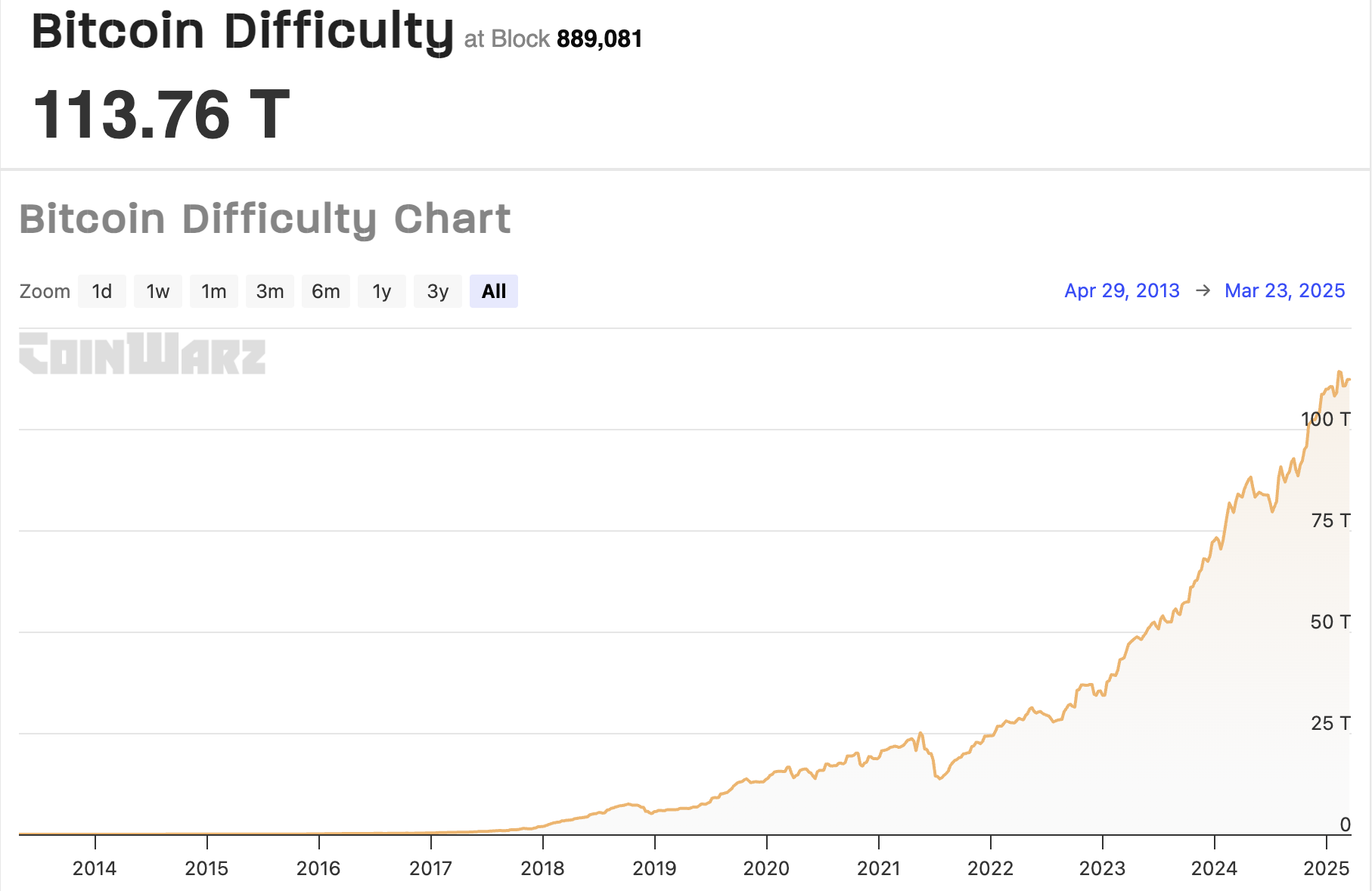

According to CoinWarz, on March 23, at block 88,908.1, Bitcoin mining difficulty rose to 1.1376 trillion, up from the previous period's difficulty of 1.121 trillion.

TheMinerMag reports that a hash rate price below $50 puts financial pressure on miners using older hardware such as Antminer S19XP and S19Pro.

Older hardware, combined with declining network transaction fees, could push some miners into unprofitable situations, forcing them to shut down their hardware until they upgrade their application-specific integrated circuits (ASICs) or the network conditions change.

Since the Bitcoin halving event in April 2024, mining companies have been struggling. That halving reduced the reward for each mined block to 3.125 bitcoins, overall increasing network difficulty, compounded by recent macroeconomic uncertainties leading to a downturn in the cryptocurrency market.

Bitcoin mining difficulty. Source: CoinWarz

Difficult Start for Miners in 2025

Research from financial services firm JPMorgan shows that in February 2025, the total market capitalization of publicly listed Bitcoin mining companies fell by 22%.

JPMorgan's report found that even those miners diversifying into artificial intelligence and high-performance computing data centers to offset revenue losses from mining activities are facing financial pressure.

The financial services company noted that the release of the open-source AI model DeepSeek R1 has put pressure on large AI data centers. The training cost of this model is only a fraction of leading models, yet its performance is comparable to closed-source AI products.

Although the hash rate of the Bitcoin network fluctuates in the short term, the long-term trend is a steady increase. Source: CryptoQuant

The hash rate of the Bitcoin network — the total computing power in the Bitcoin network — is steadily rising, which intensifies competition among miners who must consume more computing resources to remain profitable.

Concerns about a potential long-term trade war between the U.S. and Canada, along with ongoing tariff news headlines, have left miners feeling uneasy.

Canadian officials have threatened to impose tariffs on energy exports to the U.S., adding further pressure to an already struggling mining industry.

Related: Hive doubles down on Bitcoin hoarding strategy amid equity dilution and debt dependency crisis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。