Author: Alvis

Introduction: The Ethereum Dilemma and the Breakthrough Moment of Layer 2

The cryptocurrency market in 2025 is undergoing a profound value reconstruction. The trading volume on the Ethereum mainnet continues to shrink, gas fees remain low, and the TVL of leading Layer 2 projects like Arbitrum and Optimism has shrunk by over 40% compared to their peak in 2024. As the industry questions whether the "Layer 2 narrative has ended," a project named MegaETH is set to launch its public testnet on March 6, backed by a technical declaration of "100,000 TPS + 1 millisecond latency" and $30 million in funding along with support from Vitalik Buterin.

MegaETH receives direct investment from Vitalik

Is this counter-trend charge a prelude to disruptive innovation or a bubble fueled by capital? This article will deeply decode it from three dimensions: technical dissection, ecological competition, and market timing.

MegaETH Technical Overview: Reconstructing the Performance Ceiling of Layer 2

Introduction to MegaETH:

MegaETH is a Layer 2 blockchain designed to enhance Ethereum's scalability and performance by achieving real-time transaction processing. It is compatible with the Ethereum Virtual Machine (EVM). MegaETH aims to achieve unprecedented performance levels, capable of processing over 100,000 transactions per second (TPS).

MegaETH plans to deploy its public testnet starting on March 6.

The deployment will be phased. The testnet will officially launch on March 6, marking the network's opening to the public.

From March 6 to March 10, the focus will be on onboarding application and infrastructure teams, enabling developers to refine the deployment and adapt to MegaETH's architecture.

1.1 The "Triple Engine" of Performance Monsters

MegaETH claims to be the "first real-time blockchain," with its technical architecture directly addressing the core pain points of current Layer 2 solutions— the contradiction between performance and decentralization. Through three groundbreaking designs, the project attempts to push the EVM ecosystem to its hardware limits:

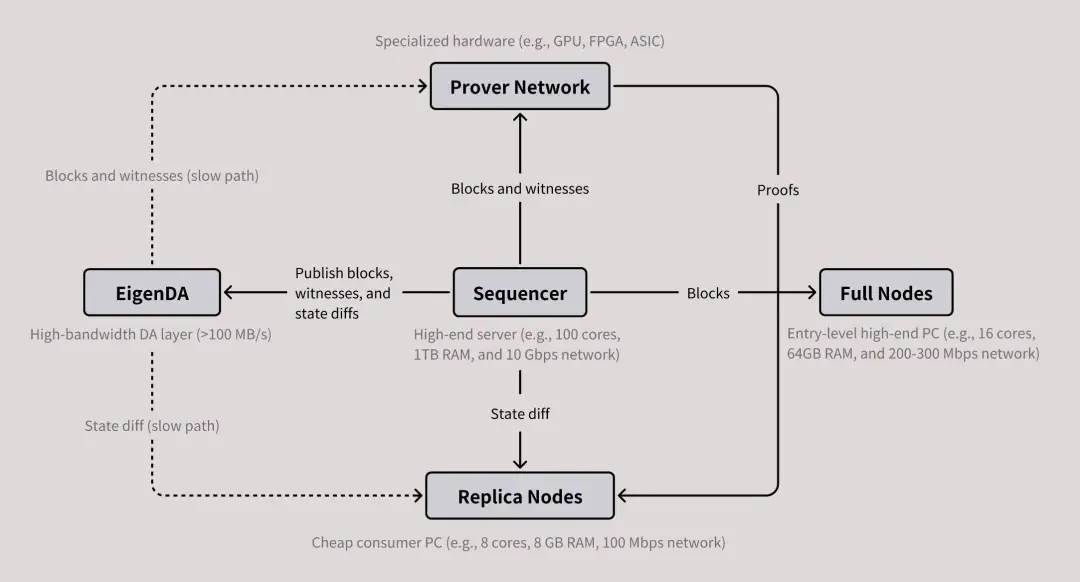

Heterogeneous Node Architecture: The network nodes are divided into three categories: Sequencers, Full Nodes, and Validators. Sequencers use customized servers to store the EVM state tree entirely in memory, achieving a state access speed 1000 times that of SSDs; Full Nodes synchronize state differences via peer-to-peer protocols to avoid redundant calculations; Validators focus on generating zero-knowledge proofs. This "specialized division of labor" centralizes key performance tasks while maintaining decentralized security verification.

Super-optimized EVM Execution Environment: A real-time JIT (Just-In-Time) compiler is introduced to dynamically compile smart contract code into native machine code, eliminating the performance loss of traditional interpreters. Testnet data shows that the execution speed of compute-intensive contracts has increased by up to 100 times. Additionally, the project has restructured the state tree, adopting a Merkle-Verkle tree scheme that reduces disk I/O operations by 90%.

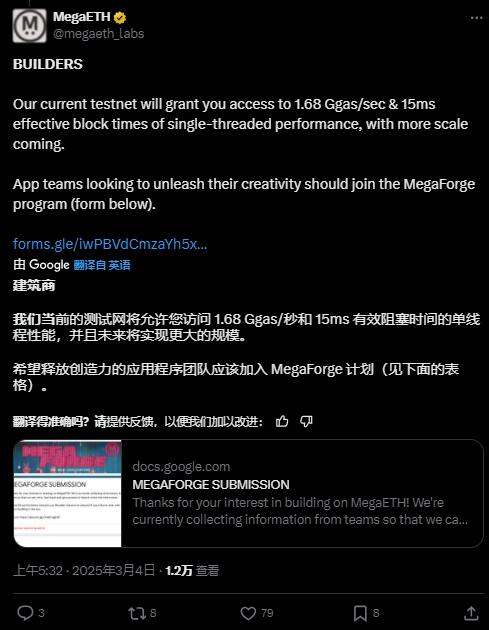

Sub-millisecond Consensus Mechanism: By streamlining block production, transaction sorting, execution, and proof generation are processed in parallel. The initial phase of the testnet has achieved an effective block time of 15 milliseconds, improving two orders of magnitude compared to Optimism's 2 seconds. The team claims that after the mainnet launch, single-threaded throughput could reach 1.68 Ggas/second, 50 times that of existing Rollup solutions.

1.2 Data Testing: Testnet Performance Analysis

According to official disclosures on March 4, the first phase of the testnet will open the following capabilities:

- Throughput: 1.68 Ggas/second, supporting approximately 5000 simple transfers per second

- Latency: End-to-end confirmation time ≤ 15 milliseconds (including network transmission)

- Fee Model: The cost of a single transaction is less than $0.001, reduced by two orders of magnitude compared to Arbitrum

It is noteworthy that this data is based on a single sequencer model and has not yet demonstrated scalability under multi-node parallel conditions. The team stated that in the future, they will increase TPS to over 100,000 through sharding technology.

Capital Competition: The Strategic Ambition Behind $30 Million

2.1 Financing Landscape and Community of Interests

MegaETH's capital story is filled with "top-tier configurations":

- $20 million seed round (June 2024): Led by Dragonfly, with follow-on investments from Ethereum "establishment" figures like Vitalik Buterin, Joseph Lubin (founder of ConsenSys), and Sreeram Kannan (founder of EigenLayer)

- $10 million community round (December 2024): Completed through the Echo platform, using a "equity + token warrant" structure, with a valuation reaching hundreds of millions

- NFT financing (February 2025): Issued the "The Fluffle" series of NFTs, raising 4964 ETH (approximately $13 million), with holders entitled to 5% of future token airdrops

Vitalik's deep involvement is particularly noteworthy. As one of the few Ethereum founders to directly invest in projects, his bet on MegaETH is seen as a "distrust vote" against the existing Layer 2 technology route. Industry insiders speculate that Vitalik may hope to use MegaETH to validate the "modular blockchain" theory, achieving a balance of performance and security through a combination of dedicated execution layer (MegaETH) + consensus layer (Ethereum) + DA layer (EigenDA).

2.2 Ecological Positioning: The "Infrastructure Bet" of Full-Chain Games and DePIN

Early adopters of MegaETH are concentrated in two tracks:

- Full-chain games: Projects like Dark Forest and AI Arena have announced their migration to the testnet, utilizing millisecond-level latency to achieve real-time combat logic

- DePIN (Decentralized Physical Infrastructure): Scenarios such as high-frequency sensor data on-chain and real-time edge computing require ultra-low fees and deterministic latency

- This "vertical scene deep cultivation" strategy differentiates itself from the "general-purpose Rollup" of Arbitrum and Optimism. The project claims that its performance can support a "Web2 level user experience," with DEX order execution speeds comparable to Coinbase.

Counter-Cyclical Launch: A Gamble or Rationality?

3.1 The "Polarization" of the Layer 2 Market

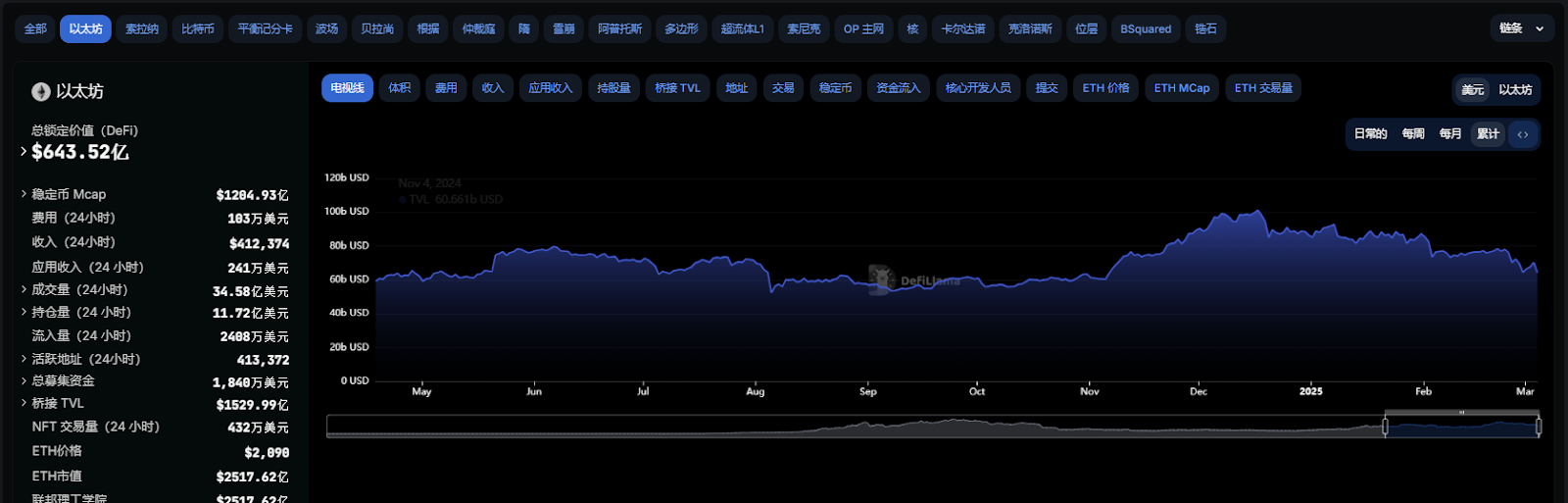

According to defillama data, Ethereum's TVL has dropped from a peak of $100 billion to the current $64 billion, with the Ethereum Layer 2 ecosystem showing brutal differentiation:

- Head Shrinkage: Arbitrum's TVL has dropped by 40% compared to its peak in 2024, and Optimism's daily transaction volume has fallen below 100,000. Base's TVL has decreased by 12% in the past month.

- New Forces Exhausted: ZK-Rollup systems like StarkNet and Scroll, with their account abstraction and privacy features, have yet to be effectively validated.

- Capital Withdrawal: VC financing in the Layer 2 space decreased by 82% year-on-year in Q1 2025.

Against this backdrop, the launch of MegaETH's testnet can be seen as a "counter-cyclical operation." Its logic may include:

- Technical window period: Using the market downturn to refine the architecture, avoiding chain instability under high concurrency pressure

- Lower ecological migration costs: Developers' willingness to experiment increases, making them more willing to try high-performance new chains

- Token expectation management: If the mainnet launches at the bottom of a bull market cycle, it may replicate the "performance narrative" surge of Solana in 2021

Risk Warning: Four Major Uncertainties

Despite its grand blueprint, MegaETH still faces multiple challenges:

- Centralization risks: The testnet uses a single sequencer architecture, and whether the mainnet can achieve multi-node competition remains to be verified

- State explosion dilemma: Memory computation relies on TB-level servers, which may lead to excessively high entry barriers for validators in the long term

- Ecological cold start: Currently, fewer than 20 projects have committed to migration, far below zkSync's data during the same period

- Token economics risk: MegaETH has yet to clarify its token model

Conclusion: The Eve of Layer 2's "Cambrian Explosion"?

The launch of MegaETH's testnet is like a sword piercing through the winter of Layer 2. Its technical route suggests a possible direction: by leveraging heterogeneous architecture and hardware synergy, blockchain performance can be pushed to "enterprise-level." If the mainnet achieves 100,000 TPS as planned, it could trigger a revolution in the infrastructure of DeFi, GameFi, and even traditional finance.

However, historical experience shows that an excessive pursuit of performance often comes with compromises in decentralization. Can MegaETH find a new balance within the "impossible triangle"? This experiment in 2025 may reshape all our perceptions of blockchain scalability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。