The intensification of great power geopolitical games, the DeepSeek open-source week reconstructing the AI track competition landscape, and the liquidity migration under the resonance of China's risk assets entering the revaluation stage.

Author: @Web3_Mario

Abstract: In recent days, the cryptocurrency market has experienced a significant correction, leading to a chaotic consultation environment. Coupled with the continuous negative impact of massive hacker attacks in the crypto space, understanding the recent market trends in the short term has become challenging.

I have some viewpoints on this matter that I would like to share and discuss. I believe there are two main reasons for the current pullback in the cryptocurrency market:

Firstly, from a micro perspective, the series of hacker attacks has raised concerns among traditional investors, increasing risk-averse sentiment.

Secondly, from a macro perspective, the DeepSeek open-source week has further exposed the AI bubble in the U.S., combined with the actual policy direction of the Trump administration. On one hand, this has ignited market fears of stagflation in the U.S., and on the other hand, it has initiated the revaluation of Chinese risk assets.

Micro Perspective: Continuous Large Financial Losses Trigger Concerns Among Traditional Investors About Short-Term Cryptocurrency Trends, Increasing Risk-Averse Sentiment

I believe everyone is still fresh in memory regarding the Bybit incident last week and the recent Infini theft. There has been much discussion on this topic, so I won't elaborate further. Here, I would like to discuss the impact of the stolen funds on these two companies and the industry. Firstly, for Bybit, the $1.5 billion amount, while roughly equivalent to its net profit for about a year, is certainly not a small sum for a company in an expansion phase. Typically, companies maintain cash reserves for 3 months to a year, and considering that exchange businesses belong to high cash flow industries, their cash reserves are likely closer to the lower end. Looking at Coinbase's 2024 financial report, we can make some preliminary judgments. Coinbase's total revenue for 2024 is projected to more than double from last year, reaching $6.564 billion, with a net profit of $2.6 billion, while total operating expenses for 2024 are $4.3 billion.

Referring to the data disclosed by Coinbase and considering Bybit's current expansion phase, it is estimated that Bybit's cash flow reserves are likely around $700 million to $1 billion. Therefore, a loss of $1.5 billion in user funds clearly cannot be covered solely by its own funds. At this point, methods such as borrowing funds, equity financing, or shareholder injections are needed to get through this crisis. However, regardless of the model, considering the concerns about sluggish growth in the cryptocurrency market by 2025, the resulting cost of funds is likely to be significant, which will undoubtedly burden future corporate expansion.

Of course, today we saw news that the core vulnerability of the attack was in Safe rather than Bybit itself, which may provide some incentive to recover some losses. However, a significant issue plaguing the crypto industry is the imperfect legal framework, so the related litigation process is bound to be lengthy and costly. Recovering losses is unlikely to be an easy task. As for Infini, a loss of $50 million is clearly an unbearable burden for a startup, but it seems the founder is financially strong, making it indeed rare to rely on injections to weather the storm.

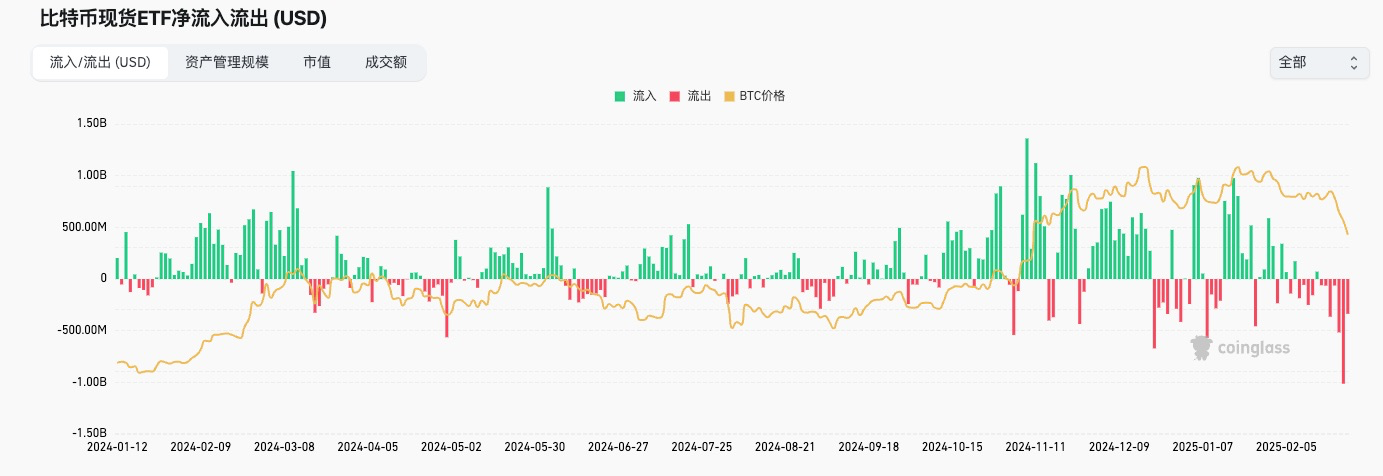

These two consecutive large losses seem to have become commonplace for traders accustomed to high risks in the crypto space, but they have evidently shaken the trust of traditional investors. This can be specifically seen from the fund flow situation of the BTC ETF, which clearly shows that the attack on the 21st triggered a significant outflow of funds. This indicates that the impact of this event on traditional investors is likely negative. If the resulting concerns focus on whether it will hinder the establishment of a regulatory-friendly legal framework, then this is a serious matter. Therefore, it can be said that the theft incident, on a micro level, is the trigger for this round of pullback.

Macro Perspective: Intensification of Great Power Geopolitical Games, DeepSeek Open-Source Week Restructuring the AI Track Competition Landscape, and Liquidity Migration Under the Resonance of China's Risk Assets Entering the Revaluation Stage

Now let's look at some macro-level impacts, which clearly indicate that the short-term outlook for the crypto market is unfavorable. In fact, after a period of observation, the policy direction of the Trump administration has become quite clear, which is to achieve internal integration and industrial restructuring through strategic contraction, thereby enabling the U.S. to regain its re-industrialization capability, as technology and production capacity are the core factors in great power competition. The most crucial factor in achieving this goal is "money," which is primarily reflected in the U.S. fiscal situation, financing capacity, and the real purchasing power of the dollar. The relationship among these three points is interdependent, making it not easy to observe changes in the related processes. However, by peeling back the layers, we can still identify some core concerns:

- The U.S. fiscal deficit issue;

- The risk of stagflation in the U.S.;

- The strength of the dollar.

First, let's look at the U.S. fiscal deficit issue, which has been analyzed extensively in previous articles. In simple terms, the core reason for the current U.S. fiscal deficit can be traced back to the Biden administration's extraordinary economic stimulus measures in response to the COVID-19 pandemic, as well as the Treasury Department, represented by Yellen, adjusting the U.S. debt issuance structure, leading to an inverted yield curve due to excessive issuance of short-term debt, thereby harvesting wealth globally. The specific reason is that excessive issuance of short-term debt depresses the prices of short-term U.S. Treasury bonds on the supply side, which in turn raises short-term U.S. Treasury yields. The increase in short-term U.S. Treasury yields naturally attracts dollars back to the U.S., as investors can enjoy excess risk-free profits without incurring time costs. This temptation is significant, which is why capital, represented by Buffett, chose to sell off risk assets in large quantities during the previous cycle and increase cash reserves. This has put immense pressure on the exchange rates of other sovereign countries in the short term. To avoid excessive currency depreciation, central banks around the world have had to sell short-term debt at a loss, converting unrealized losses into realized losses to stabilize exchange rates by regaining dollar liquidity. Overall, this is a global harvesting strategy, particularly targeting emerging countries and trade surplus nations. However, this approach also has a problem: the U.S. debt structure will significantly increase its short-term repayment pressure, as short-term debt needs to be repaid with both principal and interest. This is the origin of the debt crisis triggered by the current U.S. fiscal deficit, which can also be seen as a landmine left by the Democrats for Trump.

The biggest impact of the debt crisis is on U.S. credit, which in turn reduces its financing capacity. In other words, the U.S. government needs to pay higher interest rates to finance through government bonds, which overall raises the neutral interest rate in American society. This neutral interest rate cannot be influenced by the Federal Reserve's monetary policy, and the elevated neutral interest rate puts immense pressure on corporate operations, leading to economic stagnation. Economic stagnation, in turn, transmits through the job market to ordinary citizens, resulting in a contraction in investment and consumption. This creates a negative feedback loop that can trigger an economic recession.

The focus of observation on this main line is how the Trump administration will reshape U.S. fiscal discipline and address the fiscal deficit issue. The specific policies involved include the efficiency department led by Musk, the reduction of U.S. government spending, and the process of cutting redundant staff, as well as the impact on the economy during this process. Currently, it appears that Trump's internal integration efforts are quite strong, and reforms have entered a deep-water zone. I won't delve into tracking the progress here; I will only introduce some of my observational logic.

- Pay attention to the aggressiveness of the efficiency department's policy advancement. For example, if cuts and reductions are too drastic, it will inevitably raise concerns about the economic outlook in the short term, which is usually unfavorable for risk assets.

- Monitor the feedback of macro indicators to these policies, such as employment data and GDP data.

- Keep an eye on the progress of tax reduction policies.

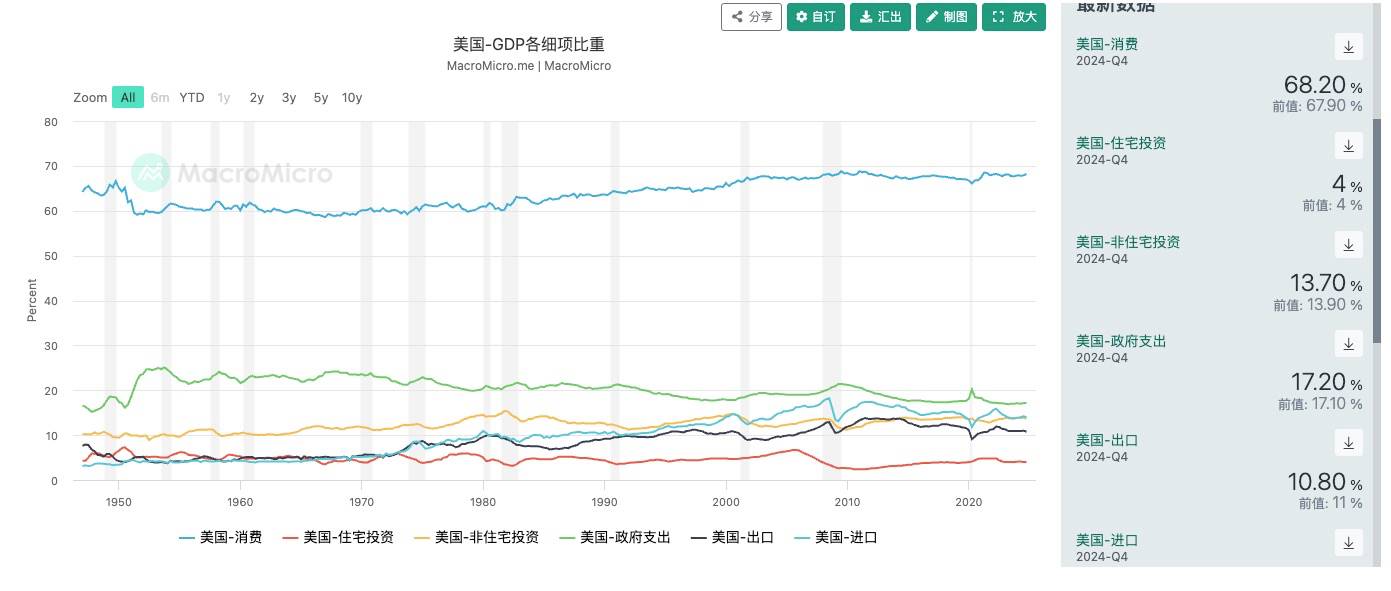

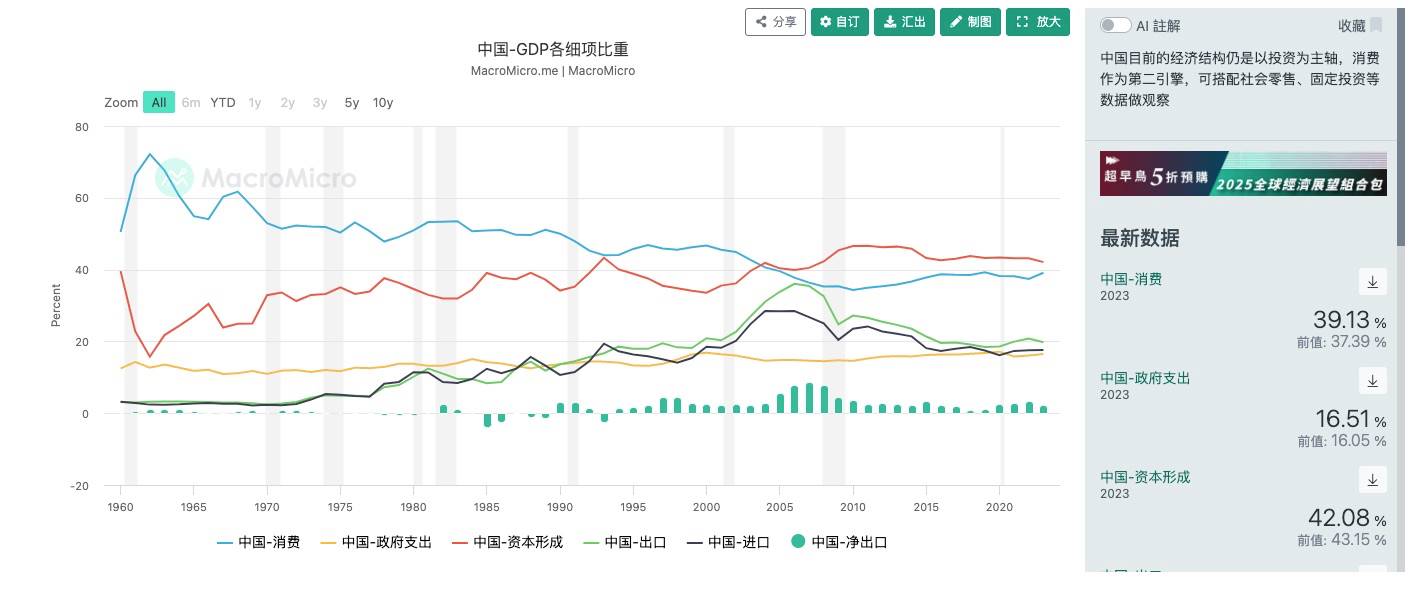

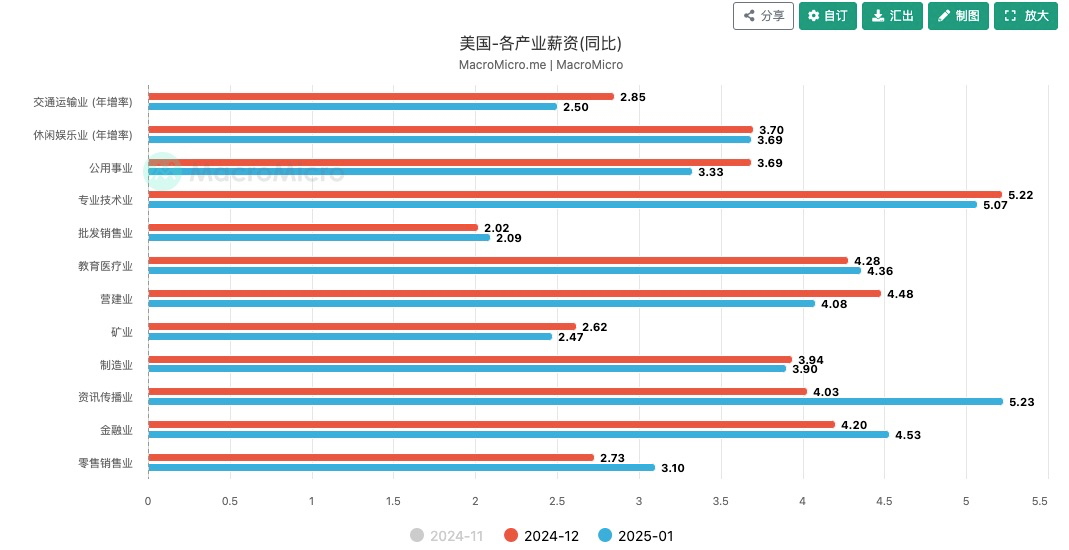

We cannot underestimate the impact of government spending and government employees on the U.S. economy. Typically, we might think that China's government spending ratio is certainly higher than that of the U.S., but this is actually a mistaken impression. U.S. government spending accounts for 17.2% of GDP, while China's is 16.51%. Moreover, government spending usually transmits through the industrial chain multiplier to the entire economic system. The structural differences between the two mainly reflect that consumption accounts for a high proportion of U.S. GDP, while imports and exports account for a higher proportion of China's GDP. This represents two different approaches to stimulating the economy. For the U.S., expanding external demand and increasing exports is a means to boost the economy, while for China, there is still significant potential to tap into domestic demand.

The same applies to consumption. In this chart, we can see that the salary levels of government departments are not low across the entire industrial chain, and reducing government redundancy also impacts U.S. economic growth on the consumption side. Therefore, overly aggressive policy advancement will certainly trigger panic about an economic recession. Some matters require a gradual approach, but they must also align with the overall policy advancement rhythm of the Trump administration. As for the progress of tax reduction policies, it currently seems that Trump's focus is not on this, so the concerns about reduced income in the short term do not appear to be significant, but vigilance should still be maintained.

Secondly, there are concerns about stagflation in the U.S. Stagflation refers to a situation where economic growth stagnates while inflation intensifies, which is socially unacceptable according to the misery index. In addition to the impact of government spending cuts on economic growth mentioned earlier, there are some important points to consider:

- How DeepSeek will further impact the AI track.

- The progress of U.S. sovereign funds.

- The impact of tariff policies and geopolitical conflicts on inflation.

Among these, I believe the most significant short-term impact is the first point. Those interested in technology may know that DeepSeek's open-source week has produced numerous shocking results, all pointing to one thing: the demand for computing power in AI has significantly decreased. This has led to the stability of the stock market during the previous interest rate hike cycle in the U.S. due to the enormous narrative surrounding the AI track and the monopolistic position of the U.S. in the upstream and downstream of the AI sector. The market has assigned extremely high valuations to U.S. AI-related stocks, naturally fostering an optimistic attitude towards a new round of economic growth driven by AI in the U.S. However, all of this will be reversed by DeepSeek. The biggest impact of DeepSeek lies in two aspects: on the one hand, it significantly reduces the requirements for computing power, which greatly pulls back the performance growth potential of upstream computing power providers represented by Nvidia. On the other hand, it breaks the U.S. monopoly on downstream AI algorithms through open-source means, thereby suppressing the valuations of algorithm providers represented by OpenAI. Moreover, this impact has just begun, and we will have to see how the U.S. AI sector responds at that time. However, in the short term, it has already shown a pullback in the valuations of U.S. AI stocks and a return of valuations for Chinese tech stocks.

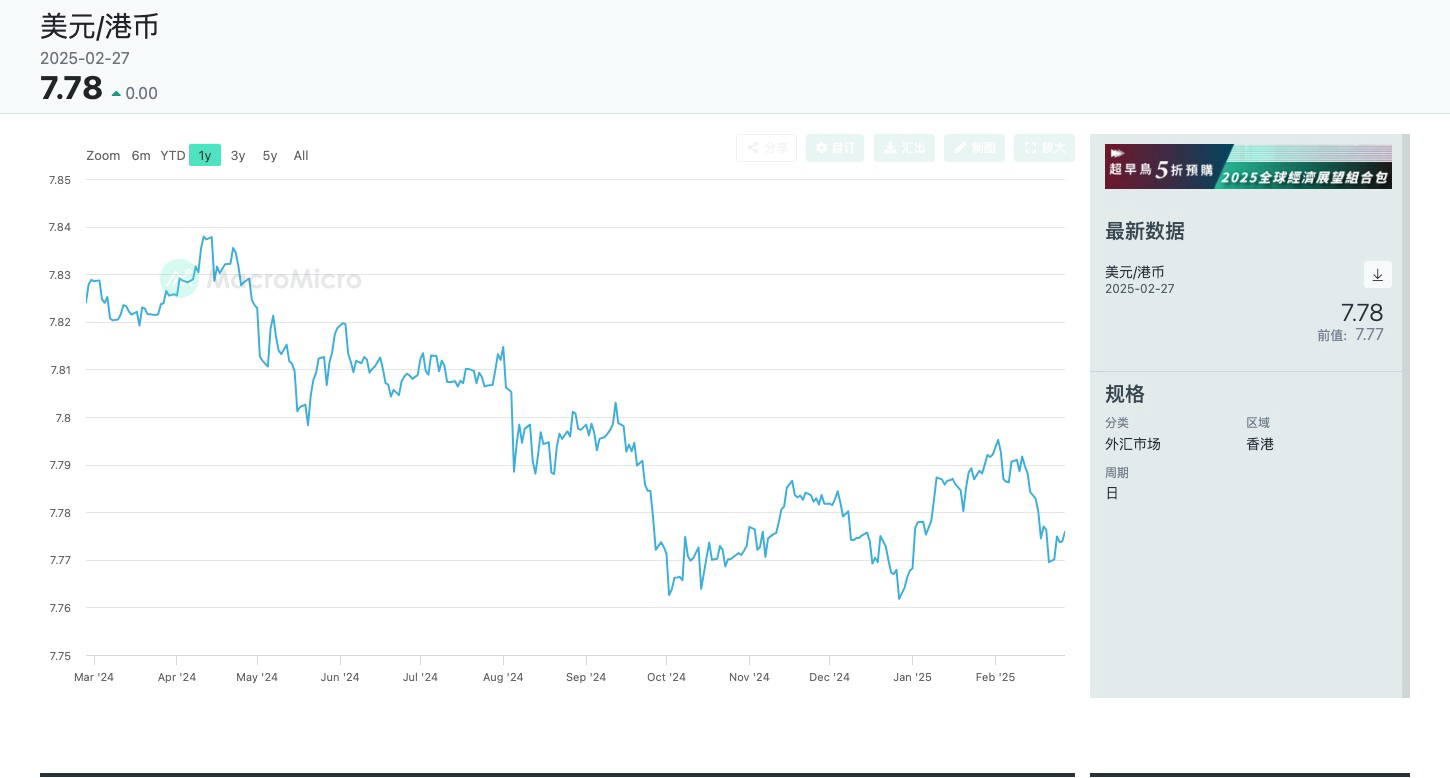

In fact, for a long time, the U.S. has suppressed the valuations of Chinese companies through public opinion, effectively keeping them undervalued. However, benefiting from the grand narrative brought by DeepSeek for the upgrade of Chinese manufacturing, along with the relatively softer stance of Trump’s policies on China-related issues, geopolitical risks have decreased, leading to a reversion in the valuations of Chinese and U.S. companies. According to a report from CICC, the recent rally in Hong Kong stocks is primarily due to the influx of southbound capital, which refers to capital flowing in from the mainland, as well as the inflow of passive overseas capital. However, active overseas funds have not shown significant changes due to Trump's investment restrictions on Chinese companies. It is also crucial to observe liquidity, as there are many ways to bypass direct investment and still benefit from the revaluation of Chinese companies, such as investing in stock markets with high correlations like Singapore. Changes in capital flow can be easily identified through the Hong Kong dollar exchange rate. We know that the Hong Kong dollar operates under a linked exchange rate system with the U.S. dollar, meaning the exchange rate will stabilize between 7.75 and 7.85. Therefore, as the Hong Kong dollar approaches 7.75, it indicates a stronger willingness of foreign capital to invest in Hong Kong stocks.

The second point worth noting is the construction of U.S. sovereign wealth funds. We know that sovereign wealth funds are a good supplement to government revenue for any sovereign nation, especially for trade surplus countries with large amounts of dollars. Among the world's top ten sovereign wealth funds, China has three, the Middle East has four, and Singapore has two, with Norway's Government Pension Fund Global ranking first, with a total asset size of approximately $1.55 trillion. However, due to the constitutional framework of the U.S. federal government, establishing a sovereign wealth fund is quite challenging, as the federal government can only receive direct taxes, resulting in limited revenue sources. The U.S. is currently also experiencing a fiscal deficit dilemma. However, Trump seems to have instructed the Treasury to establish a trillion-dollar sovereign wealth fund, which is naturally a means to alleviate the fiscal deficit. The question here is where the money will come from and what it will be invested in.

According to the new U.S. Treasury Secretary, Bessent, it seems there is a desire to reprice the U.S. gold reserves to provide $750 billion in liquidity for the sovereign fund. The reason behind this is that according to Title 31, Section 5117 of the U.S. Code, the statutory value of the U.S. government's 8,133 tons of gold is still $42.22 per ounce. If calculated at the current market price of $2,920 per ounce, the U.S. government would have $750 billion in unrealized returns. Therefore, by amending the law, additional liquidity can be obtained, which is undoubtedly a clever approach. However, if approved, the dollars used for investment or to alleviate debt pressure will inevitably come from selling gold, which will certainly impact the gold market.

As for what to invest in, I believe it is highly likely that the focus will still be on the goal of bringing production capacity back to the U.S. Therefore, the impact on Bitcoin is likely to be limited. In previous articles, I have analyzed that in the short to medium term, Bitcoin's value relative to the U.S. is becoming a safety net for the economy, based on the premise that the U.S. has sufficient pricing power over this asset. However, in the short term, there has not been a significant economic recession, so this is not the main focus of Trump's policies but rather an important tool to navigate the pains of reform.

Finally, regarding tariffs, concerns about tariffs have been well addressed. Currently, it seems that tariff policies are more of a bargaining chip for Trump in negotiations rather than a necessary choice. This can be seen from the relatively restrained tariff rates imposed on China, as Trump has been quite moderate, considering the impact of high tariffs on domestic inflation. The next point of interest for me is the tariffs on Europe and what returns the U.S. can gain from this. Of course, I am concerned about the EU's process of rebuilding its independence, as harvesting Europe to restore its own strength is the first step for the U.S. in this great power competition. As for inflation risks, although the CPI has been rising for several months, considering that it remains at a controllable level, coupled with the easing nature of Trump's tariff policies, the current risk does not seem significant.

Lastly, let's talk about the movement of the dollar, which is a critical issue that requires continuous observation. In fact, the debate over the strength of the dollar under Trump's new term has been ongoing. Some key figures' statements have significantly influenced the market. For example, Stephen Miller, the chief economic advisor recently appointed by Trump, stated that the U.S. needs a weak dollar to boost exports and promote internal re-industrialization. In contrast, after causing panic in the market, Treasury Secretary Bessent reassured the market during an interview on February 7, stating that the U.S. would continue its "strong dollar" policy, although the renminbi is somewhat undervalued.

This is indeed an interesting situation. Let's examine the impact of a strong or weak dollar on the U.S. economy. First, a strong dollar has two main effects, particularly on asset prices. As the dollar appreciates, dollar-denominated assets will perform better, which is beneficial for the U.S. government, particularly for U.S. Treasuries and global companies' U.S. stocks, as it increases the market's willingness to purchase U.S. Treasuries. Secondly, in terms of industry, a stronger dollar enhances purchasing power, benefiting U.S. global companies in reducing costs but suppressing the competitiveness of domestic industrial products in the international market, which is unfavorable for internal industrialization. Conversely, the effects of a weak dollar are the opposite. Considering that Trump's overall policy vision is based on bringing back production and enhancing capacity to improve competitiveness in great power competition, a weak dollar policy seems to be the correct approach. However, there is a problem: a weak dollar will lead to the depreciation of dollar-denominated assets. Given the current fragility of the U.S. economy and financing pressures, a rapid weak dollar policy could prevent the U.S. from overcoming the pains brought by reform.

A representative event illustrating this pressure occurred in Warren Buffett's annual letter to shareholders on February 25, where he expressed dissatisfaction with the U.S. fiscal deficit issue, which evidently heightened market concerns. We know that Buffett's recent financing strategy has been to clear out overvalued risk assets in the U.S. in exchange for more cash reserves to allocate to short-term U.S. Treasuries, while also including some allocations to Japan's five major trading companies. However, this is evidently a form of interest rate arbitrage, which I won't elaborate on here. What I want to emphasize is that Buffett's views have a strong influence on the market, and capital overly allocated to the dollar will naturally share a common concern about the real purchasing power of the dollar, specifically the fear of dollar depreciation. Therefore, the pressure from entering a depreciation channel too quickly is substantial.

Nevertheless, both countries will likely choose to exchange space for time and gradually reduce debt, and the dollar's movement will likely follow a pattern of initially strong and then weak. The changes in dollar-denominated assets will also move with this cycle. Cryptocurrencies are one of the assets affected by this wave.

Finally, I would like to share my views on the cryptocurrency market. I believe that the current market has too many uncertainties, so individual investors can adopt a barbell strategy to enhance the anti-fragility of their investment portfolios. On one hand, they can allocate blue-chip cryptocurrencies or participate in some low-risk DeFi yields, while on the other hand, they can allocate small positions to some high-volatility assets during dips. Regarding the short-term market trends, the accumulation of many unfavorable factors has indeed led to some price pressure, but there does not seem to be a clear structural risk. Therefore, if the market experiences an excessive pullback due to panic, appropriately building positions could also be a viable option.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。