Focus on cryptocurrency ecosystems that emphasize decentralization while providing an intelligent user experience.

Author: Duo Nine⚡YCC

Translation: Deep Tide TechFlow

The market is undergoing a significant transformation. Clear signals indicate that past successful strategies are no longer applicable.

In such an environment, you must choose: will you quickly adjust to adapt to the new reality, or will you be left behind by the times?

Next, I will explore five emerging and undeniable trends, delving into these new changes.

1. The Return of Safe Havens—The Rise of Gold

Before diving into cryptocurrencies, let's talk about gold. If you haven't noticed, gold (XAU) hit a historic high this week, with prices nearing $3,000 per ounce. Compared to two years ago, the price of gold has nearly doubled. What is happening behind this?

The answer is simple: someone is buying gold in large quantities.

But why are they doing this?

To a large extent, it is to hedge against market risks and geopolitical uncertainties.

From my observations, these buyers may include some countries and large investors. They have realized that the future global situation may be fraught with uncertainty. If a trade war breaks out or even military conflict occurs, gold is undoubtedly one of the safest assets.

For example, some extreme remarks by Trump, such as wanting Canada to become the 51st state of the U.S., taking over the Panama Canal, seizing Greenland from Denmark, and even planning to turn Gaza into a real estate project, have made global investors uneasy. Additionally, the U.S. imposition of tariffs on various countries only exacerbates these concerns.

However, another significant factor driving up gold prices is that BRICS+ countries (including Brazil, Russia, India, China, South Africa, and their allies) are gradually moving away from the dollar's dominance in international trade. This shift puts immense pressure on the dollar while encouraging these countries to back their currencies with as much gold as possible.

In the past, international trade relied almost entirely on the dollar, but now, more and more countries are choosing to trade using their currencies backed by gold. This new demand has propelled gold prices to soar.

So, what does this have to do with cryptocurrencies?

Bitcoin is referred to as "Gold 2.0." If gold prices continue to rise, it is undoubtedly a positive signal for Bitcoin. Moreover, this impact may far exceed your imagination. Please continue reading the next section for more details.

2. The Decoupling Phenomenon of Bitcoin and the Market

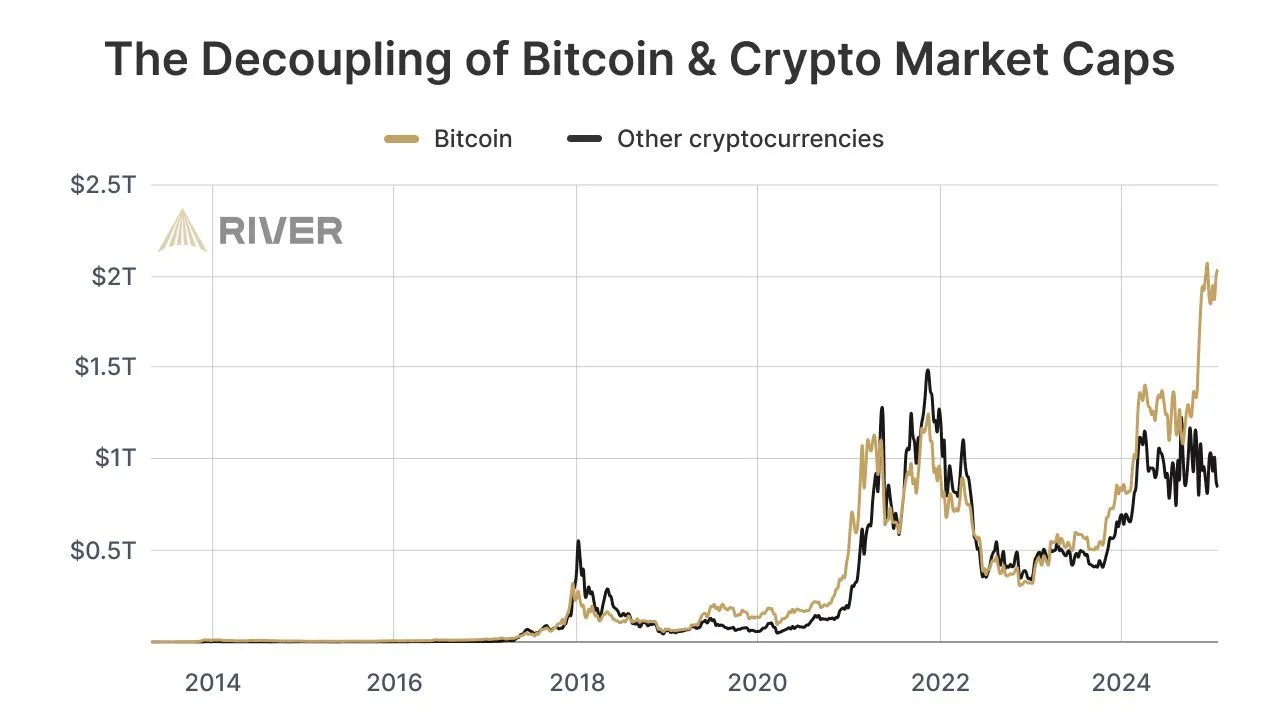

If you closely observe the current market, you will notice an unprecedented phenomenon: Bitcoin's price movements have clearly decoupled from other parts of the market, especially altcoins.

Look at the chart below. While Bitcoin continues to set new highs, the overall altcoin market has failed to follow suit. This situation has never occurred since Bitcoin's inception in 2009.

Bitcoin has now separated in price performance from altcoins, gradually becoming an independent asset class. It is no longer closely related to other parts of the crypto market but is showing greater independence. In the future, Bitcoin's movements may align more closely with gold rather than other assets.

This is also why the price chart of gold was referenced at the beginning of this article.

The turning point of this change occurred in 2024. When Bitcoin ETFs officially launched, Bitcoin gradually evolved into an asset that could compete with gold. Shortly thereafter, Bitcoin's price movements began to diverge significantly from the altcoin market, as shown in the chart above.

So, what is the conclusion?

The future of Bitcoin and gold looks bullish.

This trend may continue for quite some time. Especially as countries continue to print fiat currency to fund trade wars or other conflicts, this trend may further intensify.

Additionally, this change may have profound implications for Bitcoin's four-year halving cycle. Will Bitcoin's price still experience the same boom and bust cycles as in the past, or will it carve out a completely new path? We shall see.

3. The Dilution and Inflation Issues of Altcoins

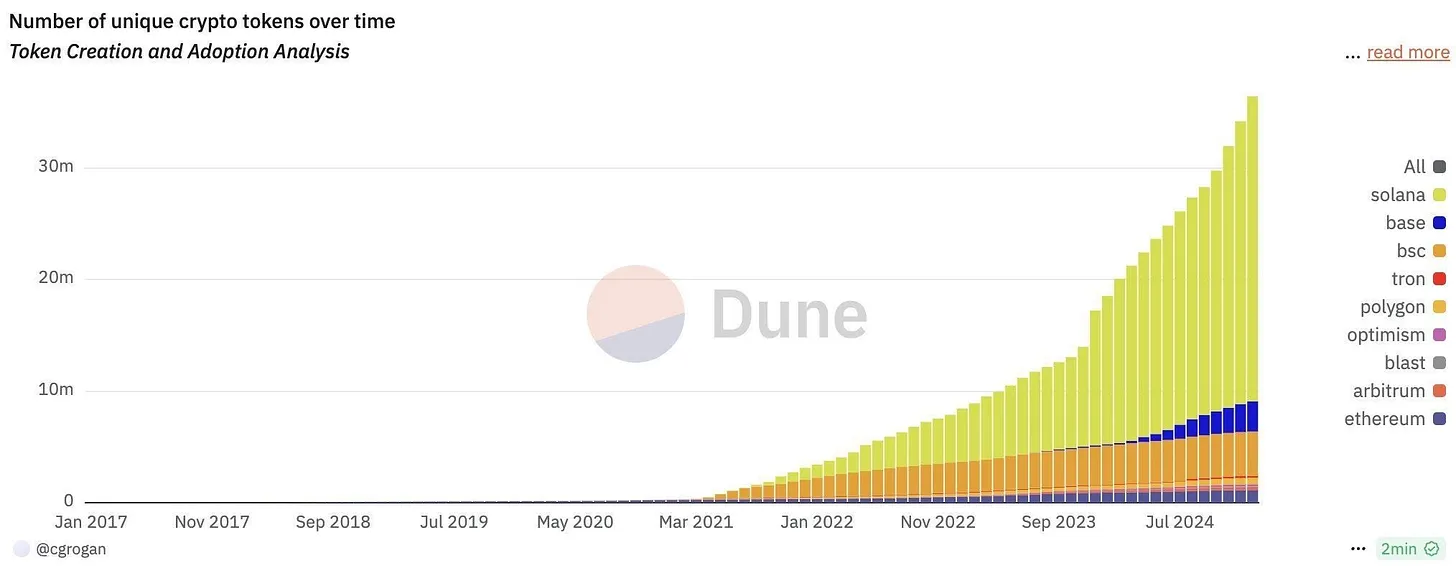

Another significant reason why altcoins lag behind Bitcoin in market performance is the continuous increase in their numbers.

Take the Solana ecosystem as an example; the network mints millions of new tokens every month. However, the overall liquidity in the crypto market has not increased in tandem.

I also mentioned this in a discussion on X platform. The logic is very simple:

When the same amount of capital is spread across more tokens, prices cannot rise. On the contrary, from a net effect perspective, each altcoin will be negatively impacted due to reduced liquidity.

This phenomenon is undoubtedly a bearish signal for the long-term development of altcoins.

By issuing more tokens, you cannot create value out of thin air. Although Solana diluted the altcoin space by minting millions of tokens and captured a significant amount of value from it, this practice is unsustainable, especially when the total liquidity of the entire altcoin market has not significantly increased.

In this competitive market, there will always be losers, and your goal is to ensure you are not among them. If you wish to adopt a more cautious strategy (because the market environment is not favorable to you), the best choice is to completely avoid the altcoin market.

Imagine this: over the past two years, simply investing in gold would have nearly doubled your funds; whereas investing in Bitcoin could yield returns of up to 5 times. In terms of risk-adjusted returns, these investments have far outperformed almost all altcoins. So, why take the risk of participating in the altcoin market?

4. User Experience Over Blockchain Terminology

The success of Solana clearly demonstrates one point: users prefer to use simple and intuitive applications rather than complex technical systems. They do not care about the technical details behind the scenes; simplicity and ease of use are the keys to success.

When users buy and sell memes, no one wants to study how gas fees or other costs are calculated. No one wants to transfer funds across chains or use bridging tools. Even fewer want to approve and then confirm a transaction like on Ethereum. This design is too complex and unfriendly for the average user.

In fact, most users do not care about technical concepts such as Layer-2 networks, decentralization, consensus mechanisms, or network security; these issues are not their focus. Solana deeply understands this and focuses on providing users with simple and easy-to-use applications.

As a result, they succeeded.

A large number of users flocked to the Solana platform to participate in Meme Token trading. As the number of users increased, liquidity also grew, attracting more developers to join and create more applications for its ecosystem. This positive feedback mechanism (flywheel effect) was fully activated, even though its driving force mainly came from greed and meme culture.

However, this success has also overshadowed other participants in the altcoin market, such as Ethereum.

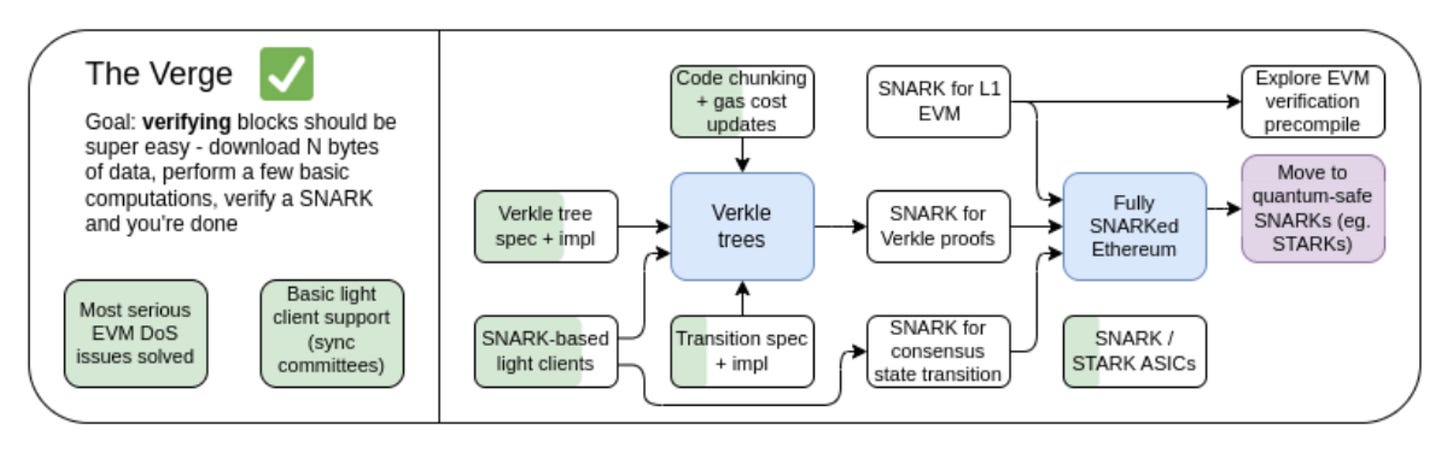

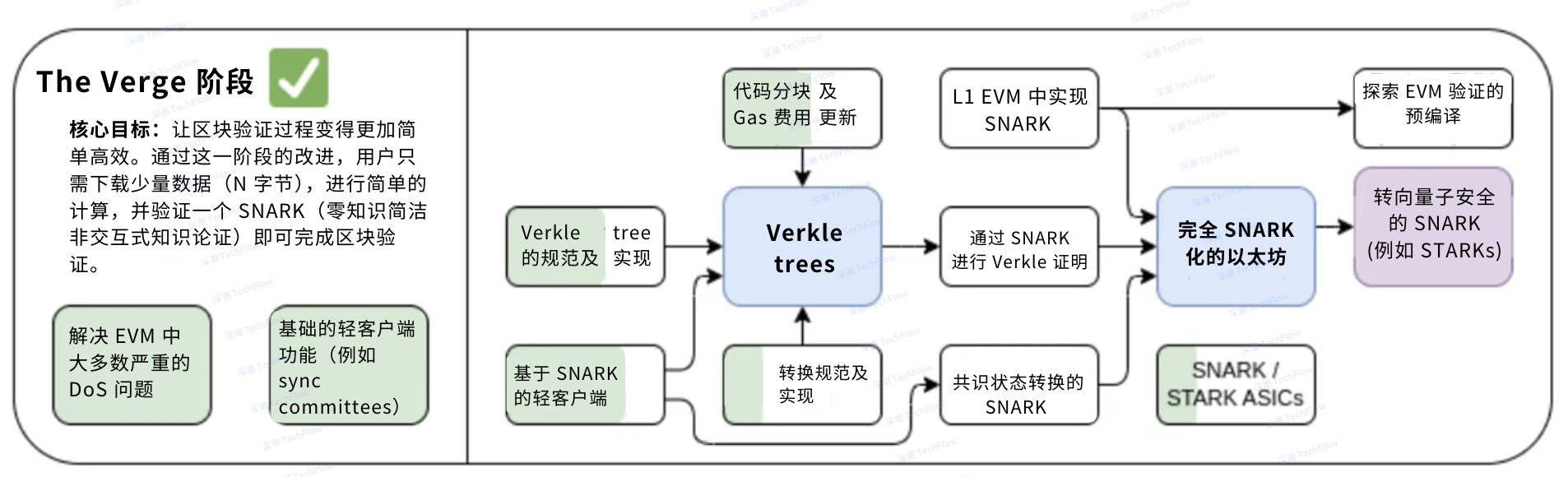

From a certain perspective, this change is normal. The cryptocurrency industry is gradually shifting from an engineer-centric language focused on blockchain technology to user-centered application scenarios. In this process, technical language is becoming secondary, even niche. However, Vitalik (the founder of Ethereum) seems to have yet to fully realize this. He remains focused on technical developments and has not kept pace with the shift in user demands.

Look at the Ethereum roadmap below, and you will understand this.

(Original images from Duo Nine⚡YCC, translated by Deep Tide TechFlow)

Cryptocurrency has long since departed from the geek circle and is no longer limited to solving the Byzantine Generals Problem in niche areas. This phase ended years ago. Now, the real investment opportunities lie in where users are headed, not in complex technical jargon.

Using Solana as an example, it is currently leading in this race, but more competitors will emerge in the future. These emerging fields are precisely the directions worth paying attention to and investing in.

5. Decentralized Exchanges (DEX) > Centralized Exchanges (CEX)

In the past, centralized platforms (CEX, such as Binance and other cryptocurrency exchanges) were the dominant force in the market. This was mainly because they provided simple and convenient interfaces that allowed users to easily enter the world of cryptocurrencies.

However, in recent years, decentralized applications (DApps) have gradually emerged in terms of user experience and cost, even surpassing centralized platforms in some aspects. This trend is becoming increasingly evident.

For example, I discussed a case in Alpha Post #52. Additionally, the TRUMP token launched this January relied entirely on decentralized tools for issuance, while traditional centralized exchanges were excluded and later rushed to try to capture the relevant market share.

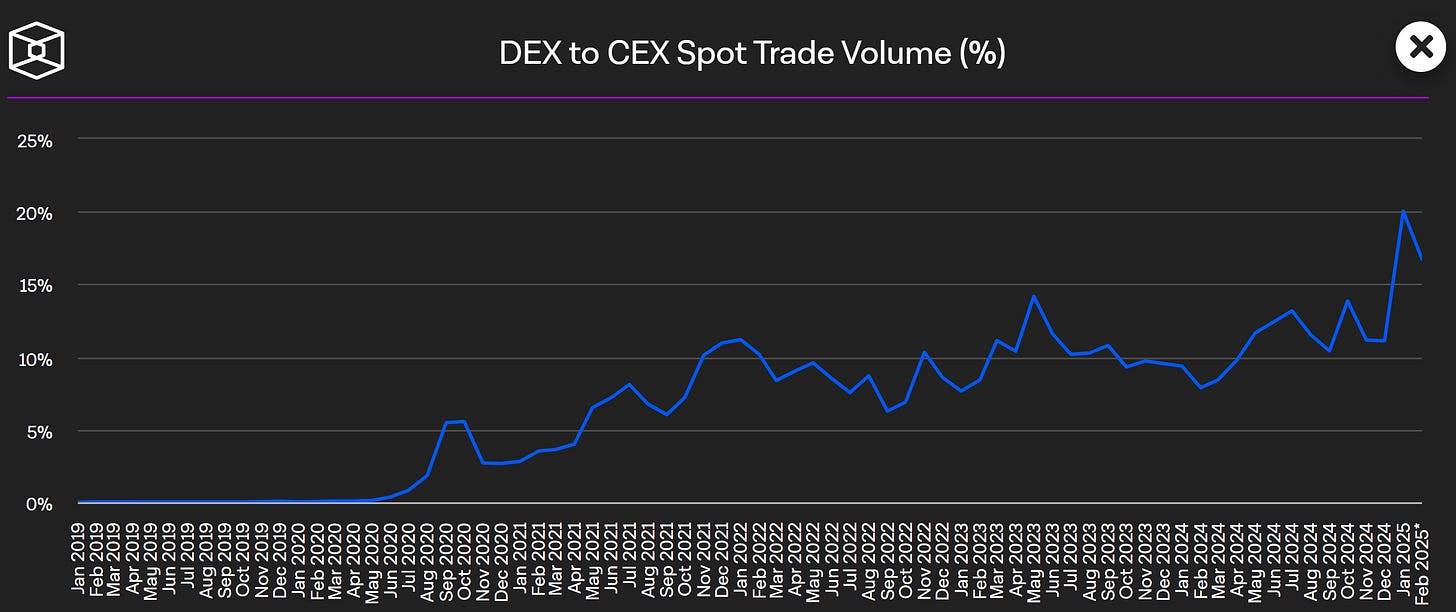

In the long run, I believe decentralized applications will gradually replace the current centralized market platforms and ultimately become the dominant force. This trend can be seen in the significant growth of trading volume on decentralized exchanges (DEX). Data shows that DEX trading volume increased significantly in 2024 (see chart).

So, why choose centralized exchanges like Binance instead of decentralized platforms? Decentralized platforms not only allow users to earn additional rewards but also share a portion of the profits by using these applications. More importantly, users always have complete control over their crypto assets, and the user interfaces of these platforms are more user-friendly. In this field, AAVE is a particularly outstanding example, with its product design and user experience widely recognized.

Finally, I want to emphasize one point: focus on cryptocurrency ecosystems that emphasize both decentralization and intelligent user experience. These ecosystems are likely to become the winners of the future, as centralized institutions often move slowly in innovation and adapting to market changes, making it difficult to keep up with user demands.

While Solana currently leads the market, it also faces two significant issues. First, the centralized nature of its network raises concerns among some users about its security and decentralization attributes. Centralization means that control over network nodes is concentrated in the hands of a few entities, which may undermine the openness and censorship resistance of the blockchain. Second, Solana's issuance of millions of tokens has led to a dilution of the ecosystem, and the market has become saturated. This practice may weaken the value of existing tokens and affect the confidence of long-term investors.

Therefore, it is advisable to closely monitor emerging ecosystems that can overcome these issues and find a balance between decentralization and user experience.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。