Original Author: Web3 Farmer Frank

In the next 10 years, will the RWA narrative gradually step into the "Kingdom of Freedom"?

From the data, the current total market size of RWA exceeds $15 billion, while BlackRock predicts a potential growth space of over 700 times in the next 7 years. This represents an incremental cake worth at least hundreds of billions of dollars. The only question is, who will take up the banner and become the "singularity" that ignites this epic transformation?

Over the past decade, the entire crypto industry has experienced every key node in the integration of traditional finance and DeFi, witnessing Wall Street and mainstream TradFi players gradually incorporating keywords like "tokenization" into their financial reports and heavily betting on RWA. Everyone is increasingly aware of a powerful trend: the ultimate battleground for RWA is not at the protocol layer, but at the infrastructure layer.

Objectively speaking, RWA needs more than just moving assets "on-chain"; it requires liquidity reconstruction to unlock its true value potential. This is why RWAfi will be the ultimate battleground for the RWA narrative, and how to redefine the future of Crypto+RWA through a "super-linear growth function."

Why is an "RWA Hub" Needed?

To truly understand and unlock the potential of RWAfi, one must first clarify a concept: "RWA Hub."

As the RWAfi asset liquidity center actively advocated and built by Plume, the "RWA Hub" is not just a technical solution but the core engine of an ecosystem that determines whether RWA assets and applications can truly achieve exponential growth.

It is well known that when Wall Street investment banks began discussing RWA tokenization, they faced three major obstacles: high compliance thresholds, fragmented liquidity, and a lack of developer tools. This explains why many RWA projects fall asleep once they go on-chain; after all, moving RWA onto the chain is merely the first step in tokenization and is far from unlocking its true potential:

To further realize the release of on-chain value, a more efficient underlying technical architecture, an open infrastructure toolkit, and a well-coordinated ecosystem are needed. This means the industry requires a complete service framework around the entire lifecycle of RWA assets, especially to safely and easily introduce RWA assets into diverse on-chain DeFi scenarios.

Only in this way can the existing dividends of traditional assets be completely transformed into incremental value on-chain. Taking real estate tokenization as an example, a property on-chain should not just be a static NFT but should become a living cell of DeFi, such as automatically distributing rental income through smart contracts, enabling trustless collateralized lending, and instant completion of fragmented property transactions.

However, this "asset empowerment" requires not just protocols but a complete set of public chain-level architectures that support liquidity and composability.

For this reason, Plume has launched a new approach centered around the "RWA Hub," targeting both RWA on-chain and mainstream traditional Web2 institutions simultaneously—by deploying interoperability solutions like SkyLink across 18 blockchain networks including Solana, Movement, Injective, and Omni Network, providing them with permissionless access to institutional-level RWA yields.

In this process, Plume acts as a bridge connecting Web2 and Web3, bringing new users and capital inflows to Web3 while opening up a new growth logic: partnering with financial giants that have massive user bases and traditional capital, gaining the cooperation of these leading Web2 companies, and directly helping them bridge their tens of billions of existing Web2 users and traditional capital into Web3 incremental users and Web3 "New Money."

Interestingly, Ondo has also recently announced plans to lay out an RWA public chain, which further validates the forward-looking nature of Plume's RWAfi public chain from another dimension. However, compared to Ondo's "WallStreet 2.0" route, one might find that Plume places more emphasis on the "Robinhood 2.0" concept—not just the inflow of institutional capital, but gradually guiding and attracting a broader range of institutional and retail users into the new financial ecosystem through the activation of underlying users.

According to publicly disclosed information, Plume has also partnered with Elixir to launch a new RWA institutional vault on Nest, connecting RWA assets from BlackRock (BUIDL) and Hamilton Lane (SCOPE), striving to expand from "RWAfi infrastructure" to the protocol layer where institutional-level assets are settled on-chain:

The currently launched $28 million institutional vault is just an experimental start—BlackRock's BUIDL scale has exceeded $460 million, while Hamilton Lane manages private equity assets totaling as high as $119 billion. Plume unlocks these assets into forms of on-chain liquidity like deUSD through the Elixir stablecoin gateway, essentially paving a gradual path for trillion-dollar RWA assets to go on-chain without impacting the existing compliance framework.

In this context, users holding certificates like BUIDL can participate in staking and earning within the Plume ecosystem, and can also use them as collateral to mint stablecoins in DeFi protocols, achieving a cycle of "settlement-activation-recreation," which is expected to evolve Plume's RWAfi vault from a custodial tool into an on-chain liquidity hub.

Essentially, this provides an excellent buffer for traditional financial giants to go on-chain, with its long-term value being exponentially released alongside the "trickle effect" of institutional assets going on-chain, making Plume a testing ground for the on-chain settlement of trillion-dollar RWA assets. Thus, this is not just a technological upgrade but a transfer of financial discourse power:

When Wall Street giants' assets gain new life on-chain through Plume, the boundaries between traditional and crypto will completely dissolve, and the ultimate significance of Plume for RWAfi far exceeds the current narrative framework:

It is not only a liquidity infrastructure for on-chain existing DeFi players and RWA tokenization but also a core pipeline capable of attracting new users and capital inflows into Web3, expanding the value of the RWAfi track to the entire Web3 world, allowing the on-chain ecosystem to achieve a qualitative change from both capital and traffic dimensions.

From Modular Toolbox to Community Resonance: Building the "Super-Linear Growth Function" of RWA

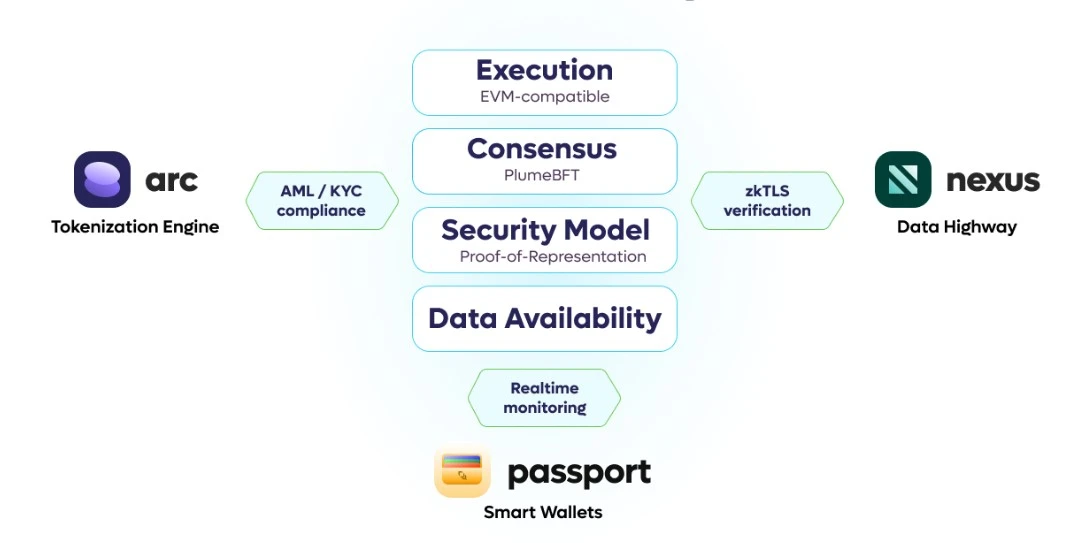

From a technical framework perspective, Plume has created a "ready-to-use" modular arsenal for developers—by integrating multiple modular key tools, it has built a complete RWA asset on-chain solution:

Arc - Tokenization Engine: Arc simplifies the tokenization process by integrating compliance workflows and reducing barriers for asset issuers, providing an effective pathway for bringing RWA on-chain;

Passport - Smart Wallet: Passport allows users to store contract code directly in their externally owned accounts (EOA), with this native feature supporting RWAFI composability, yield management, and advanced account abstraction;

Nexus - Data Highway: Nexus securely integrates real-world data into the blockchain using cutting-edge technologies like zkTLS, enhancing the security and transparency of on-chain assets while unlocking new opportunity scenarios;

This is akin to embedding "compliance as a service" into the DNA of the public chain—developers only need to focus on business innovation, while compliance, data, liquidity, and other tedious tasks are automatically handled by Plume's underlying infrastructure. It is this "developer-friendly" philosophy that has quickly attracted over 180 ecological projects to settle in, covering diverse scenarios from fund tokenization to RWA asset trading.

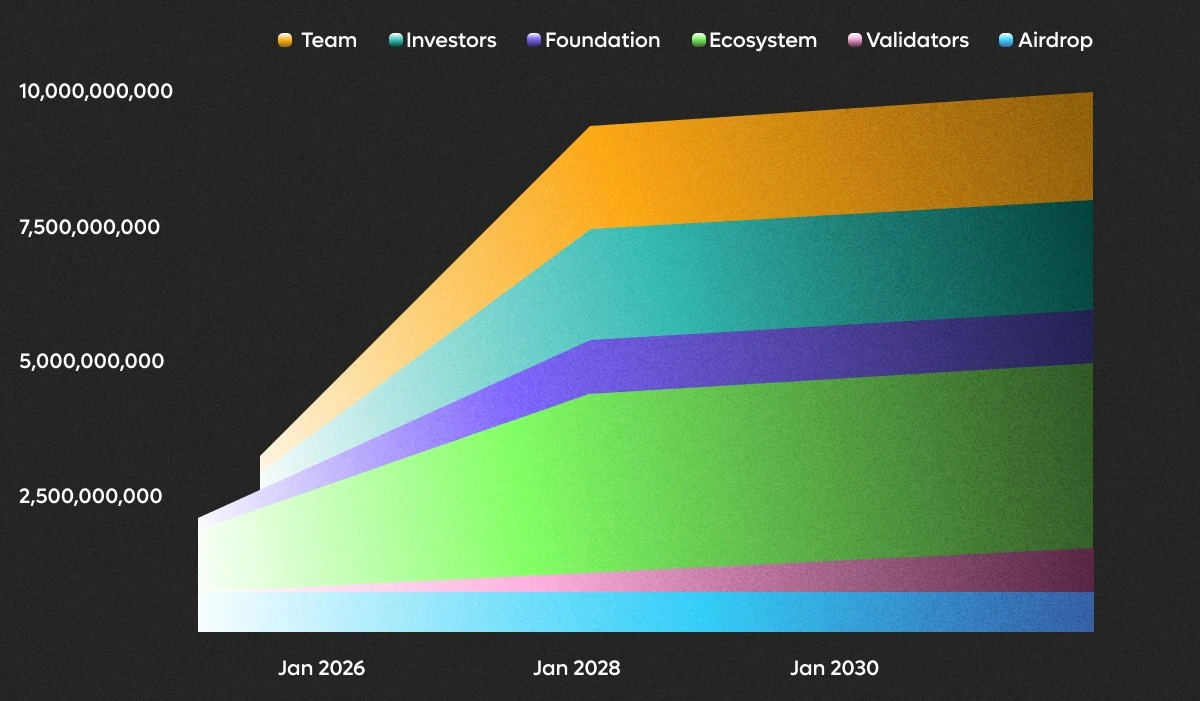

In addition, many may have noticed that after the recent TGE, the initial circulation of the PLUME token was only 20%, primarily consisting of community airdrops and early supporter shares, while the remaining tokens will gradually unlock over at least the next 5 years.

This design serves both the long-term security of market participants and aligns with the strategic needs for building the on-chain RWAfi ecosystem. The reason is simple: by gradually unlocking tokens, token distribution is no longer a one-time reward but a continuous ecological incentive tool that can provide long-term incentives for ecological participants through staking, liquidity rewards, and governance rights.

This not only incentivizes existing users but also extends an invitation to more potential users and developers, attracting more quality projects and users to join, helping to build a thriving RWAfi ecosystem based on long-termism.

Some interpret this as a model of "airdrop as a co-building ticket," transforming users into co-builders of the ecosystem rather than mere passersby, breaking away from the traditional path of "mainnet launch → ecological subsidies → token issuance," turning TGE into an accelerator for ecological construction.

Public chains are not just a pile of technology but the crystallization of community consensus. Plume has cultivated over 180 ecological projects and more than 3.75 million real users on the testnet over the past year, generating hundreds of millions of transactions, forming a moat that cannot be rapidly constructed.

In a sense, Plume has strategically positioned the community as its core competitive advantage, building a decentralized ecosystem—unlike Ondo's traditional financial background and institution-led construction path, Plume relies on the true power of the community and user needs to drive the market, aiming to break down the barriers between traditional finance and DeFi. This makes the market not solely dependent on capital inflows from large institutions, establishing a self-sustaining network effect.

Thus, the more than 180 ecological projects and over 3.75 million real users on the testnet have already proven that its community-driven model has lasting vitality. In fact, relying solely on institutional capital inflows cannot provide long-term momentum for RWAs to go on-chain, as this remains a relatively closed model.

From this perspective, the ultimate fate of RWAfi belongs to those who understand both Wall Street rules and the spirit of the crypto community, and the growth of RWAfi will lead everyone to witness a historic turning point: traditional giants like BlackRock will no longer stand by but will actively participate in on-chain ecological construction through Plume. The community users and ecosystem that Plume has previously cultivated will create a symbiotic network for the RWA protocol layer that other latecomer projects can never replicate.

In this model, the flow of assets and the formation of the market are driven by the "community," rather than merely institutional capital. This market mechanism based on community and user needs endows Plume with flexibility and sustainability that differ from traditional finance, enabling it to build a truly decentralized and vibrant financial ecosystem.

For this reason, Plume is not just a chain designed to meet institutional needs; it is a platform dedicated to breaking old rules and empowering every individual with the right to participate and make decisions. The future of RWAs going on-chain will no longer be solely "seller"-driven but will be a bidirectional flow, mutually promoting market.

Endgame Simulation: Where Are the Valuation Anchors for RWAfi and Plume?

People often discuss where the valuation anchors for RWAfi and Plume lie, and the answer may be singular: when $100 trillion worth of traditional assets begin to migrate on-chain, the existing valuation framework will be completely invalidated.

From a data perspective, there are some simple reference groups:

Just Hamilton Lane's $119 billion in private equity assets, if 5% were to go on-chain through Plume, its on-chain settled value would already exceed the actual TVL of all RWAfi projects;

If BlackRock's predicted $10 trillion RWA market by 2030 comes true, even capturing just 0.1% of the gateway share would push Plume's valuation to around $10 billion; if it reaches 1%, Plume's valuation could even soar to hundreds of billions.

This effectively opens up the valuation ceiling for Plume as an infrastructure hub, especially given its potential for direct access to trillion-dollar traditional financial assets. Considering the potential market size of the RWAfi track, as the demand for tokenization of traditional assets increases, the ecological value of RWAfi will be further released.

More importantly, we are witnessing a historic turning point: BlackRock's BUIDL fund is being converted into on-chain stablecoins through Plume's NEST vault, and traditional TradFi giants are beginning to evaluate Plume's compliance framework. This resonance between institutions and the community is constructing the "super-linear growth function" of RWAfi and Plume.

Therefore, Plume's sharpest edge lies not in short-term prices but precisely in the subsequent technological and first-mover advantages of RWAfi ecosystem construction—Plume's modular tools lower the development threshold, attracting a large number of developers and institutional users.

Especially with the continuous expansion of the RWAfi ecosystem, each new project will bring synergistic benefits to Plume's overall value network.

The winds of change begin at the edges, and under the impetus of the RWAfi narrative, the most exciting growth story of RWA is just beginning.

As more and more RWA players follow in Plume's footsteps, it is not merely a zero-sum competition but a signal of the rise of the RWA ecosystem. After all, the world of RWAfi does not need lone heroes; it needs an irreplaceable hub—a core engine that can connect traditional finance with the on-chain ecosystem, carrying the flow of trillion-dollar assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。