Author: Weilin, PANews

In the early morning of February 6, Beijing time, MicroStrategy held a conference call for its Q4 2024 earnings report and announced a rebranding plan. The company has officially changed its name to "Strategy" and claims to be "the world's first and largest Bitcoin asset management company."

The Q4 earnings report shows that the company had a net loss of $670.8 million, with operating expenses (including impairment losses on Bitcoin holdings) reaching $1.103 billion, a year-on-year increase of 693%.

Strategy's Bitcoin holdings nearly doubled in just three months. At the same time, Strategy has established KPI metrics, namely annual "Bitcoin Gain" and "Bitcoin Dollar Gain," setting a target of $10 billion for the annual "Bitcoin Dollar Gain" by 2025. During the meeting, the company's founder and CEO Michael Saylor also revealed a new strategy to attract "a large number of investors."

Q4 Earnings Report: Bitcoin Holdings Nearly Doubled in Three Months

In Q4 2024, Strategy reported a net loss of $670.8 million, with a loss of $3.03 per share. In contrast, the company achieved a profit of $89.1 million in the same period last year, with earnings of 50 cents per share. The loss was primarily due to $1.01 billion in impairment charges on Bitcoin holdings, a significant increase from the $39.2 million impairment in the same period last year.

Operating expenses (including impairment losses on Bitcoin holdings) for the quarter reached $1.103 billion, a year-on-year increase of 693%. As of December 31, 2024, the company's cash and cash equivalents stood at $38.1 million, down from $46.8 million in the same period last year.

While most investors focus on Strategy's Bitcoin assets, the company also reported earnings from its traditional software business. Total software revenue for Q4 was approximately $121 million, a decrease of 3% year-on-year. Total revenue for the entire year of 2024 was approximately $464 million, a decrease of 7% year-on-year.

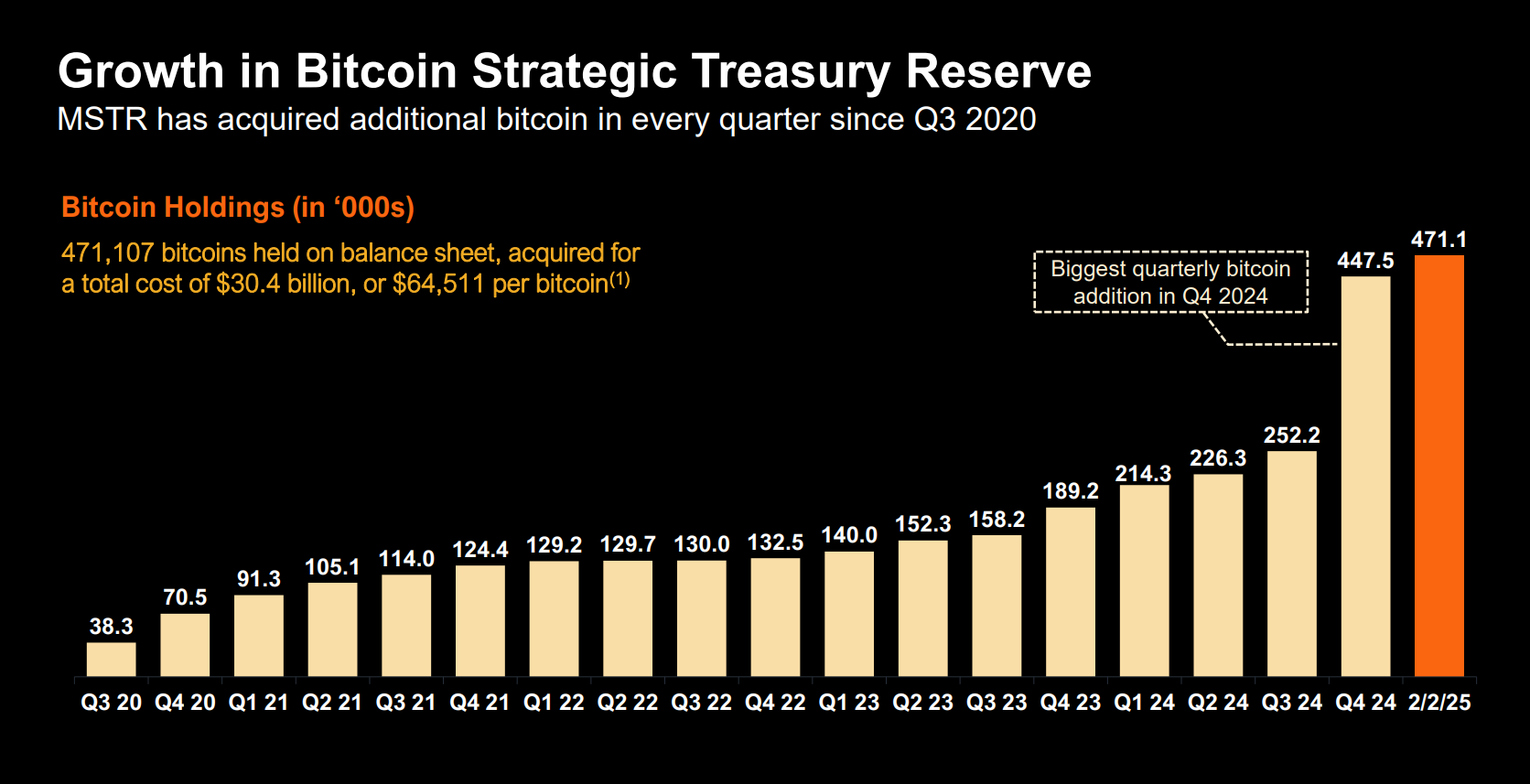

According to the earnings report, the most notable aspect is that its already substantial Bitcoin holdings nearly doubled in just three months. As of January 24, Strategy currently holds 471,107 Bitcoins, valued at approximately $44 billion, with a total cost of $30.4 billion. Q4 was the quarter with the largest increase in Bitcoin holdings for the company, with a total purchase of 218,887 Bitcoins at a cost of $20.5 billion. For the entire year of 2024, the company purchased 258,320 Bitcoins, with a total purchase cost of $22.1 billion, at an average price of $85,447.

Since August 2020, Strategy has been adding Bitcoin to its balance sheet every quarter, having issued over 50 announcements. This time, the company reported a Bitcoin yield of 74.3% for 2024, a metric used to assess the strategic performance of investing in Bitcoin.

According to the meeting documents, "Bitcoin Yield (BTC Yield) is a key performance indicator (KPI) that represents the percentage change in the ratio of the number of Bitcoins held by the company to its assumed diluted shares outstanding over the period." Strategy has raised its annual BTC yield target for the next three years from a range of 6%-8% to 15%. The company's BTC yield for Q4 was 2.9%, compared to 5.1% in Q3.

Strategy also announced another new key performance indicator (KPI), namely annual "Bitcoin Gain" and "Bitcoin Dollar Gain," setting a target of $10 billion for the annual "Bitcoin Dollar Gain" by 2025.

Bitcoin Gain represents the number of Bitcoins held by the company at the beginning of a period multiplied by the Bitcoin yield for that period. Bitcoin Dollar Gain is the dollar value of Bitcoin Gain, calculated by multiplying Bitcoin Gain by the market price of Bitcoin on Coinbase at 4 PM Eastern Time on the last day of the applicable period.

Bitcoin's "Smart Leverage"

To better reflect its Bitcoin strategy, MicroStrategy announced that it is now operating under the Strategy brand. The announcement states that Strategy is the world's first and largest Bitcoin reserve company, as well as the largest independent publicly traded business intelligence company, and is one of the components of the NASDAQ-100 index. The new logo features a stylized letter "B," symbolizing the company's Bitcoin strategy and its unique position as a Bitcoin asset management company. The primary color of the brand has been changed to orange, representing energy, wisdom, and Bitcoin.

In the Q3 earnings report released last October, Strategy announced its "21/21 Plan," aiming to raise $42 billion in funding over the next three years, with $21 billion coming from equity financing and another $21 billion from the issuance of fixed-income securities.

Strategy's capital raising and Bitcoin purchasing speed significantly accelerated in Q4 2024, with the company raising $15 billion through equity issuance and $3 billion through convertible bonds in less than two months.

"We have completed $20 billion of the $42 billion capital plan, far exceeding our initial timeline, while leading the digital transformation of capital in financial markets," CEO Phong Le stated in the announcement. "Looking ahead to the remainder of 2025, we are well-positioned to further enhance shareholder value by leveraging strong support from institutional and retail investors for our strategic plan."

Additionally, during the earnings call, company founder Michael Saylor pointed out a 45% volatility gap between Bitcoin and traditional markets and revealed a new strategy to attract "a large number of investors."

"We design our business to maintain volatility," Saylor said, contrasting Strategy's approach with traditional corporate funding operations that typically aim to minimize volatility.

The volatility levels of traditional assets (such as the SPDR S&P 500 ETF and Invesco QQQ Trust, which range between 15-20) compared to Bitcoin (which has volatility levels between 50-60) create a gap of about 45%. Strategy's common stock target volatility is even higher than Bitcoin itself, aiming for a volatility level of 80-90, while maintaining what Saylor calls "smart leverage" through a combination of equity issuance and convertible bonds.

"There are many investors who want this kind of volatility. They may not want the extreme leverage of MicroStrategy, and they may not even want the raw and unrefined volatility of IBIT or BTC, but Strike (Strategy's perpetual preferred stock STRK) attracts a new group with different return characteristics and volatility profiles."

The Strike preferred stock offers an 8% dividend yield and has exposure to Bitcoin. On January 27, according to official news, MicroStrategy announced its intention to issue 2,500,000 shares of MicroStrategy Series A perpetual preferred stock, subject to market and other conditions. MicroStrategy intends to use the net proceeds from this issuance for general corporate purposes, including purchasing Bitcoin and as working capital.

Subsequently, these shares were sold at a price of $80 per share, 20% below the market price, effectively pushing the buyer's yield up to 10%.

Currently, with the rebranding of Strategy and its significant increase in Bitcoin holdings, the company demonstrates its ambition to be one of the largest Bitcoin reserve companies in the world. In the future, whether Strategy can continue to achieve returns on Bitcoin investments while flexibly executing strategic layouts will be key to its success.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。