APY subsidies up to 20%, the completely decentralized USDD is trustworthy.

On February 5, Huobi HTX global advisor and TRON founder Justin Sun passionately spoke on Huobi HTX's Twitter Space with the theme "Can we still trust Brother Sun with USDD?" He provided an in-depth analysis of USDD 2.0 and answered community questions regarding USDD and Huobi HTX. The live event received a strong response from the crypto community, with a peak of over 12,000 concurrent viewers.

Pegged 1:1 to the US dollar, multiple mechanisms keep USDD "stable as a rock"

Official information shows that USDD 2.0 is a decentralized stablecoin project on the TRON blockchain, launched on January 25 of this year.

Justin Sun mentioned during the live stream that although there are stablecoins like USDT and USDC in the current crypto market, there is still a lack of a truly zero-trust, zero-censorship, completely decentralized, never-freezing, and secure stablecoin, which is why he insists on launching USDD.

According to him, USDD 2.0 ensures its 1:1 peg to the US dollar through multiple mechanisms including over-collateralization, liquidation and auction, risk management and real-time monitoring, PSM (Peg Stability Module), and decentralized governance, making USDD stable as a rock.

Among these, the PSM module is the key technology that ensures USDD's 1:1 peg to the US dollar, allowing users to seamlessly swap USDD with other stablecoins at a 1:1 ratio in seconds, with only a small Gas fee required. This mechanism greatly reduces arbitrage risks and can quickly stabilize prices during supply and demand imbalances.

Additionally, users who have minted USDD know that they need to over-collateralize with qualifying assets (TRX, USDT) to start minting. This mechanism ensures that even in the face of market fluctuations—thanks to the stability of USDT and the high market liquidity and ecological support of TRX as a mainstream public chain token—the overall price volatility remains relatively controllable, and the value of the collateral will always be higher than the amount of USDD minted, thus providing ample stability and minimizing risk.

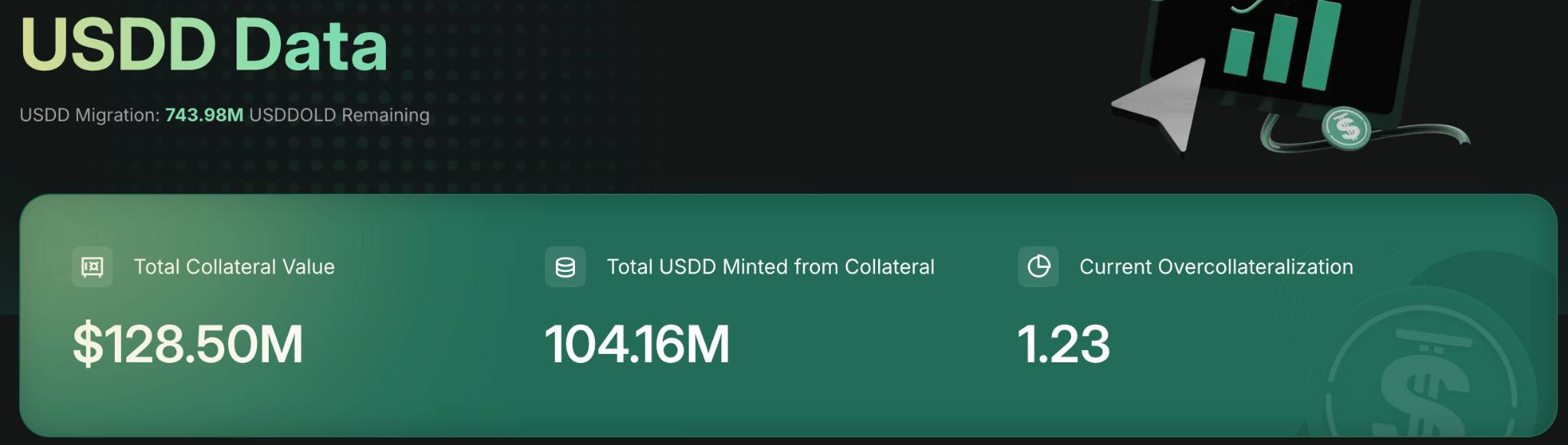

Official data shows that as of February 6 at 16:30, the total collateral for USDD approached $130 million, with an over-collateralization ratio of 1.23 times.

Justin Sun emphasized during the live stream, “If you don’t understand USDD, just think of USDD as a mirror Proxy of USDT.”

APY subsidies up to 20%, the completely decentralized USDD is trustworthy

During the live stream, Justin Sun analyzed that the ability to exchange USDT 1:1 without limits at any time is primarily focused on being smooth, seamless, and barrier-free; using USDD on the TRON network is no different from using USDT, except for the higher interest.

How high is the interest? It is reported that the annualized yield for the T1 phase of the USDD staking activity is 20%, with these earnings coming from TRON's subsidies. Additionally, Huobi Earn is currently offering a temporary interest subsidy for USDD's flexible products, with the adjusted APY also at 20%. It is reported that after launching this subsidy, the amount of USDD in Huobi Earn's flexible products increased nearly tenfold compared to the previous period. This means that depositing USDD directly into Huobi HTX or Justlend DAO can yield a stable 20% interest. Of course, users can also borrow USDT by collateralizing USDD, convert it back to USDD for staking, or directly borrow USDD to amplify their earnings.

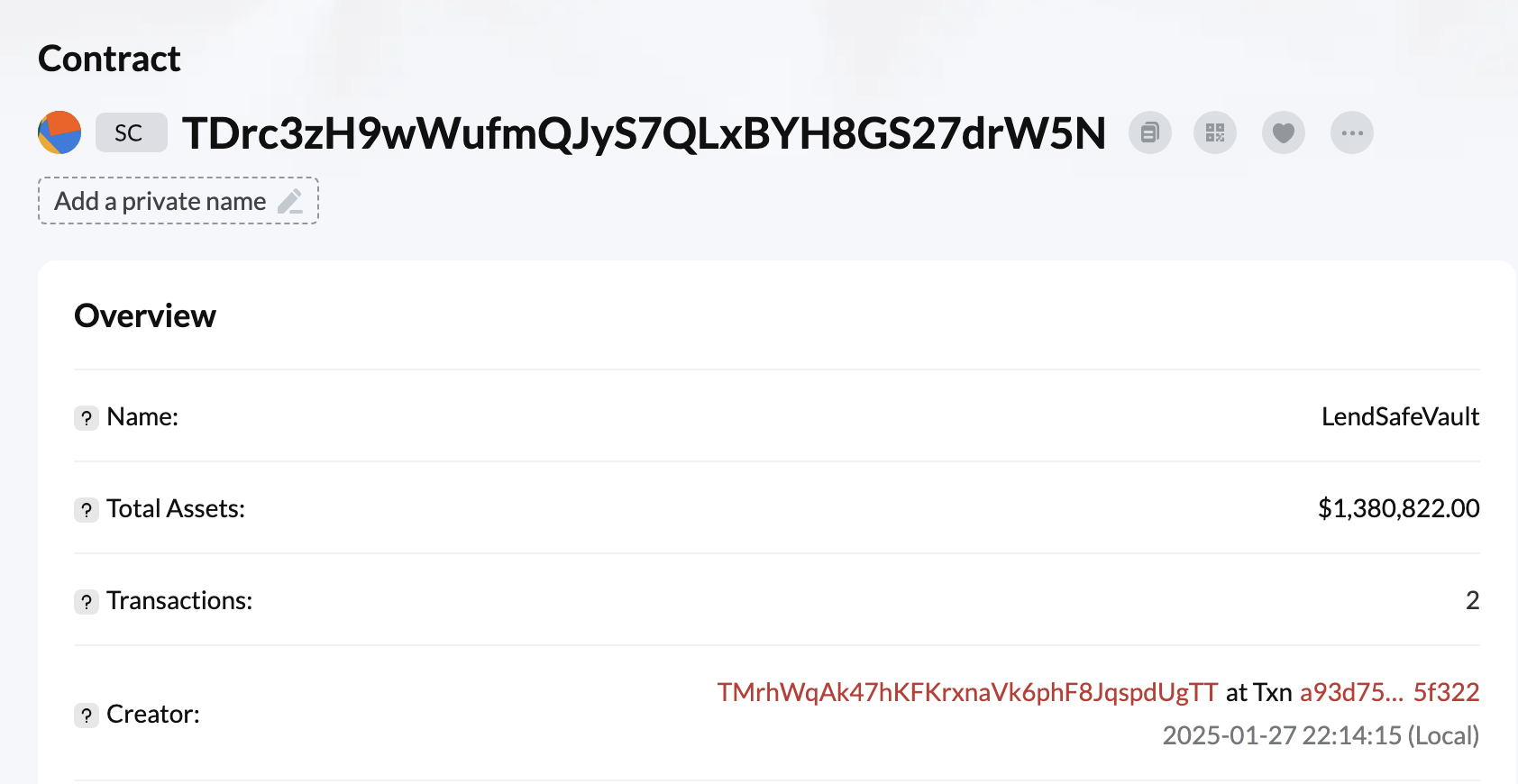

It is reported that the USDD equity address marked as “LendSafeVault” TDrc3zH9wWufmQJyS7QLxBYH8GS27drW5N has deposited USDD worth $1,380,822.00.

During the live stream, community users were particularly concerned about the safety of the 20% yield subsidy for USDD. Justin Sun candidly stated, “How much is a completely decentralized stablecoin worth on the TRON blockchain? Think about it, this is the only decentralized choice among the 60 billion USDT on the TRON blockchain, and you will understand the value of USDD.”

Regarding the application scenarios of USDD, Justin Sun revealed that USDD will first serve scenarios that USDT on the TRON blockchain cannot support. He also mentioned that they will actively promote cooperation with centralized exchanges, such as Huobi HTX and Poloniex, which may support using USDD-USDT equivalent margin for contract trading, launch a one-click USDD exchange function, and introduce a USDD version of the Yubi Bao. Additionally, cooperation with RobinHood is also being actively pursued.

Justin Sun also pointed out that it is only a matter of time before the Trump family's crypto project, World Liberty Financial (WLFI), increases its holdings of USDD.

Huobi HTX is experiencing strong growth, and $HTX will soon be listed on a compliant exchange

It is worth mentioning that Justin Sun revealed during the live stream that $HTX will soon be listed on a large compliant exchange, and in the future, it will continue to empower $HTX, which is something other centralized exchanges cannot match.

Furthermore, when discussing the development of Huobi HTX, Justin Sun stated that its listing strategy places great emphasis on wealth effects, and all listing decisions are based entirely on the independent research and judgment of the team. He also highlighted the importance of listing efficiency, which is a unique competitive advantage of Huobi HTX. Based on these two points, Huobi HTX has maintained strong growth over the past two years. In the future, Huobi HTX and he himself will focus on the AI sector and may launch AI projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。