Author: CryptoAmsterdam

Translation: Deep Tide TechFlow

**Is the saying "Without **Quantitative Easing (QE), there is no Altseason" correct?

Recently, my comment section has been filled with similar opinions:

"We need QE to usher in Altseason."

"Without QE, Altseason will never start."

Let's analyze this.

This is not typically my main area of research, but since everyone is discussing QE, I will provide a brief analysis.

(Note: I am not an expert in this field, so please correct me if I am wrong. To simplify the discussion, we will only look at charts and avoid excessive speculation; please refer to this cautiously.)

1. What are QE and QT?

QE (Quantitative Easing):

Central banks inject funds into the market by creating new money.

The specific operation is to increase market liquidity by purchasing assets.

Increased liquidity = favorable for risk assets (such as cryptocurrencies).

QT (Quantitative Tightening):

Central banks reduce the money supply in the market.

Methods include selling assets or allowing assets to mature, thereby withdrawing liquidity.

Decreased liquidity = unfavorable for risk assets.

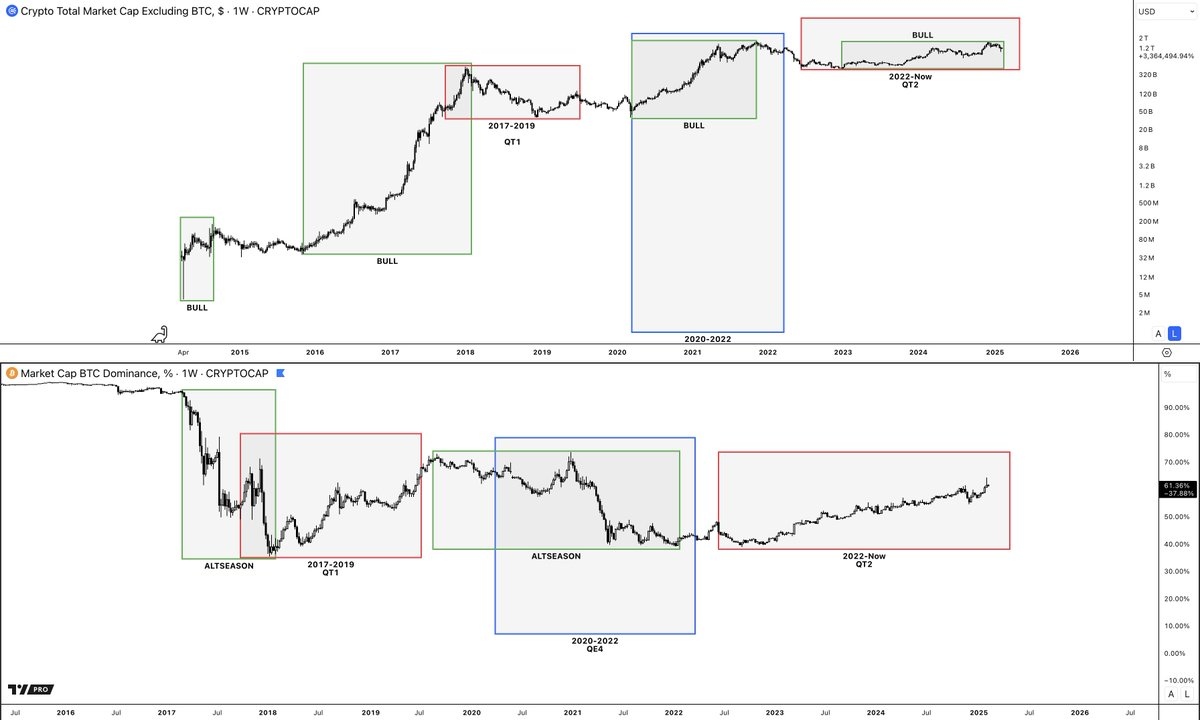

If we overlay the total market capitalization chart of the entire altcoin market with the Bitcoin dominance chart, marking the time periods of QE (favorable for the market) and QT (unfavorable for the market), we find that these two statements do not hold.

Even in the absence of QE, the crypto market has experienced significant rises, bull markets, and Altseason.

In fact, QE only coincided with a bull market once, which was in 2021.

Chart analysis summary:

The arrival of Altseason does not depend on QE.

During QT, the total market capitalization of the altcoin market soared from $400 billion to $1.7 trillion.

While QE can promote the market, it is not a necessary condition—other factors can also trigger market growth, such as the launch of ETFs, government policy support, SBR (possibly referring to some stablecoin reserve mechanism), or the increase in Bitcoin's value.

Stopping QT would theoretically benefit the market, but the market still achieved growth during QT, indicating that QT is not a decisive factor in market performance.

2. What is Altseason?

In the cryptocurrency market, it can generally be divided into two main phases:

Bitcoin Season

Altcoin Season

Bitcoin Season:

The characteristic of Bitcoin Season is the rise in Bitcoin dominance (the market capitalization of Bitcoin as a percentage of the entire cryptocurrency market). This is because funds flow from altcoins to Bitcoin, leading to a poorer overall performance of altcoins compared to Bitcoin.

New funds primarily flow into Bitcoin, causing the market share of altcoins to decline.

Altseason:

The characteristic of Altseason is the decline in Bitcoin dominance, as funds flow from Bitcoin into altcoins.

The influx of new funds drives the market share of altcoins up, while the total market capitalization of altcoins rapidly surges.

From historical data, most of the time the market is in Bitcoin Season, and the performance of altcoins usually lags behind Bitcoin. Here are a few typical phases of Bitcoin Season:

Is Bitcoin in a bear market? This is Bitcoin Season.

Is Bitcoin rebounding from a bottom? Still Bitcoin Season.

Is Bitcoin starting to rise? Bitcoin Season.

Has Bitcoin reached the previous cycle's high? Bitcoin Season.

Has Bitcoin broken a new high? Still Bitcoin Season.

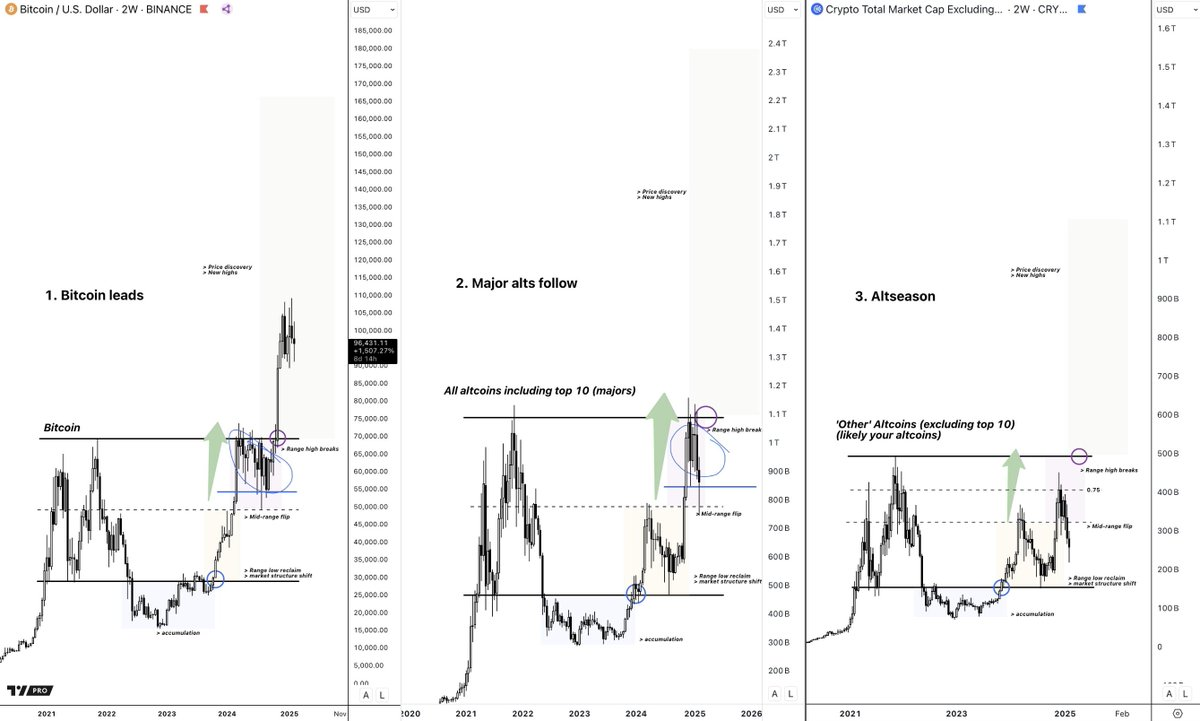

The emergence of Altseason usually follows a certain pattern: it often occurs after Bitcoin first breaks a new high and enters a consolidation phase. Subsequently, when Bitcoin rises again, Altseason truly arrives, at which point Bitcoin dominance begins to decline, and the altcoin market experiences an explosion.

3. What factors can trigger Altseason?

Altseason is typically triggered by the initiation of a Bitcoin bull market. (It is important to note that this does not rely on Quantitative Easing QE; we are currently in a Quantitative Tightening QT phase. Other possible triggering factors include the value and cycle of Bitcoin, the stablecoin reserve mechanism SBR, the launch of Bitcoin ETFs, etc.)

The first step in the flow of funds usually involves pouring into Bitcoin and major altcoins.

The subsequent results are:

Media hype attracts retail attention, leading retail investors to start buying altcoins.

At the same time, those who profited from Bitcoin will shift their funds to the altcoin market in pursuit of higher returns.

From historical data, this phenomenon typically occurs during the second time Bitcoin breaks a new high. This pattern can be observed from the previous charts.

The flow of funds in the crypto market has a relatively clear path:

Bitcoin → Major Altcoins → High Market Cap Tokens → Mid Market Cap Tokens → Low Market Cap Tokens

For example, on January 18, 2021, Bitcoin was in a consolidation phase and attempting to break a new high (as indicated by the red arrow in the chart), while Total 3 (the total market capitalization indicator for altcoins) was still at a mid-level (as indicated by the red arrow in the chart).

From this, it can be seen that Bitcoin is usually the starting point for the flow of funds, followed by the total market capitalization of major altcoins (Total 3), and only then do other tokens (including high and mid market cap tokens) come into play.

The triggering of Altseason does not depend on Quantitative Easing QE. (Of course, QE does provide assistance to the market.)

The key is that a large amount of funds first flows into Bitcoin and major altcoins, and then the market's greed will drive funds further into other altcoins.

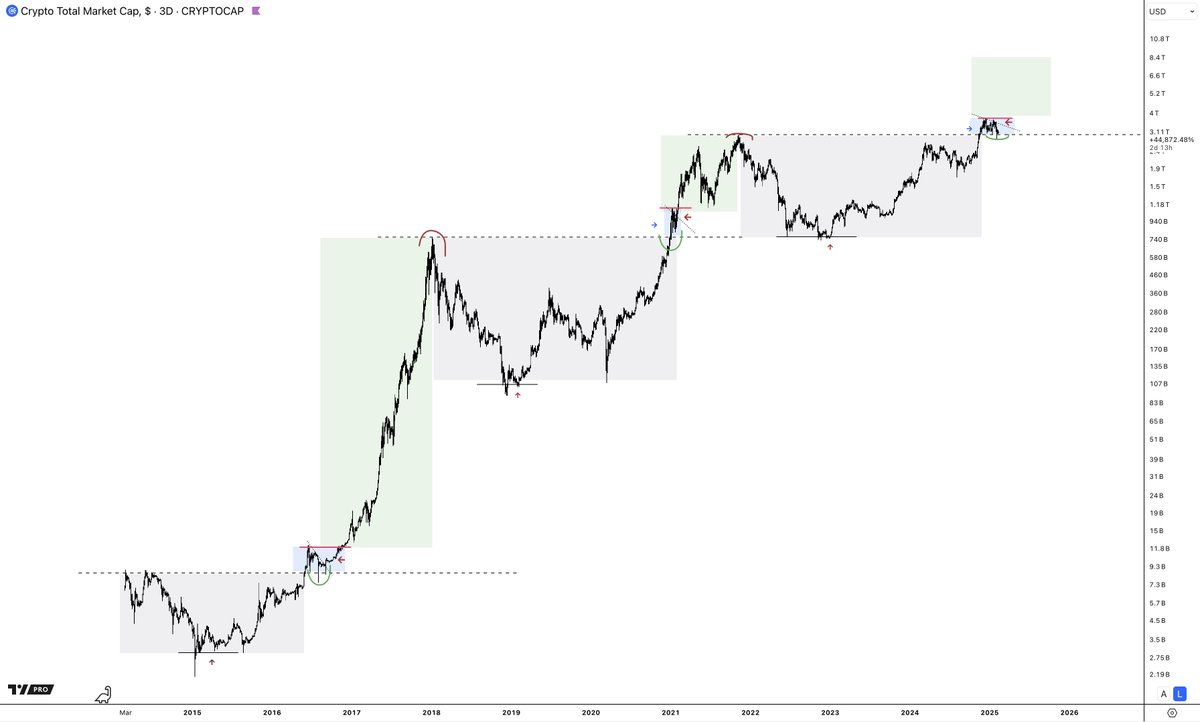

This is the triggering mechanism for Altseason. So far, whether it is QE, QT, or other external factors, we are on the right track. The entire cryptocurrency market (mainly composed of Bitcoin and some major altcoins, as Altseason has not yet truly arrived) has grown from $700 billion to nearly $4 trillion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。