Source: Cointelegraph Original: "{title}"

The Chief Operating Officer of Everstake, Bohdan Opryshko, told Cointelegraph that the new regulatory guidance in the U.S. allowing banks to become validators on blockchain networks is an important step for institutional adoption of cryptocurrencies, but it also exacerbates centralization risks.

On March 7, the Office of the Comptroller of the Currency (OCC) relaxed its stance on how banks can participate in cryptocurrency activities, stating that this includes allowing banks to engage in "independent node verification networks."

Opryshko noted that increased participation by U.S. banks in proof-of-stake networks like Ethereum and Solana could be a double-edged sword.

Opryshko told Cointelegraph on March 12: "If banks become the primary validators, power could become centralized, thereby reducing the decentralized nature of proof-of-stake networks."

He also added that the additional influx of funds into proof-of-stake networks could potentially lower staking yields, which might adversely affect smaller validators.

Opryshko stated: "If major institutional players like banks enter the staking market and suddenly stake large amounts of money, … this could lead to a significant reduction in staking rewards for all other participants."

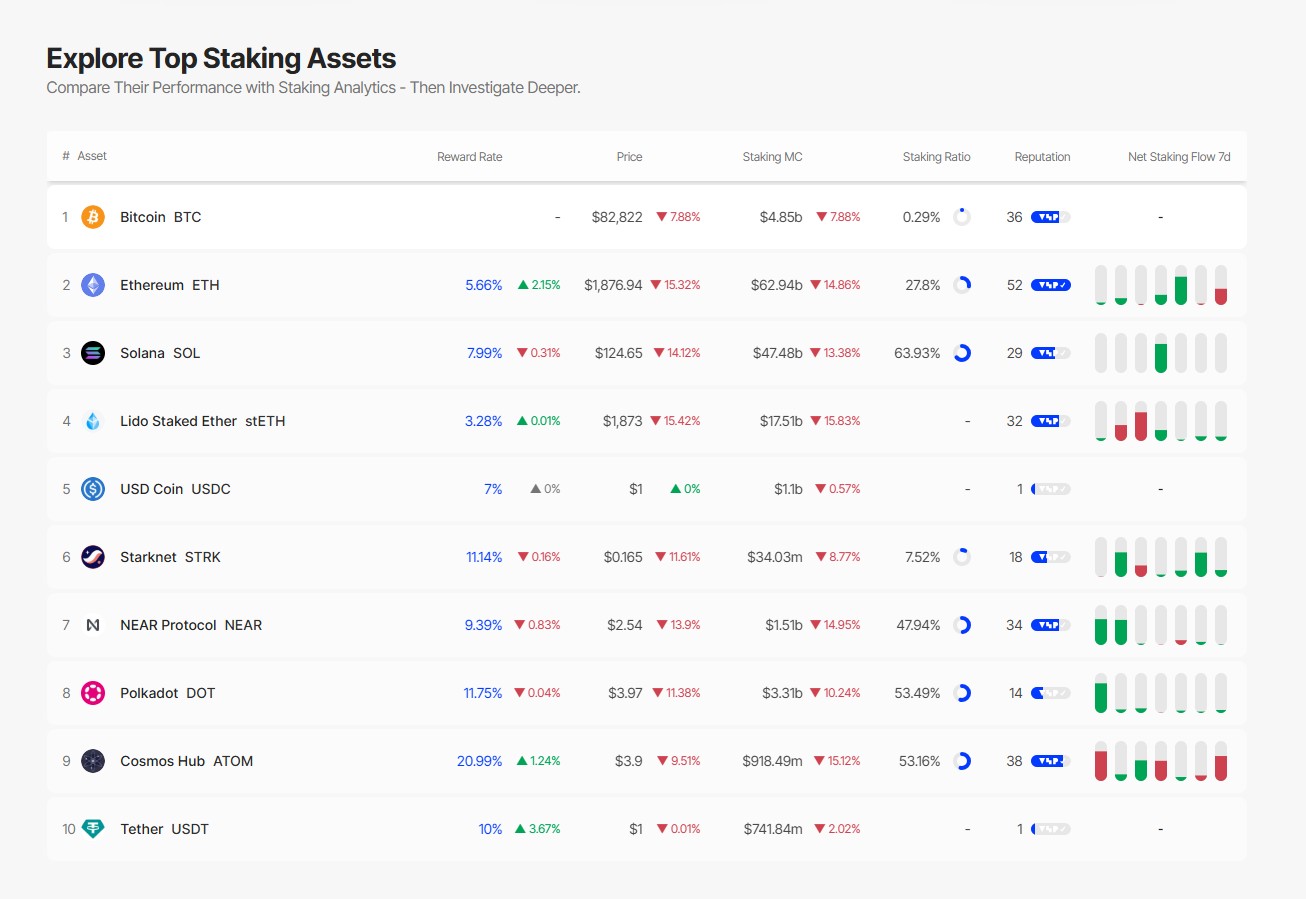

As of March 12, staking yields. Source: Staking Rewards

According to data from Staking Rewards, as of March 12, the annualized yield for Ethereum stakers is approximately 5.5%, while the yield for Solana stakers is close to 8%.

Proof of stake refers to securing the blockchain by depositing cryptocurrency as collateral with validators in exchange for rewards.

The Dilemma of Decentralization

Before the OCC issued this announcement, former U.S. President Trump had vowed to end a long-standing regulatory crackdown that limited cryptocurrency companies' access to banking services.

In June 2024, a lawsuit led by Coinbase resulted in the release of certain letters showing that U.S. banking regulators had requested some financial institutions to "pause" cryptocurrency banking activities, which peaked the cryptocurrency industry's anger over so-called "de-banking."

Trump had pledged to make the U.S. the "world capital of cryptocurrency," and in an executive order on January 23, he prioritized ensuring that agencies provide "fair and open access to banking services" for digital asset companies.

As of March 12, Anchorage Digital is the only federally chartered bank in the U.S. offering cryptocurrency staking services.

Related: Cboe seeks to add staking features to Fidelity's Ethereum ETF.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。