Web3 games are shifting from speculation-driven to focusing on real users and sustainable development.

Author: Joey @IOSG

Methodology

This research includes two main focuses:

Analyzing the internal structure of game sub-sectors;

Constructing a panoramic map of current mainstream projects in the market.

To this end, we selected leading projects with a market capitalization of over $50 million and included large games that have not yet issued tokens but have high recognition and attention in the community. If certain projects span multiple fields, they are classified into the most relevant vertical sector.

Game Ecosystem Map

As of January 2025, the Web3 game ecosystem can be divided into three main verticals: Infrastructure, Games, and Ecosystems.

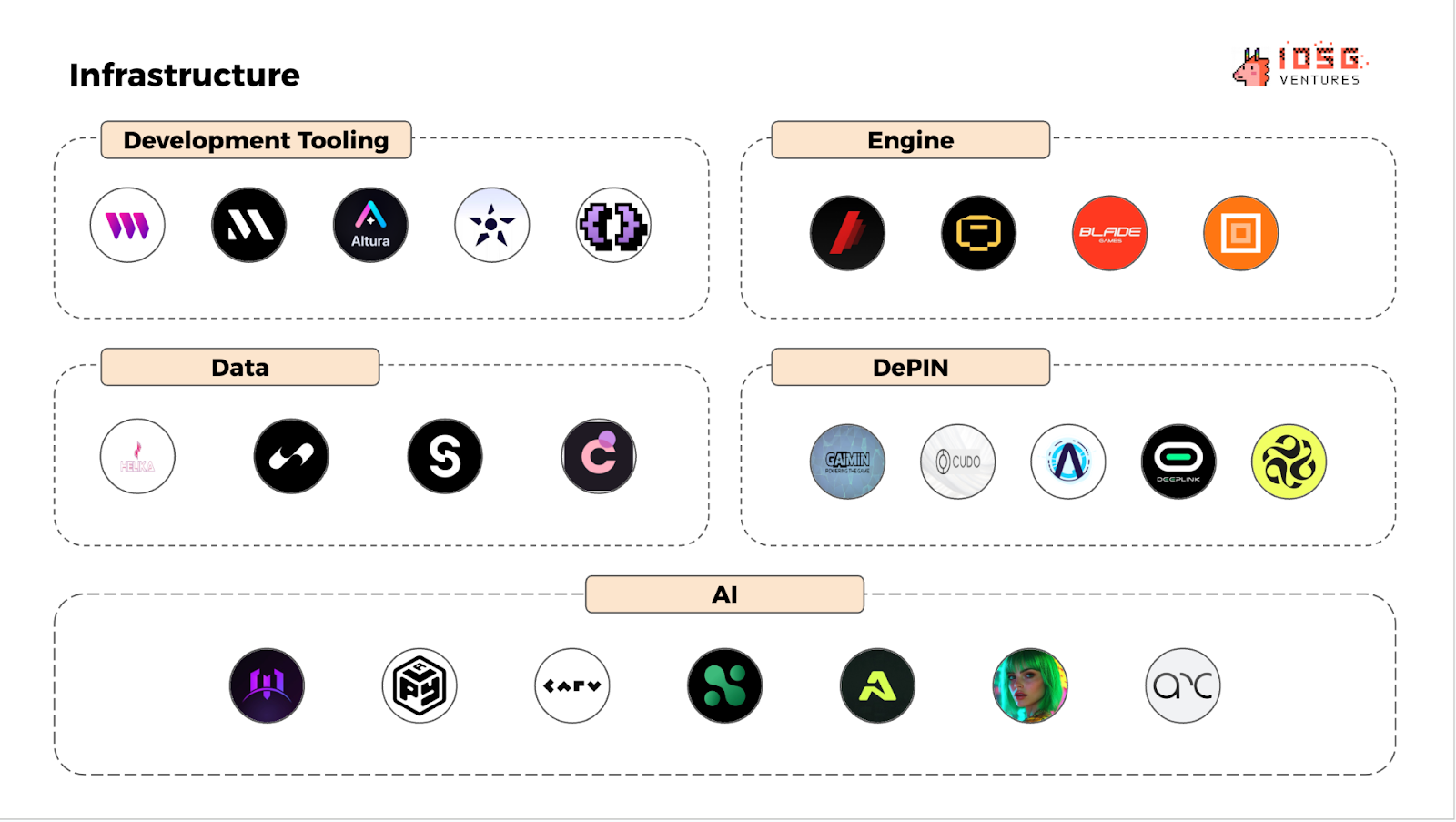

#Infrastructure

Infrastructure covers the technical foundation of Web3 games, including development frameworks, game engines, AI tools, data management systems, and DePIN (Decentralized Physical Infrastructure Network).

To avoid excessive stratification, this classification standard is relatively broad. For example, the "Data" category includes both data analysis platforms and in-game data rights protocols (such as IP protocols).

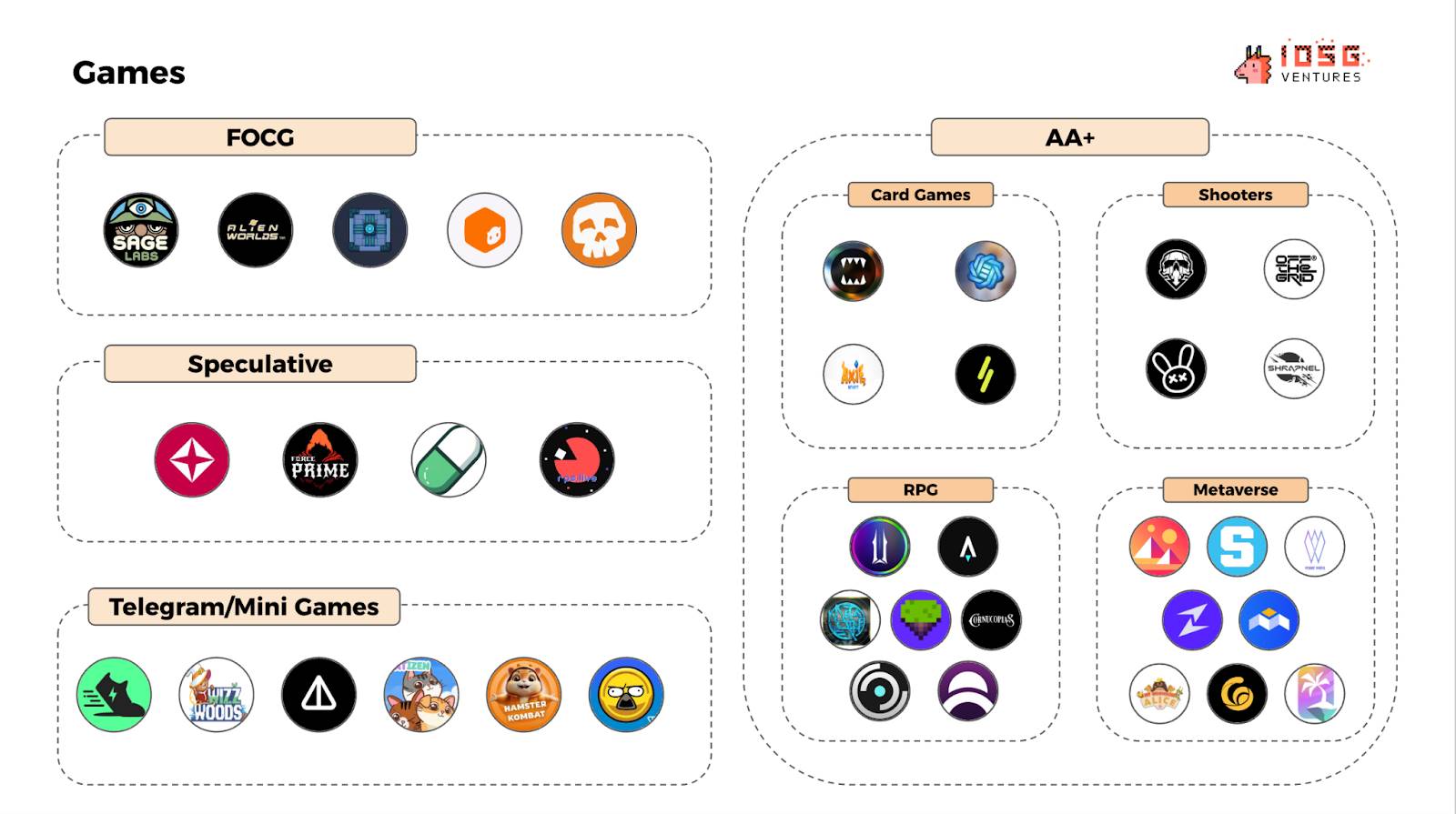

#Games

Includes all playable Web3 game types, further subdivided by different gameplay categories. Among them, "AA+ level games" represent higher quality verticals.

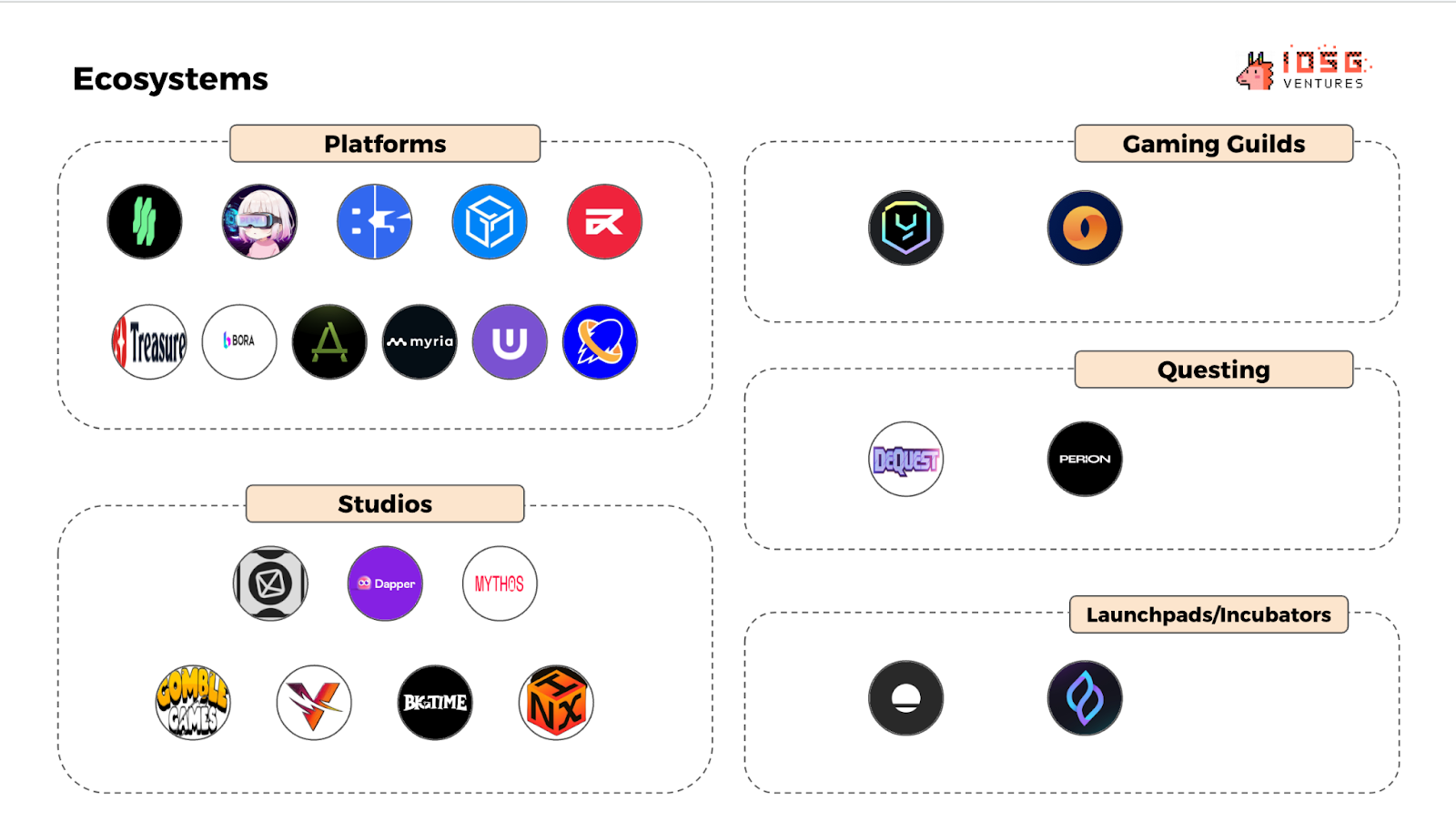

#Ecosystem

Ecosystem projects aim to build network effects, covering platforms, studios, game guilds, task systems, and incubators/launch platforms. Platforms mainly refer to aggregated entry points that provide game distribution channels.

For specific project names, please refer to the appendix at the end of the document.

Market Overview

Overall Trends in Web3 Games

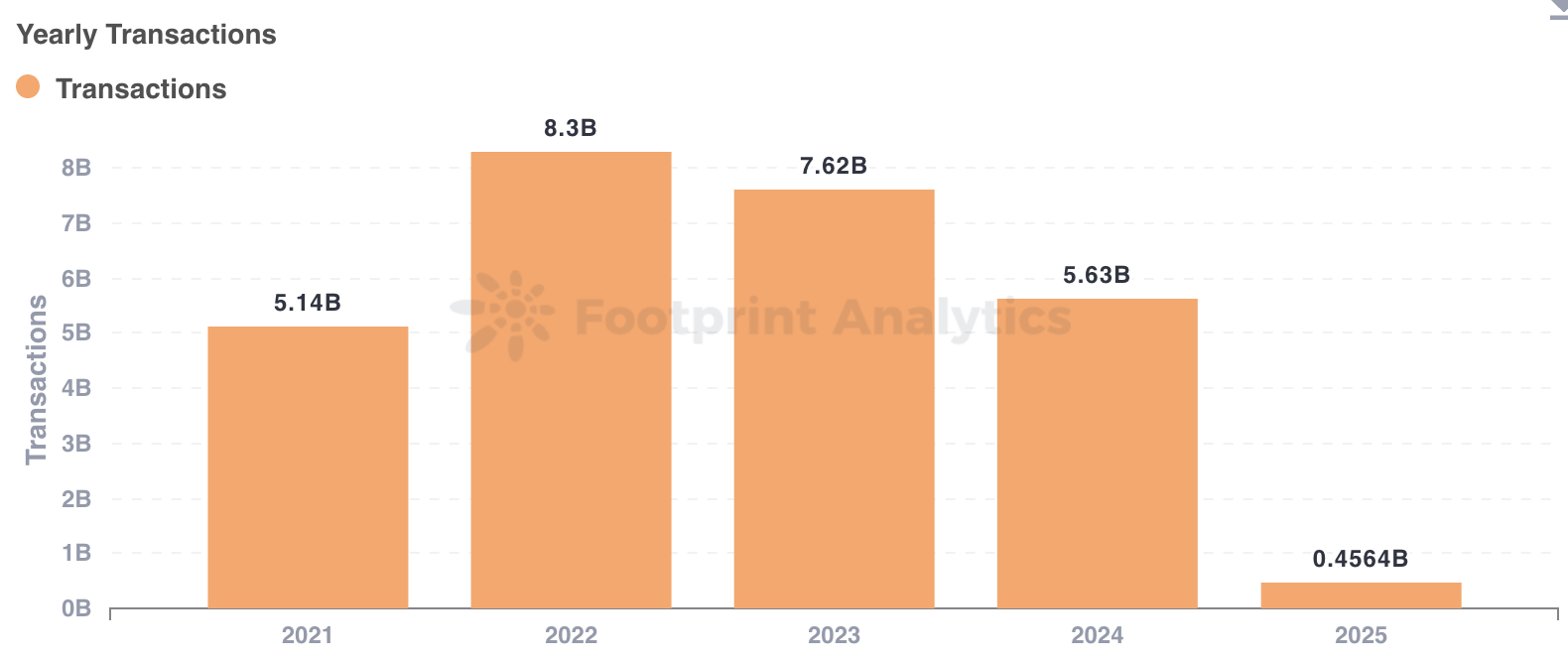

#Annual Transaction Volume

Although transaction volume remains high, it has decreased from the peak in 2022.

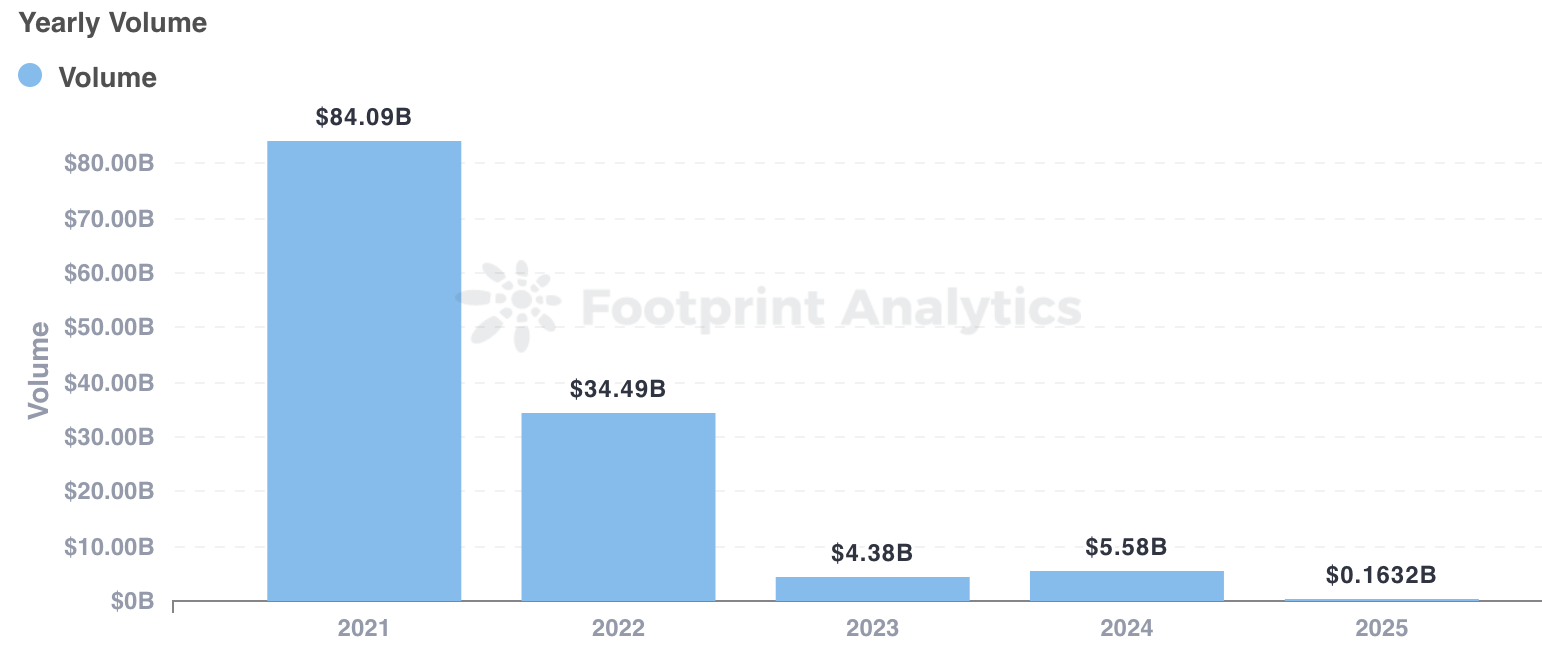

#Annual Funding Scale

Dramatically dropped from $84 billion in 2021 to $5.58 billion in 2024.

2021-2022: Speculative sentiment drove capital inflow, with NFT assets, GameFi tokens, and "play-to-earn" models dominating the market, but lacking sustainable user stickiness.

2024-2025: Speculative funds decrease, actual player participation rises, indicating a shift in the industry towards real gaming demand.

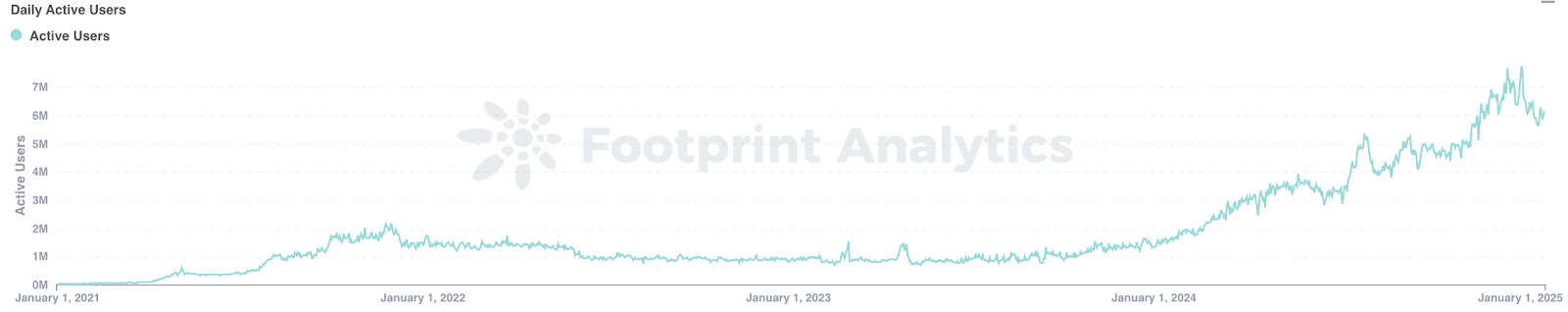

#Daily Active Player Count

The user base continues to grow, and game adoption rates are steadily increasing.

#Web3 Game Market Capitalization (CoinMarketCap Data)

After excluding the abnormal peak at the end of 2021, the current market capitalization shows little difference compared to earlier, reflecting an improvement in industry health:

Early (2021-2022): High speculation, few users, but NFT and token hype inflated market capitalization.

Current phase (2024-2025): Speculation recedes, real players dominate the market.

Game Type Trends

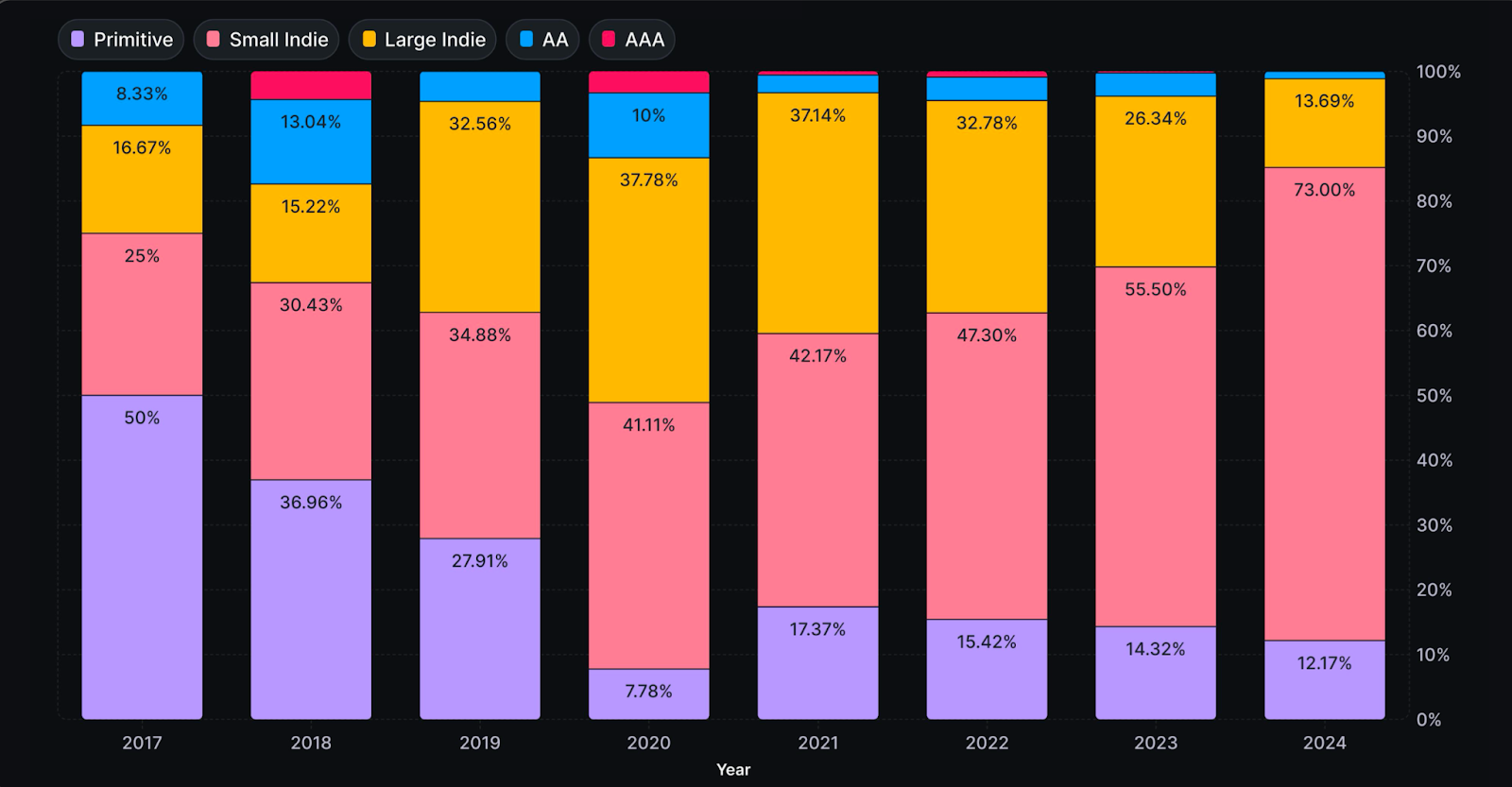

#Developer Structure

The proportion of independent developers is rising, mainly due to reduced venture capital and the maturity of development tools. With the improvement of tools, a surge in the number of games is expected in the future.

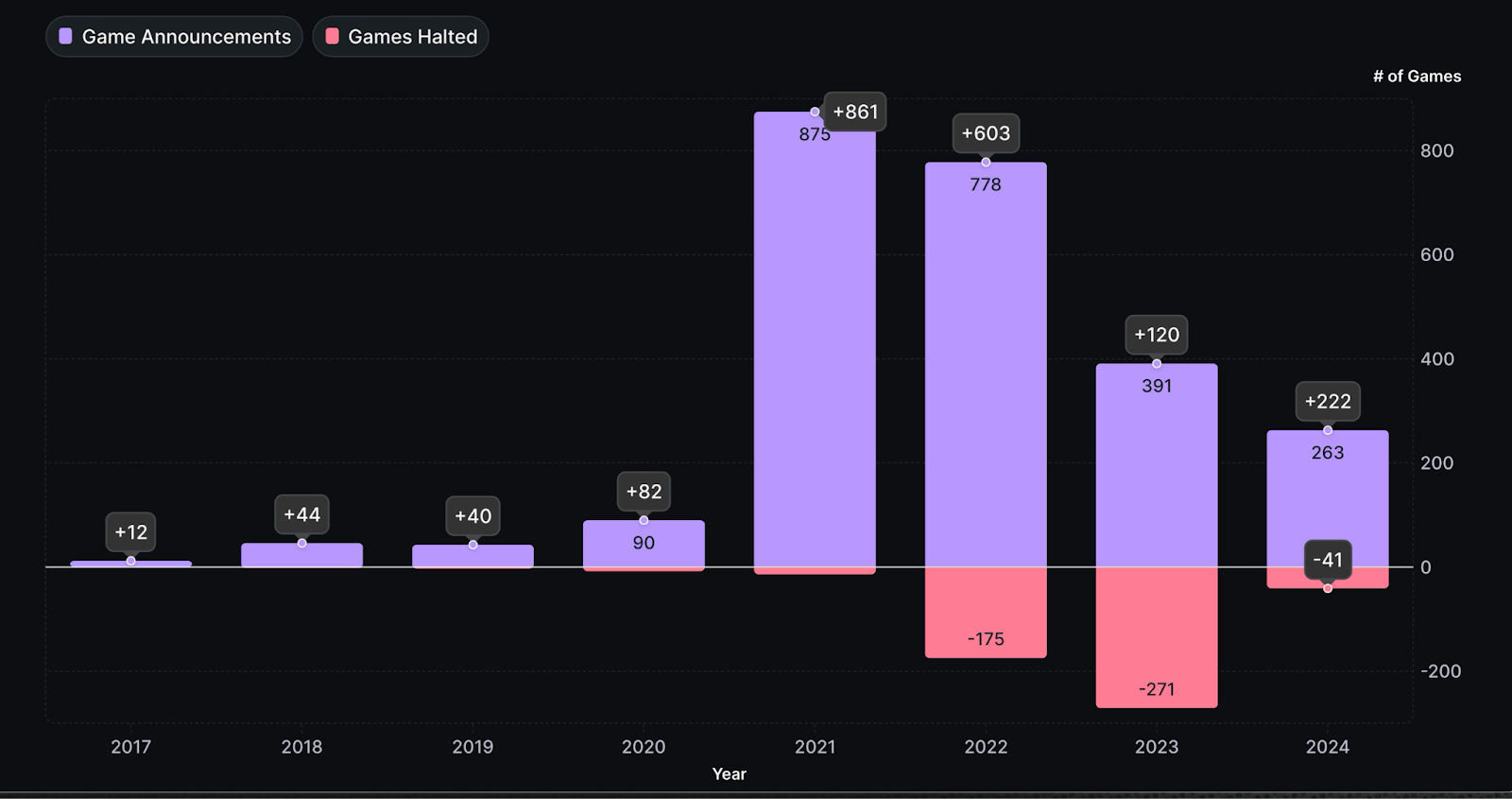

#Project Survival Rate

As the bear market of 2023 ends, studios and publishers are regaining interest in Web3 games, leading to a significant increase in the number of new releases.

Web3 Ecosystem Dynamics

#Top Chain Performance

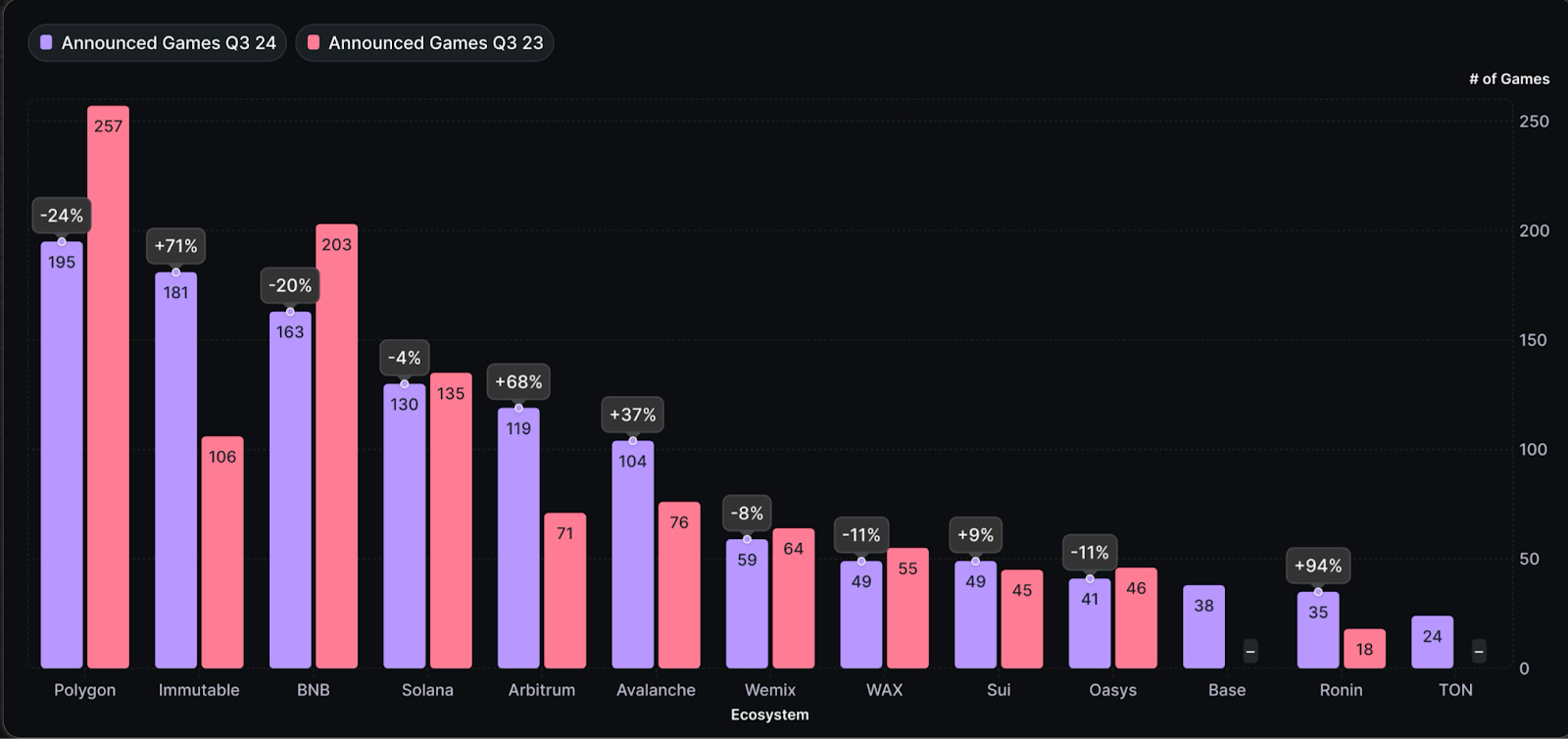

The Immutable and Arbitrum ecosystems have grown the fastest in the past 12 months:

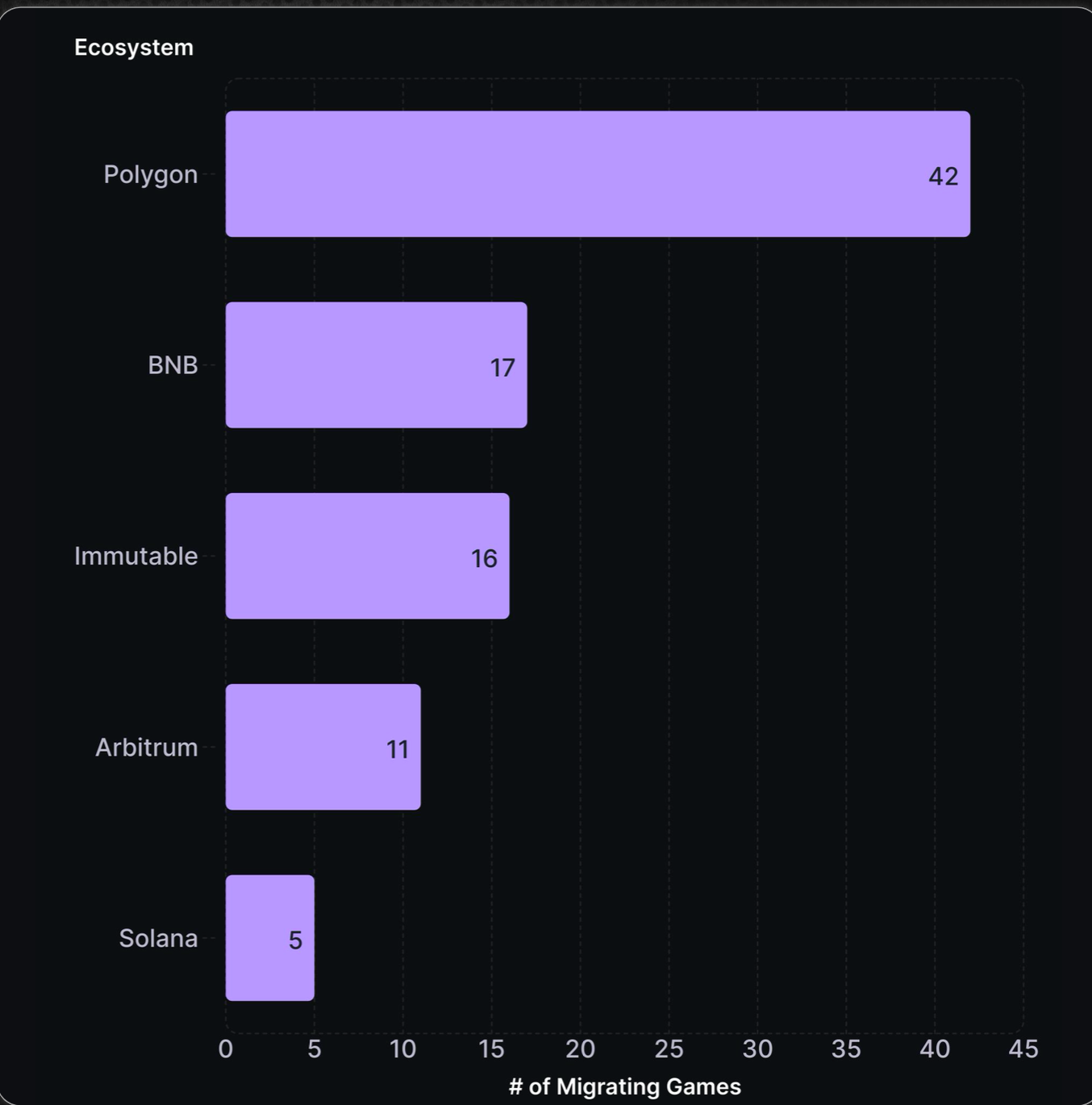

Immutable: Added 181 new games (up 71% year-on-year), with 33% of projects migrating from Polygon.

Arbitrum: Added 119 new games (up 68% year-on-year) using the Orbit framework, of which 23 are dedicated Web3 game chains.

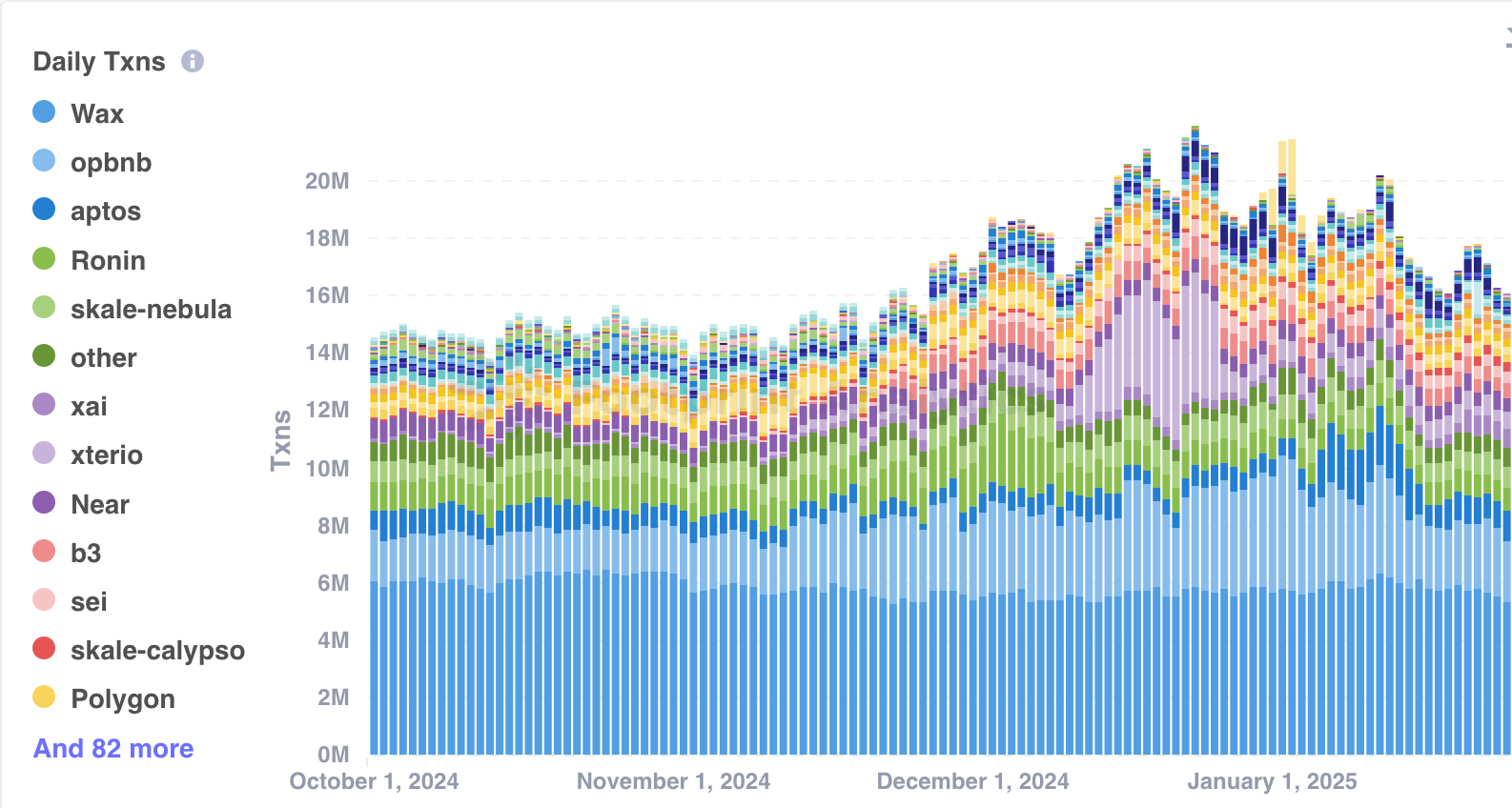

#User Distribution

In terms of user base, WAX and BNB chains still hold a major position.

#Migration Trends

Polygon has become the chain with the most projects migrating out, indicating fierce ecological competition and a need for improved stability.

Smart Contract Development Environment

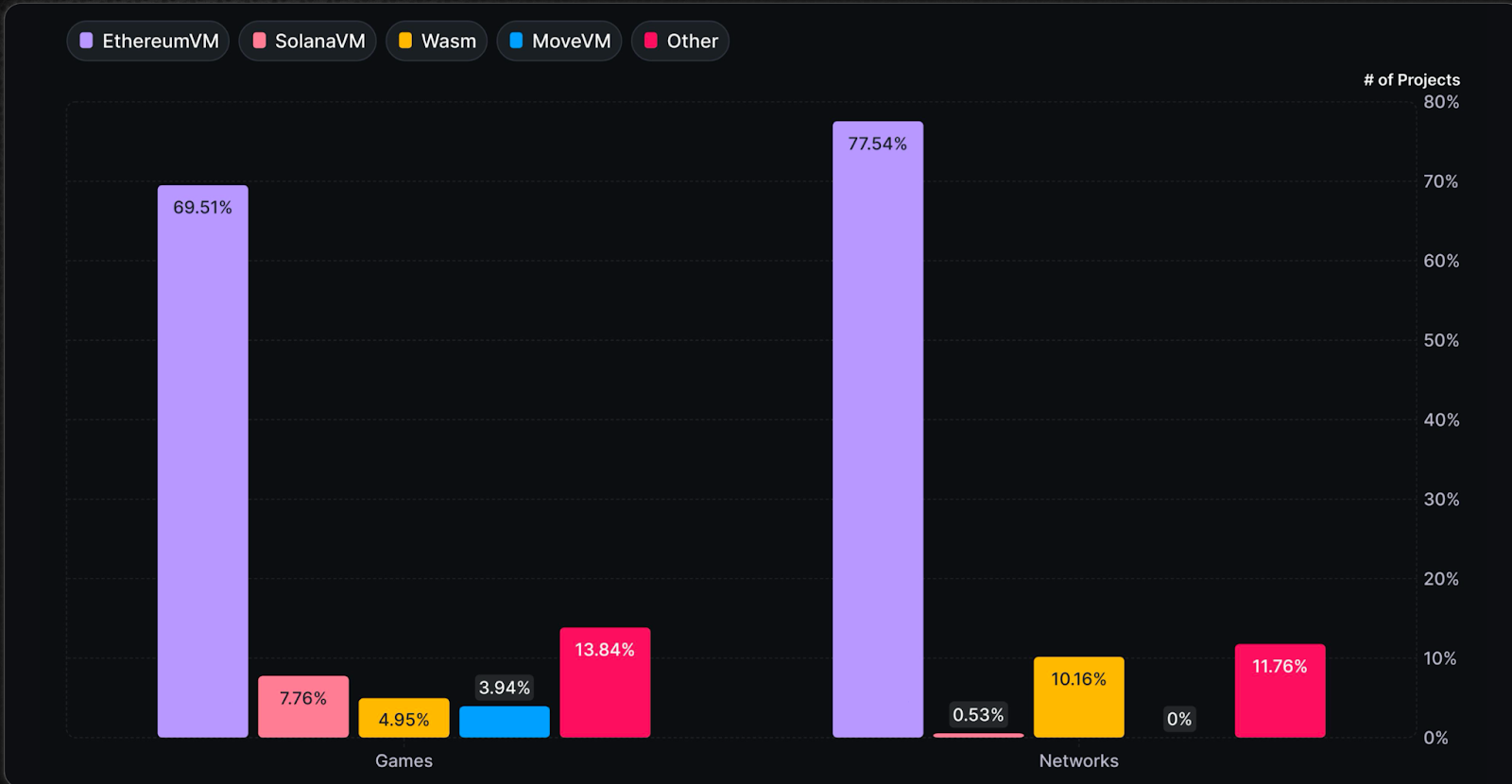

#EVM Dominance

81% of new game chains are still based on the Ethereum Virtual Machine (EVM), mainly due to:

The development tools for non-EVM chains are still immature;

High migration costs.

#Developer Choices

Project teams are actively seeking better development environments, which forces ecosystems to continuously innovate to maintain competitiveness.

Conclusion

Web3 games are shifting from speculation-driven to focusing on real users and sustainable development. Although transaction scales have decreased, the growth in daily active users indicates that the industry is maturing.

Infrastructure Layer: The improvement of tools has attracted more independent developers, and DePIN and AI technologies further strengthen the technical foundation.

Ecosystem Competition: Immutable and Arbitrum have become major migration destinations, while EVM chains still dominate the market.

Future challenges lie in ecosystem stability, project retention rates, and the development of high-quality games. The next phase will focus on:

Innovation;

On-chain deep integration;

User experience optimization.

Decentralized games will enter a new stage of development.

Appendix

Infrastructure

Development Tools: thirdWeb, Metaplex, Altura, Stardust, reNFT

Engines: MUD, Blade Games, Cartridge, Reflekt

AI: PlayAI, Carv, Aethir, Arc, Neural, Freysa, MomoAI

Data: Story Protocol, Helika, Chromia, Spaceport

DePIN: Deeplink, Gaimin, Shaga, Beamable, Cudos

Games

FOCG: Pirate Nation, Primordium, Alien Worlds, Downstream, Sage Labs

Speculative: Duper, RPS.live, Force Prime, Pump.fun

AA+ Level:

Card Games: Parallel, Axie Infinity, Gods Unchained, Splinterlands

Shooting: My Pet Hooligan, Shrapnel, Off the Grid, Deadrop

RPG: Metacene, Pixels, Cornucopias, Illuvium, Star Atlas, Mines of Dalarnia, Fusionist

Metaverse: Zentry, Decentraland, Sandbox, Nifty Island, Wilder World, My Neighbor Alice, Mobox, (RACA) Radio Caca

Telegram/Mini Games: Notcoin, Hamster Kombat, Catizen, Wizzwoods, WATC, StepN

Ecosystem

Game Guilds: YGG, Merit Circle

Platforms: B3.fun, Gala Games, Game7, SuperVerse, Bora, TreasureDAO, Myria, Ultra, Ancient8, Sonic

Studios: Nexus Interactive, Big Time, Mythos, Vulcan, Dapper Labs, Gomble, Ready Games, Playmint

Task Systems: Perion

Incubators: Seedify, Everyrealm

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。