What does not kill me makes me stronger.

Written by: Deep Tide TechFlow

Another year of 312, a number that has left countless cryptocurrency investors feeling uneasy to this day.

On March 12, 2020, Thursday. After work, I curled up in my rental apartment surfing the internet. After 6:30 PM, my phone kept sounding alarms, and a horror story unfolded:

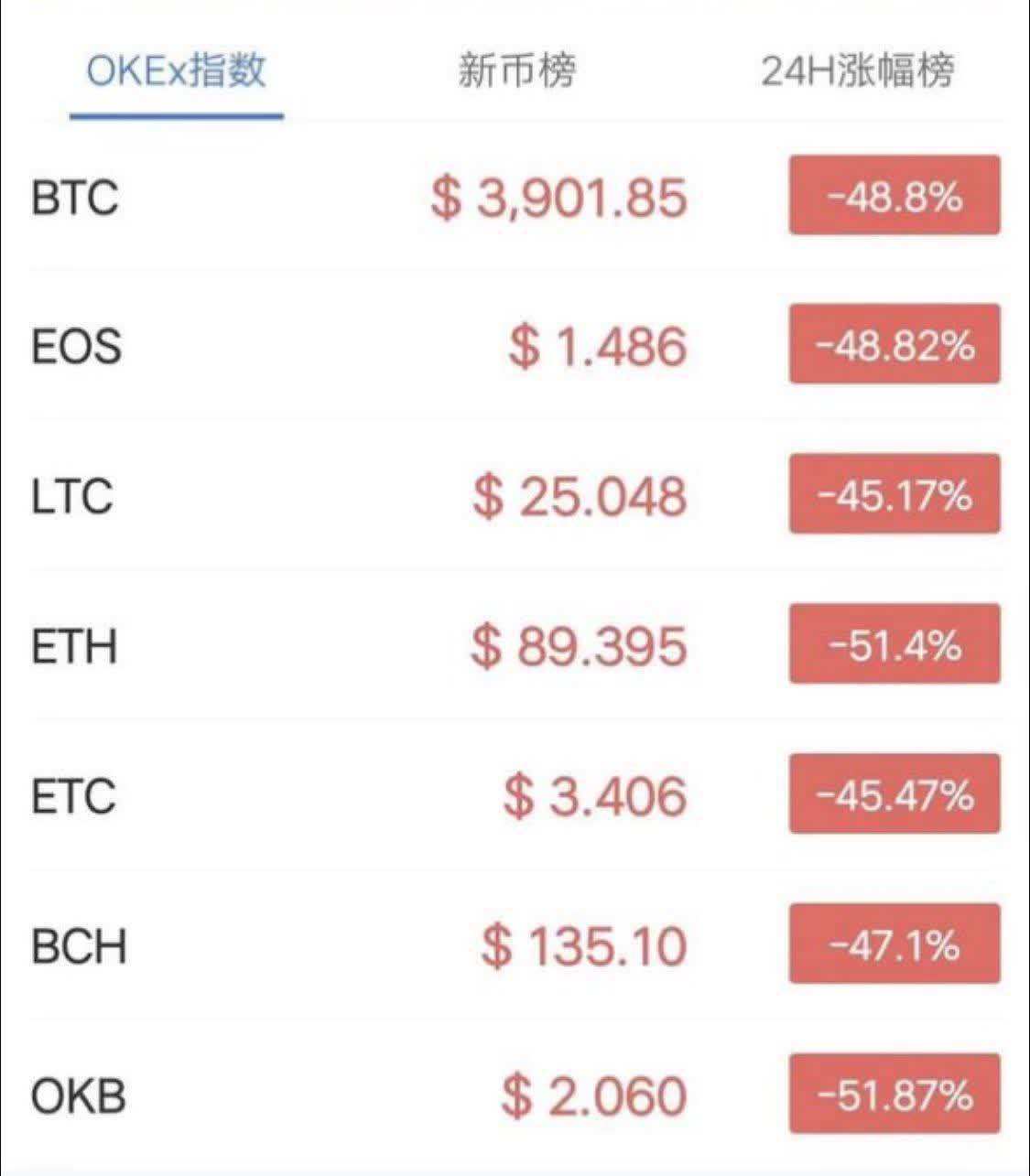

The price of Bitcoin plummeted from around $7,000 in a free fall, with no resistance, dropping to a low of $3,800, marking the largest single-day drop in Bitcoin's history.

Ethereum also crashed from around $200 to $90, a decline of over 50%.

Cryptocurrency faced the darkest day in history, with cries of despair echoing through various crypto communities. Shocked, I felt a sense of sorrow: Is the industry going to disappear? Should I change careers?

This was not an overreaction; on that day, panic spread like a plague. Peter Thiel's co-founder, Wang Li, also told his colleagues that night: This industry is finished.

Bitcoin continued to fall, from $7,000 to $6,000 to $5,000, with each drop triggering a chain of leveraged liquidations, leading to 100,000 people being liquidated. Even with 2-3x leverage, many were not spared; Ethereum kept declining, and the DeFi protocol MakerDAO also faced leveraged liquidations and a bad debt crisis…

Exchanges were overloaded, and many platforms crashed, creating an apocalyptic scene.

In this crisis moment, the largest derivatives platform at the time, BitMEX, went down. It was later widely believed in the industry that the BitMEX outage (pulling the plug) saved the industry; had it not been for the outage, Bitcoin would have faced an even greater price crisis.

The 312 crash was not an isolated event but a storm brought about by multiple intertwined factors:

Global pandemic outbreak: COVID-19 spread rapidly worldwide, triggering market panic;

Traditional financial market crash: The U.S. stock market experienced an unprecedented situation with two circuit breakers within a week, the Nasdaq index fell 8.4% in a single day, and the Dow Jones index recorded its largest single-day drop since 1987;

Oil price crisis: The oil price war between Saudi Arabia and Russia further exacerbated market panic, leading to a sharp drop in oil prices, which even briefly fell below zero.

These are external macro factors, while internally in the crypto market, the long-accumulated excessive leverage was detonated overnight, leading to panic selling that drained liquidity and exacerbated price declines.

In summary, the global financial market crash triggered by the COVID-19 pandemic, combined with the early structural flaws of the crypto market characterized by "high leverage + low liquidity," jointly created this crisis.

However, it was this crisis that became a turning point for the maturity of the crypto market.

After 312, Bitcoin embarked on a long and steady recovery path.

From the low of $3,800 in March 2020 to a historic high of nearly $69,000 in November 2021, and then to January 20, 2025, Bitcoin once broke through $108,000, with a maximum increase of over 28 times.

Ethereum rose from a low of $90 to a high of $4,800, an increase of over 53 times.

SOL dropped to a low of $0.5 and then surged to a high of $293, an increase of over 580 times.

More importantly, the 312 crisis spurred several innovations in the crypto industry:

Explosive growth of DeFi: After 312, DeFi (Decentralized Finance) ushered in DeFi Summer, marking the most dramatic wealth creation era in cryptocurrency history.

Accelerated institutional entry: Large institutions like MicroStrategy and Tesla began to include Bitcoin on their balance sheets, and El Salvador adopted Bitcoin as legal tender.

Market structure optimization: The crypto derivatives market became more mature, and liquidity provision mechanisms became more robust.

Every veteran in the crypto space who experienced 312 may look back with both fear and regret, fearing that the market might face such turmoil again and regretting not going all in to buy the dip. The cruelty and opportunities of the market often coexist.

Those projects and investors who survived 312 have all undergone extreme tests.

No matter how the market changes in the future, we have already witnessed the most extreme situations and can confidently say: We survived 312; what else is there to fear?

Since its inception, Bitcoin has been declared "dead" over 400 times. From the first major crash in 2011, to the Mt. Gox incident in 2014, to the bear market lows in 2018, and then to the massive drop on March 12, 2020, Bitcoin has experienced countless declines of up to 80% or even 90%.

However, after each collapse, Bitcoin has been able to rise from the ashes and create new historical highs. This extraordinary vitality perfectly embodies Nietzsche's words: "What does not kill me makes me stronger."

The history of Bitcoin teaches us that in this highly uncertain market, the most important thing is not short-term gains and losses, but long-term survival. As long as we survive, there is a chance to create new miracles.

As Warren Buffett said: "The first rule of investing is never lose money. The second rule is never forget the first rule." In the crypto market, this wisdom can be translated as: "The first rule is to survive, and the second rule is never forget the first rule."

Finally, let us repeat that statement: We survived 312; what else is there to fear?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。