The cost of trust is higher than everything.

Written by: shushu, BlockBeats

Yesterday, Virtuals Protocol announced that the VIRTUAL token is now tradable on the Solana chain, with its official LP now live on Meteora, and preparations made for Virtual Protocol's Launchpad on the Solana chain. Meanwhile, Nansen CEO Alex Svanevik tweeted about when Aave would be available on Solana, tagging Aave team members and the founder of Solana.

However, the comments section of this tweet turned into a debate zone for Solana supporters and Aave enthusiasts, which, more broadly, reflects the market share competition between the Ethereum ecosystem and the Solana ecosystem in specific application areas.

A "war of words" over lending protocols

Kyle Samani, a partner at Multicoin, the "milk king" of Solana, commented on this tweet about Kamino, a DeFi lending protocol in the Solana ecosystem, intending to indicate that Kamino is the Aave of the Solana ecosystem.

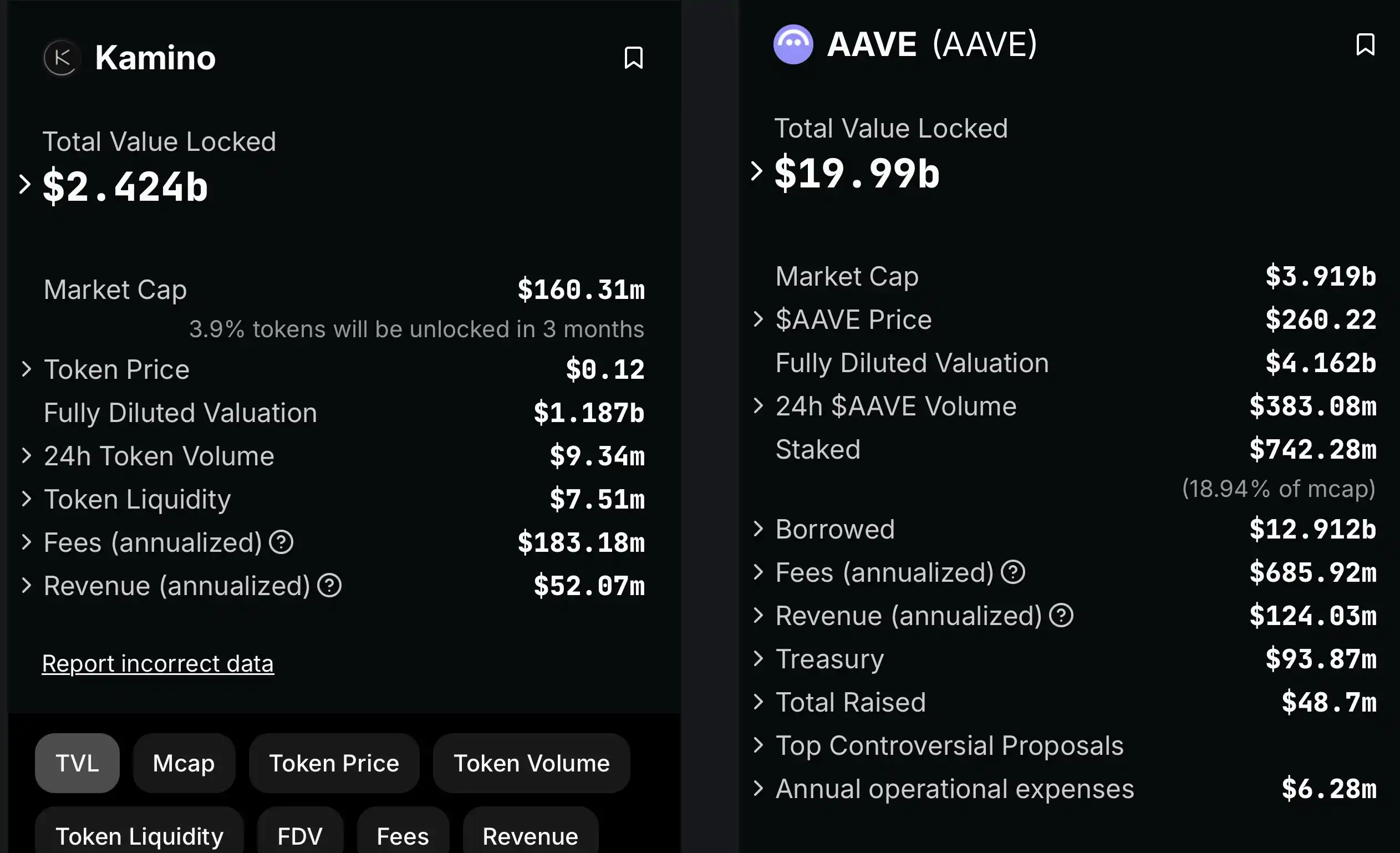

Svanevik replied that Aave's scale is ten times larger than Kamino, stating, "If Aave's users could easily switch chains, it would be a massive release of TVL."

However, Solana's founder toly and the foundation's chair Lily Liu do not share this view. Lily stated that Kamino's product is better and proudly said, "Today's metrics do not represent tomorrow's performance." Toly expressed support for a local team focused on the Solana mainnet, arguing that it is wiser to support a team that is not distracted by multiple chains, directly extinguishing the possibility of Aave coming to Solana.

Under the sharp evaluations from many in the Solana ecosystem, supporters of Aave and even the Ethereum ecosystem were not willing to back down.

Aave founder Stani fired back, saying that the current state of Solana DeFi is merely copying Aave's old technology, pasting a half-finished UI, and restricting UK users. Although Stani referred to Solana DeFi, it was clear he was targeting Kamino, which is also a lending protocol.

In response, Toly shared the DeFiLlama interface for Aave and Kamino, indicating that Kamino's TVL is 1/8 of Aave's, but its revenue is only 1/2.5 of Aave's. "I don't understand why Aave would be a better product if it can't generate revenue; TVL is just a cost."

Stani sharply replied that Kamino's USDC reserve factor (the proportion taken from each transaction or liquidity pool) is 15%, while Aave's is only 10%, meaning it extracts higher fees from user liquidity pools. Stani believes this reflects the current insufficient competition in the Solana ecosystem, leading to weaker bargaining power for users when choosing DeFi platforms, resulting in higher fees ultimately borne by users.

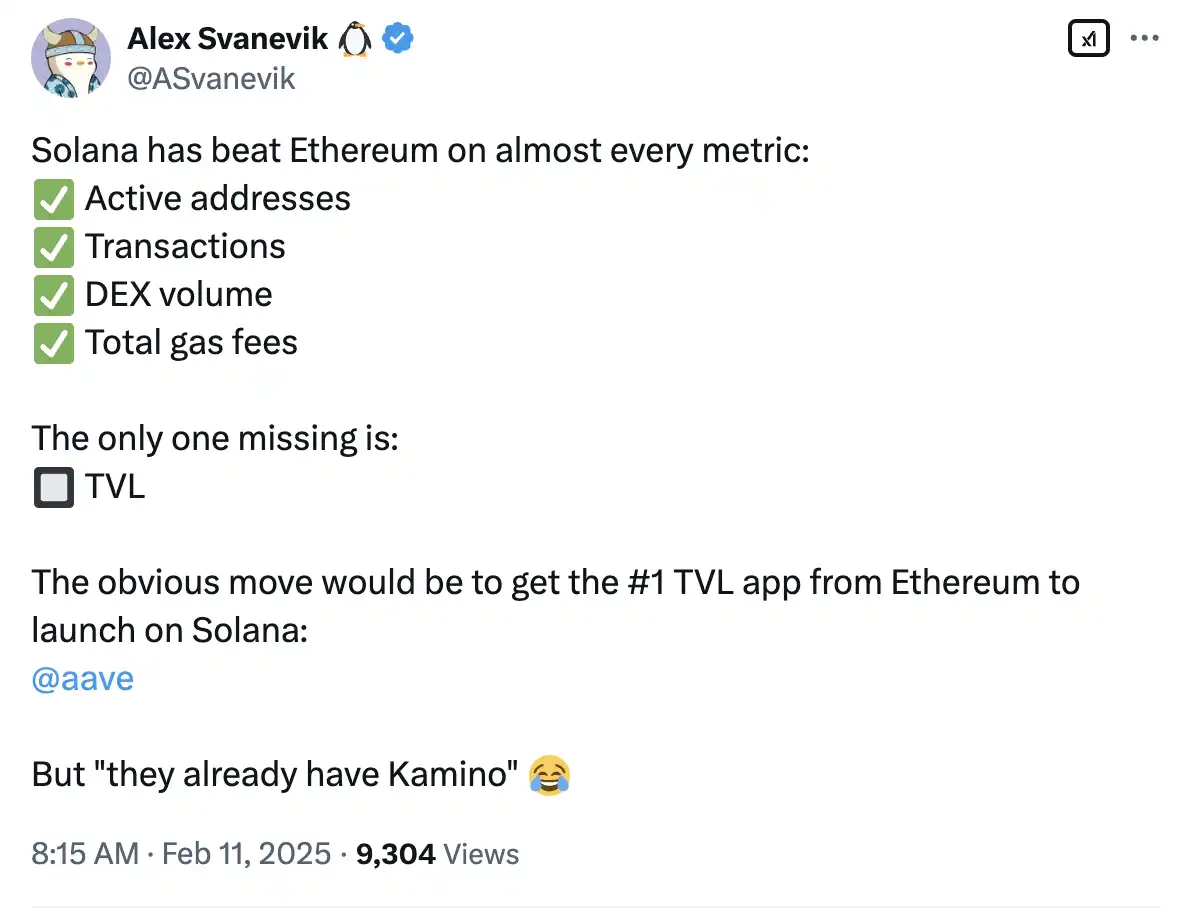

The instigator of this "war of words," Alex Svanevik, then added fuel to the fire, stating that Solana has surpassed Ethereum in several key metrics, including active addresses, transaction volume, DEX trading volume, and total gas fee revenue. However, in terms of TVL, Solana has yet to surpass Ethereum. Given this, the most direct strategy is to attract Aave, the top TVL application on Ethereum, to deploy on Solana, thereby further enhancing its DeFi ecosystem's competitiveness.

In the comments section, some questioned the reasonableness of this claim, arguing that Aave's deployment on Solana would not create TVL out of thin air. Svanevik explained that for Aave's deployment to not contribute to Solana's TVL growth, the following two conditions must be met:

- Aave's current TVL has not seen any funds migrate to Solana;

- No new TVL enters Aave on Solana.

However, Aave has already successfully attracted $20 billion in TVL, so Svanevik believes Aave should migrate to Solana, leaving one momentarily unable to discern whether Svanevik is an Ethereum maxi or a Solana maxi.

The cost of trust is higher than everything

Undoubtedly, Aave is a core DeFi application in the Ethereum ecosystem, forming a core pattern of Ethereum DeFi alongside Uniswap, Lido, and others. There are also voices in the community questioning why Ethereum's top DeFi application would miss out on a potentially limitless ecosystem like Solana. Setting aside technical factors like code, the reasons for an application choosing not to migrate to a new ecosystem are the same as those for choosing to expand into an ecosystem: to achieve incremental growth.

Virtuals Protocol's expansion to Solana has provided a broader user and liquidity base, while Aave's decision not to go to Solana likely involves considerations about the competitive landscape. The DeFi sector on Solana is becoming increasingly mature, with multiple later-stage teams like Kamino, marginfi, and Save competing for market share in the lending protocol space, meaning Aave's expansion costs will be higher than expected.

More importantly, Aave's existing brand image will also be subject to change due to expansion. As some in the community have pointed out, "If a fund with seven to eight figures wants to achieve returns higher than off-chain while ensuring safety, then ten times out of ten, they will be recommended to go to Aave on Ethereum rather than DeFi on Solana, Tron, Celestia, or other chains."

Safety is the foundation of a lending product. Only with sufficient security audits, experience in dealing with hacker attacks, and mature contract design can large funds and ordinary users choose to park their assets there. Therefore, Aave's ability to become one of the most influential lending platforms on Ethereum is closely tied to the long-standing developer ecosystem, security audit cases, and the large and mature liquidity pool that Ethereum has built over time.

The financial attributes of DeFi determine that "the longer it runs, the stickier it becomes." This stickiness is rooted in a profound trust in the safety and stability of product contracts. This layer of "trust cost" goes beyond considerations of a new chain's speed, performance, and transaction fees; it also includes the completeness of infrastructure, the coverage of auditing firms, the community's vigilance against potential security vulnerabilities, and the ecosystem's responsiveness in providing timely remedies under extreme conditions.

Related reading: "Revisiting DeFi: The Present and Future of the Most Mature Web3 Business Model Track"

Looking back at the development of Ethereum DeFi over the past few years, many projects have experienced significant vulnerabilities or security incidents, even incurring losses of over a hundred million dollars. It is through repeated responses and iterations that the security barriers of Ethereum DeFi have gradually been built. Aave's popularity is precisely due to this layer of security moat, making it the first choice for large fund users, especially institutional players. In other words, most people view Aave as synonymous with "lower risk and considerable returns," especially for users with funds reaching millions or even tens of millions of dollars, where safety and stability always take precedence over incremental returns.

In contrast, Solana, as a high-performance Layer 1 blockchain, does have certain advantages in transaction speed, gas fees, and so on. However, from the perspective of lending protocols, the core of financial applications lies in the "risk-reward ratio." Speed and low fees are certainly important, but if they cannot provide sufficiently proven safety and a record of countering attacks, such advantages are often not enough to support the long-term migration of significant liquidity in the DeFi space. Especially in lending operations, one must face multiple risk factors such as liquidation, interest rate fluctuations, contract audits, and hacker attacks; once problems arise, the brand image and trust accumulated by the platform over the years can be instantly shattered, and this "trust cost" is far more expensive than the technology itself.

Furthermore, even if Aave truly chooses to expand to Solana, it does not necessarily mean it will bring about the so-called "spontaneous increase" in TVL. Capital is profit-driven and rational; the $20-30 billion in TVL that Aave has accumulated on the Ethereum mainnet is not automatically willing to split and migrate to another chain. On the contrary, due to the significant differences in underlying technology stacks, development languages, and even community cultures between chains, Aave would need to invest substantial time and resources to adapt and audit, which itself implies extremely high expansion costs and management risks. Moreover, the existing local lending protocols on Solana are also maturing, and Aave does not possess a first-mover advantage.

Therefore, under the premise of having a security moat, brand, and capital scale as three protective barriers, if Aave insists on large-scale expansion to Solana, it may not be the wisest choice. After all, in the long marathon of DeFi, winning users' trust and safety recognition is the most difficult core barrier to shake.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。