1. Why is shorting not cost-effective?

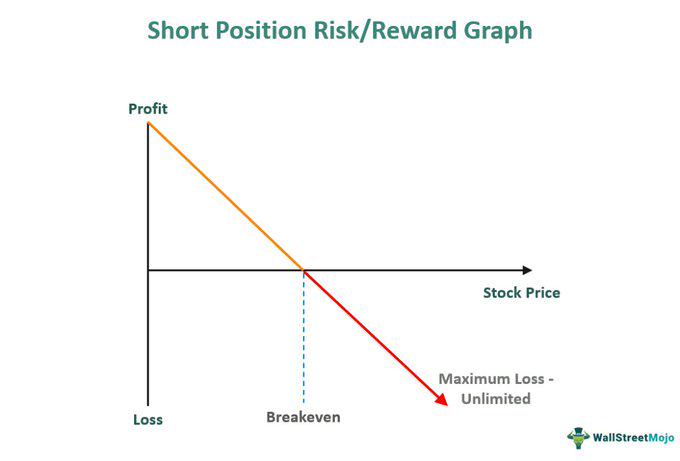

In theory, shorting can earn a maximum of 1x, but it can potentially lose an infinite amount;

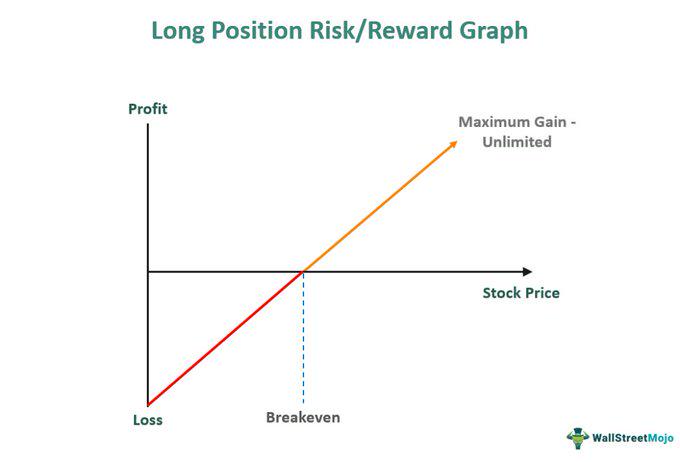

Going long can lose a maximum of 1x, but it can potentially earn an infinite amount.

Although some argue that in the crypto space, all altcoins have strong gravitational pull (team selling), so shorting is not as bad as imagined.

However, I still rarely short (except for hedging), and the deeper reason is:

Shorting can distort one's perspective, leading to hatred for the industry (seeing the dark side can deepen self-doubt).

Once hatred takes over (which it will), losing faith, one day you will definitely start trying to short Bitcoin, but the consequences, you know, are terrifying.

You need to know:

Humanity's eternal money printing √

Bitcoin's eternal bull market √

-------- Divider --------

2. How much profit did the $Luna shorting army make?

In 2022, I criticized the Luna scam daily on Twitter, to the point where for a while, Luna's die-hard fans chased me down to insult me, so I have a say in this matter.

The collapse of $Luna essentially means:

The wealth of Luna bulls

↓ Transferred to ↓

Luna shorts + CEX.

After all, it was once a top 10 market cap project, so this wealth transfer was significant, leading to huge profits for the shorts.

But we cannot [only see the thief eating meat, not see the thief getting hit].

When Luna rose from $0.3 to $120, countless shorts' money had already entered the bulls' pockets, so shorting was still not worth it.

At that time, I made one of the few short trades; I didn't short Luna, but shorted $UST (Luna's stablecoin).

I still believe this was a pretty great decision; as a stablecoin, I started shorting at around 0.9, theoretically losing less than 10%, while potentially earning 90%.

However, such shorting opportunities come around only once every few years.

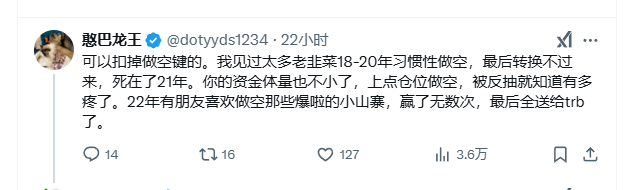

Moreover, every once in a while, you encounter something like $TRB, which can explode in place (no fundamentals, but goes from $10 to $550 in a few months), and even if you have god-level margin, it can wipe out all the shorts' ammunition in an instant.

Referencing what @dotyyds1234 said

So the conclusion is:

Do not habitually short (except for hedging)

Some money is better left unearned

In a bear market, it’s better to rest

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。