In-depth analysis of Trump's tariff policy's impact on Bitcoin and the entire cryptocurrency market, and exploration of potential future trends for Bitcoin.

Abstract

Recently, former U.S. President Donald Trump reiterated his plans to impose high tariffs on Canada, Mexico, and China, triggering significant turbulence in global financial markets. As a result, the stock market, foreign exchange market, and cryptocurrency market all experienced substantial fluctuations, with Bitcoin (BTC) briefly falling below the $92,000 mark. Although the short-term market is impacted, in the long run, the trade war and high tariff policies may actually benefit decentralized assets like Bitcoin.

This report will analyze the impact of Trump's tariff policy on Bitcoin and the entire cryptocurrency market from multiple perspectives, including macroeconomics, monetary policy, market structure, and investment sentiment, and explore potential future trends for Bitcoin.

I. Overview of Trump's Tariff Policy

1.1 Background of Tariff Policy

1.1.1 The Return of Trade Protectionism

In the context of globalization, trade relations between countries have become increasingly close. However, in recent years, U.S. trade policy has gradually shifted towards protectionism, especially during Trump's presidency (2017-2021). The Trump administration believes that the U.S. has long been at a "disadvantage" in international trade, with main reasons including:

Expanding trade deficits: The U.S. has maintained a high trade deficit with countries and regions such as China, Mexico, Japan, and the EU, which Trump believes has led to the loss of manufacturing jobs in the U.S.

Deindustrialization: Over the past few decades, U.S. manufacturing has outsourced to Asia and other regions, resulting in a decline in domestic manufacturing. The Trump administration hopes to encourage companies to return to the U.S. by raising tariffs.

National security concerns: Trump and his advisory team believe that China's technological rise poses a threat to the U.S., and they attempt to curb China's industrial development by restricting the export of high-tech products and imposing tariffs.

1.1.2 Background of the 2024 U.S. Presidential Election

In the 2024 U.S. presidential election, Trump has once again become the Republican presidential candidate and is vigorously promoting the "America First" policy during his campaign, with core measures including:

Implementing stricter trade sanctions on China: Promising to impose tariffs of at least 60% on all Chinese imports.

Reassessing trade agreements with Mexico and Canada: If elected, he may reevaluate the United States-Mexico-Canada Agreement (USMCA).

Exerting trade pressure on allies like Europe and Japan: Demanding they reduce their trade surplus with the U.S., or face high tariffs.

The introduction of these policies has led to increased uncertainty in the global market regarding the future trade environment, thereby affecting global capital flows and market sentiment.

1.2 Major Tariff Measures

The core of Trump's trade policy is to impose high tariffs on major global economies, especially on goods from China, the EU, Japan, and Mexico. The following are potential specific measures:

1.2.1 Imposing tariffs of over 60% on Chinese goods

Trump imposed a series of tariffs on Chinese goods from 2018 to 2020, but if he is re-elected, the tariffs planned for Chinese goods will be even stricter.

Scope of covered goods: Including electronics, automobiles, solar panels, industrial equipment, chip manufacturing equipment, and other key industries.

Impact: This may lead to increased import costs for the U.S. and exacerbate instability in global supply chains.

1.2.2 Adjusting tariff policies for Europe, Japan, and Mexico

Europe: Trump may raise tariffs on German cars, French wine, and Italian fashion brands to reduce the trade deficit between the U.S. and Europe.

Japan: He may demand that Japan further open its market, or else increase tariffs on Japanese cars and parts.

Mexico: Trump has previously threatened to impose additional tariffs on products exported from Mexico to the U.S. to force Mexico to strengthen border controls. If re-elected, similar policies may be reinstated.

1.2.3 Support policies for U.S. domestic manufacturing

Tax incentives: Providing tax breaks to companies investing in manufacturing in the U.S., encouraging them to relocate production bases back to the U.S.

Government procurement preferences: Strengthening the "Buy American" policy, requiring government agencies to procure more domestically manufactured products.

The implementation of these measures may lead to further tension in the global trade environment, affecting market stability and indirectly driving demand for decentralized assets like Bitcoin.

II. Impact of Tariff Policy on Global Markets and Economy

2.1.1 The Impact of Trade Wars on the Global Economy

Trump's tariff policy may bring the following negative effects:

Global economic growth slowdown: Increased tariffs will raise production costs for businesses, potentially leading to a decline in consumer spending and, in turn, suppressing global economic growth. The International Monetary Fund (IMF) has warned that trade wars could reduce global GDP growth rates by 0.5%-1%.

Supply chain disruptions: Tariffs may force companies to readjust their supply chains, increasing uncertainty. Companies like Apple and Tesla may have to seek alternative suppliers, raising operational costs. Rising inflationary pressures: The implementation of tariffs will lead to higher prices for imported goods, thereby driving up inflation. The Federal Reserve may adjust monetary policy as a result, affecting market liquidity.

2.1.2 The Impact of Tariff Policy on the U.S. Economy

Although the Trump administration believes that raising tariffs can promote U.S. economic growth, it may actually bring the following risks:

Rising consumer costs: Many everyday consumer goods rely on imports, and higher tariffs may lead to increased consumer spending in the U.S.

The tariff policies of 2018-2019 resulted in U.S. businesses and consumers paying over $80 billion in additional costs.

Declining corporate profitability: Tariffs may compress corporate profits, leading to layoffs or reduced investment. Manufacturing, retail, and agriculture sectors may be significantly impacted.

Adjustments to the Federal Reserve's monetary policy: If inflation continues to rise, the Federal Reserve may delay interest rate cuts or further raise rates, affecting market liquidity. A high-interest-rate environment may put pressure on the stock and bond markets, leading to increased market volatility.

2.1.3 The Impact of Tariff Policy on Bitcoin and the Cryptocurrency Market

Although the market may be impacted in the short term, in the long run, the trade war may indirectly benefit Bitcoin for several reasons:

Increased market demand for safe-haven assets: In the face of global economic uncertainty, funds may flow from traditional markets to decentralized assets like Bitcoin.

Rising expectations of dollar depreciation: If the trade war leads the Federal Reserve to implement loose monetary policies, the dollar may depreciate, thereby enhancing Bitcoin's appeal.

Capital flight driving growth in the cryptocurrency market: Historically, whenever global markets face shocks, the demand for Bitcoin tends to increase.

2.2 Reactions of Traditional Financial Markets

Trump's tariff policy has exacerbated market uncertainty, undermining investor confidence in economic prospects and leading to increased risk aversion across global markets. From the stock market to precious metals, the price trends of various assets have been affected.

2.2.1 Stock Market Plummets: Investor Concerns Over Economic Growth Intensify

After Trump announced the increase in import tariffs, the three major U.S. stock indices—the S&P 500, the Dow Jones Industrial Average (DJIA), and the NASDAQ—each fell by 2%-4%. The decline in the stock market is primarily driven by the following factors: rising corporate costs, reduced profitability, declining consumer spending, limited market demand, and heightened risk aversion leading funds to low-risk assets.

Investors often withdraw from the stock market during periods of heightened uncertainty, shifting funds to safe-haven assets (such as gold, the dollar, and U.S. Treasuries). As funds flow out of the stock market, the market faces further pressure, creating a downward trend.

2.2.2 Strengthening of the Dollar Index (DXY): Safe-Haven Demand Boosts the Dollar

Despite the negative impact of Trump's tariff policy on the global economy, the dollar index (DXY) strengthened in the short term. This is mainly due to market expectations that the Federal Reserve will not immediately cut interest rates, while investors seek the dollar as a safe-haven asset.

Impact of Federal Reserve monetary policy: The tariff policy may lead to rising inflationary pressures, making the Federal Reserve reluctant to cut rates in the short term to prevent inflation from spiraling out of control. The market originally expected the Federal Reserve to cut rates in the coming months, but the introduction of the tariff policy changed this expectation, driving the dollar up.

Global capital flows into dollar assets: Due to increased uncertainty in the economy, global investors tend to hold dollar cash or invest in U.S. Treasuries to avoid risk. During the 2018 U.S.-China trade war, the dollar index once broke above 100, rising sharply, and a similar situation may occur again.

Pressure on risk assets like Bitcoin: A stronger dollar typically puts pressure on risk assets priced in dollars, such as Bitcoin, as funds are more likely to flow into the dollar market rather than the cryptocurrency market.

In the short term, a stronger dollar may lead to a decline in Bitcoin prices, but in the long run, concerns about the dollar's credit system may conversely promote the value growth of Bitcoin.

2.2.3 Precious Metals Rise: Gold Breaks $2,800/oz

Against the backdrop of rising risk aversion, the precious metals market has seen an increase, especially with gold prices breaking $2,300/oz. This is mainly due to:

Safe-haven funds flowing into the gold market: As a globally recognized safe-haven asset, gold typically attracts funds during market turmoil.

Institutional investors and hedge funds may increase their holdings of gold during stock market turbulence to hedge against market risks.

Rising inflation expectations enhance gold's appeal: Tariff policies may drive inflation up, increasing gold's value as a store of value.

Historical data shows that gold often performs well in high-inflation environments. For example, during the stagflation period of the 1970s, gold prices rose significantly.

2.3 Severe Volatility in the Cryptocurrency Market

Compared to traditional financial markets, the cryptocurrency market experiences more severe volatility, primarily influenced by market sentiment, leveraged liquidations, and liquidity shocks.

2.3.1 Short-term Plunge in Bitcoin: Safe-Haven Asset or Risk Asset?

Although Bitcoin is viewed by some investors as "digital gold," it experienced a sharp short-term drop in price due to the tariff shock, briefly falling below $92,000, a decline of over 10% from its peak.

In the short term, Bitcoin is still seen as a risk asset: With increased participation from institutional investors, Bitcoin's correlation with U.S. stocks has strengthened. When market panic occurs, investors often choose to sell Bitcoin in favor of the dollar and gold.

In the long term, Bitcoin's safe-haven attributes may strengthen: If the market begins to doubt the dollar's credit system, Bitcoin may regain its safe-haven status. For example, during the 2019 U.S.-China trade war, Bitcoin experienced significant increases, becoming a safe haven for global funds.

2.3.2 Increased Liquidations Amplifying Market Sell-offs

The high-leverage nature of the cryptocurrency market determines its non-linear price fluctuations. When the market declines, highly leveraged long positions are liquidated, leading to a "waterfall" decline.

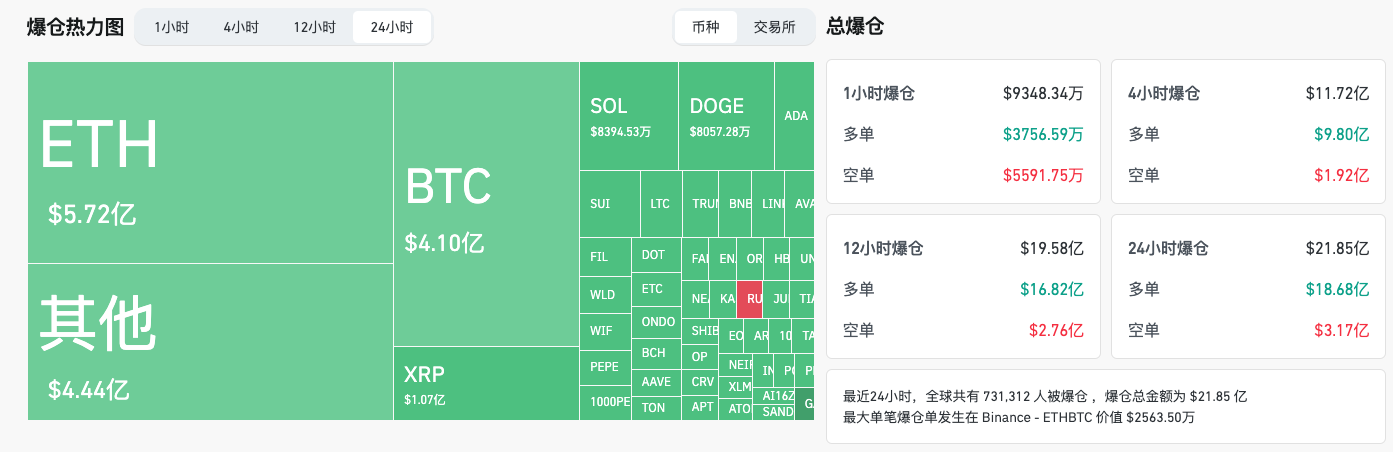

Over $2 billion in liquidations across the entire contract market: Data shows that during Bitcoin's plunge, the total liquidation amount in the cryptocurrency contract market reached $2 billion, with over 80% being long positions.

The exchanges' automatic deleveraging (ADL) mechanisms further exacerbate market volatility.

Extreme market sentiment leads to increased panic selling: Since the cryptocurrency market is primarily dominated by retail investors, extreme market sentiment leads to panic selling, amplifying the downward trend. The "Fear & Greed Index" shifted from "Greed" to "Fear" within 24 hours.

2.3.3 Altcoins Experience Greater Declines

Compared to Bitcoin, the performance of the altcoin market has been even more severe, with declines generally exceeding 15%.

Liquidity exhaustion and significant price fluctuations: Due to the low trading depth of some altcoins, when a market sell-off occurs, insufficient buying pressure leads to a rapid price collapse.

The DeFi ecosystem is impacted: The decline in the value of collateral assets within the DeFi ecosystem has led to numerous liquidation events, further exacerbating market panic.

III. How Trump's Policies May Long-term Favor Bitcoin

Although Trump's tariff policy has triggered significant market volatility in the short term, even causing a temporary drop in Bitcoin prices, these policies may, in the long run, become a driving force for Bitcoin. The main reasons include: the trade war may lead to dollar depreciation, capital flight driving Bitcoin demand, and the acceleration of the global "de-dollarization" trend, which may further solidify Bitcoin's status as a reserve asset. This section will analyze in detail how these factors may favor Bitcoin in the long term.

3.1.1 The Trade War May Lead to Dollar Depreciation

Trump's tariff policy and trade protectionism may weaken the growth potential of the U.S. economy, ultimately leading to a weaker dollar, while Bitcoin typically performs well during dollar depreciation.

3.1.2 The Federal Reserve May Be Forced to Cut Rates, Leading to Dollar Depreciation

If the U.S. economy is pressured by the trade war, the Federal Reserve may be compelled to adopt a more accommodative monetary policy, including cutting interest rates or restarting quantitative easing (QE). The uncertainty of the trade war may lead to a slowdown in economic growth, forcing the Federal Reserve to cut rates to stimulate the economy. Rate cuts will reduce the attractiveness of the dollar, leading to capital outflows and dollar depreciation. Dollar depreciation typically benefits Bitcoin.

As a scarce asset, Bitcoin is similar to "digital gold," and its appeal increases when fiat currencies depreciate.

For example, during the Federal Reserve's massive quantitative easing (QE) in 2020, Bitcoin's price soared from $4,000 to $69,000.

3.1.3 Institutional Funds May Shift to Bitcoin

Institutional investors seek assets to hedge against dollar depreciation: Institutional investors may reduce their allocation to dollar assets (such as U.S. Treasuries) and turn to hedging tools like Bitcoin. In 2021, companies like MicroStrategy, Tesla, and Square purchased Bitcoin to hedge against the risk of dollar depreciation. Bitcoin is viewed as "digital gold": Over the past few years, Bitcoin's safe-haven attributes have gradually strengthened, increasing its correlation with gold.

As the dollar depreciates, Bitcoin may become a hedging tool for an increasing number of investors.

3.2 Capital Flight Driving Bitcoin Demand

In an environment of increasing uncertainty, capital often flows from traditional financial markets to decentralized assets like Bitcoin. Trump's tariff policy may indirectly drive funds into the Bitcoin market.

3.2.1 The Trade War Intensifies Market Uncertainty, and Funds Seek Safe Havens

As market uncertainty rises, funds seek safe-haven assets: Tariff policies trigger market turmoil, leading many investors to seek safe-haven assets like gold and Bitcoin. During the 2019 U.S.-China trade war, Bitcoin experienced an increase alongside global stock market volatility.

The appeal of decentralized assets increases: In an environment where government policies are unpredictable, decentralized assets (like Bitcoin) become more attractive due to their censorship resistance and global liquidity. Funds are no longer limited to gold or the dollar; some will also flow into the cryptocurrency market.

3.2.2 The Wealthy Class in the U.S. May Shift Assets to Bitcoin

The wealthy seek tax avoidance and asset protection: If Trump's tariff policies persist, leading to a deteriorating U.S. economy or increased tax pressure, the wealthy may seek asset havens. Bitcoin's global liquidity and decentralized characteristics make it an ideal wealth storage tool.

The 2024 Bitcoin halving may boost capital inflows: In 2024, Bitcoin will undergo a new "halving event," reducing miner rewards from 6.25 BTC to 3.125 BTC. The reduction in supply may drive up Bitcoin prices. Coupled with global economic uncertainty, wealthy investors may position themselves in Bitcoin ahead of time to hedge against risks.

3.3 The Intensifying De-dollarization Trend Promotes Bitcoin as a Reserve Asset

Trump's trade protectionist policies may accelerate the global "de-dollarization" process, with more countries considering using Bitcoin as a reserve asset.

3.3.1 The Global De-dollarization Trend is Accelerating

Frequent U.S. financial sanctions prompt countries to de-dollarize: In recent years, the U.S. has frequently used the dollar system to impose financial sanctions on other countries (such as sanctions against Russia and Iran).

To circumvent the restrictions of the dollar settlement system, many countries are beginning to seek alternatives, such as renminbi settlements, digital currencies, and Bitcoin.

Trump's policies may reinforce the de-dollarization process: The trade war may encourage countries like China, the EU, and Russia to reduce their reliance on the dollar, accelerating the de-dollarization process. In 2023, BRICS countries have begun exploring the establishment of a new trade settlement system to reduce dependence on the dollar.

3.3.2 Countries or Institutions May Consider Bitcoin as a Reserve Asset

The possibility of Bitcoin entering central bank reserves as "digital gold" is increasing: In recent years, some countries (like El Salvador) have begun incorporating Bitcoin into their national asset reserves. In the future, if global confidence in the dollar system declines, some countries may consider Bitcoin as part of their reserve assets to diversify risk.

Institutional investors' asset allocation strategies may shift towards Bitcoin: Over the past five years, institutional interest in Bitcoin has surged, with giants like BlackRock and Fidelity launching Bitcoin-related products. During periods of global economic turmoil, institutional investors may increase their allocation to Bitcoin.

IV. Market Trend Analysis: How Will Bitcoin Respond?

After Trump's tariff policy triggers turmoil in global markets, Bitcoin's price trend may experience short-term consolidation, mid-term rebound, and ultimately may welcome a long-term breakthrough of historical highs. Throughout this process, the market will be influenced by multiple factors, including the macroeconomic environment, Federal Reserve policies, institutional capital inflows, and on-chain data. This section will conduct an in-depth analysis focusing on key support and resistance levels, market sentiment, on-chain data, and market evolution paths.

4.1 Key Support and Resistance Levels: Critical Price Levels in the Market

Bitcoin has several key support and resistance levels on both technical and market psychological fronts. Market trends often fluctuate around these important price areas.

4.1.1 Major Support Level Analysis

$91,000 (short-term support): This is the initial support area Bitcoin tests during its decline. If market sentiment recovers, it may become a short-term bottoming area. If it falls below $90,000, it may trigger further market panic and leveraged liquidations.

$85,000 (mid-term support): This is a stronger technical support level and may be the main entry area for institutional funds.

If the market reacts negatively to Federal Reserve policies, BTC may further retrace to this area to seek support.

$70,000 (extreme case support level): If the market turmoil caused by the trade war continues and risk aversion rises, this key level may be tested. This area will be an important buying opportunity for long-term investors, potentially seeing significant capital bottom-fishing.

4.1.2 Major Resistance Level Analysis

$105,000: This is an important threshold that the market is highly focused on. A breakthrough may lead to accelerated capital inflows. Institutional investors may test market liquidity in this area.

$110,000 (historical high): This is a key target that BTC may aim for during a bull market. A breakthrough may lead to FOMO (fear of missing out) buying. If global capital accelerates its inflow into Bitcoin, BTC may form new price discovery in this area.

$150,000 (potential long-term resistance): If Bitcoin enters a super cycle driven by institutional funds, this area may become the new target for the market.

4.2 Possible Market Evolution Paths: Analysis of BTC's Different Cycle Trends

Bitcoin's market trend may go through three stages: short-term consolidation, mid-term rebound, and long-term breakthrough of historical highs. Each stage has different driving factors for market sentiment, capital flow, and macro environment.

4.2.1 Short-term Consolidation (1-3 months): Market Repair Phase

Market Characteristics

Price Range: $80,000 - $100,000

Market Sentiment: Panic sentiment eases, and wait-and-see sentiment strengthens.

Macro Drivers: Federal Reserve policies, market liquidity, institutional buying conditions.

Short-term Market Influencing Factors:

Market sentiment repair, bottom-fishing capital enters: If $90,000 stabilizes, market panic sentiment may gradually weaken, and capital will reposition. If stablecoin reserves on exchanges begin to rise, it indicates that investors are preparing to re-enter.

Federal Reserve policy becomes the market focus: If the Federal Reserve delays rate cuts, the market may continue to fluctuate, waiting for clearer signals. If the Federal Reserve turns dovish, the market may welcome a rebound.

On-chain data monitoring: Capital flow situation: Bitcoin holding address analysis: If long-term holders (LTH) reduce selling, it indicates that the market is beginning to stabilize. Bitcoin outflow from exchanges: If a large amount of BTC flows out of exchanges, it shows that market confidence is recovering, and investors choose to hold long-term.

4.2.2 Mid-term Rebound (3-6 months): Market Repair, Entering Recovery Channel

Market Characteristics

Price Range: $100,000 - $120,000

Market Sentiment: Cautiously optimistic, capital inflow accelerates.

Macro Drivers: Institutional capital accelerates entry, clear direction of Federal Reserve policies.

Mid-term Market Influencing Factors

If the Federal Reserve turns dovish, liquidity improves: If the Federal Reserve announces rate cuts or pauses rate hikes, market liquidity will improve, and Bitcoin may enter an upward channel. During the Federal Reserve's massive easing in 2020, Bitcoin's price soared by 1600%, and history may repeat itself.

Institutional capital positions in Bitcoin, driving price recovery: After the launch of the Bitcoin spot ETF in 2024, institutional demand for BTC may further increase. Similar to 2021, institutions like Grayscale and MicroStrategy may continue to increase their BTC holdings.

On-chain data supports the upward trend

Increase in BTC holding addresses: If large BTC holding addresses (whale addresses) increase, it indicates that institutions are starting to buy.

Decrease in exchange BTC supply: If liquidity on exchanges is exhausted, it indicates strong buying pressure in the market.

4.2.3 Long-term Breakthrough of Historical Highs (6-12 months): Entering a Bull Market Cycle

Market Characteristics

Price Range: $120,000 - $150,000+

Market Sentiment: FOMO (fear of missing out), capital floods in.

Macro Drivers: Global capital seeks safe havens, Bitcoin becomes a global reserve asset.

Long-term Market Influencing Factors

If the global trade war continues, capital seeks Bitcoin as a safe haven: If the trade war becomes prolonged, global market risk-averse capital may flow into BTC.

After the 2024 Bitcoin halving, market supply and demand tension will further drive up prices.

Bitcoin's market capitalization enters institutional asset allocation: If Bitcoin's market capitalization surpasses $2 trillion, it may be included in the portfolios of more global institutions. Similar to gold, Bitcoin may become one of the assets allocated by global sovereign wealth funds.

The scale of Bitcoin ETFs continues to grow: Currently, the scale of BTC spot ETFs is still in the early stages, and it may attract more institutional capital in the future. If ETF funds accelerate inflows, BTC may enter a new super bull market cycle.

4.3 Conclusion: Bitcoin Will Welcome Long-term Growth After Short-term Fluctuations

Summary of Market Development Path

Short-term (1-3 months): The market fluctuates, with a support level at $90,000, waiting for signals from Federal Reserve policies.

Mid-term (3-6 months): Bitcoin gradually rises to $100,000, with institutional capital accelerating inflows.

Long-term (6-12 months): If the trade war prolongs, BTC may break through $120,000 and set a new historical high.

Although Trump's tariff policy has caused market panic in the short term, it may accelerate Bitcoin's process of becoming a global safe-haven asset in the long run.

V. Conclusion: Short-term Fluctuations, Long-term Positivity

Trump's tariff policy has undoubtedly brought significant volatility to global markets, especially the cryptocurrency market, where Bitcoin's price performance is strongly influenced by market sentiment in the short term. Bitcoin has experienced a substantial price correction, with declines exceeding 10% at one point. However, from a broader perspective, the ongoing changes in the global economy and the long-term impacts of Trump's policies may support Bitcoin's long-term value, driving its price gradually upward.

While Trump's tariff policy has led to short-term market fluctuations and exerted downward pressure on Bitcoin's price, the core value of Bitcoin has not changed from a longer-term perspective. As global economic uncertainty increases and the digitalization trend in capital markets, particularly the development of decentralized financial systems, continues, the demand for Bitcoin as a safe-haven asset will further increase, driving its long-term value upward.

Investors should pay attention to global economic policies, market sentiment, and technological advancements in the Bitcoin network to prepare for mid- to long-term positioning. Although the market may continue to face certain fluctuations in the short term, Bitcoin's safe-haven asset attributes and its potential as digital gold will increasingly solidify its role as an important asset in the global economy. As the global economic environment changes, Bitcoin will continue to be an indispensable asset in the global financial system.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。