In the coming years, inevitable government pressure will create opportunities for truly decentralized and private stablecoins.

Author: DC

Translation: Shenchao TechFlow

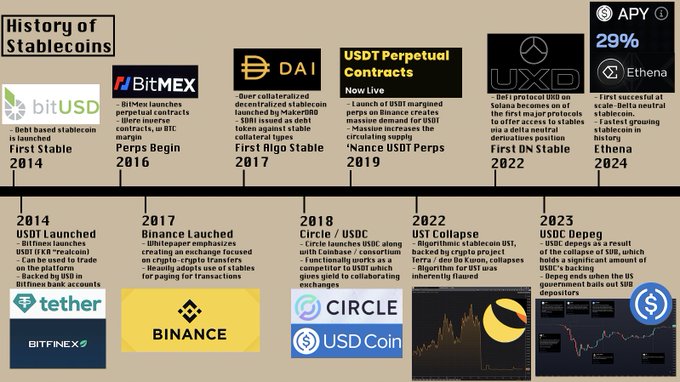

Stablecoins account for 2/3 of on-chain transactions, whether for exchanges, use in DeFi, or pure transfers. Initially, stablecoins gained attention through Tether—the first widely used stablecoin. Tether was created to address the banking restrictions faced by Bitfinex crypto users. Bitfinex launched USDTether, backed 1:1 by the US dollar. Since then, Tether has become popular, allowing traders to more easily seize arbitrage opportunities across exchanges using USDT. Tether transactions can be completed in just a few blocks (minutes), while wire transfers can take days.

Despite this crypto-specific beginning, the use of stablecoins has far exceeded their initial applications. They are now powerful tools for everyday currency transfers, increasingly used to earn yields and facilitate real-world transactions. Stablecoins account for about 5% of the total cryptocurrency market capitalization, and if we include the companies managing these stablecoins or blockchains like Tron, which primarily derive their value from stablecoin usage, stablecoins make up nearly 8% of the total cryptocurrency market capitalization.

However, despite such astonishing growth, there is still relatively limited content on why stablecoins are so popular and why tens of millions of users globally are replacing traditional financial systems with stablecoins. There is even less discussion about the many platforms and projects that have contributed to this remarkable expansion, as well as the types of users interacting with them. Therefore, this article will explain why stablecoins are so prevalent, who the participants in this field are, and who the main user groups of stablecoins are, while exploring how stablecoins are becoming the next significant evolution of currency.

A Brief History of the Dollar

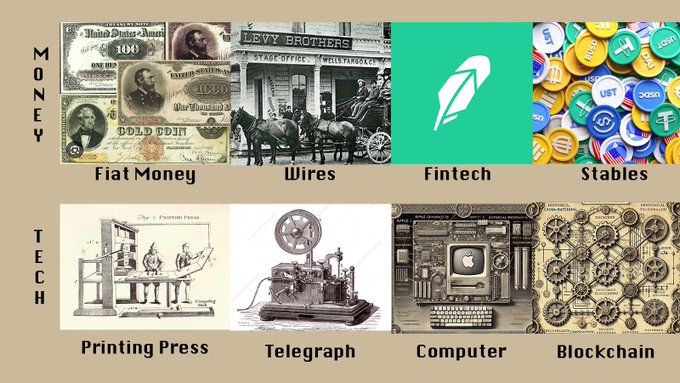

What comes to mind when someone says "money"? Cash? The dollar? Prices at the supermarket? Taxes? In these contexts, money is a unit of account used to assign value to various different, heterogeneous items. Money began with shells and salt, evolving into copper, silver, gold, and now the dollar/fiduciary currency.

Let’s focus on the dollar. The dollar/modern fiat currency (currency issued by the government rather than backed by commodities) has gone through several stages. In the United States, paper currency (paper dollars issued by banks) was initially private. Banks could print their own money at will, similar to how the Hong Kong dollar operates. After issues arose with this model, the government intervened and took over, legally tying the dollar to gold.

In 1871, using telegraphs, the Western Union completed the first wire transfer, allowing funds to be transferred without moving large amounts of paper currency. This was a huge breakthrough as it eliminated the physical barriers to the flow of money, making currency—and the entire financial system—more efficient.

A brief overview of history:

1913: The Federal Reserve System was established.

1971: Nixon ended the gold standard, decoupling the dollar from gold and allowing it to float freely.

1950: The first credit card was invented.

1973: The SWIFT payment network was established, allowing faster and more global dollar transactions.

1983: Stanford Federal Credit Union established the first digital bank account.

1999: PayPal allowed pure digital payments without the need for a bank account.

2014: Tether launched the first dollar-backed stablecoin, leading us to today.

This brief history lesson tells us that money—what it is and how we use it—has always been changing. Today, paying $20 through PayPal, Cash, Zelle, or bank transfer is equally accepted, even though traditional bank transfers may raise eyebrows. The same is true for stablecoins in developing countries and increasingly in developed nations. Personally, I use stablecoins to pay salaries, have transferred stablecoins to obtain cash, and am increasingly using them instead of bank accounts to save through protocols like @HyperliquidX, HLP, AAVE, Morpho, and of course, @StreamDeFi.

We live in a world where many existing financial systems impose heavy burdens on the most vulnerable consumers. Capital controls, monopolistic and legacy banks, and high fees are the norm. In this environment, stablecoins are an excellent tool for achieving financial freedom. They allow for cross-border currency transfers and are increasingly used for direct payments for goods. To understand how this has happened in such a short time, we must first understand why stablecoins outperform traditional financial products.

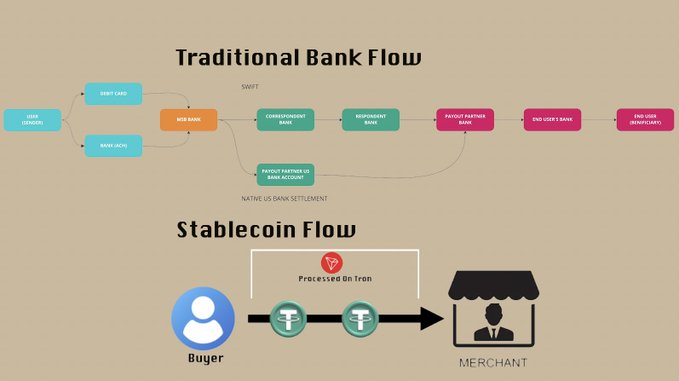

Stablecoins vs. Bank Transfers: A Comparison of Two Worlds

The essence of stablecoins is that they are tokens pegged to fiat currencies (like the dollar or euro). Many readers of this article may come from developed countries in North America, Europe, or Asia, where financial systems are relatively fast, smooth, and efficient. The U.S. has PayPal and Zelle, Europe has SEPA, and Asia has numerous fintech companies, especially Alipay and WeChat Pay. People in these regions can confidently deposit money into bank accounts without worrying about whether their balance will disappear in the morning or about hyperinflation. Small transfers can be processed quickly, and while large transfers may take longer, they are never unmanageable. Most companies force customers to use local banking systems, as they are considered safer and easier than alternatives.

In other parts of the world, people live in a different reality. In Argentina, bank deposits have been confiscated multiple times, and the local currency is one of the worst-performing currencies in history. In Nigeria, there are official and unofficial exchange rates, and moving funds in and out of the country can be extremely difficult—ironically, this also applies to Argentina. In the Middle East, bank account balances can be arbitrarily frozen, leading most non-political individuals not to store most of their liquid assets in bank accounts. Besides the high risks of holding funds, sending money is often even more difficult. SWIFT transfers are expensive and cumbersome, and many people (for the reasons mentioned above) do not have traditional bank accounts. Alternatives like Western Union often charge high fees for international transfers (see their fee calculator) and use the official local government exchange rates, leading to significant "hidden" costs, as the official rates are higher than the actual market rates.

Stablecoins allow people to hold funds outside of local financial systems because they are inherently global, transferring via blockchain rather than local bank servers. This reflects their history—crypto exchanges have struggled to obtain bank accounts, handling large deposits, withdrawals, and cross-exchange transfers. It is well-known that due to Japan's overly bureaucratic banking system and capital controls, there are arbitrage opportunities between global cryptocurrency prices and Japanese prices.

In 2017, Binance released a white paper stating that it would only support stablecoin-crypto trading pairs to ensure faster settlements. As a result, most trading volume began to occur in stablecoin pairs. In 2019, Binance launched USDT perpetual derivative contracts, allowing users to use USDT instead of BTC as collateral, further solidifying this trend. Stablecoins have been widely accepted as base assets by global users in the crypto space—now, this acceptance is beginning to extend beyond purely crypto use cases.

Let’s take a moment to compare stablecoins and fintech companies: primarily in terms of their speed, innovative design, and focus on solving global financial issues. So far, fintech companies have mostly only been able to beautify or obscure the obscure and complex payment infrastructure faced by users.

Stablecoins represent the first significant transformation of the global financial system in 50 years. Their speed, reliability, and verifiability make stablecoins very suitable for storing value and sending remittances without paying absurd fees (although, admittedly, this sacrifices the traditional safeguards of existing bureaucratic systems). Stablecoins can be seen as competing with cash and payment processors like Western Union, while being more durable and secure than cash. They cannot be washed away by floods, stolen in a burglary, and are easily convertible to local currency. Fees (depending on the blockchain) are typically under $2 and fixed, far below the minimums of processors like Western Union, whose fees can vary but may range from 0.65% to 4%+.

Once stablecoins become more accepted and mature, they will inevitably be used to fill the gaps in the global financial system that traditional providers have yet to address. With this stable adoption, there has also been an explosive growth of more services and more complex products. @MountainUSDM has brought RWA yields to many platforms in Argentina, and @ethena_labs allows users to earn through delta-neutral trading without interacting with traditional banking systems or exchange custody.

Stablecoins are increasingly being used to earn yields and handle local payments, not just for processing payments, holding value, or selling local currency. As this situation unfolds, stablecoins are becoming a core part of global financial planning and even corporate balance sheets. Many stablecoin users may not even realize that they are using cryptocurrency in the background, which proves the significant leaps companies have made in creating products around stablecoins in recent years.

Companies Attracting Stablecoin Users

The main projects related to stablecoins are the issuing companies themselves. USDC's @circle, USDT's @Tether_to, DAI/USD's @SkyEcosystem, and PYUSD, @PayPal and @Paxos products. There are many others I haven't mentioned, but these are the primary stablecoins used for payment purposes. Most of these companies have bank accounts, receiving traditional wire transfers and converting them into stablecoins for users.

Stablecoin issuers hold the transferred funds and charge users very low fees (usually 1-10 basis points). Users can now transfer these assets, while issuers earn "floating income" (or "yield" for DeFi enthusiasts) on the assets in their bank accounts. Trading firms are increasingly engaging in large-scale dollar-stablecoin trading, especially as many exchanges crack down on users who only use them for fee-free deposits and withdrawals. Trading firms typically offer better large-scale pricing than local exchanges, further enhancing the efficiency and competitive advantage of stablecoins in this unique environment—where all major trading firms are openly competing to facilitate this liquidity. Meanwhile, stablecoin issuers earn interest on user funds, allowing them to profit through floating income rather than charging users high fees.

It is worth mentioning that @SkyEcosystem (formerly Maker) is somewhat different. Sky uses various types of collateral and reserves of other currencies to back its stablecoin USDS. Users deposit these types of collateral and borrow SUSDS from the protocol at a predetermined interest rate. Users can earn yields similar to a "risk-free rate" by depositing into the "savings rate module," or lend SUSDS on platforms like @MorphoLabs and @aave, or simply hold them in their accounts. This system provides safer yield options or more risky ones.

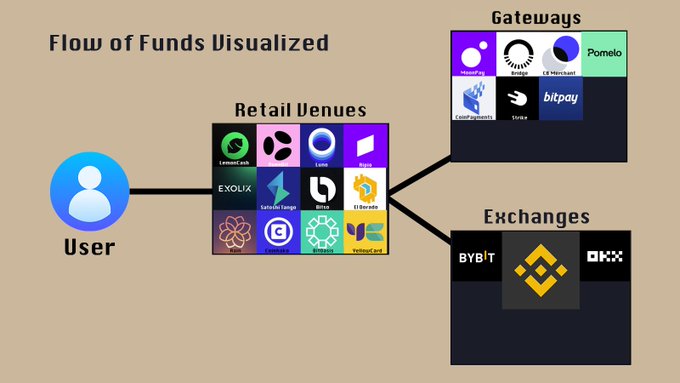

Currently, most major stablecoin issuers are notdirectly consumer-facing.

Instead, they interact with consumers through various different companies, similar to how MasterCard works with your bank but not directly with you.

Names like @LemonCash, @Bitso, @buenbit, @Belo, and @Rippio are not commonly seen on Crypto Twitter. Nevertheless, just the mentioned Argentine exchanges have over 20 million KYC users—equivalent to half of Coinbase's user base, while Argentina's population is only 1/7 that of the U.S. Last year, Lemon Cash processed about $5 billion in total transaction volume, a significant portion of which was stablecoin-stablecoin or Argentine peso-stablecoin transactions. Platforms like Lemon serve as gateways for most non-P2P stablecoin transactions. These platforms also have substantial cryptocurrency trading and stablecoin deposits, although most (except Rippio) do not have their own order books for 90% of the market but operate through order routing.

This is similar to how Robinhood is not an exchange but manages pricing through market maker routing. I refer to these platforms as "retail venues" because they focus on the retail user experience and products without their own exchange infrastructure. Just as Robinhood does not allow market makers to use its app or API (in fact, if you make too many API requests, Robinhood will ban you), BuenBit or Lemon do not; this is simply not their customer base or target audience.

At the same time, we have the actual blockchain—the place where stablecoin transfers and transaction records occur. This is dominated by @justinsuntron's @trondao, @binance's Binance Smart Chain, @solana, and @0xPolygon. These chains are used for users to transfer value, not necessarily for interacting with DeFi or earning yields.

Ethereum still leads in TVL (Total Value Locked), but its high costs make it unattractive for most stablecoin transfers. 92% of USDT transactions occur on Tron, with about 96% of Tron transactions related to stablecoins, compared to 70% of value transfers on Ethereum being related to stablecoins. Additionally, there are various new chains dedicated to efficiently and cost-effectively handling stablecoins, notably LaChain, which is actually a consortium made up of Ripio, Num Finance, SenseiNode, Cedalio, Buenbit, and FoxBit, primarily targeting Latin American users and platforms. This shows how complex and sophisticated the stablecoin space is becoming as it continues to mature.

As stablecoins become more widely used in remittances, they are increasingly being used for local payments. This is where crypto payment portals and gateways come into play, which I define as systems that allow stablecoins to be converted into fiat or facilitate fiat payments. For example, merchants can "accept" cryptocurrencies but are actually selling the cryptocurrencies for dollars, depositing them into bank accounts, or directly accepting stablecoins.

Given that redeeming stablecoins always involves some friction, whether time-related or fee-related, many companies are simplifying this process for users and platforms. These products range from relatively simple but very useful offerings, like Pomelo (https://www.pomelogroup.com/, which allows for processing crypto debit card transactions), to broader projects like @zcabrams's Bridge. Bridge allows for easy transfers between stablecoins, chains, and local currencies, significantly reducing friction for platforms and merchants, to the extent that @stripe acquired Bridge to enhance the efficiency of its payment system. Systems like Bridge currently exist because merchants do not directly accept USDC or USDT, so the portal/gateway must convert stablecoins for users and typically prepare liquidity in exchange for fees. As stablecoin payments expand, given that many of these platforms have fees lower than credit cards and banking systems, the volume of stablecoin-stablecoin transactions (between currencies and end products) will increase as merchants accept stablecoins to improve unit economics. This is how stablecoins are beginning to shape a post-bank-dominated payment world.

An increasing number of companies and projects are focusing on the applications of stablecoins and trying to enable current stablecoin users to save on-chain or through some of the previously mentioned platforms.

For example, Lemon Cash has an option that allows users to deposit funds into @aave to earn yields. @MountainUSDM's USDM earns yields on stablecoins and is integrated into multiple retail venues and exchanges in Latin America. Many retail venues and exchanges view stablecoin yield generation and the fees it brings as a potential source of stable income to smooth out revenue fluctuations caused by reliance on trading fees and bull market volumes—revenue can drop significantly during bear markets (by orders of magnitude).

What’s Next for Stablecoins?

The non-crypto applications of stablecoins are international transfers, and they are increasingly being used for payments. However, as the infrastructure for stablecoin usage continues to improve, they are becoming ubiquitous, and savings may also shift towards cryptocurrencies, a trend that has already begun in developing countries. A few weeks ago, @tarunchitra told me a story: a grocery store owner in Georgia collects Georgian lari (local currency) from customers, converts it to USDT, and earns interest, keeping a rough physical ledger of balances and extracting fees from the interest. In the same grocery store, payments can be processed via a QR code from Trust Wallet, notably occurring in a country with a relatively healthy banking system. In countries like Argentina, according to the Financial Times, citizens are estimated to have over $200 billion in cash outside the traditional financial system. If half of that were to enter on-chain or cryptocurrency, it would double the scale of DeFi and increase the total market capitalization of stablecoins by about 50%—this is just a relatively small country, while other countries like China, Indonesia, Nigeria, South Africa, and India have large informal economies or relative distrust of banks.

As the use of stablecoins increases, numerous additional use cases may continue to grow. Currently, stablecoins are only used for fully collateralized credit, one of the least common forms of credit in the world. However, with new tools from Coinbase and other companies, KYC information can be used to provide capital to users, which, if not repaid, could lead to negative credit reports. Stablecoin issuers are increasingly allowing yields to be "passed through" to stablecoin holders, such as USDC's 4.7% yield and Ethena's typically over 10% variable yield. There is also an increasing volume of cross-fiat transactions, meaning starting from one currency, converting to a dollar stablecoin, and then converting to a third currency. As this situation continues, it becomes more meaningful to convert directly to the underlying currency stablecoins to avoid paying fees twice. As more capital flows into stablecoins, more products will become available in crypto and on-chain, which will help drive the everyday use of cryptocurrencies to become increasingly mainstream.

Future Challenges

Finally, I want to discuss some points that I believe are not discussed enough in the conversation surrounding stablecoins. One is that almost every stablecoin today relies on bank accounts to some extent, and the banking system is not always safe, as we saw in the 2023 USDC depegging and the collapse of Silicon Valley Bank.

Additionally, stablecoins are currently being used extensively for money laundering. If you agree that stablecoins are used to evade capital controls and escape local currencies, then you inadvertently acknowledge that this use case constitutes money laundering in local countries. This is an open secret with significant implications. Currently, both Circle and Tether do not allow "reissuance"—meaning if a user's stablecoin balance is frozen due to legal action or assets being deemed stolen, they cannot be returned to the person with a court order. This practice is ethically questionable at best and unsustainable in the long run. Governments will increasingly demand or enforce regulations that make stablecoins seizable. Potentially, this could mean replacing stablecoins with CBDCs (Central Bank Digital Currencies), although I will discuss this in a later article.

The inevitable government pressure in the coming years will create opportunities for truly decentralized and private stablecoins, which can continue to operate in a fully decentralized manner, unaffected by government actions. I may write a more in-depth article later exploring this dark side of stablecoins, as it is a rather broad topic.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。