Fluid is currently the only lending market that can actively prevent liquidity crises.

Author: DMH

Translation: Deep Tide TechFlow

(Original image from DMH, translated by Deep Tide TechFlow)

Abstract

Fluid performed excellently during the largest liquidation event in history, successfully completing the liquidation and saving users millions of dollars.

Fluid is currently the only lending market capable of actively responding to liquidity crises.

The design of Fluid DEX further enhances the security and user experience of the Fluid lending market.

Background

Last week, the market experienced the largest liquidation event ever, and Fluid once again demonstrated its strong stability. During this event, Fluid successfully completed the liquidation operation with the highest liquidation threshold in the market (up to 97%) and the lowest liquidation penalty (as low as 0.1%).

What are the main threats faced by the lending market during liquidation events?

Bad debts resulting from failure to liquidate in a timely manner.

The utilization rate of assets needing liquidation reaching 100%, making liquidation impossible.

During the market crash last August, ETH plummeted 16% in just 4 minutes. I previously analyzed in detail how Fluid's efficient liquidation mechanism helped users recover millions of dollars in losses.

However, like other lending markets that rehypothecate assets, Fluid previously lacked a comprehensive safety mechanism for liquidity crises. To better illustrate this, it is essential to understand the basic process of liquidation: liquidators need to seize collateral and repay debts to complete the liquidation. If the collateral that needs to be liquidated has already been fully borrowed, liquidation cannot proceed, resulting in bad debts for the protocol.

How the Introduction of Fluid DEX Changes the Situation

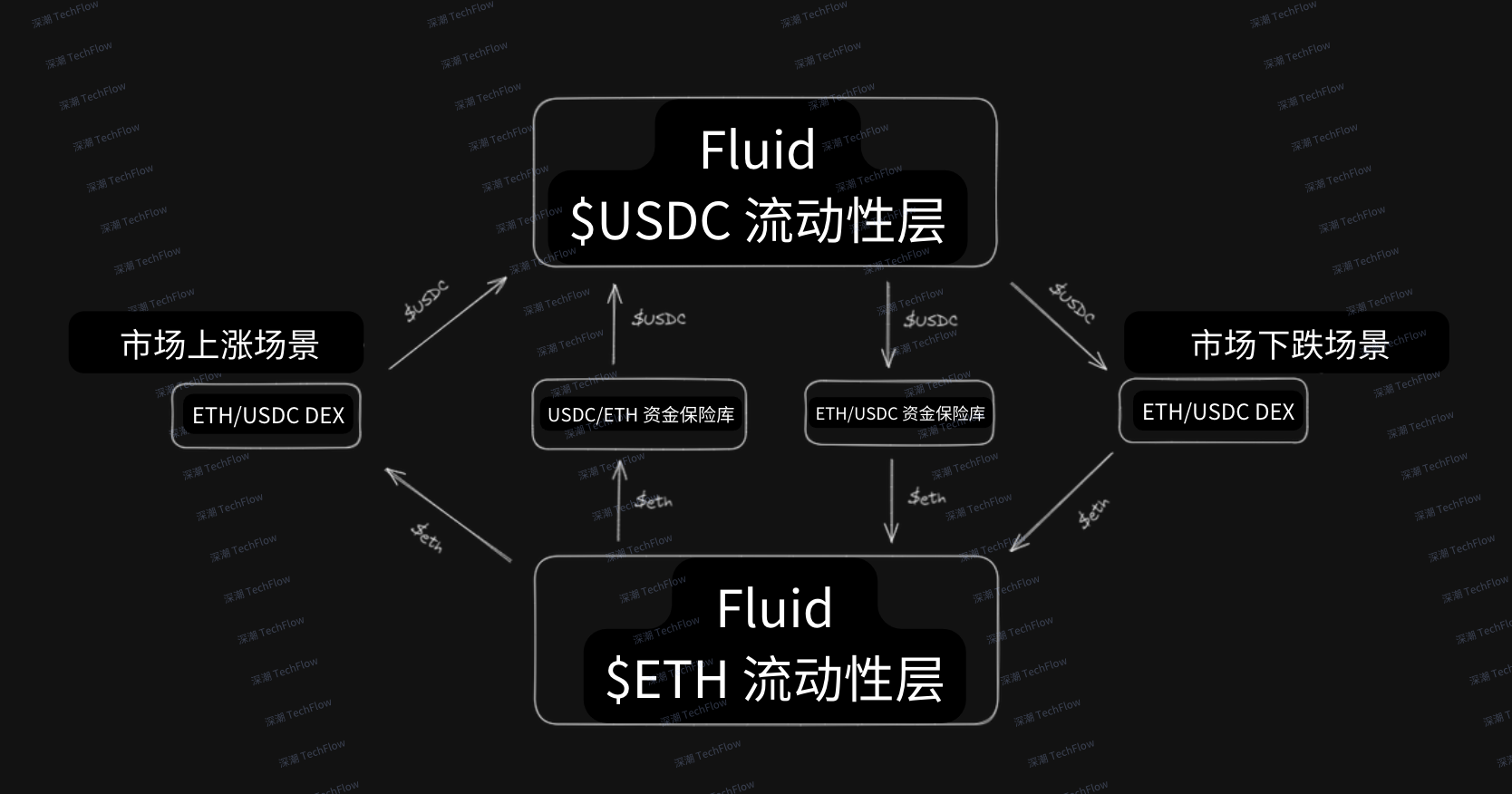

In the event of a sudden market crash, ETH in the market will be sold for USDC. In this scenario, liquidity providers (LPs) of the decentralized exchange (DEX) protocol will receive ETH while providing USDC to traders. This process effectively increases the liquidity of ETH within the protocol and further enhances the overall ETH liquidity of the Fluid system, thereby preventing the occurrence of a liquidity crisis.

Conversely, when the market is on an upward trend, the direction of liquidation will lean more towards USDC collateral and ETH debt trading pairs. In this market environment, more USDC will flow into the Fluid system while ETH will flow out. This dynamic increases the liquidity of USDC, making the liquidation process more efficient and smooth.

Fluid is currently the only lending market that can actively prevent liquidity crises. In contrast, other lending markets can only respond to liquidity issues through passive measures (such as raising the annual percentage rate (APR) when asset utilization increases). However, this passive approach often proves ineffective during sudden market crashes.

The Fluid lending market was initially supported by Fluid DEX, and now Fluid DEX, in turn, brings significant advantages to the Fluid lending market by ensuring that there is always sufficient liquidity during liquidation. This synergy significantly enhances the operational efficiency of the capital market, increasing its efficiency by as much as 10 times.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。