Generative AI protocols can enable individuals to become outstanding artists and open doors to previously unattainable careers.

Written by: Kava Labs

We will continue to delve into the integration of artificial intelligence (AI) and blockchain technology, focusing on the roles of generative AI and tokenization. As one of the most innovative yet controversial areas in AI and blockchain technology, we need to reference previous discussions on RWA tokenization, Natural Language Processing (NLP) in AI, the role of AI in risk mitigation and cross-chain interoperability to fully understand the broader implications of the integration of these two technologies.

In this article, we will explore the powerful capabilities of generative AI, how it works, and the copyright material issues faced when tokenizing content generated by generative AI. We will then turn to the role of blockchain technology and non-fungible tokens (NFTs) as potential solutions to these issues. We will also examine industries that have already utilized NFTs and discuss the future potential of this dynamic field and the role AI may play.

The Future of Content Creation

Like other aspects of the AI field, the evolution of generative AI has deep roots in computer science, dating back to the 1960s. British artist Harold Cohen achieved early iterations of computer image generation through his AARON project at the University of California, San Diego. However, despite these early iterations of generative AI imaging, it wasn't until the launch of ChatGPT 3.5 at the end of Q4 2022 that marked the boom of modern AI, giving the general public access to this groundbreaking technology.

With the release of Midjourney, Leonardo.ai, and DALL-E in 2023, the popularity of generative image protocols exploded, bringing generative AI (GenAI) and prompt engineering into the public eye, while large language models (LLMs) also gained significant attention. Overnight, everyone gained the ability to generate realistic images in seconds, a task that previously required significant labor and could only be accomplished by professional artists and photographers.

Since then, generative AI has made significant advancements, continuously iterating and improving upon early versions. Even traditional Web2 companies have begun implementing AI image generation and editing protocols, such as Photoshop launching its Generative Fill Toolkit in May 2023. We have also witnessed the field expand from images to audio, video, and 3D modeling.

How does generative AI actually work? Should traditional artists be concerned, and how can blockchain assist generative AI?

Understanding the Technology

To determine where blockchain may intersect with generative AI, we first need to understand how this technology works and whether it could be interpreted as plagiarism.

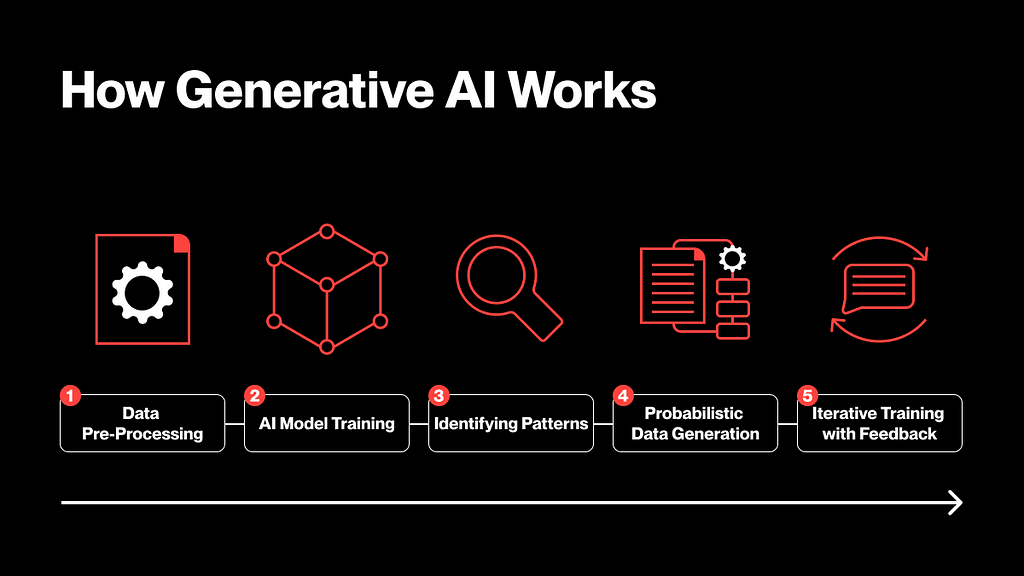

The first step of generative AI is the same as other AI models — collecting, indexing, and cleaning raw data. Generative AI collects images, audio samples, videos, or 3D digital models. The model can then be trained to recognize objects, textures, colors, and audio patterns.

Once the model breaks down its sample data into its most basic components, it can be used to reconstruct and replicate patterns and dependencies, such as how colors interact and the spatial relationships between objects. Similar to how large language models use probabilistic models to predict the next word, sentence, or paragraph, generative AI uses probabilistic models to predict pixel values and their spatial relationships to each other, combining them into a single coherent image output.

The final stage of generative AI is utilizing these outputs in its feedback loop. By iterating and improving the model, more accurate outputs are created over time.

The controversy surrounding copyright begins to blur, as models can be trained on open-source data and do not directly copy any single original data for reproduction. They use highly complex predictive models based on billions of original data touchpoints and combine them into an output through predictive modeling. One way to think about it is that these models are more like modern singers who may be influenced or inspired by Michael Jackson or The Beatles rather than directly covering their songs.

The Rise of NFTs

NFTs first emerged in 2014 when digital artists Jennifer and Kevin McCoy minted Quantum on the Namecoin blockchain. In 2017, with the release of CryptoKitties, NFTs began to gain a niche following in this field and became popular in the 2021 bull market alongside projects like Bored Ape Yacht Club and CryptoPunks as well as independent digital artists like Beeple.

During the 2021 bull market, NFTs showcased the powerful capabilities of their underlying blockchain technology use cases. The immutable decentralized ledger can solve the long-standing problem of establishing coherent proof of provenance. By having a permanent and unchangeable digital certification stamp, industries can easily determine the legitimate ownership of their products. The high-end art database Artory has excelled in utilizing blockchain technology to establish provenance for exclusive artworks.

Since the peak of the NFT craze in 2021, although the popularity of NFTs has declined, their significance has not diminished. The introduction of dynamic and non-fungible NFT projects through ERC-721 and ERC-1155 token standards has created new markets with the rise of real-world assets (RWA). The tokenization of real-world assets, particularly in real estate and automotive industries, benefits from the ability to establish coherent proof of provenance while updating NFTs over time to reflect maintenance and improvements.

Minting NFTs

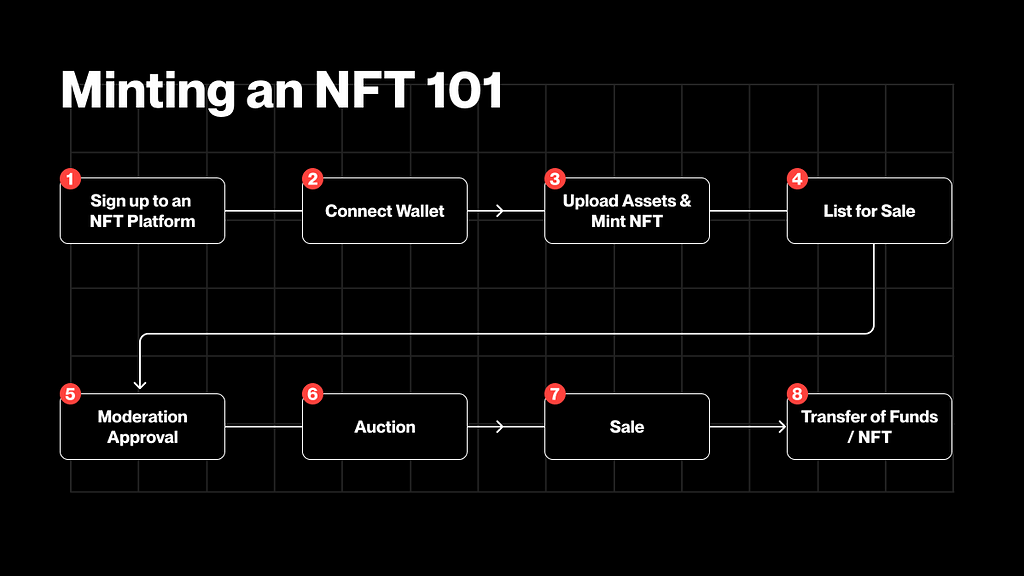

NFTs gained popularity during the 2021 bull market due to the ease of minting NFT series. For a relatively niche and rapidly growing industry with technical entry barriers, the ability to mint NFTs on platforms like OpenSea and Rarible provided millions of users with a simple entry point. Setting up a wallet may be more challenging compared to creating one's own NFT series.

The initial setup was completed through a simple account creation process. After that, once users connect their wallets to their accounts, they can easily upload and mint a series in just a few minutes, similar to the convenience of uploading images to a cloud provider. The user experience is unparalleled, and once their images pass the review, they can easily trade on the platform between their chosen exchanges.

Liquidity of Digital Art

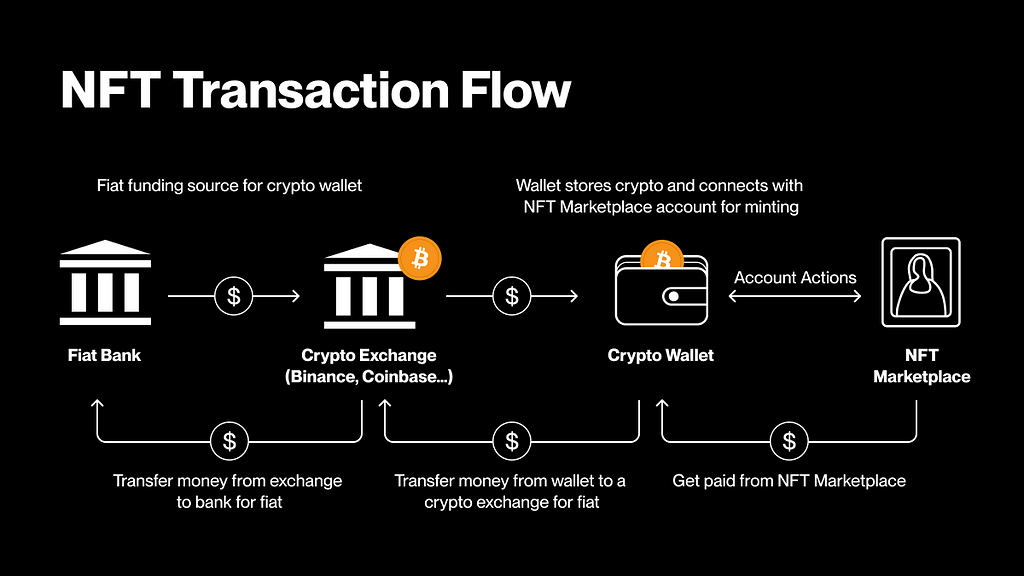

The ability to mint NFTs and freely buy and sell digital artworks is a significant step in attracting millions of users. While this serves as a crash course on the volatility of the cryptocurrency market, more importantly, it provides users with a dynamic educational tool. They quickly understand and begin to implement cryptocurrency trading. For example, assets can be seamlessly transferred from the NFT platform to wallets and exchanges, and then converted back to fiat currency.

This also enables many creators to monetize their digital artworks for the first time. It embodies the fundamental promise of Web3: to return financial and creative sovereignty to individuals rather than third-party gatekeepers.

A New Era of Royalties

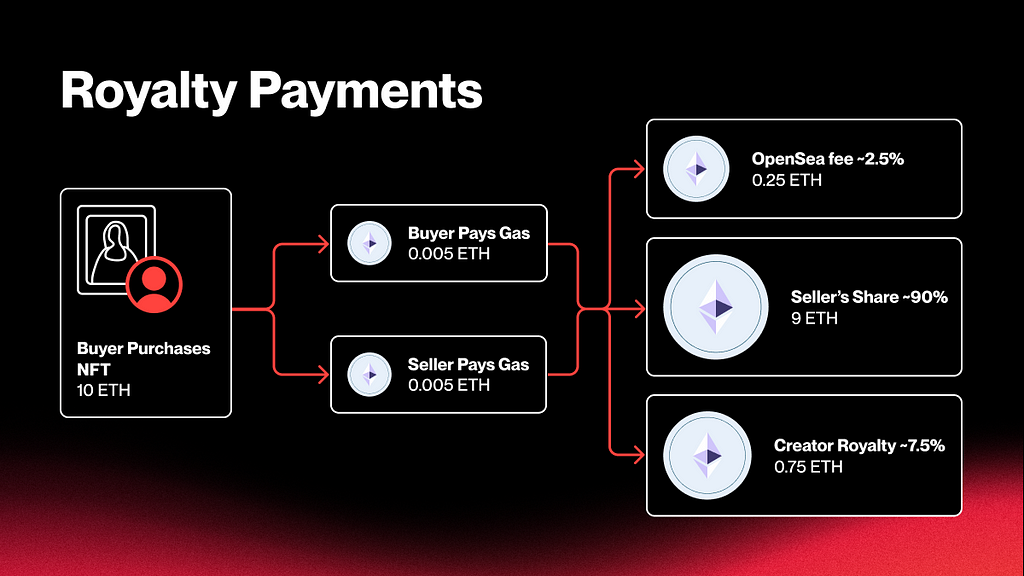

One often-overlooked aspect of NFTs in establishing the provenance of digital assets is their ability to automatically pay royalties to original creators. Although the concept of Artist Resale Rights (ARR) or droit de suite has existed since it was first introduced in France in 1920, it remains a relatively new practice for many countries.

In this regard, NFTs provide a unique opportunity. The process of automatically implementing royalties for any specific NFT transaction addresses this issue without the need for cumbersome traditional intermediaries. The curation process of NFT platforms directly returns this power to creators, allowing them to decide the percentage of royalties they wish to receive.

The Future of AI and NFTs

One impressive aspect of the rise of NFTs in 2021 is that it did not rely on generative AI protocols. In that environment, digital artists shone brightly, but now, anyone can easily create high-production-value artworks as simply as using a chatbot, making the future profitability of this market uncertain. People may focus more on the utility of projects and community.

Generative AI protocols can enable individuals to become outstanding artists and open doors to previously unattainable careers. However, a major issue artists faced in the previous cycle was that their artworks were sold as NFTs without consent. There remains legal ambiguity regarding the monetization of digital assets created through generative AI protocols. These two factors may conflict, especially if generative AI assets are used to create generational wealth through popular NFT series.

In the previous cycle, the act of copying NFTs and minting them on multiple blockchains also fueled plagiarism. The themes of lack of interoperability and data silos have been discussed in previous blog posts. In this regard, AI can play an important role. Through security enhancements such as early anomaly detection and fraud prevention, AI can serve as a backbone, just as it does in the RWA and DeFi fields. This is crucial for establishing cross-chain interoperability security when determining the provenance of digital assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。