Author: ARK Invest

Source: ARK Invest Official Website

Translation: Nicky, Foresight News

I. Bitcoin: Maturation and Institutionalization of the Global Monetary System

Bitcoin is set to achieve a milestone development in 2024, with significant improvements in its network fundamentals and institutional adoption, showcasing its long-term value as "digital gold."

1. Market Performance and Accelerated Institutionalization

- Price and ETF Breakthrough: In 2024, Bitcoin's price reached an all-time high, surpassing $100,000, with its market dominance (percentage of total cryptocurrency market cap) exceeding 65% for the first time. This growth was catalyzed by the launch of spot Bitcoin ETFs. The first U.S. spot Bitcoin ETFs attracted over $4 billion in inflows on their first trading day, far exceeding the historical record set by gold ETFs in September 2004. By the end of 2024, the total assets under management (AUM) of Bitcoin ETFs surpassed $100 billion, with a significant increase in the proportion of institutional investors. Meanwhile, Bitcoin's annual volatility dropped to a historical low, while its risk-adjusted return remained superior to most major asset classes.

- Halving and Scarcity: Bitcoin completed its fourth halving, reducing the annual inflation rate to 0.9%, falling below gold's long-term supply growth rate (approximately 1.7%) for the first time, further highlighting its deflationary attributes. The total supply cap of 21 million coins set in its code and its mathematical monetary policy further solidified the narrative of "digital gold." On-chain data shows that long-term holders (holding for over 3 years) account for 45%, a historical high, indicating increasing recognition of Bitcoin as a store of value.

- Corporate Holdings and Strategic Reserves: A total of 74 publicly listed companies globally have included Bitcoin on their balance sheets, with total holdings exceeding 550,000 coins, valued at approximately $55 billion. MicroStrategy, as the largest holder, has a holding of 446,000 coins (2.1% of Bitcoin's circulating supply). Additionally, Pennsylvania became the first U.S. state to propose establishing a strategic reserve of Bitcoin, marking a governmental exploration of cryptocurrency.

2. Technological Evolution and Network Health

- Hashrate Hits New Highs: Despite miners' revenues being halved post-halving, the overall network hashrate reached a historical record, indicating long-term confidence among miners.

- Runes Protocol Activation: The Fungible Token protocol based on Bitcoin has driven a surge in on-chain transaction volume, with daily transactions exceeding 800,000, and the ecosystem's application scenarios continue to expand.

- Long-term Holding Behavior: Over 45% of Bitcoin's supply has not moved for more than 3 years, with on-chain liquidity dropping to a 14-year low, reflecting its positioning as a store of value.

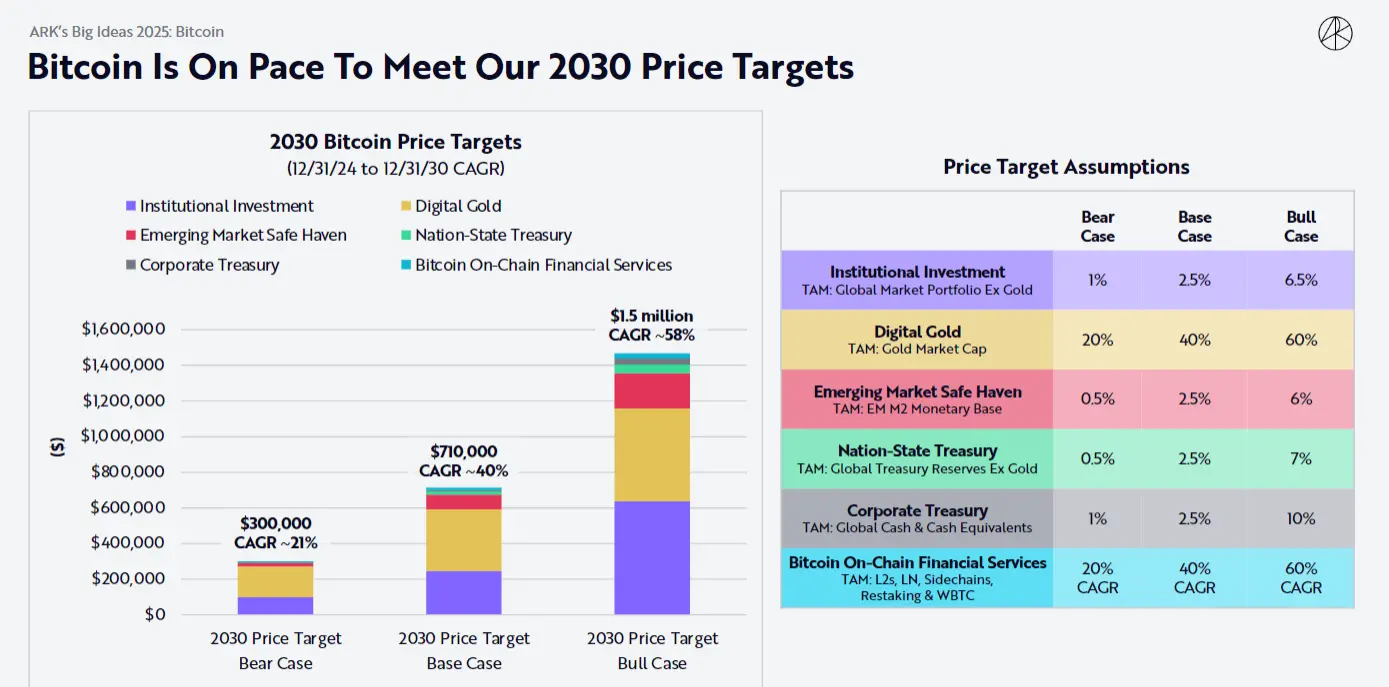

3. 2030 Price Predictions

ARK predicts the price outlook for Bitcoin in 2030:

- Bear Market Price: $300,000

- Neutral Price: $710,000

- Bull Market Price: $1,500,000

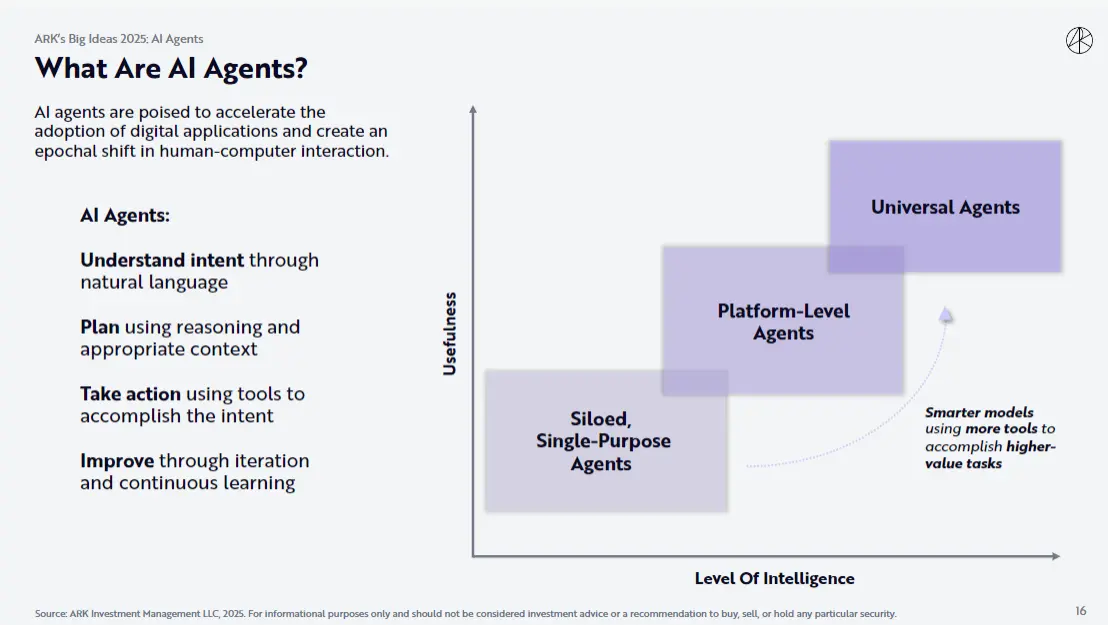

II. AI Agents: Restructuring Human-Machine Interaction and Business Efficiency

AI Agents are evolving from single-task tools to general intelligence platforms. Their core capabilities include: natural language understanding, contextual reasoning, tool invocation, and continuous learning.

1. Consumer Side Transformation

- Search and Advertising Restructuring: AI-driven personalized agents will replace traditional search engines, with AI advertising revenue expected to account for 54% of the digital advertising market by 2030, reaching $600 billion.

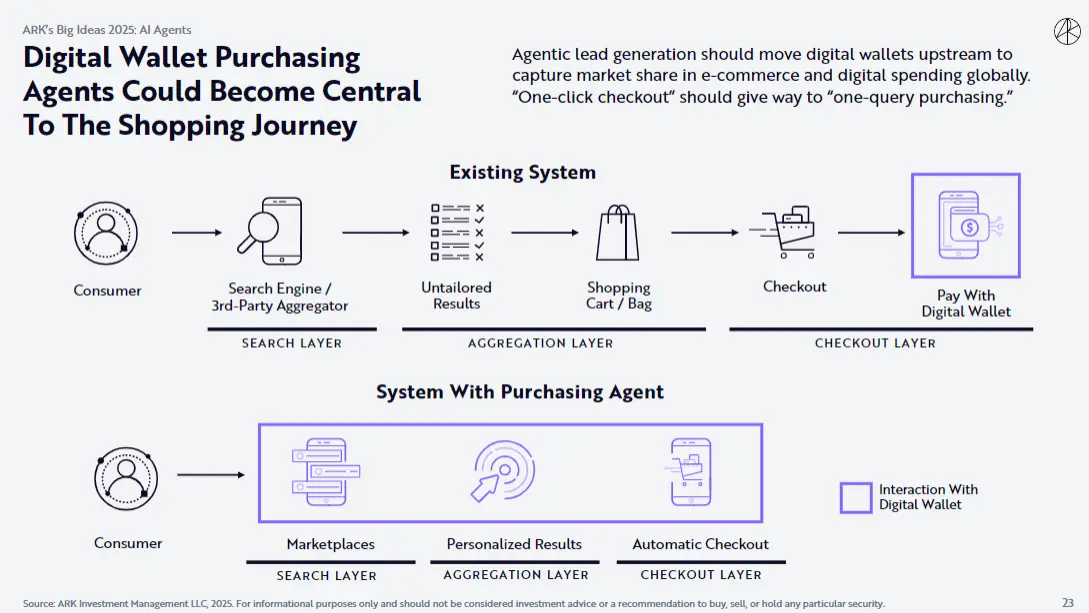

- E-commerce Revolution: AI agents deeply integrated into operating systems will allow users to complete the entire process of product search, price comparison, and payment through voice or text commands. For example, shopping agents embedded in digital wallets can automatically filter optimal products and complete transactions, driving the share of digital wallets in global e-commerce transactions to 72%, creating an additional enterprise value of $200 billion annually. By 2030, such agents are expected to facilitate $9 trillion in online consumption, accounting for 25% of the global e-commerce total.

- Hardware Proliferation: After 2025, most consumer electronics will be equipped with AI agent functionalities, with penetration curves potentially surpassing those of smartphones.

2. Leap in Enterprise Efficiency

- Customer Service Cost Optimization: AI customer service can reduce the cost per interaction from $1 to $0.125, handling 70% of inquiry demands, saving global enterprises over $500 billion in labor costs.

- Software Development Revolution: AI coding tools (such as GPT-4, Claude 3.5) can now solve 70% of real tasks, shortening the software development lifecycle by 40%, shifting enterprises from purchasing software to custom development. If AI agents automate 81% of knowledge work time, they could release $117 trillion in productivity dividends by 2030. The software market size could surge from the current $1.5 trillion to $13 trillion (with a compound annual growth rate of 48%), with underlying cloud infrastructure and AI chip demand exploding simultaneously.

III. Stablecoins: Reshaping the Digital Asset Landscape

In 2024, the annualized trading volume of stablecoins reached $15.6 trillion, surpassing Visa ($13.1 trillion) and Mastercard ($7.8 trillion), becoming the fastest-growing payment network globally.

1. Market Explosion and Innovation

- Scale and Efficiency: The annual settlement amount of stablecoins reached $15.6 trillion, with individual transaction values far exceeding credit cards, and on-chain settlements on chains like Solana and Tron accounting for over 60%. In December, the monthly on-chain stablecoin transaction volume reached $2.7 trillion, with small transactions (under $100) accounting for over 85% on Layer 2. Users in emerging markets (Brazil, Nigeria, etc.) are using stablecoins for cross-border remittances and inflation-resistant savings, pushing the number of active addresses to over 23 million. At the same time, the adoption rate of stablecoins on Layer 2 (Base, Arbitrum) and emerging public chains (TON, Celo) surged, driving demand for cross-chain interoperability.

- Yield-bearing Stablecoins Rise: Ethena Labs' USDe offers 20%-30% returns through a delta-neutral strategy, locking in $6 billion in assets within 12 months, increasing the share of non-fiat collateralized stablecoins to 10%.

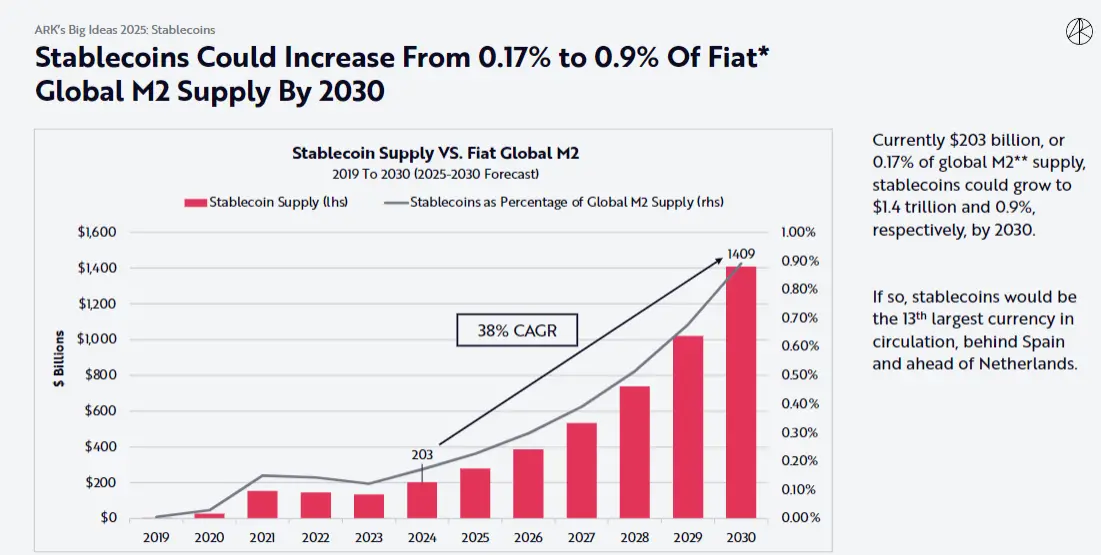

- Dollarization Trend: Despite many countries promoting de-dollarization, dollar stablecoins still account for over 98%, with Tether and Circle ranking among the top 20 holders of U.S. Treasury bonds. Stablecoins have become a core tool for the "digital export" of the dollar, especially under the trend of "de-dollarization," where demand for dollar stablecoins in emerging markets offsets some countries' reductions in U.S. Treasury holdings. ARK predicts that by 2030, the scale of stablecoins will reach $1.4 trillion, accounting for 0.9% of the global M2 money supply, becoming the 13th largest circulating currency.

2. Regulation and Challenges

- Accelerated Compliance: The framework of the U.S. "Payment Stablecoin Act" is emerging, requiring 100% reserves and audit transparency, further concentrating market share among leading issuers.

IV. Scaling Blockchains: Competition Between Layer 2 and High-Performance Public Chains

Ethereum Layer 2 and Solana are leading the scaling wave, driving the smart contract ecosystem towards high throughput and low cost.

1. Ethereum Ecosystem Upgrade

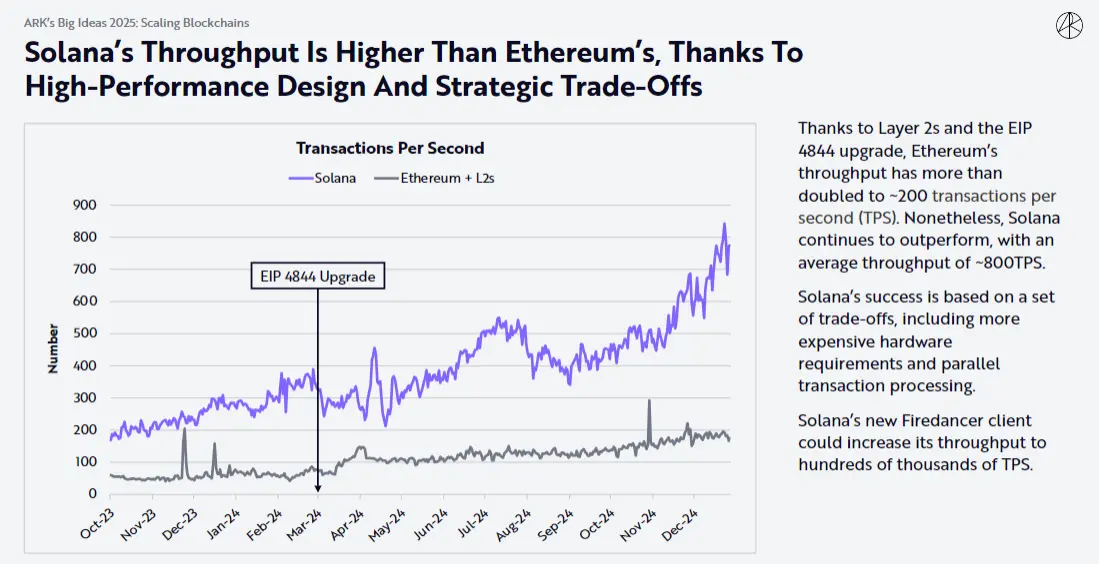

- EIP-4844 Effect: The EIP 4844 upgrade reduced Layer 2 transaction costs from $0.50 to $0.05, with daily transaction volume soaring from 3 million to 15 million.

- Rapid Development of Base: Base chain's daily active users (DAU) account for 46%, with total value locked (TVL) surpassing $15 billion, showcasing the synergistic effects of the Coinbase ecosystem and pushing Ethereum from a settlement layer to an application layer.

2. Solana's Retail Breakthrough

- Performance Advantage: With an average of 800 TPS, far exceeding Ethereum's ecosystem (200 TPS), daily active addresses surpassed 1.2 million, and on-chain fee revenue accounted for 22% of the cryptocurrency market. Its low fee rate (0.001 USD per transaction) attracts a large number of retail users, with market platforms like Polymarket and DEX Raydium becoming ecosystem benchmarks. The Firedancer client is expected to boost throughput to hundreds of thousands.

- Developer Migration: In 2024, the number of new developers on Solana surpassed that on the Ethereum mainnet, with Memecoin and DePIN (Decentralized Physical Infrastructure Network) becoming dual engines for ecosystem growth.

3. Application Layer Explosion

- DeFi Challenges CEX: The proportion of DEX trading volume increased from 8% to 14%, with the derivatives market growing to 8%. Uniswap's single employee efficiency is 200 times that of Binance.

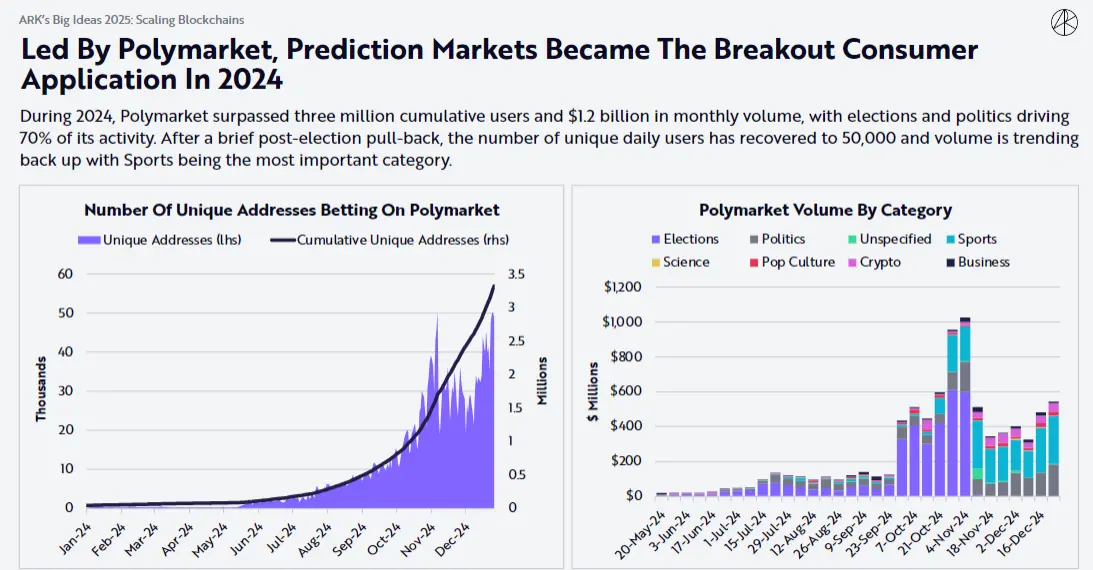

- Rise of Prediction Markets: Polymarket, leveraging U.S. elections and sports betting, surpassed $1.2 billion in monthly trading volume, with over 3 million users.

- Re-staking Economic Model Matures: Liquid staking protocols (such as Lido, EigenLayer) manage over 5.5 million ETH (17% of total staked), driving the maturation of the re-staking economic model.

Conclusion: Integration and Breakthrough of Web3

By 2025, Bitcoin's monetary attributes, the productivity release of AI Agents, the expansion of stablecoin payment networks, and technological breakthroughs in scaling blockchains will collectively form the core of ARK's "2025 Vision." The convergence of these technologies will reshape the global economy: AI-driven demand for computing power will spur an energy revolution, stablecoins will enhance dollar hegemony, and blockchain scaling will unleash the potential of decentralized applications. Web3 practitioners need to focus on the evolution of underlying protocols, seizing key tracks such as cross-chain interoperability, AI-native DApps, and compliant stablecoins to capture value in the integration of technologies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。