The cryptocurrency sector, due to its emerging nature, high risks and returns, and incomplete regulation, has become one of the most sensitive areas in the tariff storm.

Written by: Penny, Rhythm BlockBeats

Since Trump and his wife launched their own meme coins $Trump and $MELANIA, attracting massive funding, the cryptocurrency market quickly fell into a state of liquidity exhaustion. On the other hand, the impact of the domestic AI large model DeepSeek, sovereign nations canceling Bitcoin's fiat status, and a series of negative news such as the U.S. imposing tariffs have further exacerbated the already sluggish market.

The first major drop after the New Year was triggered by Trump's tariff increase.

Policy Tied to Coin Prices? The Highly Sensitive Crypto Market

Trump's tariff policy is hitting the market hard. On February 1, U.S. President Trump signed a tariff order imposing an additional 25% tariff on imports from Canada and Mexico, and a 10% tariff on energy resources from Canada, set to take effect on the 4th. Additionally, Trump signed an executive order on the 1st to impose an additional 10% tariff on goods imported from mainland China.

Global risk markets reacted swiftly, with cryptocurrencies being the first to bear the brunt. On that day, Bitcoin's price plummeted from around $105,000, breaching the $100,000 mark, and even briefly falling below $92,000, with a drop of over 7% within 24 hours. Ethereum dropped about 25% to its lowest level since early September last year, and other mainstream cryptocurrencies also saw significant declines, all dropping over 10%, marking an epic crash.

On February 3, Trump announced an agreement with the President of Mexico to immediately suspend the anticipated tariffs for a month. Following the delay in tariff policy, Bitcoin rebounded to a high of $102,500, Ethereum rebounded to a high of $2,923, and other mainstream coins also generally rebounded to prices before the major drop.

Jeff Park, Chief Strategy Officer at Bitwise Alpha, stated that tariffs may only be a temporary tool, but in the long run, Bitcoin will not only rise but will rise faster, as both parties in trade imbalance want Bitcoin, leading to the same result: higher prices and faster speeds.

It can be said that the tariff increase caused a significant drop in global stock markets, and coupled with other negative news, the cryptocurrency market also experienced a decline. The tariff increase is not only a reshaping of the international trade landscape but also a heavy blow to global financial market confidence. The cryptocurrency sector, due to its emerging nature, high risks and returns, and incomplete regulation, has become one of the most sensitive areas in this storm, further confirming the increasingly close connection between the cryptocurrency sector and global macroeconomic policies.

Meme Coins Sucking the Market Dry

On January 18, 2025, Trump announced the launch of his personal meme coin $TRUMP on his social media account. Once launched, the coin surged over 15,000% within just 12 hours, reaching around $30, with a market cap exceeding $80 billion. Such astonishing growth and massive market cap quickly attracted a flood of funds, leading many investors who originally invested in mainstream cryptocurrencies like Bitcoin and Ethereum to sell off their holdings in favor of going all-in on $TRUMP, with all other coins, except SOL, being heavily drained in the short term, while other meme coins and AI agent tokens also saw significant declines.

Moreover, the issuing team of Trump Coin holds as much as 80% of the locked coins, meaning they have strong control over the coin's price. As the lock-up period gradually unlocks in the future, whether they dump on exchanges or stake on DeFi chains, it could have a huge impact on the market. At the same time, such behavior would further disrupt the market order in the cryptocurrency sector, making it harder for other genuinely valuable cryptocurrency projects to gain funding, leading to an imbalance in the entire cryptocurrency ecosystem.

The blood-sucking effect brought by Trump's coin not only caused unreasonable capital flow in the cryptocurrency sector in a short time but also had a serious negative impact on the development of other cryptocurrency projects and market stability, pressing the pause button on the originally booming DeSci, DeFAI, and AI agent sectors. According to the fast-paced nature of the cryptocurrency sector, which typically favors new over old, these sectors will inevitably require greater momentum to revive. This leaves the cryptocurrency sector facing more uncertainty and risks.

Arthur Hayes, co-founder and Chief Information Officer of BitMEX, believes that the near $100 billion fully diluted valuation (FDV) of $TRUMP within 24 hours is an absurd market signal, and the surge of $TRUMP is reminiscent of the FTX purchasing advertising space for Major League Baseball umpires during the 2021 bull market—it symbolizes the approach of a market top.

Clearing Out and Shouting Orders: The Confusing Behavior of WLFI

Arkham data shows that World Liberty Financial conducted a large-scale transfer of crypto assets on the evening of February 3, with ETH holdings dropping from around 66k on February 2 to 52, almost completely clearing out their ETH assets, primarily flowing into a Coinbase Prime deposit address.

At this sensitive time of asset transfer, Trump's son Eric Trump stated on his social platform that now is the best time to increase ETH holdings (In my opinion, it’s a great time to add ETH.). The initial version of the tweet even included the line "You can thank me later."

The community expressed skepticism, with some attentive investors noting that the ETH holdings dropping from 66k to 66 is just one unit less, which clearly seems to be an attempt to avoid detection of asset transfer, leading to suspicions of a conspiracy to harvest retail investors. WLFI explained that these actions aim to maintain a strong, secure, and efficient financial system, and are merely reallocating assets for ordinary business purposes, without selling tokens. However, once the funds are transferred to Coinbase Prime, we cannot know their exact use, and investors can only analyze based on price fluctuations and subsequent asset operations by WLFI.

Interestingly, on the morning of February 6, Eric publicly shouted orders for BTC while also mentioning the family project WLFI, leading the community to jokingly ask, "Is it time to sell Bitcoin next?" Perhaps this was indeed a shout-out before unloading, perhaps to boost confidence suppressed by the tariff increase, or perhaps just routine promotion of the family project, as shouting orders and CX are the norm for these individuals.

Crypto Tsar, but Also a Major Harvest?

David Sacks, chairman of the Crypto Council, is well-known as one of the founders of PayPal and later gained fame by creating Yammer and selling it to Microsoft for $1.2 billion. In the cryptocurrency sector, David Sacks is most notably an investor in the crypto venture capital firm Multicoin and a major proponent of Solana, earning the title "Crypto Tsar."

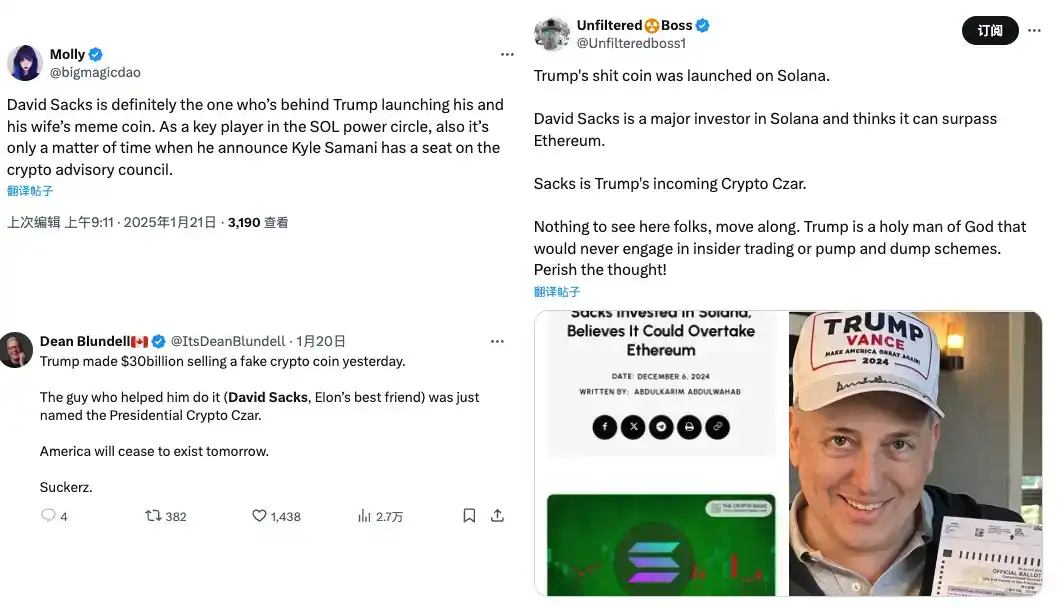

Since $TRUMP is deployed on the Solana chain, and David Sacks remained silent about these "zero-sum meme coins" when Trump launched the $TRUMP coin, many believe that the chairman of the Crypto Council is somehow involved.

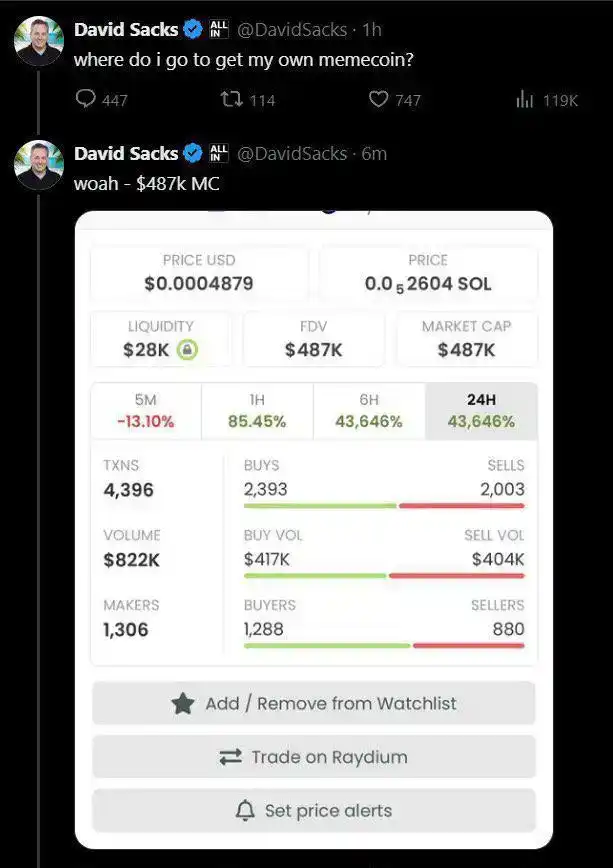

Another piece of evidence is that David Sacks has a "criminal record." In March 2024, David Sacks posted about his own meme coin $Sacks.

Although he tweeted nine times telling people not to buy it when they started purchasing, this has already solidified the evidence that he "once issued a coin," which is exactly the same method used for issuing the $TRUMP coin. (According to community members, David Sacks recently deleted his posts about $Sacks.)

This has led many to develop a dislike for David Sacks, feeling that his methods are too opportunistic and overly eager to profit through such aggressive means. Even if Sacks did not directly participate, as the chairman of the Crypto Council, he should be held accountable for this incident. There are even rumors suggesting that someone proposed replacing the entire leadership team of David Sacks' Crypto Council with a new one.

On February 5, David Sacks reiterated his goals during a press conference that started at 3:30 AM Beijing time, stating that he would "clarify the crypto regulatory framework," "ensure crypto innovation occurs domestically in the U.S.," and "create a golden age for digital assets," but did not announce any new (or specific) content. When mentioning the establishment of a Bitcoin reserve, David Sacks used the term "evaluate," which carries a lighter degree of affirmation (previously, the U.S. government would use the term "evaluate" to dodge the issue when they had to address it but did not want to truly resolve it). Perhaps due to the press conference "not releasing any positive news," leading to unmet market expectations, Bitcoin fell back below $99,000, hitting a low of $96,147.

Is He a True Builder, or Just a Bigger Scythe?

Looking back at Trump's actions over the years, his attitude towards cryptocurrency has changed significantly. During his previous term, he publicly stated that cryptocurrencies like Bitcoin were "scams," but now he promises to make the U.S. the global "crypto capital" and "Bitcoin superpower," has formed a cryptocurrency task force, established a family DeFi project, lifted restrictions on new token sales, and strengthened ties between cryptocurrency companies and other traditional financial enterprises.

Trump's change in attitude may be attributed to multiple factors. On one hand, the cryptocurrency market has developed rapidly in recent years, boasting a large investor base and significant economic influence. Engaging this segment could help boost his political support. On the other hand, there are powerful interest groups behind the cryptocurrency industry that may exert influence on Trump through political donations and other means, prompting him to implement policies favorable to the development of cryptocurrencies. Additionally, Bitcoin can be seen as a tool to hedge against the weakening status of the dollar; incorporating it into the national strategic reserve is also a means to attract capital inflows and maintain dollar hegemony.

As the election results come in, Trump's every move gradually becomes a barometer for the cryptocurrency sector. Especially before taking office, Trump launched his own meme coin, sparking a frenzy among countless investors both inside and outside the circle, creating many phenomenal wealth myths. It was initially thought to be the start of a bull market, but the subsequent issuance of the $MELANIA token shattered this illusion, causing the market to cool down and question the purpose behind the coin issuance. The previously booming AI Agent sector was heavily drained by $TRUMP and $MELANIA, and coupled with the impact of DeepSeek, it has remained sluggish. Although the frenzy for memes continues, the peak market values of numerous tokens are shrinking, with the time to zero constantly shortening, and mainstream coins continuing to decline after the initial excitement. We cannot help but ponder whether Trump's pro-crypto stance is genuinely aimed at being a builder or if it is primarily to profit his interest groups and maintain U.S. hegemony during his term, ultimately leaving a trail of devastation.

In the short term, the market will inevitably experience wild fluctuations to digest various major trends, but long-term value growth and industry consolidation require more than just favorable policies; they necessitate a two-way game between the market and politicians. From his series of commitments and statements, he seems to hold a positive supportive attitude towards cryptocurrencies. However, his past remarks and the significant shift in his stance make it difficult to fully trust him. Will he truly spare no effort in promoting the development of cryptocurrencies and make the U.S. a paradise for them? Known for his "unexpected" nature, will the favorable policies he promised actually be implemented, or are they merely superficial gestures aimed at gaining political advantage? These questions are filled with uncertainty.

For cryptocurrency investors, Trump's current attitude and policy direction are like a double-edged sword. If he can indeed fulfill his promises and create a relaxed, friendly development environment for cryptocurrencies, the sector may very well usher in a new wave of prosperity. However, Trump's frequent sanctions against other countries, his family's criticized business style, and the internal conflicts and divisions within his team could exacerbate global economic and political instability, leading to unpredictable cryptocurrency policies. This instability may spread panic among investors, negatively impacting the cryptocurrency market.

It can be said that Trump's tariff increases are just the beginning of his influence on the cryptocurrency sector after taking office. In the future, as he advances and implements policies in various areas such as the economy and diplomacy, the cryptocurrency sector is likely to face even more severe fluctuations. In such an environment, investors need to closely monitor policy dynamics and make investment decisions with greater caution.

The bigger the storm, the bigger the fish. Regardless of the unknowns ahead, this ship of cryptocurrency has set sail, ready to face the tumultuous waves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。